I guess I finally got the answer to my question, "How is the stock market going to discount a disastrous economic event that'll take years to play out?"

Answer? Slowly at first, then all at once.

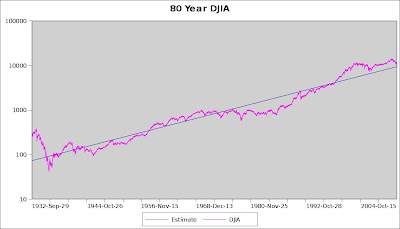

Or for a longer term view of The Pain:

So this weeks little meltdown has put us on a negative 10 year return on the DJIA.

And I don't want to say much this week, cuz I figure events are speaking for themselves, but on the hyper-long term basis, this week, is the first time in a long, long time that the DJIA has fallen to PARITY with its L/T trend.

Here's a 80 YEAR chart of the DJIA, with a best-fit logarithmic estimate. Those 2 big humps on the right are of course, the 2 great bubbles of our lifetimes, The NASDAQ & RE Bubbles.

You'll also notice that when NASDAQ cracked, it never really returned to trend.

And it has been above trend every single day since Mar 24, 1995. Until Wednesday.

The regression estimate for Wednesday is 9,390, and we closed at 9,258.

This may be easier to see in a log chart:

That far right convergence of actual vs estimate doesn't appear to quite meet, but believe me, it does.

Note that this time period includes all sorts of crazy things, from nuking the Japs, to putting man on the moon, WWII, WWI, and essentially the entire modern transportation & electronics era.

It is tough to put some sort of parallel on today's events given the past. But it does look like we are experiencing a Super Wave correction similar to The Great Depression or The Great Malaise of the 1970's.

Strating with the less wrenching meltdown of the 1970's, we see that after a Super Wave up that essentially began in the decades after The Great Depression

I guess we can say The Official Start of The Great Malaise began on July 10, 1969. The DJIA crossed below the L/T least squares estimate of 856.18, and closed at 847.79.

This put to an end an unbroken string of above-trend closes which began on Sept 13, 1954 at DJIA 351.10.

So when did the prior below-trend string start? On May 10, 1940 at DJIA 144.77.

I guess the point here is that what we've seen the past 30 years actually HAS happened, in some measure, before. Calamity following euphoria following calamity... The beat rolls on.

The other point is that this is NOT a short term phenomenon. These long waves take an adult lifetime.

The post Great Depression low of 41.22 was hit on Jul 8, 1932.

A monster rally ended on Mar 10, 1937 at 194.40, or +372%.

New lows were set on Apr 28, 1942 at 92.92, or down 52.2%.

The coming mega-wave carried through to Jan 18, 1966, when the Dow settled at 994.20, or stunning +970%.

But we then paid for it with a pounding that carried us to 577.60 on the Dow, on Dec 6, 1974.

Here begins our modern comparison of the Super Wave Modern Age DJIA Bull Market.

And if you look close and IGNORE the huge, but relatively short live burst from 1932 to 1937, and use the Great Depression low of 41.22 as a starting point, and the near 1,000 top in 1966 as a top, you see this mega wave had a bottom-to-top gain of exactly +2,300%.

A Super Wave up that took 34 years.

Then we had possibly the worst bear market in modern history that took us down 42%, ending 8 years after it started. This is the Dec 6, 1974 low.

Here is the interesting part: We had a super wave higher from Depression lows of +2,300% which took 34 years, right? Extrapolate the 1974 lows forward +2,300% and 34 years and you get...

Yes. Highs in the 13,862 area in 2008. Not perfect. But eery as hell.

Our long wave recent (post 2000) "Opportunity Cost" top was hit July 19, 2007 at 14,000 even.

We have subsequently fallen 40% from this Super Wave Mega-Top.

So where do we go from here? Well, the mathematical nature of a least-squares regression is that the L/T machinations of the market, both positive & negative, will net to zero. And the subsequent negatives will cancel out the prior positives.

On this count, we are in dire straights. Look at the 90th percentile confidence limits:

In point of fact, we have NEVER been as overvalued as we were on Jan 14, 2000 at DJIA 11,722.98 on an opportunity cost basis (excepting the brief Euphoria of pre Great Depression). THAT was the maximum CASH OUT selling point. The only time we've been close to that overvalued was when the DJIA was crashing towards Great Depression lows.

DO NOT believe the banter that we can't go incredibly lower from here. We can, we will. Here is a view of only the difference between actual DJIA closes & least squares estimates:

A short explanation: This is the log of the DJIA close minus the log of the least squares expected value. So at 0, the market is at "fair value" based on long term regression. "+.5" is actually e^.5 - 1, or 64%, above fair value. "-.5" is similarly 39% below fair value. It's no coincidence that (1 + .64) * (1 -.39) = 1.0. Both are equidistant from fair value logarithmically.

You can see that the 2000 top was a selling opportunity of a lifetime comparable to the 1982 bottom was a buying opportunity. Unfortunately these Long Wave moves are just that: Long. They have staying power. This won't end soon.

The Good News? We will probably hit nominal lows soon. That lower band stands at DJIA 5,190 today. I will state right now, that I would go all in at that point. That would mark an almost incomparable nominal low buying point in our lifetimes.

The Bad News? Although nominal lows were hit in late 1974, REAL LOWS were not left behind until late 1982, about 8 years later. There were severe rallies in the meantime, and subsequent falls. Note: REAL LOWS rarely coincide with NOMINAL LOWS. Same for HIGHS. Our recent REAL HIGH was in 2000, the nominal high was late last year. The REAL LOW of The 1970's Malaise was set in 1982, while the NOMINAL low was set in late 1974.

That said, if you do get the chance to buy stocks in the 5,000's, I would DO IT. But I would also consider the next decade a trading range market, and you should sell after significant rallies. That's doubles off the bottom.

If you buy at mid 5,000's, I would consider a run to 11,000 a good sale.

These gut-wrenching falls bring us closer to The End. Buy stocks in the 5,000's. These will be some of the best values of our lifetimes. They ARE coming. We are closer to a bottom than the top. It is too late to sell. Just hold, and buy on severe downdrafts. Scale in on The Horror.

We are simply at fair value now. We might tread water here, we might implode, who knows. But buying stocks at mid 5,000's is a Dead Lock for the trade of a lifetime. Just make sure you sell near +80-100%. Because REAL LOWS will not occur until 2016. Probably in the 6,000's.

THAT will be the Buy-And-Hold point of a lifetime.

352 comments:

«Oldest ‹Older 201 – 352 of 352 Newer› Newest»-

Anonymous

said...

-

-

October 15, 2008 at 2:52 PM

-

Anonymous

said...

-

-

October 15, 2008 at 2:58 PM

-

Anonymous

said...

-

-

October 15, 2008 at 2:59 PM

-

Anonymous

said...

-

-

October 15, 2008 at 3:11 PM

-

Anonymous

said...

-

-

October 15, 2008 at 3:16 PM

-

Bewert

said...

-

-

October 15, 2008 at 6:18 PM

-

Anonymous

said...

-

-

October 15, 2008 at 6:23 PM

-

Anonymous

said...

-

-

October 15, 2008 at 6:25 PM

-

Anonymous

said...

-

-

October 15, 2008 at 6:29 PM

-

Bewert

said...

-

-

October 15, 2008 at 7:15 PM

-

Anonymous

said...

-

-

October 15, 2008 at 7:43 PM

-

Bewert

said...

-

-

October 15, 2008 at 7:56 PM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 7:59 PM

-

Anonymous

said...

-

-

October 15, 2008 at 8:43 PM

-

Bewert

said...

-

-

October 15, 2008 at 8:58 PM

-

Bewert

said...

-

-

October 15, 2008 at 9:09 PM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 4:48 AM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 4:51 AM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 4:57 AM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 5:28 AM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 5:32 AM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 7:18 AM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 7:22 AM

-

IHateToBurstYourBubble

said...

-

-

October 16, 2008 at 7:33 AM

-

Anonymous

said...

-

-

October 16, 2008 at 7:38 AM

-

Anonymous

said...

-

-

October 16, 2008 at 7:46 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:00 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:03 AM

-

tim

said...

-

-

October 16, 2008 at 8:08 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:10 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:13 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:18 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:25 AM

-

tim

said...

-

-

October 16, 2008 at 8:30 AM

-

Bewert

said...

-

-

October 16, 2008 at 8:38 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:44 AM

-

Bewert

said...

-

-

October 16, 2008 at 8:46 AM

-

Anonymous

said...

-

-

October 16, 2008 at 8:50 AM

-

Bewert

said...

-

-

October 16, 2008 at 8:50 AM

-

Anonymous

said...

-

-

October 16, 2008 at 9:17 AM

-

Bewert

said...

-

-

October 16, 2008 at 9:56 AM

-

Anonymous

said...

-

-

October 16, 2008 at 10:08 AM

-

Anonymous

said...

-

-

October 16, 2008 at 10:18 AM

-

Anonymous

said...

-

-

October 16, 2008 at 10:20 AM

-

Anonymous

said...

-

-

October 16, 2008 at 10:23 AM

-

Anonymous

said...

-

-

October 16, 2008 at 10:25 AM

-

Bewert

said...

-

-

October 16, 2008 at 10:39 AM

-

Bewert

said...

-

-

October 16, 2008 at 10:40 AM

-

Anonymous

said...

-

-

October 16, 2008 at 10:44 AM

-

Anonymous

said...

-

-

October 16, 2008 at 10:45 AM

-

Bewert

said...

-

-

October 16, 2008 at 10:56 AM

-

Bewert

said...

-

-

October 16, 2008 at 10:59 AM

-

Anonymous

said...

-

-

October 16, 2008 at 12:11 PM

-

Anonymous

said...

-

-

October 16, 2008 at 1:23 PM

-

Anonymous

said...

-

-

October 16, 2008 at 2:02 PM

-

Bewert

said...

-

-

October 16, 2008 at 2:28 PM

-

Quimby

said...

-

-

October 16, 2008 at 3:48 PM

-

Quimby

said...

-

-

October 16, 2008 at 4:00 PM

-

Anonymous

said...

-

-

October 16, 2008 at 4:05 PM

-

Anonymous

said...

-

-

October 16, 2008 at 4:09 PM

-

Anonymous

said...

-

-

October 16, 2008 at 4:09 PM

-

Anonymous

said...

-

-

October 16, 2008 at 4:10 PM

-

Anonymous

said...

-

-

October 16, 2008 at 4:48 PM

-

Anonymous

said...

-

-

October 16, 2008 at 5:18 PM

-

Anonymous

said...

-

-

October 16, 2008 at 6:16 PM

-

Anonymous

said...

-

-

October 16, 2008 at 6:33 PM

-

Anonymous

said...

-

-

October 16, 2008 at 9:18 PM

-

IHateToBurstYourBubble

said...

-

-

October 17, 2008 at 7:16 AM

-

Anonymous

said...

-

-

October 17, 2008 at 7:38 AM

-

Anonymous

said...

-

-

October 17, 2008 at 7:39 AM

-

IHateToBurstYourBubble

said...

-

-

October 17, 2008 at 8:43 AM

-

Anonymous

said...

-

-

October 17, 2008 at 8:48 AM

-

Anonymous

said...

-

-

October 17, 2008 at 8:49 AM

-

Anonymous

said...

-

-

October 17, 2008 at 8:52 AM

-

Anonymous

said...

-

-

October 17, 2008 at 8:53 AM

-

Anonymous

said...

-

-

October 17, 2008 at 9:32 AM

-

Anonymous

said...

-

-

October 17, 2008 at 9:38 AM

-

Anonymous

said...

-

-

October 17, 2008 at 9:45 AM

-

Anonymous

said...

-

-

October 17, 2008 at 9:50 AM

-

Anonymous

said...

-

-

October 17, 2008 at 9:54 AM

-

Anonymous

said...

-

-

October 17, 2008 at 9:58 AM

-

Anonymous

said...

-

-

October 17, 2008 at 10:25 AM

-

Anonymous

said...

-

-

October 17, 2008 at 10:28 AM

-

Anonymous

said...

-

-

October 17, 2008 at 10:29 AM

-

Anonymous

said...

-

-

October 17, 2008 at 11:16 AM

-

Anonymous

said...

-

-

October 17, 2008 at 11:19 AM

-

Anonymous

said...

-

-

October 17, 2008 at 11:49 AM

-

Anonymous

said...

-

-

October 17, 2008 at 12:01 PM

-

Anonymous

said...

-

-

October 17, 2008 at 12:16 PM

-

Anonymous

said...

-

-

October 17, 2008 at 12:47 PM

-

Bewert

said...

-

-

October 17, 2008 at 12:58 PM

-

Anonymous

said...

-

-

October 17, 2008 at 1:01 PM

-

Anonymous

said...

-

-

October 17, 2008 at 1:06 PM

-

Bewert

said...

-

-

October 17, 2008 at 1:10 PM

-

Bewert

said...

-

-

October 17, 2008 at 1:22 PM

-

Bewert

said...

-

-

October 17, 2008 at 1:34 PM

-

Bewert

said...

-

-

October 17, 2008 at 1:51 PM

-

Quimby

said...

-

-

October 17, 2008 at 1:53 PM

-

Bewert

said...

-

-

October 17, 2008 at 2:03 PM

-

Anonymous

said...

-

-

October 17, 2008 at 4:32 PM

-

Bewert

said...

-

-

October 17, 2008 at 5:08 PM

-

Anonymous

said...

-

-

October 17, 2008 at 5:13 PM

-

Bewert

said...

-

-

October 17, 2008 at 5:15 PM

-

Bewert

said...

-

-

October 17, 2008 at 5:19 PM

-

Bewert

said...

-

-

October 17, 2008 at 5:33 PM

-

tim

said...

-

-

October 17, 2008 at 5:40 PM

-

Bewert

said...

-

-

October 17, 2008 at 5:49 PM

-

Anonymous

said...

-

-

October 17, 2008 at 11:03 PM

-

Anonymous

said...

-

-

October 18, 2008 at 4:48 AM

-

Anonymous

said...

-

-

October 18, 2008 at 4:52 AM

-

Anonymous

said...

-

-

October 18, 2008 at 4:55 AM

-

Anonymous

said...

-

-

October 18, 2008 at 4:58 AM

-

Anonymous

said...

-

-

October 18, 2008 at 5:00 AM

-

Anonymous

said...

-

-

October 18, 2008 at 5:09 AM

-

LavaBear

said...

-

-

October 18, 2008 at 7:08 AM

-

LavaBear

said...

-

-

October 18, 2008 at 7:10 AM

-

Anonymous

said...

-

-

October 18, 2008 at 10:07 AM

-

Anonymous

said...

-

-

October 18, 2008 at 10:09 AM

-

Anonymous

said...

-

-

October 18, 2008 at 3:54 PM

-

Anonymous

said...

-

-

October 18, 2008 at 4:04 PM

-

Bewert

said...

-

-

October 18, 2008 at 5:17 PM

-

Bewert

said...

-

-

October 18, 2008 at 7:16 PM

-

Bewert

said...

-

-

October 18, 2008 at 7:23 PM

-

Anonymous

said...

-

-

October 18, 2008 at 7:39 PM

-

Anonymous

said...

-

-

October 18, 2008 at 8:39 PM

-

Anonymous

said...

-

This comment has been removed by the author.

-

October 18, 2008 at 8:40 PM

-

Anonymous

said...

-

-

October 18, 2008 at 9:14 PM

-

Quimby

said...

-

-

October 18, 2008 at 9:15 PM

-

Anonymous

said...

-

-

October 19, 2008 at 5:56 AM

-

Anonymous

said...

-

-

October 19, 2008 at 8:17 AM

-

Anonymous

said...

-

-

October 19, 2008 at 11:05 AM

-

Anonymous

said...

-

-

October 19, 2008 at 12:53 PM

-

Bewert

said...

-

-

October 19, 2008 at 1:49 PM

-

Bewert

said...

-

-

October 19, 2008 at 3:23 PM

-

Bewert

said...

-

-

October 19, 2008 at 3:26 PM

-

Bewert

said...

-

-

October 19, 2008 at 3:42 PM

-

Bewert

said...

-

-

October 19, 2008 at 3:54 PM

-

Anonymous

said...

-

-

October 19, 2008 at 4:04 PM

-

Anonymous

said...

-

-

October 19, 2008 at 4:06 PM

-

Anonymous

said...

-

-

October 19, 2008 at 4:17 PM

-

Bewert

said...

-

-

October 19, 2008 at 4:57 PM

-

Anonymous

said...

-

-

October 19, 2008 at 5:01 PM

-

Anonymous

said...

-

-

October 19, 2008 at 5:08 PM

-

LavaBear

said...

-

-

October 19, 2008 at 5:38 PM

-

Anonymous

said...

-

-

October 19, 2008 at 5:59 PM

-

Anonymous

said...

-

-

October 19, 2008 at 5:59 PM

-

Anonymous

said...

-

-

October 19, 2008 at 6:01 PM

-

Anonymous

said...

-

-

October 19, 2008 at 6:03 PM

-

tim

said...

-

-

October 19, 2008 at 6:36 PM

-

Anonymous

said...

-

-

October 19, 2008 at 6:42 PM

-

Anonymous

said...

-

-

October 19, 2008 at 7:13 PM

-

Bewert

said...

-

-

October 19, 2008 at 7:31 PM

«Oldest ‹Older 201 – 352 of 352 Newer› Newest»201: It's all Trudi Ewert's Fault. Not sure what she did, brought Bruce to Bend, Calif?.

Are you kidding? TV will be the last to go. You ever see a kid try to give up a pacifier?

*

Are you kiddin? No more video games, no more shit, instead of giving little AmeriKKKan emperors what they want 24/7 I highly suspect 'spare the rod, spoil the child will return big time'.

Yep, 50 yrs of TV baby-sitting, you may be right, years ago they used to have a dish called 'beef&plate', it was a plate with a picture of beef. TV could provide the nourishment, but hungry, angry people I don't think will sit in front of the TV long without their favorite microwave COSTCO SHIT.

COSTCO will soon have armed guards, and not let you in, unless you have plastic that is verifiable, already NOBODY is taking checks in BEND or any other 3rd-world usa city.

Marge,

Stick to your sources, it shouldn't be hard to verify MR-BARNWOOD, just call like you did DORN and ask if he's there?

I thought you verified that BARNWOOD was 'alive', now your saying your not sure???

Costco used to take just debit cards, no credit cards. Is it still like that?

My I broke my frame today on my 25+ yr old hardtail mtn bike, I want to buy a full-suspen for the hell.

I note a lot of desperate shit on craigs for bend, any suggestions out there by others??

There are no sales right now, maybe somebody knows??

I think I'm looking around a $2200 budget for a new bike.

I think I want a spec-stump-jump/fsr, or trek fuel ex-8 or equiv, ... something in that world.

****

Check out the Giant Anthem, right now I think its the best bang for the buck, gives you plenty of travel and it's spec'd pretty good..Specialized is too expensive for what you get.

Re: There are no sales right now, maybe somebody knows??

Everything is/should be on sale right now if you ask, except for the 2009 bikes trickling in. Holding bikes over the winter is not good business.

Sagebrush is rumored to be hurting--go in and offer them $2200 or $2400 cash for a $3000 Santa Cruz Blur LT if they have one in stock.

Check out the Giant Anthem, right now I think its the best bang for the buck, gives you plenty of travel and it's spec'd pretty good..Specialized is too expensive for what you get.

...

Thanks, know anybody that has one? Con's & Pro's??

This is a good thread, so many people here talk about mtn-biking, but its interesting to see who actually does it :) Today

Everything is/should be on sale right now if you ask, except for the 2009 bikes trickling in. Holding bikes over the winter is not good business.

...

Specialized Dealers will not budge an inch.

Hate to take advantage of the guy at Sagebrush, sort of reminds me Dunc, where you have just one employee. Truth be told, these kind of guys might survive, fact is we have dozens of bike shops, with HUGE payroll's.

I don't know how NWA will do they're lean & mean, but it seems that most of the BEND bike shops are over-flowing with employees.

I want to mention something else as well, in PDX 'bike gallery' is booming, as EVERYONE is going commuter. Bikes are BOOMING in PDX, they have never had better biz, but in BEND, I see the stores empty. Go figure why the cali SUV rounda-bout folk of Bend-CALI are going bike like PDX???

Re: Hate to take advantage of the guy at Sagebrush, sort of reminds me Dunc, where you have just one employee.

I think a lot of bike shops will survive around here no matter what. But you have to remember that it is like cars--every year new models come out and the old ones go down in value by 25-30%. NWA has two full time and a few part time employees, and Trudy is pretty hard on the hours. One full time guy will be going back to Skjersaa's(SP?) soon for the winter.

Sagebrush made a huge investment in high end road bikes, in direct competition with Sunnyside and Bend Bike and Sport, which is a tough thing to do. He's a great guy and people get sent back and forth between the shops regularly.

But that '08 bike sitting on the floor until spring, when the '09 will be right beside it, versus cash in the till paying the rent and IRS (remember that employment taxes were due today) is a choice that can be made best by the shop owner. He can always say no.

But realistically bike sales have slowed down by at least half due to the change of seasons. Every penny coming in counts right now.

Norway has decided to do something way out of left field--snomachine performance mods for a winter business. It only makes sense when you realize his brother Sky owns Rage Films and they have been using snomachines to get into the backcountry for years. Plus they are all local-grown gearheads...

There are a hell of a lot of bike stores. Anyone think we're going to lose a few?

Oh, yeah. But cycling is such a big tourist industry here, and with the commuting option pushing sales, most will survive.

What I find interesting is the McDonald's/Burger King model, where a bunch survive right in the same area, like Galveston. People like comparison shopping, which is the free market at it's finest.

Another great local shop with a model different than most is WebCyclery. Kevin has managed to very successfully grow a web niche with cross and trials while simultaneously growing a nice local brick and mortar shop.

Don't Blame Capitalism

By Peter Schiff

Thursday, October 16, 2008; A19

Amid the chaos of recent days, as the federal government has taken gargantuan steps to stabilize the financial markets, realigning the U.S. economic system in the process, comes a nearly universal consensus: This crisis resulted from government reluctance to regulate the unbridled greed of Wall Street. Many economists and market participants who were formerly averse to government interference agree that a more robust regulatory framework must be constructed to cage the destructive forces of capitalism.

For the political left, which has long championed the need for such limits, this crisis is the opportunity of a lifetime.

Absent from such conclusions is the central role the government played in creating the crisis. Yes, many Wall Street leaders were irresponsible, and they should pay. But they were playing the distorted hand dealt them by government policies. Our leaders irrationally promoted home-buying, discouraged savings, and recklessly encouraged borrowing and lending, which together undermined our markets.

Just as prices in a free market are set by supply and demand, financial and real estate markets are governed by the opposing tension between greed and fear. Everyone wants to make money, but everyone is also afraid of losing what he has. Although few would ascribe their desire for prosperity to greed, it is simply a rose by another name. Greed is the elemental motivation for the economic risk-taking and hard work that are essential to a vibrant economy.

But over the past generation, government has removed the necessary counterbalance of fear from the equation. Policies enacted by the Federal Reserve, the Federal Housing Administration, Fannie Mae and Freddie Mac (which were always government entities in disguise), and others created advantages for home-buying and selling and removed disincentives for lending and borrowing. The result was a credit and real estate bubble that could only grow -- until it could grow no more.

Prominent among these wrongheaded advantages are the mortgage interest tax deduction and the exemption of real estate capital gains from taxable income. These policies create unnatural demand for home purchases and a (tax-free) incentive to speculate in real estate.

Similarly, the FHA, Fannie and Freddie were created to encourage lending by allowing primary lenders to turn their long-term risk over to the government. Absent this implicit guarantee, lenders would probably have been much more conservative in approving borrowers and setting interest terms, and in requiring documentation of incomes and higher down payments. Market forces would have kept out unqualified buyers and prevented home-price appreciation from exceeding the growth in household income.

Interest rates contributed the most to creating the housing boom. After the dot-com crash and the slowdown following the attacks of Sept. 11, 2001, the Federal Reserve took extraordinary steps to prevent a shallow recession from deepening. By slashing interest rates to 1 percent and holding them below the rate of inflation for years, the government discouraged savings and practically distributed free money.

Artificially low interest rates invigorated the market for adjustable-rate mortgages and gave birth to the teaser rate, which made overpriced homes appear affordable. Alan Greenspan himself actively encouraged home buyers to avail themselves of these seeming benefits. As monetary policy caused houses to become more expensive, it also temporarily provided buyers with the means to overpay. Cheap money gave rise to subprime mortgages and the resulting securitization wave that made these loans appear safe for investors.

And even today, as market forces deflate the credit bubble, the government is stepping in to re-inflate it. First came the Treasury's $700 billion plan to purchase mortgage assets that no one in the private sector would buy. Now it has recapitalized banks to the tune of $250 billion, guaranteeing loans between banks and fully insuring non-interest-bearing accounts. Policymakers say that absent these steps, banks would not be able to extend loans. But given our already staggering debt burden, perhaps more loans are not the answer. That's what the free market is telling us. But the government cannot abide solutions that ask for consumer sacrifice.

Real credit can be supplied only by savings, so artificial steps to stimulate lending will only produce inflation. By refusing to allow market forces to rein in excess spending, liquidate bad investments, replenish depleted savings, fund capital investment and help workers transition from the service sector to the manufacturing sector, government is resisting the cure while exacerbating the disease.

The United States reached its economic preeminence on the strength of its free markets. So far, the economic disaster exacerbated by government policies is creating opportunities for further government interference, which will lead to bigger catastrophes. Binding the country to a tangle of socialist ideals will seal our fate as a second-rate economic power.

As always, gov't wants to be the solution to the troubles it causes.

Re: Our leaders irrationally promoted home-buying, discouraged savings, and recklessly encouraged borrowing and lending, which together undermined our markets.

And yes, they are trying to re-inflate it.

The thing is, the players are far more worried about the hundreds of trillions in derivatives each other hold than a few trillion in mortgages held by poor non-white people.

The mortgage issue is a smokescreen.

Here's a good one:

Hank Paulson was John Ehrlichman’s assistant in 1972 and 1973. Read bio.

Paulson was Staff Assistant to the Assistant Secretary of Defense at The Pentagon from 1970 to 1972. He then worked for the administration of U.S. President Richard Nixon, serving as assistant to John Ehrlichman from 1972 to 1973.

Old enough to remember Nixon and Watergate?

I'm convinced these guys are trying to milk as much out of our tax dollars as possible to prop up their house of cards before a much more "unhelpful" administration is installed.

RE/MAX to close its Bend branch

By Jeff McDonald / The Bulletin

Published: October 16. 2008 4:00AM PST

The housing downturn will claim one of Bend’s top real estate brokerage firms when RE/MAX Equity Group closes its doors Nov. 1.

Fifty-five employees, most of them brokers, were sent a letter Wednesday from the company’s corporate offices in Denver telling them the office would close at the end of the month and encouraging them to join one of the company’s three independently owned branches in Central Oregon.

The cuts hurt at a time when new opportunities will be hard to find, said Leighsa Francis, a RE/MAX broker at the Bend office.

“It affects us — it’s very sad,” Francis said. “We’re such a large family. It’s sad to see the agents having to go out during a distressed time. It’s a double blow to them.”

There were 864 sales of single-family homes in Bend from January through September, 30 percent fewer than the same nine-month period in 2007 and 49 percent fewer than the same period in 2006, according to a report released last week by the Bratton Appraisal Group.

The corporately owned branch of RE/MAX International, located off Wilson Avenue in The Old Mill District, is the only one of 19 corporately owned firms in Oregon and Washington planning to close its doors, said Jim Homolka, president of RE/MAX Equity Group Inc., based in Portland.

Homolka cited the drop in sales this year as the major reason why the Bend office is closing.

“It’s a business decision,” Homolka said. “The market over there has been struggling and has been very slow for some time. We hated to do it, because it’s such a great area, but it made financial sense at this time.”

RE/MAX has about 150 listings in Central Oregon, Homolka said. It was one of the top real estate firms in Central Oregon in terms of number of sales and agents, Homolka said.

Customers who listed with a RE/MAX agent will be able to keep their listing with the same agent at another firm or drop their listing and go with another firm, Homolka said.

Brokers could end up working for another RE/MAX firm, including Town & Country Realty, based in Sisters, said Peter Storton, owner of the Sisters office. The company also has independently owned offices in Redmond, Sunriver and La Pine.

Storton is working with other brokers to open a new, smaller RE/MAX office in Bend, he said.

“We’re going to see what we can put together with the top 20 to 25 percent that do all the work,” Storton said. “Those are the brokers who have a following and clients that have been following them all the years. There’s still business going on and it makes sense to see if we can’t put something together.”

From my Oct 29, 2007 Post:

PREDICTION:

Renaissance Homes goes broke in 2008

But I don't want to pick solely on Renaissance. There are some big fish that are going down around here in the next 12-24 months. So here's a sneak peak at Paul-doh's first bi-anal Implode-O-Meter:

10) Franklin Crossing & Big downtown commercial/condo live/work crap -- will take years to sell & lease, some will be foreclosed

9) Steve Trono's Mercato, and other similar mega-projects -- won't get built

8) Mass, and I mean MASS, industrial exodus, failures, and bankruptcies

7) Downtown goes Ghost Town -- minimum double digit vacancies

6) Bank branch closings at minimum, and buyouts/failures at worst

5) Large franchised RE brokers go bust -- Morris in The Old Mill for one

4) Destination Resorts -- mass failures and abandonment

3) Idiot Projects -- The Shire, Redmond Water Park -- you know those things ain't gonna fly

2) The Plaza -- goes under, plus B&T go to the Big D, and I don't mean Dallas

1) Sisters, Prineville, and finally the City of Bend -- all will go broke.

Steadily working through the list...

From March 3, 2008:

So Paul, how many years of inventory will we have at the end of February?

IHateToBurstYourBubble said...

...

We're going to have to really bust it out to hit 50 homes by the end of the month. 30 homes seems to horrible to consider. I'm guessing 30 months for Feb 08, or 2 1/2 years.

That's GAME OVER for soooooo many people around here. That's Hasson, Remax & Morris shutting down shop in The Old Mill & leasing 1,000sf next to a consignment shop, or something. These people cannot make their lease/mtg payments at that level of sales, much less anything else.

I think a lot of brokerage will go "boutique" in the next few years. Big franchises will exit. Lots of little 4-5 man shops. And of course the rise of cut-rate, limited service shops. Bye-bye 6%.

And I'm not entirely sure, but I think the building housing Re/Max is owned by Becky Breeze.

Breeze was the original founder of that branch. Sold it to some partners a few years ago, they in turn sold it to Re/Max corporate and moved it to it's current location in The Old Mill.

I guess this is the end of her legacy.

It's an object lesson for anyone in the same spot: Bubbles ALWAYS end, and they DO NOT end well. When they end they bring down almost everyone.

I've added Tetherow & Re/Max to the RIP list.

Subscription only:

Destination resorts

No new resorts in Crook County

Ruling blocks them for at least 3 years

October 16, 2008 4:00 am

PRINEVILLE — With a tap of Judge Scott Cooper’s gavel Wednesday morning, the....MORE

Judge is doing these developers a favor.

So is Re/Max corporate. Destination resorts, big RE brokerage, STD subdiv's... All Dead. The faster people are forcibly made to STOP WHAT THEY ARE DOING, the faster the suicide rate will drop here.

I can't imagine how many people would die as a result of that nutty Redmond Water Park. 20? 30? Geez.... that's just insane.

New Revenue Source! Penalize downtown SHOPPERS! Yeah!

In Bend, multiple parking tickets may bring higher fines

October 16, 2008 4:00 am

People who receive multiple parking tickets in downtown Bend could be placed on a repeat offenders....MORE

Good call. Predatory fines of downtown workers & heavy shoppers. Luckily, SDC charges have been eliminated to COMPENSATE.

This should tell you who runs this town.

I'm still incredulous that Patty Moss hasn't been fired from CACB.

Bruce, did you get a rifle?

Elk starts on Saturday!...gotta buy your tag by Friday.

>>Elk starts on Saturday!...gotta buy your tag by Friday.

Christ. They let you shoot minor league baseball players here?

New Revenue Source! Penalize downtown SHOPPERS! Yeah!

In Bend, multiple parking tickets may bring higher fines

*

It's sort of an interesting problem. The business people have no parking near their shops, they just move their car every two hours. Now the HOLLERN PRIVATE TICKET FIRM is logging plates, so even if you move your car around the corner every 2 hr's your now busted.

People will start only using area neighborhood parking.

I know all US DRUNKS bike to the beer-joints, never ever drive a car downtown. Then walk when you can't ride a bike.

I think you'll see a lot more 'policing' things like this privatized in BEND, as they go broke, the private companys can pull any game out their ass.

I think it will be so painful to visit downtown Bend people will quit going.

Until then, ride your bike. With the horrible DUI laws, and towing your car, its really stupid to drive in Bend, CALIF.

The issue here is privatization of government services. Another issue is plain laziness, its amazing the MAJORITY of people must always bee 100 feet from their auto.

I know at Deschutes and other places, its a regular occurence that folks get off their ass every 2 hrs to move their car, but they're already watching for that.

Yes, the city-hall has been talking about increasing the cost for repeat offenders forever, so now its here, just another reason to either NOT go downtown, or if you do ride a bike or walk.

Homer,

Even BIGGER than SDC exemption for HOLLERN.

Is this new big PUSH for URBAN-RENEWAL ZONES by GARZINI&Co, basically property tax exemption by location.

I really think that the way the HO's that run our city will protect HOLLERN&CO is ...

1.) NO SDC COST for builders

2.) Selective property tax exemption for land holders ( hollern )

3.) Privitization of service by HOLLERN&CO for income ( think parking tickets ).

We're going to see the richest people in BEND paying no tax, getting all services for free, and running all the tax collection agencys.

Bend is going to completely shear the few sheep with money.

I just always make sure to make my trips downtown brief. If I can't find a space, I bail.

Except for business lunches, when I can't bail. Then I go super early, park way far away if I have to, and hoof it.

I find the whole experience stressful. Including biking. But maybe my perception of the safety of bikes is off. In Eugene, if you leave a bike for 5 minutes, it's called a frame.

Predatory fines of downtown workers & heavy shoppers. Luckily, SDC charges have been eliminated to COMPENSATE.

*

It's really the people to park in over 2 hr increments, and that be biz owners or employees, and the employees are the worst.

Take Stacatto or Merenda both with say 40-80 employees, dozens at any time, they all want to park close to the front door, as their car is like their cell phone. You know drugs, smoke, private talk, but mostly drugs; during the break at any of Bends diners the kids want to go out for a line of 'blow', and they want their auto to be a few feet from the front door. SO what ALL do is move their car every two hours while their on SHIFT.

Every fucking kid I know does this, and with all these fancy places downtown, it just blows away all the parking.

If the PIGS didn't have contract private parking enforcement, if the PIGS actually walked around downtown Bend in its tiny 3 by 4 blocks, they could nail the kids smoking and snorting in their auto, and that then the kids wouldn't care about parking in the front door.

It's all part of the cat&mouse game, most people that go to Merenda, or any of the COUGAR Bars, are going to get drugs or pussy from out skirts of Bend, coming into town, if you take away the real action of Bend, then it would be a ghost town, or it would all move out to 3rd ave, ...

I think with the new rule, that the same kids who get the same tickets every night, ... What do they care?? they're selling $1,000/night worth of cocaine from their car, you think they care about a $20 ticket every night?? HELL NO

Just a cost of doing business.

Welcome to Bend, CALIF.

In Eugene, if you leave a bike for 5 minutes, it's called a frame.

*

I have ONE BIKE just for tying to the tree in front of the deschutes, and its always covered with dirt.

Yes, in BEND if you have a nice bike, and you leave it locked anywhere in town in public, it will be on craigs-list the same day. FACT.

Just BUY a junker for BEND downtown, and lock it up where you wish.

NEVER EVER ride a nice road-bike, or mtn-bike in downtown BEND.

Virtually ALL the kids who hangout at the pubs in BEND, by kids I'm talking under 30, are on bikes.

The biggest OUCH is if you get pulled over by the PIGS, its almost $1,000 to get your car back, as they impound. Diversion isn't that bad, they all go, but losing the wheels is 'ouch', which means you can't drive up the mtn to ski or bike. Thus most athletic kids ride their bikes in downtown.

The non-athletic kids downtown are about coke, pot, driving around, and parking, and working min-wage jobs to meet the public and sell coke & pot, and ecstasy, ... and all the other good shit that comes over from PDX by the truckload daily.

Different scene mtn bike guys, or ski bums, having a beer.

Whole different scene than Bend's higher end restaurant scene where NOBODY rides a bike, and its all auto's, tunes, and coke.

Except for business lunches, when I can't bail. Then I go super early, park way far away if I have to, and hoof it.

*

FUCK DUNC's ugly parking garage,

The sad fact is that in 20+ years we have lost 50% of downtown parking as all the lots were filled in by buildings. Then a 4X population. It seems that long ago every other building had a lot next door, not anymore.

Today ALL street parking has 2hr max til late, ... And all off street parking is private with 'tow signs' ( another racket ),

Then you got the FUCKING push this election on public transportation. Make driving your car so fucking painful, you have to take the bus.

In PDX now its over $2 for a fucking bus ticket, even for a short, it can cost a small fortune for a bus or max pass. This is where they want to take BEND, once they get you out of your car by pain, and put you in the BUS, the BUS will go astro.

Like the MTN-B bus, it used to be $1 UP, and free down, last season it was $5 in either direction, and I hear it may go to $10.

This is always what is done.

BIKE IN BEND.

>>Just BUY a junker for BEND downtown, and lock it up where you wish.

Makes sense. Take a beater.

RE:

“We’re going to see what we can put together with the top 20 to 25 percent that do all the work,” Storton said.

Nice.

Re: downtown parking.

WTF, there is five stories of parking 200 yards away.

>>the top 20 to 25 percent that do all the work

That's where all the employees should park. Customers shouldn't have to.

As a rule, parking garages smell like urine.

The thing is the stupid fucking council will spend hours debating this while spending millions in ten minutes on JR.

>>“We’re going to see what we can put together with the top 20 to 25 percent that do all the work,” Storton said.

What a great guy. You just KNOW he's always been good at making friends. Ever since grade school.

"Your freckles are ugly!"

"You have a gap between your teeth."

"Your mom's legs are fat!"

"Your raincoat is too yellow."

Re: In PDX now its over $2 for a fucking bus ticket, even for a short, it can cost a small fortune for a bus or max pass.

Obviously you haven't filled your tank lately.

>Yes, in BEND if you have a nice bike, and you leave it locked anywhere in town in public, it will be on craigs-list the same day. FACT.

CRAP I say. Fear mongering. I worked downtown for years, and while most of the time I rode my cruiser down, there were many many occasions when I road my Dura-Ace equipped road bike to work, or my custom single speed with Chris King parts. These days I hardly ever ride my cruiser to town so it's always on a "nice" bike. I've never had an issue, nor has anyone else I ride with.

The funny thing is, I bought my cruiser years ago to keep my nice bikes from being stolen. After, I realized that I have a $500 deductible with my insurance. If my cruiser was stolen, I would be out that money. If one of my nice bikes were stolen I would make money as I race and have sponsors so I don't pay retail.

For most people a junker makes sense, and that's not bad advice. But COME ON - stop being so dramatic about the other bikes.

Re: that WaPo article

Best thing I've read in a long time.

Greenspan shot back that CFTC regulation was superfluous; existing laws were enough. "Regulation of derivatives transactions that are privately negotiated by professionals is unnecessary," he said. "Regulation that serves no useful purpose hinders the efficiency of markets to enlarge standards of living."

Greenspan is in the running for the dumbest fucking guy in the world, right next to Doug Feith.

"The Village" -- five building 199 unit hotel/condo project with restaurant/bar and Deepak Chopra Wellness Center is to break ground in March '09 near Old Mill. Me thinks the only thing it will break is into your RIP list.

For most people a junker makes sense, and that's not bad advice. But COME ON - stop being so dramatic about the other bikes.

*

Last year I went to sunnyside to 'buy' my wife a bike-lock. They laughed their ass off and told me they wouldn't sell me one. As her bike in this instance was a nice TREK road-bike, and they said it was last about 1/2 hour downtown, no matter what the lock.

Their advice? Never leave a fucking 'nice' bike downtown.

A Cruiser ain't a nice bike.

I'm for dirty old beatup mtn bikes for downtown, albeit with urban tires.

Like they told me at Sunnyside, "anybody that leaves a Nice Carbon RoadBike locked up downtown deserves to have it stolen.'

I think the reason nobody stole your cruiser is, who the fuck wants a cruiser, thats another issue for TT, get a bike that sucks so bad, even a thief don't want the fucking bike.

That's where all the employees should park. Customers shouldn't have to.

[ employees want to be near the bar so they can do drug deals, and be in site unless it goes down ]

As a rule, parking garages smell like urine.

[ nobody like to do deals in parking garages, except criminals, and idiots ]

Another deal on this 'privatized' parking BULLSHIT, is that its college kids writing the tickets.

For the most part they'll write a ticket for a car that sits over 2 hr's, which is public, but if your in the know, and move your car every two hr's ( which is also illegal ), there is a lot of variance, if you know the kid writing the tickets.

Lots of room for CORRUPTION in this racket.

Lots' pussy, coke, and pot gets traded for the parking ticket writer looking the other way for locals.

It's all part of Bend, Calif.

Greenspan shot back that CFTC regulation was superfluous; existing laws were enough. "Regulation of derivatives transactions that are privately negotiated by professionals is unnecessary," he said. "Regulation that serves no useful purpose hinders the efficiency of markets to enlarge standards of living."

*

It's essentially true BP, that 'existing laws' might have been enforced, but that is the essence of the issue, is that laws don't get enforced.

"The more the laws, the more corrupt the nation" - very old saying.

Those today asking for MORE government, are in effect asking for more totalitarianism.

I think BP&HBM will get it 'FASCISM' with the face of an OREO.

Plan for Redmond industrial site clears key hurdle

SALEM — A plan that will redefine the landscape south of Redmond — and potentially lure large industrial employers to Central Oregon — earned a preliminary green light on Tuesday.

A mile-wide swath of state-owned High Desert just south of the Deschutes County Fair & Expo Center will house a large-lot industrial park, a green energy development hub and a new National Guard Armory, under a land use plan approved by the State Land Board, made up of the governor, secretary of state and state treasurer.

That decision is the latest step in a long-term state plan to develop several formerly federal parcels in Central Oregon, with the profits going to public schools.

The focus for the 945-acre south Redmond site, developed by the Department of State Lands in conjunction with the city and Deschutes County, is large industrial sites that would be a minimum of 100 acres apiece.

About 80 acres of the property would be set aside for smaller business sites.

The state will now work with the city of Redmond to annex the property, and then seek development permits.

In a separate decision, the land board also agreed to deed a piece of the state property, adjacent to the fairgrounds, to Deschutes County to allow for future expansions of the popular facility.

The state will receive two county-owned parcels in return, totaling 267 acres and suited for residential development.

Depending on appraisals, the state will give the county as much as 238 acres of the south Redmond site.

Plans also call for extending 19th Street through the property from the fairgrounds south toward Deschutes Junction, and for a new railroad spur that would allow for trains of as much as a mile long to load and unload cars.

A potential south Redmond reroute of U.S. Highway 97 could bisect the property.

‘Visionary’

“A project like this is visionary,” said Gov. Ted Kulongoski, who said the state’s investment can provide stability and jobs as the economy evolves both nationally and internationally.

“We have to change and this is a great opportunity that is in the long-term interest, I think, of the state of Oregon.”

Among the goals is to create what state planners are calling an “eco-industrial park” that would encourage firms to cooperate to save energy, generate energy and reduce industrial waste.

Department of State Lands officials said there are few available industrial sites of 100 or more acres in the western United States.

The state lacks expertise in developing and managing industrial sites, so it is working with private sector partners on the project, said Department of State Lands Director Louise Solliday.

Kulongoski did voice some concern about how the development might further tax Highway 97, the already congested north-south transportation corridor through the fast-growing region.

Doug Parker, an asset planner for the agency, said the proposed development is expected to actually reduce traffic on the highway because it will provide more places for Redmond residents to work, which would result in fewer people commuting south to Bend.

Concerns about the capacity of Highway 97 have stymied development plans at the 1,200-acre Juniper Ridge area just north of Bend, where city officials envision a mix of businesses, homes and potentially a university-based research park.

Moving quickly

Tuesday’s decision clears the way for the state to request annexation of the south Redmond parcel to the Redmond Urban Growth Boundary, and city officials who attended the hearing in Salem signaled that they would move quickly to approve those plans.

“This is a unique parcel,” said Redmond City Council President George Endicott, who said it will be moved to the top of the list of properties to bring into the city’s urban growth boundary.

“It will meet local, regional and state needs and is the only large lot industrial park of this size under single ownership in the state,” he said. “We think the site offers great potential.” Endicott said the support of the governor for the Redmond project might help with efforts to attract public dollars for the south-side Highway 97 project.

“When the governor says he wants this to happen, it warms my heart,” Endicott said.

The Oregon Military Department will relocate its Redmond Armory, now downtown, onto 10 acres of the property.

The industrial lots will be a minimum of 100 acres, but could be larger.

The land use plan also covers 80 acres along Highway 97 known as the Juniper Scenic Wayside, now owned by the Oregon Parks and Recreation Department.

No decision has been made whether to sell or develop that land, Solliday said.

The state is still acquiring land in Central Oregon from the U.S. Bureau of Land Management to satisfy a long-standing debt.

A legal ruling in the 1980s found that Oregon had been shorted land at the time of statehood that was supposed to be used to help pay for public schools.

Proceeds from economic activity on state-owned lands go into the Common School Fund.

With a goal of maximizing profits, the state targeted federal parcels in fast-growing Central Oregon for acquisition.

In addition to the 945-acre Redmond site, the state has already received 1,080 acres in the region that could be developed as resorts and rural subdivisions.

Two other parcels have been identified but ownership has not formally been transferred: a 640-acre parcel in Crook County and a 1,577-acre tract north of the Bend Airport, off Deschutes Market Road.

Deschutes County Commissioner Mike Daly, who attended the hearing, said the county had been eyeing the BLM property south of the fairgrounds for years, and is enthusiastic about the opportunity to get it through a land trade.

“We think we have the finest fairgrounds in the western United States,” he said. “This will give us some room to expand, because we already don’t have enough room when we have the RV shows come in.”

There is 80 acres of parking at the fairgrounds now, but the county rents another 100 acres to accommodate parking during those events, he said.

The 945-acre south Redmond tract is characterized as juniper woodland and has been used for grazing, and also as a site for military training. It is now zoned as exclusive farm use, but it has never been farmed, according to the state land use and management plan.

The Juniper Golf Course is adjacent to the property, but the city has no plans to expand the course.

The extension of 19th Street to the south could serve as a secondary access to the exclusive Pronghorn resort, which must add another exit route once it is halfway built out.

Meanwhile our City Council is determined to turn our 1500 acres at Juniper Ridge Celebration West.

At least it's a closer commute to the jobs in Redmond, I guess.

"INTO" Celebration West...

The problem is and always has been 'selective law enforcement'.

Just like the issue of parking-tickets today in Bend, Calif.

All law enforcement becomes corrupt when-ever money, pussy, or drugs are involved.

The good news with derivatives is that 'trillions' were involved, which created a law enforcement bonanza.

Thus 'law enforcement' for finance looked the other way, and will always look the other way, unless there is NO money or pussy involved.

Remember Spitzer was brought down by pussy.

We're a nation of lawyers, we have tons of laws, the most complex tax code on earth. We are the most corrupt nation in the history of the earth.

Solution? Buy a toy-rifle and blow your brains out pussy.

Waaaaahhh... downtown is HARD to get to. I can't park anywhere and someone will steal my bike.

I mostly ride my bike downtown. Often it is my 'beater', a 14 yr old mtn bike with XTR. Never had a bike stolen, even when it was my modern $5k Specialized road bike, $4k custom cross bike, $4k custom mtn bike, etc... Yes, I often left these bikes locked up on Minnesota ave.

When I worked downtown, up until 2 years ago, I was there 9-5 and rode a bike most every day. If I drove I parked just past the Library and walked to Minnesota St.

Now if I go downtown during the day I'm there less than 2 hrs. Why? I have a job that I need to get back to. I find on-street parking almost every time. If there isn't on street parking there is the garage. It doesn't smell like urine.

If I'm downtown for more than 2 hrs it's in the evening.

After 6pm there is no ticketing. Since you get to park for 2 hrs that means that if you park after 4pm you don't get a ticket.

I've been here for 10 years, and have received 1 ticket, about 7 years ago when there were still "15 minute" zones.

It's not that hard, people.

Downtown isn't an inconvenience.

I take no issues with the ticketing.

Re: Solution? Buy a toy-rifle and blow your brains out pussy.

That's why we call you Dumbfuck.

Here is another quote from that great article:

Long Term Capital Management, a huge hedge fund heavily weighted in derivatives, told the Fed that it could not cover $4 billion in losses, threatening the fortunes of everyone from tycoons to pension funds. After Russia, swept up in the Asian economic crisis, had defaulted on its debt, Long Term Capital was besieged with calls to put up more cash as collateral for its investments. Based on the derivative side of its books, Long Term Capital had an astoundingly high debt-to-capital ratio. "The off-balance sheet leverage was 100 to 1 or 200 to 1 -- I don't know how to calculate it," Peter Fisher, a senior Fed official, told Greenspan and other Fed governors at a Sept. 29, 1998, meeting, according to the transcript

So we just ignore the truly greedy rich fleecing the rest of us, let them pay themselves off, and sink into despair? Without putting up a fight?

You can crawl back into your cave. I'm not going to. I simply am not wired that way.

And he said a compensation system that he estimated paid him about $350 million between 2000 and 2007 even as the company headed for disaster was appropriate.

"We had a compensation committee that spent a tremendous amount of time making sure that the interests of the executives and the employees were aligned with shareholders," Fuld said.

We simply have to rein in assholes like this. It was done at times before, and it can be done again.

Rein in the assholes, but no more laws that won't be enforced anyway, or laws that will be selectively enforced to go after someone that they really want to nab for some OTHER reason.

More and more laws all the time. From both Dems and Reps. Damn all politicians.

I have not seen Mr Barnwood. Either way it is rumor.

You can crawl back into your cave. I'm not going to. I simply am not wired that way.

*

So instead your going to buy and toy gun, and a barnwood toilet seat??

Re:

So instead your going to buy and toy gun, and a barnwood toilet seat??

No, I'm working to get Dem control and some regulation passed.

Why would you want a toy gun? I've had real guns for over 40 years.

>> Makes sense. Take a beater.

Uggg, I had my beater stolen in Eugene.

I beat the fuck out of that college girl I saw riding it 3 years later. At least I think it was the same bike...hmmmm not really sure now.

Seriously though, yes, even my beater was stolen (in short order) in Eugene. Horrid town.

>> No, I'm working to get Dem control and some regulation passed.

Bruce, why regulation? The downside of the "market" should be all thats needed to keep idiots from doing this shit in the future. Except they are bailed out by Bush/Paulson and protected from their poor choices so there is no incentive to be cautious.

Now, there's that pesky issue of people deliberately messing with the system and making investments/choice loaded with moral hazard in order to enrich their bonuses or compensation structure. THAT is where regulation MIGHT come in handy.

Bruce what are you going to do with a barn-wood toilet seat? Have you been to the website?? those things are priced for bank execs. Are you getting some of this bail-out money bruce.

Bruce, tell us about how your influencing regulation in NY?

Then that DEM party of yours, tell us about all the cargo we're going to get when you party takes over???

Don't play with real guns bruce, you'll go to jail, and we wouldn't want you to become you to become some man-hole in prison.

Quim,

Poverty is the only solution.

So long as all women ain't ugly, and all money ain't tied down somebody will figure out how to steal it,

Always been this way,

De-Regulation, Re-Regulation, ... The problem is WHO is the Regulator? A DEM HO or a PUG HO, just like the parking meter maids in BEND, are they DEM's or are they PUG's??

A cop is a cop, and all will take donuts, pussy, drugs, and cash for looking the other way.

It's always been this way, and always will,

There will always be fields with too much money, where people can pa themselves infinite sums of money. Eventually everyone else gets jealous and the gig ends, ... It's continually a moving target.

Quim,

Poverty is the only solution.

So long as all women ain't ugly, and all money ain't tied down somebody will figure out how to steal it,

Always been this way,

De-Regulation, Re-Regulation, ... The problem is WHO is the Regulator? A DEM HO or a PUG HO, just like the parking meter maids in BEND, are they DEM's or are they PUG's??

A cop is a cop, and all will take donuts, pussy, drugs, and cash for looking the other way.

It's always been this way, and always will,

There will always be fields with too much money, where people can pa themselves infinite sums of money. Eventually everyone else gets jealous and the gig ends, ... It's continually a moving target.

It'll be interesting to see how the Democrats stand up to the population's anger after the honeymoon.

OBAMA- put an s where the b is.BIDEN after the i add NLA- What's that spell? OSAMA BINLADEN.I KNOW WHO IAM NOT VOTING FOR.

"OBAMA- put an s where the b is.BIDEN after the i add NLA- What's that spell? OSAMA BINLADEN.I KNOW WHO IAM NOT VOTING FOR."

ya, you're not a total fuckin idiot...:o

>>ya, you're not a total fuckin idiot...:o

elitist

Wow! my fellow humans astound me on a continual basis. I can't believe I am asking thisbut here I go.

So to the writer of the rearrange the letters in Obama/Osama comment: you WERE being facetious right? Please, please tell me you were.

Should the Fed pop bubbles early on? From the WSJ:

OCTOBER 17, 2008

Fed Rethinks Stance on Popping Bubbles

The Federal Reserve and academics who give it advice are rethinking the proposition that the Fed cannot and should not try to prick financial bubbles.

"[O]bviously, the last decade has shown that bursting bubbles can be an extraordinarily dangerous and costly phenomenon for the economy, and there is no doubt that as we emerge from the financial crisis, we will all be looking at that issue and what can be done about it," Fed Chairman Ben Bernanke said this week.

The bursting of this decade's housing bubble, which was accompanied by a bubble of cheap credit, has wrought inestimable economic damage. The U.S. economy was faltering before the crisis in credit markets recently intensified, rattling financial markets and sending home prices down further. Even if the government's decision to take stakes in major banks works, it could take weeks for money to flow freely again.

"A recession at least of the magnitude of 1982 is quite likely," said ITG economist Robert Barbera. The recession that ended in 1982 lasted 16 months -- twice as long as the 1991 and 2001 recessions -- and saw the unemployment rate rise to 10.8% from 7.2%.

While it is too soon to pronounce an about-face in Fed thinking, policy makers' views clearly are evolving. The Federal Reserve's longtime line on financial bubbles has been that they were impossible to identify. Even if the central bank could identify a bubble, policy makers said, trying to lance it would be far worse for the economy than letting the bubble run its course and dealing with the consequences.

Economists' view that central banks shouldn't meddle with financial bubbles was informed by the Fed's disastrous efforts to pop the stock-market bubble in the late 1920s, which led to the 1929 stock-market crash and contributed to the Great Depression. That view was reinforced when the Bank of Japan's pricking of the late 1980s' stock-market bubble shepherded in a decade of economic stagnation.

"[T]he degree of monetary tightening that would be required to contain or offset a bubble of any substantial dimension appears to be so great as to risk an unacceptable amount of collateral damage to the wider economy," former Fed Chairman Alan Greenspan said in 2002.

The Fed's view on bubbles helped fuel what became known as "the Greenspan put" -- the conviction among investors that the Fed would let them take excessive risks and step in as custodian if the bets they made went awry. By giving market participants an incentive to assume greater risk than they would have otherwise, the Fed's laissez-faire position on bubbles may have contributed to the surge in credit that helped push housing prices skyward in the first half of this decade.

Part of the problem was that the Fed applied the lessons of the dot-com bubble to housing and credit, says Harvard University economist Jeremy Stein. When Internet stock prices collapsed in 2000, the economic fallout was contained, because the use of leverage -- borrowing money to magnify bets -- was limited. The housing market is far more dependent on credit, and therefore leverage. As the issuance of mortgages expanded, and investors plunged money into complex securities based on those loans, matters got dangerously out of hand.

Identifying bubbles is tricky, with some seemingly irrational price spikes turning out to be justified. Policy makers need to be careful of valuing their judgment over the collective judgment of the market, because efforts to quash prices could interfere with the crucial role markets play in relaying information and allocating capital.

In recent years, economists have made headway in identifying incipient bubbles. Princeton University's Jose Scheinkman and Wei Xiong have shown how bubbles lead to overtrading -- whether day trading dot-com stocks or flipping condos -- and this might be a useful alert. Researchers at the Bank for International Settlements have flagged excessive credit growth signaling a bubble.

Once authorities identify a bubble, the next step is figuring out how to deal with it. Fed officials appear uncomfortable with the idea of raising interest rates to prick a bubble, because rates affect a wide swath of economic activity, and a bubble may be confined to just one area.

"Monetary policy, for which we in the Federal Reserve are responsible, is a blunt instrument with economy-wide effects," said Federal Reserve Bank of Minneapolis President Gary Stern. "We should not pretend that actions taken to rein in those asset-price increases, which seemingly outstrip economic fundamentals, won't in the short run curtail to some extent economic growth and employment."

Fed officials are leaning toward regulating financial firms with more of a focus on how they are contributing to risk throughout the financial system. This approach could also have drawbacks, said Princeton economist Hyun Song Shin.

"These Wall Street people are very intelligent, and their incentives are so vast that they're going to find a way to go around the rules you set down," he said. "Leaning against the wind by raising interest rates in the face of what seems like a credit boom is one way of at least damping down on potential excesses."

Write to Justin Lahart at justin.lahart@wsj.com

Fed Rethinks Stance on Popping Bubbles

Notice while the rest of the country thinks about PREVENTING this sort of catastrophe in the future, Bend city leaders eliminated SDC charges to try to get the party started... AGAIN.

Which is why I am of the mind that Bend CANNOT & WILL NOT be saved, a position taken by BEM several months ago.

This place doesn't want to be saved. City leaders are doing EVERYTHING IN THEIR POWER to resurrect the Bubble Regime. Won't work of course, and stands to make the implosion THAT MUCH WORSE... City of Bend will almost certainly go BANKRUPT because of this.

Everytime I see some City-fueled measure to resurrect RE, it just lengthens & deepens my estimate of how bad things will get here. I used to think we'd stop at $185K medians at bottom, but now I think it's closer to $120K.

I'm coming to Bend this weekend.

I'm looking for some man-twat, and the hand-job from the comic guy.

Where exactly is the D&D?? What are the hours that the man-twat operates??

People from my town here in California, think that Bend will become a tourist sex destination.

I would not want to live in Bend, but its a great place to get your dick sucked.

Yep, cheap sex & drugs, Bend is #1.

Which is why I am of the mind that Bend CANNOT & WILL NOT be saved, a position taken by BEM several months ago.

I guess I should clarify: BEM put forth a Good List of things Bend should do to put things right economically over the long haul.

I agree with what he said in principle, it's just that we don't have the revenue to do ANYTHING. We'll be broke before long. It's inevitable.

Now, once we're broke, we've had our fill of Kool-Aid methedone, we've let our low-cost base (it's coming) attract a new round of employers (this is all 10-20 years off), we'll be able to implement BEM's Good Ideas.

But for the next decade, there won't be any money for anything, whether well-intentioned or not. Look at the SDC boondoggle: Our city leaders think BUILDING HOMES is the answer to our problems. That should tell you that we are dealing with borderline morons.

The Portland people who rented their Bend house to me and then kicked me out after a year to try to flip just got their NOD.

Of course, they tried for the moon and failed to sell. Lost about a dozen thousand bucks of rent money from me, then rented out again.

I'm sure they've been busy spreading the word around Portland that Bend is toxic. Or else they've been very, very quiet.

Our city leaders think BUILDING HOMES is the answer to our problems. That should tell you that we are dealing with borderline morons.

*

Tourism & Building is what we do 'NOW' homer, its all we do, its all we know.

Tourists will continue to CUM to Bend.

Builders are 'city-hall' 100% ownership between HOLLERN&HOA that be 100%.

Materials are now cheaper, labor is now cheaper, and SDC's have been eliminated. Empty land is now tax deferred ( urban renewal ).

Best time to build in 20 years.

The few that still have their retirement 'intact' may drift to Bend to retire.

NWXC is building RIGHT-NOW like its 2005!

BEM's good ideas require a new breed of poly-tick-ians, that will be a long time, we'll get the breed of BP type parasites for years to come, until this town is flat broke, only then will these newbie BP grifters drift away.

I guess I should clarify: BEM put forth a Good List of things Bend should do to put things right economically over the long haul.

*

At this POINT nobody wants to fix BEND the goal today 100% if to RESCUE HOLLERN, so that BROOKS survives this down-turn.

Once this HOLLERN killing is over, and BROOKS is the last man standing, the next breed of poly-tick-ians, can focus on BEND.

Right now the GOAL is boss-hogg survival, cuz that is BEND 100%.

Renting a 'nothing-down' home that is under-water in BEND sucks.

A lot of PDX people bought homes in Bend, as second, but now that is all a nightmare.

Our Barney is simply one of 1,000's.

"elitist"

Whenever I hear the "elitist" label thrown around, I like to listen to Bill Maher:

The East Coast is where all the liberals, with their bad ideas, come from.

You know, bad ideas like the Declaration of Independence and the Constitution and the Bill of Rights.

As opposed to the brilliant ideas that have come out of the west like frontier justice and wearing cowboy boots with a suit.

The ideas this nation was founded on came from the most cosmopolitan people of their day, the founding fathers, who believed in science, who looked to Europe for wisdom, and who had no use for ignorant hicks like Bush and Palin.

Truth is - the truth is, as America moved west and got farther away from its birthing in Boston and Philadelphia, it became less American, not more.

We keep hearing about small-town values, you know, like shooting wolves from an airplane or forcing your daughter into a doomed, loveless marriage.

Cities are about diversity of thought. Small towns are about...well, crystal meth.

And, last year, police found 42 meth labs in Sarah Palin's home county.

Drug addiction is a terrible thing, but apparently it beats living in Wasilla sober.

There's so much meth in this town, I'm surprised the Palins didn't have a kid named "Tweaker."

So, now I know what they mean when they talk about the Alaska spirit. Ah, yes, Alaska, where the townsfolk are jittery and the hockey players screw right through the condoms.

[Bill Maher, New Rules, September 12, 2008]

>>I like to listen to Bill Maher

Oh god. You're an elitist BECAUSE you listen to Bill Maher.

I suppose you read the Economist and speak with a Brahmin accent. You have little umbrellas in your drinks.

More on "elitist"

Bill Maher (April 18 New Rules)

Now, at the end of last week when Barack Obama ignited the "bitter-gate" scandal, you would have thought that he had scaled Mount Rushmore, dick-slapped Jefferson in the face--and spray painted "God damn America" over Lincoln.

But, he wasn't lying. The truth is that religion and guns and hating gays and immigrants, are crutches that people lean on.

So are fast-food, crystal meth and child beauty pageants, but we don't have time to tackle all of America's addictions in one night.

So, let's focus on the big thing. That the people who claim to be the "non-elitists," are the ones who constantly shift tax burdens from the people who fire you, to you.

John McCain voted to repeal the estate tax, voted against raising the minimum wage, has no health care plan, and is fine with keeping the working class in Iraq for a hundred years. But, he's a real "man of the people."

And the president went to Harvard and Yale, and inherited your country from his dad. But, he's not an elitist because he can neither read nor write.

What does it take to label someone "elitist" these days anyway? They wear shoes? They don't buy their groceries at the gas station? Their dog has a name and their truck doesn't?!

You know who is bitter in America?

I am. Because shit-kickers voted twice for a retarded guy they wanted to have a beer with, and everybody else had to suffer the consequences!

Yes, yes, you do love your Bill Maher!

What is it with elitists endlessly quoting Bill Maher and Jon Stewart and Keith Olberman? It reminds me of kindergartners with knock-knock jokes.

It's so important to be charmingly clever, isn't it?

"It's so important to be charmingly clever, isn't it?"

No, it's just important to call the PUG bullshit that gets people to vote against their economic interests ...

Karl Rove described Obama as - quote - "the guy at the country club with the beautiful date, holding a martini and making snide comments about everyone who passes by." Unlike George Bush, who is the guy at the country club who makes snide comments and then passes out.