Johnson said the banks of the canal aren’t stable enough to withstand construction like that, and that the only long-term solution would be to pipe the canal through that entire area.

Driving slowly on the road atop one bank of the canal Tuesday, Johnson pointed out all the nearby development: dozens of homes; a strip mall with ice cream and video stores; an auto parts store with its parking lot 10 feet below the canal; and the Sun Ranch Mobile Home Park on the canal’s south bank, which will be razed for the condominiums.

If the canal were to breach near the planned development, water would flow across Reed Market and back toward Third Street, he said. And even if the water was cut off immediately at the top of the canal, the torrents out of a rupture would last for several hours.

Johnson’s piping solution is more complex and costly than it may seem at first blush.

“You can’t just do this, plop a 50-foot piece of pipe in the middle of the canal, because you can’t necessarily get all the water in the pipe,” Johnson said.

Such a pipe would have to start where the canal’s current is faster — in that case where it passes under Third Street.

And with the city’s possible future plans to create a new intersection at Reed Market and American Lane, Johnson would like to extend that pipe past the Burlington Northern Santa Fe railroad tracks to the east.

Cost for such a project: $5.5 million, Johnson said. In a perfect world, he’d like to do it in the next five years, too.

“It’s fair to ask the developers for a share,” Johnson said. “I think it’s likely the city and COID will have to pay something (also).”

"Fair"? What the hell does he mean it's FAIR! It's not just "fair", it should be implicit & mandatory. But of course it's not. You must remember these are developers bringing something we are in dire need of: About 2 billion housing units. You see, we are down to our last couple of decades of housing supply. Prineville only has 10,000+ home units, or 76 years supply at July's torrid sales pace (11 homes sold). Madras is in more perilous condition having breached below the half century mark (in Yarrow alone) by blowing 8 homes out the hatch in July.

This issue has been (over?)addressed by BendBust, SDC charges are Way Too Low in Bend, and this article brings this out in high relief. This move will cost millions, and is being brought on largely by construction activity itself, which threatens to burst these canals. But as usual, City Councilors walk on eggshells around developers who basically run the show in this 2-horse shithole. Perhaps a short graphical novelette is in order? Yes, yes it is. We'll call it:

Steve Johnson, district manager of the Central Oregon Irrigation District, has got a haircut you can set your watch to. I like this guy. He is tired of fuckin' around, and that haircut clearly telegraphs that this guy ain't gonna take any bullshit.

Yeah, here's your typical sleazy-ass Bend Condo Developer. It's not bad enough these bitches make millions, they gotta nickel & dime taxpayers to death on SDC charges. I hate these bitches.

Yeah, here's your typical sleazy-ass Bend Condo Developer. It's not bad enough these bitches make millions, they gotta nickel & dime taxpayers to death on SDC charges. I hate these bitches. Typical City Council meeting swarming with filthy stinkin' rich developers, trying to sleaze their way out of $5 in SDC charges. City Councilor Linda Johnson chimes in when asked about the consequences to locals if excavation activity breaches the canal.

Typical City Council meeting swarming with filthy stinkin' rich developers, trying to sleaze their way out of $5 in SDC charges. City Councilor Linda Johnson chimes in when asked about the consequences to locals if excavation activity breaches the canal. Here we see a recent proposal by Brooks Resources President, Mike Hollern, to build a underground condo parking garage. Hollern uses PowerPoint technology & a laser pointer which quickly makes the male Councilors remark about his virile constitution, and women City Councilors moist about their mid-sections.

Here we see a recent proposal by Brooks Resources President, Mike Hollern, to build a underground condo parking garage. Hollern uses PowerPoint technology & a laser pointer which quickly makes the male Councilors remark about his virile constitution, and women City Councilors moist about their mid-sections. Of course, Steve Johnson doesn't like this one bit. It's his job to see that the muddy banks of the Bend canals ("River Fudge") are packed hard as a fuckin' carp. Above, Johnson utters a solemn creed within his COID corps and it's loyal band of ruthless fudge packers.

Of course, Steve Johnson doesn't like this one bit. It's his job to see that the muddy banks of the Bend canals ("River Fudge") are packed hard as a fuckin' carp. Above, Johnson utters a solemn creed within his COID corps and it's loyal band of ruthless fudge packers. Of course this proposal, like all others, is quickly approved, and Hollern is in the air in no time.

Of course this proposal, like all others, is quickly approved, and Hollern is in the air in no time.

Here's your typical outcome: Stupid-ass City Councilors, reassured by some glad-handing and a $6 bottle of wine from The Grocery Outlet compliments of condo developers, have overlooked the pesky business of DUE DILIGENCE. And something they were assured would cost $1.59 ends up costing $250 million and kills 6,000,000. Nice.

Condo developers celebrate with the Usual Victorious Fly-By...

Condo developers celebrate with the Usual Victorious Fly-By... ...before returning to headquarters. And Bend taxpayers end up where they always do...

...before returning to headquarters. And Bend taxpayers end up where they always do... Well, I don't want to bore you anymore with tales of Bend City Councilor incompetence, so I'll move on....

Well, I don't want to bore you anymore with tales of Bend City Councilor incompetence, so I'll move on....The Bulletin finally came out with what I can typify as The Tipping Point article in the implosion of Bend real estate, "Prices still sliding, sales still slowing". Now, if you go back and take a quick look at last months article, "Home sales continue decline", you see The End Of An Era: The Last YoY chart of Bend home prices rising for what will be many, many moons.

Yup, sales are imploding, but PRICES as of June 2007 were UP year over year. No more. July 2007 is DOWN, across all Cent OR markets. This was clearly telegraphed by the terrible state of volume implosion. No one is buying homes in Bend Oregon anymore. You'll hear different, but simply respond with, "Then why in hell are volume AND price falling?". OK, this is The End that I talked about wayyyy back last Winter. Here is a reproduction of the data from The Bulletin piece:

These are July data points, and it's smooth sailing until July 2007. And then you see something that hasn't happened in many moons, DROPPING PRICES. Get used to it. Now for a better vantage points, here are area medians normalized at 1.0:

These are July data points, and it's smooth sailing until July 2007. And then you see something that hasn't happened in many moons, DROPPING PRICES. Get used to it. Now for a better vantage points, here are area medians normalized at 1.0: You can see it's a pretty close horserace with Prineville taking the clear lead in 2006. Prices are really being led by volume though, which is disastrous:

You can see it's a pretty close horserace with Prineville taking the clear lead in 2006. Prices are really being led by volume though, which is disastrous:In Bend, 109 single-family homes on less than an acre of land sold in July, down 27.8 percent from June’s sales, according to the Central Oregon Multiple Listing Service. The median price — the price at which half sold for more and half for less — stood at $340,000, 4.5 percent less than the median price of homes sold in July 2006.

Monthly sales figures in Redmond, Crook County and Jefferson County also fell to their lowest levels in five years, according to the MLS, while median sale prices dipped below prices in the same month a year ago.

In Redmond, 40 non-acreage homes sold in July, down 45.2 percent from July 2006. Median prices also slipped to $247,000, down 5.7 percent from the same month last year.

In Crook County, 11 homes sold — half of the July 2006 number — while median sales prices slid to $190,000, off 13.5 percent from homes sold in July 2006.

In Jefferson County, eight homes sold — a third of the July 2006 volume — while median sales prices dipped 4.9 percent from July 2006 to $173,250.

These are just huge declines. It's hard to remember that on an individual basis, people of course care about the value of their own home. But the industry as a whole is about dollar volume. When there's no volume, you can ask all you want for your house, but you got a snowballs chance of getting it. You have to have volume to get "what you think it's worth", otherwise you're just dreaming.And volume has gone to hell here. And the other implication of imploding volume is that The Largest, Most Influential, And Certainly Most Lucrative Industry in Central Oregon IS DYING. The 300 layoffs at Columbia Air will look like chickenfeed compared to the RE industry losses coming in the next few years. There will be THOUSANDS losing their jobs day in and day out for as far as the eye can see around here.

THIS IS IT, THE END. This is what this blog has been about in large measure: When will there come a day when there is INCONTROVERTIBLE PROOF that the RE bubble in Bend has busted? That day is today. It's Over.

For a aside, I noticed the Bulletin has gone far afield looking for fresh young nubian Realtors with which the Bend blogosphere could tear a new ass... if it dared. And they found one Pam Lester of Redmond. Clearly not staying abreast of Whitey McBlogfuckers penchant for tearing nitwits a new corn chute, Lester popped off this Cleveland Steamer:

“I don’t expect prices to go anywhere but up from here,” Lester said, “because they can’t go any lower.”

Pam, cuz you quasi-hot, I'm going to give you some advice. That statement is what we call, in the business, a TAUTOLOGY. Like "Boys will be boys". Wikipedia puts it this way:

In propositional logic, a tautology (from the Greek word ταυτολογία) is a sentence that is true in every valuation (also called interpretation) of its propositional variables, independent of the truth values assigned to these variables.

Sounds smart, but actually it's real, real stupid. Your thesis, "they can't go any lower" is flawed in that it is idiotic. Prices can go lower, and will. I'm going to go easy on you, cuz it's your first time, and like I said, you got some moderate hotness. Please refrain from making tremendously stupid statements like that again. Your clients start to wonder where your cheerleading outfit is. And so do I. Where is it, by the way?

On a personal note, the fact that The Bulletin is going farther afield for their Skank-O-The-Month, and skirting pathological liars like Norma "Sold Out" DuBois & Becky Breeze, makes me think that this blog may be achieving one of it's primary goals: Making RE markets FAR more transparent by raising awareness of what are clear misstatements in the public media. It takes me back...

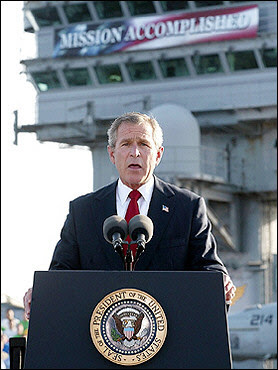

Man, what a proud moment. About 45 minutes after we commenced bombing those filthy stinkin' rich Iraqis, GW arrives via hoverbus on the USS Fuck You, to deliver the Good News:

Man, what a proud moment. About 45 minutes after we commenced bombing those filthy stinkin' rich Iraqis, GW arrives via hoverbus on the USS Fuck You, to deliver the Good News:Damn right. And as we all know, it's been smooth sailing ever since with Iraqi's celebrating, basking in an economic renaissance, and carrying American GI's down Baghdad's glorious palm tree lined boulevards in their Rolls Royces, Lamborghinis and Ferraris. Well, in that spirit, I thought I'd share a personal moment when I realized the battle between Paul-Doh, Blogger Extraordinaire, and Evil Bend Media had well & truly been won:

Finally, for all the World to see, we see Paul-doh sitting on his patented "Coff-Toila-Matt" (combination Mattress, Toilet, and Coffin), soaring light as a feather over his vanquished foes, who he later ate. But Paul-doh doesn't work in a vacuum. No, Paul-doh never give up the fight due to the unwavering support of his Old Lady, who give him comfort when he low, snap occasional PR pics (with titillatingly placed T-shirt/pup tent), and bring Paul-doh 32 gallon drum of lard when it dinnertime.

Finally, for all the World to see, we see Paul-doh sitting on his patented "Coff-Toila-Matt" (combination Mattress, Toilet, and Coffin), soaring light as a feather over his vanquished foes, who he later ate. But Paul-doh doesn't work in a vacuum. No, Paul-doh never give up the fight due to the unwavering support of his Old Lady, who give him comfort when he low, snap occasional PR pics (with titillatingly placed T-shirt/pup tent), and bring Paul-doh 32 gallon drum of lard when it dinnertime.