Welp, if you can't tell, I'm pressed for time, and people seem to want to talk about McPAIN no matter what I post, so this will be just a short weekly placeholder.

I noticed something on Wall St that I haven't seen in a long, long while: 9, count 'em, NINE empty parking spaces in a row. Nine! I the middle of the day. Last year at this time, on a nice sunny day, you just started rounding Bond & Wall, and finally settled on something way off the beaten path.

I can SEE Bend slowing VISIBLY. Which is bad. Cuz once you can SEE it on the streets, it's pretty damn bad.

The Pita Pit, which opened with such fan-fair & crowds, similar to Sonic, was DEAD EMPTY. I mean, the half life of The Big Bang Openings, has gotten down to 1 week. It's just one week, and the honeymoon is over.

And Bend's Beautiful People, you know, the people with 278 non-profits started in the past 3 months... you know, people with morals, looks, titties and MONEY so superior to you and me, that you & me make THEM wanna VOMIT.... well, those people have started engaging in the lowest, most VILE activity known to man:

THEY ARE APPLYING FOR JOBS!

AHHHHHHHHHHHHH! NOOOOOOOOOO!!!! MY GOD!!!!!!! NORMALCY IS FOR LOSERS!!! ONLY THE START-UP & ABANDONMENT OF NON-PROFITS IS GOOD ENOUGH FOR ME!!!!! AHHHHHHHHHHHHHHH!!!!

Yeah. These people are applying for jobs. OK, this is like The Yankees putting a penguin on first base or something. It's so alien to these people to engage in NORMAL LIFE, even they don't know how to do it well, if at all.

Well, if you have 2 cents to rub together this should all be obvious. Hard times are here to stay. If you're looking for The Turn, don't look in Bend. We're 18 months behind, and twice as deep in the shitter.

We're supposedly 3X the exposure to RE as the rest of the state. Bullshit. We're 5-6X MINIMUM. 150% MINIMUM of this regoins growth over the past 10-12 years is due to RE. Without it, we'd have SHRUNK.

This "Credit Crunch" is the End of Days for us. We're dead meat. $120K medians may look Way The Hell Too Optimistic at the end. Why? Bend was purposefully BILKED FOR EVERY FUCKING CENT by RE INTERESTS. And they were enabled by our beloved City Council. Realize that these positions have NO PURPOSE but dispensing influence.

TOM GREENE is the PRESIDENT of the Central Oregon Realtors Association, and I'm sorry, but we DO NOT NEED yet another BOUGHT & PAID FOR WHORE RUNNING THIS TOWN. We have FAR MORE than enough. My God.

These people got us HERE. This is the "Who could have possibly predicted THIS would have happened?" types. They literally cannot predict the sunrise.

Bend council candidates all over map in fundraising

The second-highest fundraiser, attorney Jeff Eager, has brought in $17,563 in his bid for the seat currently held by Mayor Bruce Abernethy, who is not seeking re-election. About $4,000 of Eager’s money comes from Central Oregonians for Affordable Housing and the Central Oregon Association of Realtors’ PAC.

In the three races with an incumbent seeking re-election, the challengers all have raised more money. Former Mayor Kathie Eckman, who is trying to unseat Councilor Linda Johnson, has raised the most of any candidate: $19,446. More than a third of that money has come from Eckman and her husband, Paul, but a large amount has also come from a handful of political action committees, including the Bend Firefighters Association, Deschutes County Republican Central Committee, Central Oregon Association of Realtors and Central Oregonians for Affordable Housing, a builders’ group.

Eckman said this election is the first time she’s received money from political action groups. She said the builders and real estate agents are supportive of her because of her earlier work in city government.

Fundraising efforts in the race between Councilor Peter Gramlich and Tom Greene, the president of the Central Oregon Association of Realtors, are more evenly matched. To date, Gramlich has raised $9,329 and spent $4,007, while Greene has raised $10,034 and spent $8,899.

Gramlich has not received any contributions from organized PACs. Greene has received $3,000 from the Realtor’s association’s PAC and $1,000 from the builder’s group.

In the race between Councilor Jim Clinton and propane company owner Don Leonard, Clinton has raised $5,149 — including $500 from the Bend Firefighters Association’s PAC — and spent $1,279. Leonard has raised $9,100 and spent $6,171. About half of Leonard’s bank account has come from the Realtor’s and builder’s PACs. He has also received $250 from the Deschutes County Republican Central Committee.

No. That is NOT BULLSHIT. Nearly every SINGLE FUCKING CITY COUNCIL CANDIDATE is a bought & PAID FOR WHORE of the LOCAL RE PAC's. Every fucking one.

This Jeff Eager fucker takes the cake, in that he's a LAWYER too.

OK, NONE of these FUCKWADS are worthy of having me pee in their fucking mouths. they are to a one, INFLUENCE PEDDLERS. That is the ONLY GROWTH INDUSTRY LEFT in this town. Hell, it's almost the only industry, period.

This is similarly how I feel about Obama-Nation & McPAIN: This country has become a nation of Politco's, influence peddling whores. WHY is the HELL would Osama spend $160 MILLION in one month?

Because politics is the industry of SELLING OUT EVERYONE ELSE. Get as close to The Honey Pot as you can, and then FUCK EVERYONE.

This country is doomed. They're starting to raise the idea of AmeriKKKa as a second-rate power in mainline media. That means it's really already here. And believe me, it IS inevitable.

Don't vote for these City Council fuckers. Write in someone. Write in Dunc. Write me in, I Hate To Baste Your BUTTERBALL. Write in someone. This town is going to shit, and COAR has their hands firmly on the rudder, which is planted in the asshole of EVERY SINGLE CANDIDATE. COBA too.

We're losing this place. To the worst fucking bunch of thieves on EARTH. read the above article and DO NOT VOTE FOR A SINGLE FUCKER that is either:

1) Supported by RE or builder PAC's, or

2) Won't disclose their funding sources. Dallas Brown comes to mind.

Send a message folks. Write in someone you know. This town is LOST cuz of these fuckers. They have put us on the road to OBLIVION. Go look around downtown. It's a fucking GHOSTTOWN.

THAT is what RE has gotten us. We put ALL our eggs in ONE BASKET, because RE PAC's have bought every election for a generation in this town. You CAN SEE they are trying to buy this one. They will probably succeed.

They will SUCK THIS TOWN DRY. They will DESTROY IT. They really already have. We are already totally doomed. Vote, and tell these fuckers to FUCK OFF.

Monday, October 27, 2008

Monday, October 20, 2008

It's Guest Post Monday! The Mayor?

I have to apologize for not putting these 2 submissions to bendbubble2@gmail.com up sooner. I am just lame. Anyway, 2 guest posts, 1 from the Mayor, and 1 from an RE dude. First, his highness:

To whom it may concern ... (is this you Bruce?) I was looking at your blog and came across an amazing bit of text. A quote attributed to me that is not only inaccurate, but I never said it.

January 3, 2008 you wrote "Green is not alone as a second-home owner in Deschutes County. These days, two of every three dwellings in Bend, Oregon is a second home, according to Bend, Oregon Mayor Bruce Abernethy, himself a real estate broker."

What??? First of all, I would never say two out of three homes are second homes because it isn't true. Secondly, I am not and never have been a real estate broker. Where do you make this stuff up? I suppose I should give you some credit because you did get the part about me being mayor right.

Bruce Abernethy

383-6030 (w)

Now the RE dude:

General State of the Economy

I am a Real Estate Appraiser. I have worked as a Realtor, Loan Officer and Real Estate Appraiser here in Central Oregon since 1995. While I agree with the majority of your opinions regarding our local real estate industry, I wholeheartedly agree with your comments regarding the "bailout".

Bailout-

I think the term "pissing in the ocean" applies here. There is a reason the administration rushed this legislation through congress. The bailout is the biggest hoax on the American people since Reagan's deregulation. It would have been better to let these financial institutions fail, because the free market has shown that something better and stronger will take it's place. Think of these mortgages as a game of musical chairs... taxpayers are once again out of the game without a chair, but holding all the debt. As you've seen from the stock market the last few days... those in the know are not buying into the bailout as a saviour.

Family Wage Jobs-

The Central Oregon area has some special challenges that occur in other areas of the country (Aspen, Durango, Lake Tahoe come to mind). Unfortunately, we have a number of groups which have formed political alliances to maintain the status quo. The number one priority of our local government should be in obtaining family wage jobs. The status quo group of Realtors, Politicos, Developers and the Bend Bulletin believe that we should be building additional resorts. While tourism brings needed dollars and businesses to our area, the minimum wage jobs these industries spawn does nothing to raise the standard of living for the majority of Central Oregonians. The developing of our land, for resort use, benefits those at the top of our economic food chain with very little dribble down to the majority of Central Oregonians. The time, effort and money wasted by our local government spent in kowtowing to this cartel would be much better spent in wooing businesses to the area with tax breaks and/or other benefits.

The Local Housing Market-

I told my clients at the beginning of this year, that I believed our local housing market was going to get worse. The bad news is that we have not hit bottom yet. This makes the March 2008 prediction of recovery by Dana Bratton, one of our local appraisers, look that much more ridiculous. Home pricing will continue to spiral downward as credit tightens - it's a horrible snowball that is still gaining strength as it rolls down the hill. Check out Kevin Phillips book - Bad money : reckless finance, failed politics, and the global crisis of American capitalism. This gives a glimpse of how short sighted politicians have allowed greed to ruin our economy. Locally, foreclosures are increasing and driving the median home pricing down. This will continue to snowball as local businesses begin to fail and thereby force more pressure on homeowners already struggling to pay their monthly mortgage. This financial pressure has tragically manifested itself through a number of suicides and a rise in divorce filings. The financial strain of our declining real estate market takes a very real toll on the personal lives of all Central Oregonians.

Folks - it's going to get a bit worse before it gets better. There may be a very real up-tick in consumer confidence after the Presidential election. Look for positive signs in the economy after the first of the year. However, if this economic snowball continues, it could turn into an avalanche and take most of the world with it. Most economic experts are predicting a few years of stagflation. The only fix is to pry open the credit markets. This 700 billion dollars would have been much better spent establishing a direct government mortgage system. If consumers know they can once again have access to credit, then home pricing will stabilize and people will start spending again.

Of course, Central Oregon is still a great place to live and work. I am heartened by the citizens of Bend who care deeply about this place. I moved here for the lifestyle and I have not been disappointed, those who moved here to "get rich" in the housing industry can't help but be disappointed.

Thank you for allowing me to post...

David Skelton

To whom it may concern ... (is this you Bruce?) I was looking at your blog and came across an amazing bit of text. A quote attributed to me that is not only inaccurate, but I never said it.

January 3, 2008 you wrote "Green is not alone as a second-home owner in Deschutes County. These days, two of every three dwellings in Bend, Oregon is a second home, according to Bend, Oregon Mayor Bruce Abernethy, himself a real estate broker."

What??? First of all, I would never say two out of three homes are second homes because it isn't true. Secondly, I am not and never have been a real estate broker. Where do you make this stuff up? I suppose I should give you some credit because you did get the part about me being mayor right.

Bruce Abernethy

383-6030 (w)

Now the RE dude:

General State of the Economy

I am a Real Estate Appraiser. I have worked as a Realtor, Loan Officer and Real Estate Appraiser here in Central Oregon since 1995. While I agree with the majority of your opinions regarding our local real estate industry, I wholeheartedly agree with your comments regarding the "bailout".

Bailout-

I think the term "pissing in the ocean" applies here. There is a reason the administration rushed this legislation through congress. The bailout is the biggest hoax on the American people since Reagan's deregulation. It would have been better to let these financial institutions fail, because the free market has shown that something better and stronger will take it's place. Think of these mortgages as a game of musical chairs... taxpayers are once again out of the game without a chair, but holding all the debt. As you've seen from the stock market the last few days... those in the know are not buying into the bailout as a saviour.

Family Wage Jobs-

The Central Oregon area has some special challenges that occur in other areas of the country (Aspen, Durango, Lake Tahoe come to mind). Unfortunately, we have a number of groups which have formed political alliances to maintain the status quo. The number one priority of our local government should be in obtaining family wage jobs. The status quo group of Realtors, Politicos, Developers and the Bend Bulletin believe that we should be building additional resorts. While tourism brings needed dollars and businesses to our area, the minimum wage jobs these industries spawn does nothing to raise the standard of living for the majority of Central Oregonians. The developing of our land, for resort use, benefits those at the top of our economic food chain with very little dribble down to the majority of Central Oregonians. The time, effort and money wasted by our local government spent in kowtowing to this cartel would be much better spent in wooing businesses to the area with tax breaks and/or other benefits.

The Local Housing Market-

I told my clients at the beginning of this year, that I believed our local housing market was going to get worse. The bad news is that we have not hit bottom yet. This makes the March 2008 prediction of recovery by Dana Bratton, one of our local appraisers, look that much more ridiculous. Home pricing will continue to spiral downward as credit tightens - it's a horrible snowball that is still gaining strength as it rolls down the hill. Check out Kevin Phillips book - Bad money : reckless finance, failed politics, and the global crisis of American capitalism. This gives a glimpse of how short sighted politicians have allowed greed to ruin our economy. Locally, foreclosures are increasing and driving the median home pricing down. This will continue to snowball as local businesses begin to fail and thereby force more pressure on homeowners already struggling to pay their monthly mortgage. This financial pressure has tragically manifested itself through a number of suicides and a rise in divorce filings. The financial strain of our declining real estate market takes a very real toll on the personal lives of all Central Oregonians.

Folks - it's going to get a bit worse before it gets better. There may be a very real up-tick in consumer confidence after the Presidential election. Look for positive signs in the economy after the first of the year. However, if this economic snowball continues, it could turn into an avalanche and take most of the world with it. Most economic experts are predicting a few years of stagflation. The only fix is to pry open the credit markets. This 700 billion dollars would have been much better spent establishing a direct government mortgage system. If consumers know they can once again have access to credit, then home pricing will stabilize and people will start spending again.

Of course, Central Oregon is still a great place to live and work. I am heartened by the citizens of Bend who care deeply about this place. I moved here for the lifestyle and I have not been disappointed, those who moved here to "get rich" in the housing industry can't help but be disappointed.

Thank you for allowing me to post...

David Skelton

Sunday, October 12, 2008

Great Depression 2.0

So... how's this Bubble Bursting working out for everyone?

I guess I finally got the answer to my question, "How is the stock market going to discount a disastrous economic event that'll take years to play out?"

Answer? Slowly at first, then all at once.

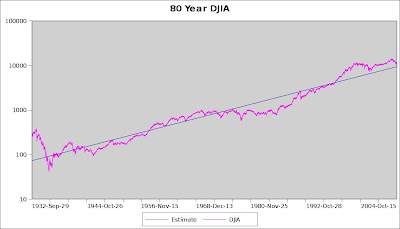

Or for a longer term view of The Pain:

So this weeks little meltdown has put us on a negative 10 year return on the DJIA.

And I don't want to say much this week, cuz I figure events are speaking for themselves, but on the hyper-long term basis, this week, is the first time in a long, long time that the DJIA has fallen to PARITY with its L/T trend.

Here's a 80 YEAR chart of the DJIA, with a best-fit logarithmic estimate. Those 2 big humps on the right are of course, the 2 great bubbles of our lifetimes, The NASDAQ & RE Bubbles.

You'll also notice that when NASDAQ cracked, it never really returned to trend.

And it has been above trend every single day since Mar 24, 1995. Until Wednesday.

The regression estimate for Wednesday is 9,390, and we closed at 9,258.

This may be easier to see in a log chart:

That far right convergence of actual vs estimate doesn't appear to quite meet, but believe me, it does.

Note that this time period includes all sorts of crazy things, from nuking the Japs, to putting man on the moon, WWII, WWI, and essentially the entire modern transportation & electronics era.

It is tough to put some sort of parallel on today's events given the past. But it does look like we are experiencing a Super Wave correction similar to The Great Depression or The Great Malaise of the 1970's.

Strating with the less wrenching meltdown of the 1970's, we see that after a Super Wave up that essentially began in the decades after The Great Depression

I guess we can say The Official Start of The Great Malaise began on July 10, 1969. The DJIA crossed below the L/T least squares estimate of 856.18, and closed at 847.79.

This put to an end an unbroken string of above-trend closes which began on Sept 13, 1954 at DJIA 351.10.

So when did the prior below-trend string start? On May 10, 1940 at DJIA 144.77.

I guess the point here is that what we've seen the past 30 years actually HAS happened, in some measure, before. Calamity following euphoria following calamity... The beat rolls on.

The other point is that this is NOT a short term phenomenon. These long waves take an adult lifetime.

The post Great Depression low of 41.22 was hit on Jul 8, 1932.

A monster rally ended on Mar 10, 1937 at 194.40, or +372%.

New lows were set on Apr 28, 1942 at 92.92, or down 52.2%.

The coming mega-wave carried through to Jan 18, 1966, when the Dow settled at 994.20, or stunning +970%.

But we then paid for it with a pounding that carried us to 577.60 on the Dow, on Dec 6, 1974.

Here begins our modern comparison of the Super Wave Modern Age DJIA Bull Market.

And if you look close and IGNORE the huge, but relatively short live burst from 1932 to 1937, and use the Great Depression low of 41.22 as a starting point, and the near 1,000 top in 1966 as a top, you see this mega wave had a bottom-to-top gain of exactly +2,300%.

A Super Wave up that took 34 years.

Then we had possibly the worst bear market in modern history that took us down 42%, ending 8 years after it started. This is the Dec 6, 1974 low.

Here is the interesting part: We had a super wave higher from Depression lows of +2,300% which took 34 years, right? Extrapolate the 1974 lows forward +2,300% and 34 years and you get...

Yes. Highs in the 13,862 area in 2008. Not perfect. But eery as hell.

Our long wave recent (post 2000) "Opportunity Cost" top was hit July 19, 2007 at 14,000 even.

We have subsequently fallen 40% from this Super Wave Mega-Top.

So where do we go from here? Well, the mathematical nature of a least-squares regression is that the L/T machinations of the market, both positive & negative, will net to zero. And the subsequent negatives will cancel out the prior positives.

On this count, we are in dire straights. Look at the 90th percentile confidence limits:

In point of fact, we have NEVER been as overvalued as we were on Jan 14, 2000 at DJIA 11,722.98 on an opportunity cost basis (excepting the brief Euphoria of pre Great Depression). THAT was the maximum CASH OUT selling point. The only time we've been close to that overvalued was when the DJIA was crashing towards Great Depression lows.

DO NOT believe the banter that we can't go incredibly lower from here. We can, we will. Here is a view of only the difference between actual DJIA closes & least squares estimates:

You can see that the 2000 top was a selling opportunity of a lifetime comparable to the 1982 bottom was a buying opportunity. Unfortunately these Long Wave moves are just that: Long. They have staying power. This won't end soon.

The Good News? We will probably hit nominal lows soon. That lower band stands at DJIA 5,190 today. I will state right now, that I would go all in at that point. That would mark an almost incomparable nominal low buying point in our lifetimes.

The Bad News? Although nominal lows were hit in late 1974, REAL LOWS were not left behind until late 1982, about 8 years later. There were severe rallies in the meantime, and subsequent falls. Note: REAL LOWS rarely coincide with NOMINAL LOWS. Same for HIGHS. Our recent REAL HIGH was in 2000, the nominal high was late last year. The REAL LOW of The 1970's Malaise was set in 1982, while the NOMINAL low was set in late 1974.

That said, if you do get the chance to buy stocks in the 5,000's, I would DO IT. But I would also consider the next decade a trading range market, and you should sell after significant rallies. That's doubles off the bottom.

If you buy at mid 5,000's, I would consider a run to 11,000 a good sale.

These gut-wrenching falls bring us closer to The End. Buy stocks in the 5,000's. These will be some of the best values of our lifetimes. They ARE coming. We are closer to a bottom than the top. It is too late to sell. Just hold, and buy on severe downdrafts. Scale in on The Horror.

We are simply at fair value now. We might tread water here, we might implode, who knows. But buying stocks at mid 5,000's is a Dead Lock for the trade of a lifetime. Just make sure you sell near +80-100%. Because REAL LOWS will not occur until 2016. Probably in the 6,000's.

THAT will be the Buy-And-Hold point of a lifetime.

I guess I finally got the answer to my question, "How is the stock market going to discount a disastrous economic event that'll take years to play out?"

Answer? Slowly at first, then all at once.

Or for a longer term view of The Pain:

So this weeks little meltdown has put us on a negative 10 year return on the DJIA.

And I don't want to say much this week, cuz I figure events are speaking for themselves, but on the hyper-long term basis, this week, is the first time in a long, long time that the DJIA has fallen to PARITY with its L/T trend.

Here's a 80 YEAR chart of the DJIA, with a best-fit logarithmic estimate. Those 2 big humps on the right are of course, the 2 great bubbles of our lifetimes, The NASDAQ & RE Bubbles.

You'll also notice that when NASDAQ cracked, it never really returned to trend.

And it has been above trend every single day since Mar 24, 1995. Until Wednesday.

The regression estimate for Wednesday is 9,390, and we closed at 9,258.

This may be easier to see in a log chart:

That far right convergence of actual vs estimate doesn't appear to quite meet, but believe me, it does.

Note that this time period includes all sorts of crazy things, from nuking the Japs, to putting man on the moon, WWII, WWI, and essentially the entire modern transportation & electronics era.

It is tough to put some sort of parallel on today's events given the past. But it does look like we are experiencing a Super Wave correction similar to The Great Depression or The Great Malaise of the 1970's.

Strating with the less wrenching meltdown of the 1970's, we see that after a Super Wave up that essentially began in the decades after The Great Depression

I guess we can say The Official Start of The Great Malaise began on July 10, 1969. The DJIA crossed below the L/T least squares estimate of 856.18, and closed at 847.79.

This put to an end an unbroken string of above-trend closes which began on Sept 13, 1954 at DJIA 351.10.

So when did the prior below-trend string start? On May 10, 1940 at DJIA 144.77.

I guess the point here is that what we've seen the past 30 years actually HAS happened, in some measure, before. Calamity following euphoria following calamity... The beat rolls on.

The other point is that this is NOT a short term phenomenon. These long waves take an adult lifetime.

The post Great Depression low of 41.22 was hit on Jul 8, 1932.

A monster rally ended on Mar 10, 1937 at 194.40, or +372%.

New lows were set on Apr 28, 1942 at 92.92, or down 52.2%.

The coming mega-wave carried through to Jan 18, 1966, when the Dow settled at 994.20, or stunning +970%.

But we then paid for it with a pounding that carried us to 577.60 on the Dow, on Dec 6, 1974.

Here begins our modern comparison of the Super Wave Modern Age DJIA Bull Market.

And if you look close and IGNORE the huge, but relatively short live burst from 1932 to 1937, and use the Great Depression low of 41.22 as a starting point, and the near 1,000 top in 1966 as a top, you see this mega wave had a bottom-to-top gain of exactly +2,300%.

A Super Wave up that took 34 years.

Then we had possibly the worst bear market in modern history that took us down 42%, ending 8 years after it started. This is the Dec 6, 1974 low.

Here is the interesting part: We had a super wave higher from Depression lows of +2,300% which took 34 years, right? Extrapolate the 1974 lows forward +2,300% and 34 years and you get...

Yes. Highs in the 13,862 area in 2008. Not perfect. But eery as hell.

Our long wave recent (post 2000) "Opportunity Cost" top was hit July 19, 2007 at 14,000 even.

We have subsequently fallen 40% from this Super Wave Mega-Top.

So where do we go from here? Well, the mathematical nature of a least-squares regression is that the L/T machinations of the market, both positive & negative, will net to zero. And the subsequent negatives will cancel out the prior positives.

On this count, we are in dire straights. Look at the 90th percentile confidence limits:

In point of fact, we have NEVER been as overvalued as we were on Jan 14, 2000 at DJIA 11,722.98 on an opportunity cost basis (excepting the brief Euphoria of pre Great Depression). THAT was the maximum CASH OUT selling point. The only time we've been close to that overvalued was when the DJIA was crashing towards Great Depression lows.

DO NOT believe the banter that we can't go incredibly lower from here. We can, we will. Here is a view of only the difference between actual DJIA closes & least squares estimates:

A short explanation: This is the log of the DJIA close minus the log of the least squares expected value. So at 0, the market is at "fair value" based on long term regression. "+.5" is actually e^.5 - 1, or 64%, above fair value. "-.5" is similarly 39% below fair value. It's no coincidence that (1 + .64) * (1 -.39) = 1.0. Both are equidistant from fair value logarithmically.

You can see that the 2000 top was a selling opportunity of a lifetime comparable to the 1982 bottom was a buying opportunity. Unfortunately these Long Wave moves are just that: Long. They have staying power. This won't end soon.

The Good News? We will probably hit nominal lows soon. That lower band stands at DJIA 5,190 today. I will state right now, that I would go all in at that point. That would mark an almost incomparable nominal low buying point in our lifetimes.

The Bad News? Although nominal lows were hit in late 1974, REAL LOWS were not left behind until late 1982, about 8 years later. There were severe rallies in the meantime, and subsequent falls. Note: REAL LOWS rarely coincide with NOMINAL LOWS. Same for HIGHS. Our recent REAL HIGH was in 2000, the nominal high was late last year. The REAL LOW of The 1970's Malaise was set in 1982, while the NOMINAL low was set in late 1974.

That said, if you do get the chance to buy stocks in the 5,000's, I would DO IT. But I would also consider the next decade a trading range market, and you should sell after significant rallies. That's doubles off the bottom.

If you buy at mid 5,000's, I would consider a run to 11,000 a good sale.

These gut-wrenching falls bring us closer to The End. Buy stocks in the 5,000's. These will be some of the best values of our lifetimes. They ARE coming. We are closer to a bottom than the top. It is too late to sell. Just hold, and buy on severe downdrafts. Scale in on The Horror.

We are simply at fair value now. We might tread water here, we might implode, who knows. But buying stocks at mid 5,000's is a Dead Lock for the trade of a lifetime. Just make sure you sell near +80-100%. Because REAL LOWS will not occur until 2016. Probably in the 6,000's.

THAT will be the Buy-And-Hold point of a lifetime.

Sunday, October 5, 2008

Why The Bailout Is 100% Doomed, In Under 1,000 Words.

The bailout legislation passed Friday is doomed to failure. It CANNOT succeed.

Why?

First, it is too little, too late. $700BB is only about 3.5% of the total housing stock of around $20TT.

Second, banks will have learned their lesson, and NOT lend to shaky credits. Or they will. And we will start this thing over, but there will be no accompanying price bubble. People will begin defaulting almost immediately because prices are falling.

What the bailout actually does is ensure The Worst Of All Economic Worlds: STAGFLATION.

The Cause Was A Price Bubble. The Cure Is Popping It. That's All.

This bailout is like "bailing out" the hamburger market that has recently gone to $30/lb. But now, it's FALLING, and it's at $20/lb! OH NO! Let's BAIL IT OUT! Let's get it back to $30/lb.!

Nonsense, of course. Goods that go to unsustainable prices must simply fall back to prices in line with incomes & substitutes. That means home must be in line with local incomes and must provide a comparable return as rentals. At the peak, Bend homes were priced at negative returns FOREVER. At the peak, 92% of all Bend homes were unaffordable to families making 120% of the median family income.

Prediction: Obama wins, and he will oversee The Worst economic malaise since the Great Depression. Question is, will he be a Carter or an FDR?

There is No Question, The Bailout Is Doomed. We will all begin to realize THAT in the coming weeks & months. There is ONLY ONE CURE: Home prices falling to parity with incomes. That's all. All else prolongs and intensifies the pain.

We are in a death spiral of bad loans, default, and foreclosure, a cycle that will repeat itself until we hit bottom. So, in addition to local incomes & rental return parity, people must Get Loans to buy houses, and that will NOT HAPPEN until it looks like housing has hit bottom AND is headed up. Believe me, Banks Will Not Loan Money At The Bottom. Only after a few years of stable to rising prices will they lend.

THAT Final Nail In The Housing Coffin is why home prices are headed LOWER than they were before this thing got started. That's why Bend could easily hit $120K medians AND STAY THERE FOR YEARS.

Prediction: Banks will HORDE this cash. The Gov't will ultimately have to INSURE HOME LOANS to get lending going again. But all this will be after a wave of foreclosures & continuing PLUMMETING of prices.

Why?

First, it is too little, too late. $700BB is only about 3.5% of the total housing stock of around $20TT.

Second, banks will have learned their lesson, and NOT lend to shaky credits. Or they will. And we will start this thing over, but there will be no accompanying price bubble. People will begin defaulting almost immediately because prices are falling.

What the bailout actually does is ensure The Worst Of All Economic Worlds: STAGFLATION.

The Cause Was A Price Bubble. The Cure Is Popping It. That's All.

This bailout is like "bailing out" the hamburger market that has recently gone to $30/lb. But now, it's FALLING, and it's at $20/lb! OH NO! Let's BAIL IT OUT! Let's get it back to $30/lb.!

Nonsense, of course. Goods that go to unsustainable prices must simply fall back to prices in line with incomes & substitutes. That means home must be in line with local incomes and must provide a comparable return as rentals. At the peak, Bend homes were priced at negative returns FOREVER. At the peak, 92% of all Bend homes were unaffordable to families making 120% of the median family income.

Prediction: Obama wins, and he will oversee The Worst economic malaise since the Great Depression. Question is, will he be a Carter or an FDR?

There is No Question, The Bailout Is Doomed. We will all begin to realize THAT in the coming weeks & months. There is ONLY ONE CURE: Home prices falling to parity with incomes. That's all. All else prolongs and intensifies the pain.

We are in a death spiral of bad loans, default, and foreclosure, a cycle that will repeat itself until we hit bottom. So, in addition to local incomes & rental return parity, people must Get Loans to buy houses, and that will NOT HAPPEN until it looks like housing has hit bottom AND is headed up. Believe me, Banks Will Not Loan Money At The Bottom. Only after a few years of stable to rising prices will they lend.

THAT Final Nail In The Housing Coffin is why home prices are headed LOWER than they were before this thing got started. That's why Bend could easily hit $120K medians AND STAY THERE FOR YEARS.

Prediction: Banks will HORDE this cash. The Gov't will ultimately have to INSURE HOME LOANS to get lending going again. But all this will be after a wave of foreclosures & continuing PLUMMETING of prices.

Subscribe to:

Posts (Atom)