A 3 year ride to be exact. As it started on Sunday December 17, 2006, so shall it end. This time for real.

Why? Well, I suppose in part for the same reason the original & kick-ass Bend Bubble Man shut his down: You just get caught up in other things. It's hard to keep up sometimes.

And I suppose I was much more interested in "Calling The Top", than cataloging the long, slow, agonizing demise. Face it, store closure after store closure, foreclosure after foreclosure, perp walk after perp walk, BK after BK, suicide after suicide... it can get monotonous & depressing.

But I suppose mainly it's because, to paraphrase a retarded asshole:

Yeah, The Bubble proper is over. We're not in a bubble anymore. Haven't been for awhile. We're in the deflationary phase. Well into it. And unfortunately for a lot of folks, it's not even close to over.

This thing will be an "L" shaped recovery, At Best. At Best.

"But, Bend is still one of the most overvalued RE markets in the country!", you say.

True. Especially true if by "overvalued" you mean "it has the farthest still to fall", because Bend is not even close to a "bottom".

And I can't help but keep quoting the word "bottom", because I see a painful and very long-lasting decline as the horizontal part of that "L" bottom. The sharp downdraft may be over... now the teeth-pulling life-sucking slow bleed-out begins. That's what I mean by "bottom". This thing is far from being over.

Just a quick review of where we've been:

So, as stated, we were here in Dec 2006. Gloom-and-dooming pretty well. Raising more hackles than awareness. Most of the comments have progressed with almost textbook precision over the past 3 years in parallel with the 5 Stages of Grief:

- Denial

- Anger

- Bargaining

- Depression

- Acceptance

Bargaining? "OK, fine... there is a slowdown, but we'll bounce back better than ever!" Costa, DuBois, and many other Kool-Aid addicts are still riding that horse.

We've hit Depression & Acceptance. Perhaps another reason to shut'er down...

I started this thing to raise awareness that something is severely wrong with the mindset of Bend. It went beyond the Bubble here, although it was almost certainly a root cause. Ironically, it was best stated by one of our best known RE cheerleaders, Mike Hollern:

Developer Mike Hollern blames the Doctrine of Bend Exceptionalism – the peculiar notion that Bend is so special that it’s immune to outside economic forces. “We were overwhelmed by the amount of money pouring in,” Hollern told Costa. “We thought that we were different from the rest of the country. It turned out that we are not so much [different].”

I talk about this pretty extensively in my Feb 29, 2009 post.

What a great term for something so widespread, so insidious, and so economically deadly to a place, that even it's main proponent could no longer deny it's lethality to his company, his town, his region, his World.

The Doctrine of Bend Exceptionalism encapsulates So Much of what is wrong with this country. We have been convinced, All Of Us, that We Are Owed More. Always More. More. More. More. Never Less. No Matter What. No Matter The Cost. We are God's Chosen Flock. We have a Date With Destiny. We Are Rightful Heirs To A Kingdom. Nothing is to good for us.

1 house? Pathetic. I have 2.

2? I have 3, and I've never been to 1 of them.

3? What a loser, I have 5, none are rented out, and I only make $22K/yr!

And so it goes.

Our problem is not so much economic, as it is pathological. I know people don't like to hear that, even on this blog, because it goes after everyone, it is not analytical and it's fatalistic in a way.

But it's true. We've got an extreme case of Cultural Hedonism. We're a nation of Narcissists.

We've learned that All Our Whims (not "Needs") Should Be Satisfied. No Matter What. Now.

"What the fuck does this really have to do with the housing bubble?", you ask.

Hmmmm... let's see.

It's still going on in case you're interested. The above one-upping and keeping up with the Jonese, was the Consumer Side.

But we're starting to find that the Producer Side was at least as Greedy, Corrupt and Criminal. Think it's just Tami Sawyer, or 1031 Assfuckers? Think again:

13 indicted in Bend real estate case

By Jeff Manning, The Oregonian

In the largest fraud case so far to arise out of Oregon's real estate boom and bust, a federal grand jury on Friday indicted 13 people on a variety of bank fraud and conspiracy charges stemming from the 2008 collapse of a Bend real estate development company.

The grand jury indicted Desert Sun Development founder Tyler Fitzsimons and several of his former employees as well as two mortgage brokers, former loan officers with West Coast Bank and Umpqua Bank, and others.

Banks loaned about $41 million to Desert Sun or its employees through a series of falsified loan applications and ultimately lost $19 million on those loans, prosecutors allege.

The Oregonian first broke the story of the problems at Desert Sun in May 2008. The grand jury charged Fitzsimons, a 31-year-old Prineville native, with multiple counts of bank fraud, conspiracy to commit bank fraud, money laundering and making false statements to banks. Also charged were three other former executives of the now defunct company, Jeremy Kendall, Shannon Egeland and Garret Towne. "The conduct alleged in these indictments is typical of what has caused so much havoc in the mortgage and financial sectors," said Kent Robinson, acting U.S.Attorney in Portland.

Fitzsimons, Egeland and Towne declined comment. Kendall and the numerous other defendants could not be reached.

Desert Sun, a developer of both residential and commercial real estate projects, embodied the land-rush mentality that arose during the economic boom.

Desert Sun offered to build at cost new homes for its employees and certain friends and family. In return, the company said it wanted to split profits 50-50 with the owner should they choose to sell their homes.

In central Oregon's red hot housing market, it seemed like a sure moneymaker. More than 30 people signed up. Financial institutions like Columbia River Bank, the now-defunct Community First Bank, West Coast Bank and U.S. Bancorp eagerly participated, lending $16 million to participants.

Desert Sun clerks and construction workers making $20,000 a year soon found themselves on the hook for mortgages of up to $400,000. According to the indictment, Desert Sun executives helped falsify loan applications, forged employees' names and put thousands of dollars into the workers' individual bank accounts to make them seem more credit-worthy than they actually were.

Desert Sun got the construction loan proceeds. But it never built many of the promised homes. Some participants found themselves owing hundreds of thousands of dollars with nothing but a vacant lot to show for it. In addition to the Desert Sun employees, the grand jury indicted Bend resident Jeffrey Sprague, 46, who was a loan officer with West Coast Bank. He and Barbara Hotchkiss, a loan processor who worked with him, were charged with bank fraud for allegedly helping prepare and submit false loan applications.

Also charged were two Bend mortgage brokers, Shaun Little, 41, and Del Barber Jr., 44, for allegedly participating in the scheme.

Barber has already been banned from the mortgage business by state regulators for unrelated violations. Prosecutors appear to be sending a strong signal with these indictments that they intend to crack down hard on even relatively minor transgressions.

Among the indicted was Terri Ausbrooks of Bend, who was among the victims of the Desert Sun home loan program. She found herself more than $300,000 in debt for a house that Desert Sun never built.

Yet, the grand jury charged Ausbrooks with bank fraud for overstating her income and not listing a debt she owed to Fitzsimons in her loan application.

Inflated loan applications abounded during the real estate boom. The biggest, most respected banks in the industry began to accept "stated income" loans, sometimes called "liar loans" because they allowed the borrowers to list whatever earnings they saw fit.

Apart from the home ownership program, prosecutors also leveled additional charges against Fitzsimons, Egeland and Kendall for allegedly defrauding a number of banks in a series of commercial construction loans.

Prosecutors allege that Desert Sun repeatedly secured construction loan draws from a number of different banks based on phony construction progress reports. Without the falsified reports, the banks wouldn't have released the money.

Robert Brink, 58, then a loan officer at Umpqua Bank, allegedly helped Fitzsimons pull off the scheme. The grand jury charged Brink with making false statements to the bank, alleging on five different occasions Brink filed bogus construction inspection reports with the bank.

"The economic hit that a community like Bend takes in a case like this one is very real," said Arthur Balizan, special agent in charge of the FBI in Oregon, which helped investigate the case along with the IRS and the Oregon Division of Finance and Corporate Securities.

"When a development company collapses under the pressure of fraud – as alleged in this case –we are left with millions of dollars in losses, empty lots and abandoned buildings. Everyone loses."

And there is just so much more of this to come. Remember the local piece where an appraiser basically stated that he stopped getting hired because he would not produce fraudulent appraisals at the BEHEST OF LOCAL RE BROKERS?

Yeah, when you HAVE TO commit fraud to survive in your business, you know that you & your industry are well & truly FUCKED. RE in Bend is STILL 100% FUCKED.

But not Garden Variety Fucked.

Fucked Long & Hard for the rest of our lives.

And it is due to the people, mortgage & RE brokers, appraisers, The Fucking Media, CACB, COBA, and every other cheerleading fraudster that made a buck from this disaster.

Let me inject another Bully story that has just come up this morning:

Homes for auction, buyer be prepared

It’s been a busy year on the Deschutes County Courthouse steps, where foreclosure auctions are conducted. Few auctions end in a sale, but every once in a while, a fantastic deal comes along. Of course, you need to have the money on you.

By Andrew Moore / The Bulletin

Before the housing bubble, Paul Helikson, a Bend-based process server, would conduct foreclosure auctions on the Deschutes County Courthouse steps every Friday at 1 p.m. On a busy day, there might be five auctions.

Now, Helikson conducts foreclosure auctions every day at 10 a.m., 11 a.m. and 1 p.m., with an average of 20 homes on the block each day.

With more than 3,100 notices of default — a filing that initiates foreclosure proceedings — recorded in Deschutes County so far this year, Helikson is busy. By comparison, there were 221 notices of default filed in 2006.

But where there’s crisis, there’s opportunity. Usually gathered on the courthouse steps along with Helikson are a small band of investors ready to scoop up properties for cents on the dollar.

They have to pay cash on the spot if they win. They also have to do their research, as a home sold at auction is sold as is, meaning broken pipes, missing appliances and even tax liens are their headaches if they submit the winning bid.

“Caveat emptor fully applies to all the auctions we do, and I think that’s the biggest thing,” Helikson said.

Helikson estimates only 3 percent of the auctions he conducts end with a sale, with the remainder either postponed or concluded without a buyer, meaning the property is turned over to the borrower’s lender.

Occasionally, however, a gem — a home in a good neighborhood or priced far below market value — goes under the gavel.

“There are (incredible deals), said Gene Norton, a Bend investor who’s been attending auctions for the last three months. “But you have to do your research ... it’s a pretty interesting scenario.”

Foreclosure process

Generally, a notice of default is filed against a borrower by the lender’s trustee after the borrower is 90 days delinquent on his or her loan, said Tami MacLeod, an attorney with Karnopp Petersen in Bend who specializes in foreclosures.

The notice must be sent to the borrower via certified mail as well as physically served to the property. On occasions when the home is vacant, the notice is posted on the property after the third attempt. The notice also must run once a week for four weeks in a local general circulation newspaper.

In addition to notifying the borrower that his or her loan is delinquent, the notice also lists a time, date and location for a sale of the property by auction if the loan is not brought current.

By law, the trustee must wait 120 days from the date the borrower is notified to conduct the sale. Therefore, the sale is set roughly 150 days in advance of the filing date, in case there are delays in notifying the borrower, MacLeod said.

During those 150 days, borrowers can attempt to remedy their default by bringing the loan current, either by catching up their payments or by working out a loan modification with their lender. A borrower also can sell the home to satisfy the default.

In cases where the likely sale amount is less than the loan amount — which has become common in the last two years due to the steep depreciation of home values — the borrower also can work out what’s called a short sale with the lender, whereby the lender agrees to forgive the amount of the loan not satisfied by the sale.

In years past, such forgiveness was treated as income by the Internal Revenue Service, but the rule was relaxed by Congress in 2007 and applies through 2012.

If there is no remedy for the loan in default, the home or property goes to auction.

Auction process

Before the auction, the trustee, in consultation with the lender, sets a minimum bid, according to Helikson, who is hired by trustee companies to conduct their auctions. The amount is either posted a few days before the auction or, in some cases, is phoned in to Helikson minutes before the auction.

Most trustee companies have Web sites where they list foreclosure auction properties and their minimum bids. A prominent site is www.usa-foreclosure.com.

Generally, the minimum bid is the amount of the outstanding loan plus any interest, late fees, lien amounts or costs the trustee accrues arranging the auction. By law, banks can’t ask for more than that, MacLeod said.

However, Ryan Strasshofer, a principal with Gorilla Capital, a Eugene-based company that buys homes at foreclosure auctions in Deschutes County and 14 other counties in Oregon, said more lenders are discounting their minimum bids to entice buyers.

“(Banks) are essentially trying to recoup as much money as they can and are using trustee sales more than ever before to get rid of these properties,” Strasshofer said. “They are maxed out on inventory and would rather take $50,000 at auction than spend $20,000 to clean (a house) up and list it to make $60,000.”

Strasshofer said his company, which also operates in Idaho and Arizona, has purchased homes at auction for as little as 30 cents on the dollar.

“The fact is that with most notes out there, the note is worth more than the value of the property,” Strasshofer said.

MacLeod confirmed that she’s noticed more banks lowering their minimum bid to less than what they’re owed on the mortgage.

“I saw one where the (minimum) bid was $100,000 less than what was owed,” she said.

Walter Molony, a spokesman with the National Association of Realtors, said the foreclosure auction market nationwide remains small, comprising only 1 percent of sales volume, he said.

While foreclosure auction prices may sound appealing to some, MacLeod warns anyone interested in purchasing a home in a foreclosure auction to research the property as much as possible. This can be difficult considering it’s impossible to authorize an appraisal without the owner’s permission.

“Bidders on the steps need to be careful about it (because) these are not your typical sales,” she said. “Odds are you have never set foot inside the house, have no idea what condition it’s going to be in ... and it’s not uncommon for people to strip their houses (before they leave), so it’s a buyer-beware situation.”

Said Strasshofer, “We put a lot of time into research.”

Reading the scripts

Helikson said a common misconception among people new to the process is that bidding starts at zero, which is never the case.

When the hour of the auction begins, Helikson begins reading the “scripts,” as he calls them, the legal documents that announce the sale, identify the property and spell out the terms, mainly that a successful bidder has to pay in cash and is purchasing the property with no guarantees.

Helikson speeds through these, having nearly memorized them in the 20 years he has conducted foreclosure auctions.

The “script” also calls for any interested bidders to pre-qualify for an auction. In other words, bidders must prove to Helikson they have the money on their person and can turn it over immediately after the sale is concluded. Only cash or cashier’s checks are accepted.

“Most people know what the (minimum) bid will be and come with that plus a buck,” MacLeod said.

But sometimes, knowing how much cash to bring can be a quandary for bidders if the minimum bid is not made known until minutes before the auction or if they suspect a bidding war might break out.

In such cases, bidders usually bring a cashier’s check for what they guess will be the minimum bid amount as well as cashier’s checks in smaller increments that they can add on.

Helikson doesn’t make change, so any amount submitted over the winning bid is returned when the title is transferred, which must occur within 10 days of the sale, MacLeod said.

As Helikson works his way through his auction scripts, a familiar refrain is, “Going once, going twice, going three times, going back to beneficiary,” meaning the property has not sold and becomes the property of the lender.

Another familiar refrain is the announcement of a postponement. Banks often postpone auctions because they are still sorting through a short-sale offer or some other contingency, MacLeod said.

But banks can’t postpone an auction forever. If they have not conducted an auction within 180 days of the auction sale date listed on the default notice, they are required to rescind the notice and start the whole process over, MacLeod said.

If a home isn’t sold at auction, the lender takes ownership.

Tom Unger, a Portland-based spokesman with Wells Fargo Bank, said the bank tries to list a property after the auction “as soon as possible.” Unger said some homes are easier to list than others depending on what sort of cleanup needs to be performed, but the goal is to get houses listed with a local real estate brokerage quickly.

Molony, with the National Association of Realtors, pegs the number of bank-owned properties currently sold nationwide at 20 percent of all properties.

Sheree MacRitchie, a Bend Realtor who will assume the presidency of the Central Oregon Association of Realtors in 2010, said the number in Bend is roughly 35 percent.

Foreclosure impact

Helikson, whose company also serves notices of default to borrowers, estimates half of the notices he serves are on vacant homes, indicating to him they were either purchased by investors or homeowners who have walked away from their home.

Of the remaining half, 25 percent are served to owners still in their homes and the other 25 percent on renters living in a home that is being foreclosed on.

There have been lots of investors who have defaulted on homes, said Helikson. He can tell because he’ll recognize the same name on different properties. Some names he’s read 10 or 15 times, he said.

He said he doesn’t feel sorry for them, but he does feel for the families that have lost their homes.

On occasion, homeowners will come to their home’s auction to witness the event but generally do so quietly, Helikson said.

“They’re wanting closure, or want to know how long they have to move out, but typically people aren’t too mad because the process has been drawn out so long,” Helikson said.

The flip side, he notes, is all the homes that go through foreclosure re-enter the market at prices that are more affordable, which helps the community in the long run.

“First-time homebuyers are doing very well in this market,” Helikson said.

The median price of a single-family home in Bend rose in October to $220,000 on sales of 175 homes, the most in any month since August 2006, according to the Bratton Report, a monthly real estate sales analysis released by the Bend-based Bratton Appraisal Group.

Median prices for single-family homes in Bend have twice dipped below $200,000 in the last six months. At the market’s peak in May 2007, the median price was $396,000.

The collapse of the housing bubble also has helped Helikson’s company, Tri-County Legal Process Services. It has doubled in size the last two years, from approximately six employees to 12. Helikson estimates he conducts 75 percent of the county’s foreclosure auctions.

Another company that conducts foreclosure auctions in Deschutes County is Central Oregon Legal Services.

MacLeod’s firm, Karnopp Petersen, also conducts some foreclosure auctions for Bank of the Cascades.

Strasshofer said Gorilla Capital is the state’s largest buyer of homes from foreclosure auctions. While the company is profit-driven — its goal is to resell properties within 30 days after purchasing them at auction with a markup of as little as 10 percent of the purchase price — the company helps communities by quickly converting foreclosures into occupied homes, he said.

Gorilla, whose business model is dependent on volume, often resells its homes to buyers who have secured traditional financing, which includes many first-time homebuyers, Strasshofer said.

“We’re getting these things cleaned up and back on the market,” he said.

For investors like Norton, homes purchased at a foreclosure auction can be lucrative as rental properties. That’s because most of the rent is positive cash flow since there’s no underlying mortgage to service after buying the home with cash. Also, because of the discounted purchase price, the homes have a better chance to be sold at a profit as the market rebounds and home prices increase, Norton said.

“You have opportunities for short-term gains and long-term gains,” he said. “You make a little bit of money while waiting to make larger sums of money later, and that might take eight to 10 years, so you have to be prepared, (but) I’m a very conservative investor. The best deals may still be down the road.”

Nationally, more than 14 percent of homeowners were behind on their mortgage payments or in foreclosure in the third quarter, the Mortgage Bankers Association reported Thursday, indicating many more foreclosed homes could yet hit the market.

In Deschutes County, the pace of notices of default filings appears to be slackening, though it’s not yet a trend. There were 310 notices of default filed in September, 261 in October and 180 through Nov. 19.

With unemployment figures still high and affecting a broad group of homeowners beyond those who took out risky loans, Helikson looks to remain busy for a while.

“The thing that sticks out the most is a year and a half ago, it was usually lower-end homes (at auction) and now it’s homes over the whole spectrum,” Helikson said. “There’s not a community that hasn’t been affected by this, from million-dollar homes to $100,000 homes to business complexes to apartment complexes. The whole spectrum is being foreclosed on.”

The Doctrine of Bend Exceptionalism. Look what it's got us. 20 homes a day getting foreclosed. Don't buy the bullshit that Bend isn't shrinking. It is. BIG TIME.Bend Exceptionalism: We're Always Right. Doing what we're doing CANNOT be wrong, because we are God's Chosen People. So this isn't STEALING or FRAUD or MONEY LAUNDERING. No. I'm Tami Sawyer (YOUR NAME HERE), so this is OK.

Our Exceptionalism validates, buttresses, and finally supports our LIES & OUR CRIMES.

Guaran-fucking-tee you that Tami Sawyer, Sun Development, Epic Air, and 1031 Butt-Fuckers (and a hell of a lot I'm not including) ALL thought they were doing nothing wrong. Maybe that changed a little when the FBI came calling.

Narcissism. Exceptionalism. Egoism. Hubris. Belief that we are better than anyone else, we deserve the best of everything, NOW, and no cost is too high to get it.

That was how this bubble got started by both consumers (RE buyers) and producers (fee earning intermediaries). It is also the philiosophy fueling the Current Bubble... which I will try to talk about later.

I tended to never broach this Narcissism subject, because it struck many as WRONG for this blog. Maybe they're right. It's a really amorphous term with no really strong direct link to the creation of the RE-Asset Bubble in this country.

But it is my belief that it is the CORNERSTONE of the creation of the bubble. And it's CULTURAL. It's become PART OF THIS COUNTRY'S ETHOS.

Which makes me think we have more Bubbles to face in the future.

I wanted to divert next into something that I call The 1% Business Plan.

Bend is The Home of The 1% Business Plan. What is it?

Well, you know that if you are starting a business, you map out your idea, the finances, and all the niggly details about what you think will happen, right?

And there are always the "unknowns". How much demand, the costs of items, the ups, the downs, various projections, and all that. Pretty standard.

But most places plan for something like, say a 20-25% downturn as their "PESSIMISTIC" scenario. A real ball breaker.

Conversely, they plan for similar sized (maybe slightly more... these are business people, they're supposed to be optimistic) upside, say 25-30%.

This is Everywhere Else.

Not Bend.

No. In Bend the Pessimistic Scenario is PLUS 20% EVERY YEAR FOREVER. That's the DOWN SIDE.

The upside starts at 40% a year, and typically goes up from there.

Yes. In Bend, +20% is the new DOWN. Even when things are falling apart.

Maybe this concept is best explained by... surprise... a Bully article!

Over next 10 years, Central Oregon expected to see strong job growth

Economists say it will be fastest rate in the state

State economists estimate that 11,000 new jobs will spring up in Central Oregon by 2018, while the state as a whole will see an increase of about 163,000 total jobs.

Job growth in Central Oregon’s three counties — Deschutes, Jefferson and Crook — is expected to rise the fastest in the state, increasing from 2008 staffing numbers by 14 percent, to 92,340 jobs. That’s compared with statewide growth estimated at about 9 percent.

“Over the last 10 years, Central Oregon has grown tons faster than the state,” said Carolyn Eagan, Central Oregon’s regional economist, who helped compile the projections for the region. “There was nothing to me that would indicate that wouldn’t happen after the recession.”

The region could use some of those jobs today. The three counties suffer from some of the state’s highest unemployment. In September, the latest data available on a county level, seasonably adjusted unemployment rates were 15.9 percent, 15.9 percent and 19.7 percent in Deschutes, Jefferson and Crook counties, respectively.

The state, in its job growth projections, didn’t say when those jobs could be expected to start showing up — only how many are expected to be added, in total, over the years leading to 2018. But state economist Tom Potiowsky, in a speech last week in Bend, said he didn’t expect any job growth to occur until, at earliest, 2011 or 2012.

According to Tuesday’s Oregon Employment Department estimates, the education and health services industry is projected to grow the most in the three counties: by more than 2,900 positions, or a 29 percent increase, to nearly 13,000 total jobs. Both the professional and business services industry, and the food and beverage industry should grow by about 18 percent.

Construction will likely continue to lag behind other industries, growing at only 1 percent. Eagan said that construction statewide was at an unsustainable level before the recession, adding that it’s unclear whether the state will reach those levels again.

The projections — used to track job openings, the size of industries and the fastest-growing industries — are released every two years. This most recent projection uses 2008 employment levels as a starting point.

State economists make projections based on factors such as input from the industries and staffing patterns they observe, Eagan said. The projections track jobs in nearly a dozen general industries: everything from manufacturing to leisure and hospitality to government services.

These forecasts can vary, depending on the stability of the economy, Eagan said. When economists made projections based on 2006 staffing levels, they estimated Central Oregon would have about 100,000 jobs in 2016, she said. After the 2008 job losses, the area is now expected to staff about 92,000 positions by 2018.

Besides the creation of new jobs, the state also expects 21,112 positions to open up because people will either retire or move to a different line of work.

Only one industry, information, is expected to decline by 2018. Most others, such as manufacturing, government, leisure and hospitality, and trade, transportation and utilities are expected to grow by between 9 and 14 percent.

During 2008, 4,113 people who worked in construction filed for unemployment insurance, more than any other industry. More than 3,200 people from the manufacturing industry and 1,800 people from retail trade filed for benefits.

U.S. Sen. Jeff Merkley, D-Ore., co-sponsored legislation Tuesday to reauthorize the Economic Development Administration, an agency that aims to promote economic development in communities whose unemployment rate for the past two years is at least 1 percent higher than the national average or whose per capita income is 80 percent or less than that of the national average, according to a news release from Merkley’s office. The Economic Development Administration has created an estimated 392,000 jobs nationwide since its last authorization, according to the release, and has funded 11 projects in Oregon, totaling $10.58 million, since 2007.

Note that the SLOPE OF BEND GROWTH was NOT ALTERED ONE IOTA.

No. Growth, my friend, is STILL HERE. Despite the fact that... there... is... no... growth.

No, what we'll do is simply slide the Still Ridiculously Optimistic Growth Projections down just a bit on the Y-axis. So.... instead of 100K, we're down to 92K. But for the love of Christ, MAKE SURE WE STILL HAVE GROWTH!

This is The Bend Way. Always Exceptional.

This is why The Most Pessimistic Plans are for PLUS 20%. That's The Worst that could happen. The upside is UNBOUNDED really.

Hence, The 1% Business Plan. Bend is The Home of Unbounded Business Failures, because a smaller & smaller number of entrepreneurs are actually even remotely close to the True Crux of Bend Growth... which is honing in on MINUS 20%.

This brings me to another idea:

Too Big To.... EXIST.

We've heard a lot now about the astronomical costs of saving firms that are "Too Big Too Fail". These costs will ultimately bankrupt this country, but that's another blog...

But I don't hear much about what seems to be the Inevitable Conclusion to this idea: Too Big To Exist.

How do we "cure" Too Big To Fail? Well, it seems the only Sure Way is to not let it happen in the first place.

But, doesn't that mean some sort of Quasi-Socialism? Some sort of "invisible" government hand moderating, or flat out quashing success, and possibly nurturing failure, if for no other reason than to serve as a dampener to a firm that may be endangering our "National Stability" because of it's size & importance?

Have we actually reached the Limits of Capitalism?

I find this to be a fairly facinating question. It is strating to seem like that "Cowboy Capitalism" (fairly unregulated) seems to breed "concentration" of wealth, assets, and opportunity.

This flies in the face of the "democratization" of opportunity that it seemed the internet would make all but inevitable, only a few years back. I was utterly convinced of this in 2000.

I thought The Big would get smaller. Much smaller. Competition would come out of the woodwork. Regulation would be like trying to herd a swarm of bees. The elephants would fall.

Wrong.

Bank deposit concentration has increased enormously over the past 2 decades.

Increased Concentration in Banking: Megabanks and Their Implications for Deposit Insurance

During the past two decades, the U.S. banking industry has experienced an unprecedented wave of consolidation, marked by a substantial decline in the number of insured depository institutions and the emergence of banking behemoths with assets totaling in the hundreds of billions of dollars. This unparalleled concentration of assets and deposits among a handful of megabanks has important implications for deposit insurance. Most importantly, the Federal Deposit Insurance Corporation (FDIC) now faces a situation in which the failure of even a single megabank could overwhelm the resources immediately available to the deposit insurance system and expose both the banking industry and the government (i.e., taxpayers) to huge potential liabilities. This article highlights the current structure of the banking industry, examines the threat that this structure poses to the deposit insurance funds, and suggests possible approaches for dealing with megabanks and the increasing concentration of insured deposits.

And banking is just one industry in which this has happened.

Virtually the entire chain of financial services has been joined into one huge inter-linked system in which all the participants either sink or swim.

Is this Too Big To Exist? Or is it that the inexorable binding linkages of successful firms are flawed, and the entire system is bound to implode & destroy itself?

I don't know honestly. It does seem inevitable that Like Everything Else, the FDIC will ultimately fail & have to be bailed out to save its industry. They will try to extort premiums from members, which will weaken their insureds balance sheets, which will increase failures, resulting in a vicous Drag-Me-To-Hell scenario of failure & bailout.

I just know there is something Deliciously Ironic in the idea that all the Too Big To Fail firms will at some point be subjected to a Too Big To Exist philosophy that will shape up over the next coming years in our beloved government.

This will alter the very idea of Capitalism in this Country. Many firms are too big to exist. Perhaps it's true of everything.

I wanted to mention something briefly that just irks me....

What's Been Destroyed In Bend By The Bubble

A lot has changed since the inception of this blog in this town. Increasing prices seems to do funny things to people.

Things that are "OK" at one price point, are torn down at another. Prosperity has a price. Especially if you are in the way of a Tear Down.

Increasing prices for homes in Bend accomplished much of what Bend's Monied Gentry truly wanted to happen in the first place: Apartments, low-income housing, and vast swaths of trailer parks were either converted to high-priced condos, or bulldozed altogether.

A similar fate awaited much of Bend's undeveloped land on the fringe of the City.

We've popularized (I like to think) the term STD, or Siberian Tract Development.

This is typically an amalgam of dense-development, low-to-no quality slave-labor huts that are best suited to cooking meth, growing Mary Jane, and finally blowing up in a fireball of decapitated Maxicans, tiara's, satin proms dresses, and fucking 75 kids and infants.

And worse still, the 1977 Mercury Grand Marquis Station Wagon in the garage cannot house the survivors.

Sure, this sounds like standard issue shit for Madras (and La Pine) for the last 50 years, but the immense fields of STD shit shacks populating the East side (mostly) have made this a common occurence in our own beloved Bend.

This is a real monkey in the wrench for people like Costa who are summarily thrashing the Exceptionalism Doctrine for all it's worth.

But worse, is that after all the Meth-Cooking-Mexicans have burned these shitholes to the ground in what is really a public service... we are stuck with these ass-end of the World shithole homes that I wouldn't let a maggot live in... on postage stamp lots.

Ummmm... didn't we all COME HERE for The Scenery?

Didn't we all come here to Breathe The Air In The Wide Open Spaces?

Didn't we come here so that when we look out our window, we DO NOT SEE INTO OUR NEXT DOOR NEIGHBORS KITCHEN, GAT DAMN IT!

I mean, WHAT THE FUCK.

This is just another reason this fucking Bubble PISSES ME OFF.

This place has been CUT UP into ANT-SIZED plots of dirt, NEVER TO BE UNDONE, in an attempt to profit as much as is humanly possible from what is now an asset that only a FUCKING PSYCHOPATH would want -- a house. But not just a house, a house that is practically INSIDE the fucking house next door.

Fuck you fucking builders, and the Bend City Councilor SELL OUT MOTHERFUCKERS for doing this. There is no UNDO button for this. These shitholes will act as a blight FOR DECADES on this town.

You greedy fucks have cut up "paradise" (that's 1 STD above the mean), and made it a checkerboard of shit. The entire East side of Bend is going to morph into a decrepit pile of crap. Also happening to SW Bend, and (HORROR OF HORRORS), some sections of West Bend (yes, I put Tetherow in that bucket).

The pathetic afterbirth of Measure 37, and it's bastard bitch, Measure 49, can only serve to make this worse in EVERY WAY.

Of course, the Bully has given us a steady stream of GREEDY-ASS-CUNT-MOTHERFUCKERS who want to, INCREDIBLY, build trailers, air-drop rusted out Chevy Citations, and God Knows What The Fuck Else onto their pristine, undivided, and dare I say, picturesque farm land, and replace it with something NO ONE FUCKING WANTS ANYMORE.

Of course, the Bully portrays these people as VICTIMS:

Awaiting decisions in a land use limbo

One of the goals of Measure 49 was to streamline development claims made under Measure 37. With a key deadline looming, though, the law's meaning is still debated, and families like the Bolkens are increasingly frustrated.

But they could not sell the old house to their 41-year-old son because a zoning change on their land in 1979 prevented them from dividing the property. “By selling the one lot to our son, that would clear all our debts,” Olaf Bolken said. Instead, Torfinn Bolken chips in to help pay the mortgage, and Olaf said he has to count the payments as rental income.

Oh man. What a fuckin' load.

Poor fucking OLAF can't anally fuck the US Tax Code for all it's worth, so the Poor Fucker has to hold onto his PRISTINE FARM LAND BOUGHT FOR NEXT TO NOTHING, instead of subdivide it like a Narcissistic Greedy Fucking Douche, thereby increasing his own net worth by 50 FUCKING CENTS while wrecking everything around him.

Yeah, I feel REAL BAD for Olaf.

If Costa had his way, EVERYONE WOULD BE AN OLAF, and Cent OR would be a tax-evasion PARADISE.

But... yeah, that's right. This fucking place would be, instead of an outdoor paradise, a checkboard shithole of trailers, medieval-slingshotted motherfucking rusted out GMC Gremlins, hurled into low-Earth orbit and abandoned whereever OLAF-FUELED FUCKSTICKS have cut up their pastures for Meck-mobbed insanity. FUCKERS.

Costa, do you REALLY want to allow any dumbass hick douche to cut up their land, and house half of fucking GUATAMALA on thier dirt farm?

THINK, MC FLY. THINK.

Our fucking free public lands (Drake Park, the River, Taco Salsa, aka "Meth-N-More", and our forests) are already overrrun with the 3 worst demographic groups on this planet: Motherfucking lazy-ass meth-cooking Mexicans, Murderous Bums, and 800 lb White Trash Single Mothers. To date, we've contained this cancerous scourge to where it should be:

Deschutes River Woods.

But these little nipper fucks are devious, and all they need is 50 sq ft, and fucking 2,000,000 mexicans will invade & be living right next to Legitimate White People.

Think about it Costa, you brain-dead motherfucker.

Again, Narcissim, Greed, Obsession With Self. That's ALL this is. Fuck you, as long as I get mine. Not a brain cell anywhere concerned with the after-effects. Who cares what the costs are. Just GIMME. Now!

I can live with the RUDE SUV DRIVING CALI-BANGER ASSHOLES.

But we're all going to destroy this place we love, one subdiv at a time. And that shit cannot be undone, driven out, or fucking exterminated. We're going to have to live with that for a long damn time.

I guess I couldn't possibly go out without at least mentioning the Mother Of All Boondoggles, JUNIPER RIDGE.

In a piece that can only be filed under "I Guess You Never Know", The Incredible Hulce has allowed a piece titled "General Custer & Juniper Ridge" to somehow slip by her martini-addled editorial radar.

While it is far past time for the City of Bend to acknowledge that Juniper Ridge (JR) has failed to meet even minimal objectives in seven years, they are more likely to pursue "business as usual" because only taxpayer money is at stake. The purpose of this editorial is to explain in clear and simple business terms why everything associated with JR that could possibly go awry did go wrong, and why Juniper Ridge is now a tainted brand just like Ford's Edsel of decades ago.

Holy Fucking Crap!

Yes, this is in the current Cascade Business Buttfucker. Incredible.

Author Scott Siewert goes into a play-by-play of the utter failure that is Juniper Ridge.

And I can only assume that "Scott Siewert" is a pseudonym for someone I can't quite put my finger on right now....

Siewert goes on to just tear JR a new corn chute, and predicts it's complete demise only after, of course, swallowing as much money as Drew Bledsoe swallows donkey cum. That's a lot of fucking money.

Read the piece. Yes, throw The Incredible Hulce a fucking bone, and read her useless rag. This one article is actually a no-holds-barred look at the only place ON EARTH where a City deluded by it's own munificience manages to turn a$1 piece of shit volcano rock strewn Superfund shithole tract of 1,500 acres, into a sure-thing CITY of BEND BANKRUPTCY.

Believe it. Only in Bend. Nowhere else on EARTH are the elected officials STUPID ENOUGH to somehow turn an enormous FREE FINANCIAL ASSET (at bubbles peak, at least) into a complete City-wide bankruptcy in less time, than Bend Oregon.

Thank you, you selfish dumbfuck City Councilors.

What's the difference between a SELFISH fucker and a STUPID fucker?

Nothing. That little dicotomy is what will bring down this country.

Now, just a little summary of where we are & where we might go in the financial markets.

Well first, on the macro-scale, my super-duper, never-fail prediction for the stock market is.... {drumroll!}

meh

I mean, we're not extremely over or under valued from a L/T perspective.

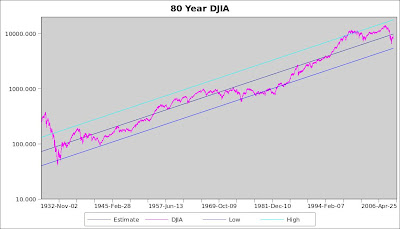

DJIA, 80 year chart.

We're still in the dead middle of that trend line. Fair Value just floated above 10K for the first time ever 2-3 weeks ago.

If this were a "normal" economy, maybe there'd be reason to be at least hopeful.

But I have a sneaking suspicion that the damage from the Bubble imploding, and possibly the even worse side-effects of trying to AVOID ANY PAIN AT ALL COSTS, NO MATTER HOW HIGH under the Obama-Jeebus, will actualy make the current "fair value" a pipe dream in a scant few years.

I actually think we'll be re-visiting the lower band of that trend line before all is said & done.

That's why I am out of stocks for the foreseeable future. No IRA money, no taxable money. Nut'n.

Stocks aren't quite in a bubble, but they are much like RE: Stuck ina temporary holding pattern on a long, slow bleedout to horribly low levels.

So why the "meh"?

Well, at some point, in the far distant future, you actually will be able to make money in US stocks again. Not today, mind you. Not tomorrow. But someday. And when we break through to the horrible depths only touched briefly on a statistical basis way back in 1982, it will be one hell of a ride up. To...ohhhh.... I'd say a triple off the low, over the course of 10 years.

So 12K on the DJIA in 2025.

So don't buy stocks now. Or RE.

But there's an even Bigger Bubble out there.

US Government debt. This is the Ponzi scheme that is making MADOFF look like a piker.

It's really remarkable in it's simplicity. And it's evil.

See, you & me, are going to be sheered by the US Gov't over the coming decades. Our taxes are going to go apeshit. That's because today, our government is borrowing trillions to effect the largest Corporate Welfare Program the World has ever seen, or will ever see in the current living generations lifetime.

They are borrowing the money from our kids, loaning it to corporations, and requiring them to buy T-bonds, which pay interest via taxes.

It is incredible. The amount being transferred is staggering. It's trillions.

This is why in the midst of the most dire, job-crushing recession in 100 years, stocks are headed up. They are making billions on this Ponzi scheme.

But much like the FRAUD-U-NET RE Bubble, at some point even this Government-sponsored fraud must collapse on itself.

And there are 2 outcomes: We pay or we start shooting.

There is a hell of a good chance that we will go to war (and LOSE) over this currently collapsing RE Bubble. Yes. People will die because of this.

From the smallest scale (Tami Sawyer), to the largest (China has nukes), people want to get their money. And when you steal a few hundred grand, you just get a little alone time in the slammer.

But when TRILLIONS are on the line, the slants get their guns. And nukes.

You watch.

The US bond market will be the trigger for our next war. Watch for it to implode, that's the signal that you need to "Get Your Ass To Mars".

And with its collapse will come the dominant theme for the next generation: STAGFLATION.

It's a ways off now, because we are in the throes of deflation. But I have the feeling that Obama-Jeebus-Bernanke will be unable to turn off the spigot in time. They've already admitted as much. They are projecting low rates ad infinitum.

So what do you do when deflation rules the roost, stocks, bonds and RE are all a bust for the forseeable future, what to do?

Gold seems one possible play.

I read that (especially with gold at $1,150/oz), and I say "TOP!".

Which is why I'm still not crazy about gold. What I like more is "stuff".

Copper, non-ferrous mineral, timber, coal, water. Stuff. Basic stuff. I like the materials stocks. But they've had a hell of a run already, and they may well get knocked when the market as a whole is re-valued lower.

But if there is going to be some sort of Next Bubble, seems like they would be a good pick.

Basic Materials, Defense, and choice Pharma.

We're going to war, and old fuckers are going to live long enough to watch their spawn die.

Besides that, it's slim pickins'. I guess buy toys from the foreclosed on. Cars, trucks, stuff. People are going to leave Bend in droves for years, and they will want to sell their shit. WTF... buy it. There's nothing else to do with your money.

So, that's the MACRO.

The Regional?

California is going down.

Yes, the topic that caused almost as much loathing as all my Narcissism Yammering, was the idea that Cali in it's entirety, is becoming a second-rate piece of shit.

Seems logical, the state is following the path of it's citizens.

But think about it: Cali is a VC fueled economy, full of horribly over-priced trailers about to be overrun by the Mexican hordes.

Cali is only considered to BE a paradise, because it has BEEN a paradise.

Is Haiti a paradise? Fuck no. Jamaica? No.

Paradise is what you make it. Something we've all learned from hbm.

WHich I guess brings me to a little aside about weather, scenery and all the shit that makes a place "home".

I always said that bland places like Iowa would do the best in this current economy, because they never participated in the upside, they won't get killed in the downturn.

hbm always said he'd rather be dead in Bend than alive in Iowa.

But really, when I think back on my life, and the myriad of places I've lived, the weather, the scenery, and all the other externality bullshit that is so overly touted as an ABSOLUTE reason for moving to a place like Bend, somehow pales in comprison to the reasons that I truly enjoyed some of the places I've lived.

It was always friends or family that made a place. Not weather.

I love the place I went to college because of all the good times & friends I had there.

You could throw me in the middle of a cornfield to camp with my siblings, and I'd probably have a better time than I would camping alone in Yosemite.

Not only does scenery NOT pay the bills, it is cold & unfeeling. It's very nice to be in a new surrounding for a bit, and I've had some of the greatest times of my life out in the bush.

But being around people you enjoy is 100X more important in the long run.

Assholes can make paradise a total shithole, as has been demonstrated many times over by the equity locust invasion this place has suffered. Which is why I sometimes question the wisdom of moving to a place because of the outdoor activities.

I know more than one person (couple) that drank the Visit Bend Kool-Aid, moved here, bought at the top, and are now drowning in debt and DESPISE THIS PLACE. And they went out every weekend & did something real fun.

But they have had it. They want out.

'Course they can't get out. Bank won't short sale till they default, and once they default they can't get a job cuz they got fired when Epic/Cessna/Unicom/Equity Group/whoever went broke and stole their last paycheck & 401K.

But that's trivialities.

I think a lot of people go through life think all the external pieces of their environment are what count most; no, it's people. And on that mark, Bend is below average. And it will be until there are no H2 Hummer driving Cali-cunts who cut me off on Wall. Fucking cunts.

Hmm. Anyway, back to the business at hand. I suppose it only really matters that Cali is taking a financial bath in that Where Cali goes, so goes Oregon. 18-24 months later.

And if you want to see where we are going in the future, read this piece from Calculated Risk, "Unemployment Rate Increases in 29 States in October".

Even more interesting is this chart with the highst, lowest & most recent unemployment rates for all 50 states.

Click to enlarge...

You can see that California is suffering the highest unemployment EVER. It is maxed out.

Oregon is not far behind, of course, at #7.

This bodes ill for us. As recently as a year ago, COVA, Visit Bend, and all those other marketing schills were selling California Billionaires as Cent OR's economic saviors. Fucking ridiculous.

The facts: Bend unemployment will probably hit 20% one of these years. I guess that's pretty bad. But worse, it will NEVER go down. It will probably stay persistantly high. Why? People won't leave!

They've drank the Kool-Aid and actually think things are going to turn around here. They will not. Things are going to get far worse.

"Hey, but what about that Olive Garden? They must know something we don't!"

What about Gottschalks? What about Cessna? Oregon Woodwork?

This place is an investment SHITHOLE. Anything doing Bend-based business is a MIRAGE. When I came here, a business broker told me 80% of the businesses in Bend were TECHNICALLY INSOLVENT, being kept alive solely by spousal welfare.

There are very precious few companies actually making any money in Bend.

You want to know the Best Investment for anyone living in Bend? Buy a tankful of gas AND LEAVE.

People think that this blog & it's commenters are Broken Clock Bears, and are full of shit. OK. Fine. Take a sec to read a few pieces from someone who really knows how to throw down.

Wall Street's 2012 meltdown sweepstakesDon't say we didn't warn you this time -- a new crash is dead ahead

By Paul B. Farrell, MarketWatch

LOS ANGELES (MarketWatch) -- It's coming in 2012: Another, bigger meltdown of Wall Street's "too-greedy-to-fail" banks. No, this is not another fanatical warning about that Dec. 21, 2012 end-of-days prediction based on the Mayan calendar, though you may well ask "Who will survive?"

Here is what's happening: History is repeating itself. Wall Street's soul-sickness is setting up a new meltdown. Dead ahead. Be prepared.

My track record speaks for itself. Back on March 20, 2000, my column headline read: "Next crash? Sorry, you'll never hear it coming." Bull's eye: The dot-com bubble popped at 11,722. The economy collapsed. A 30-month recession. Markets lost $8 trillion. Today the market is still below that 2000 peak. Factor in inflation and Wall Street's "too-greedy-too-fail" banks have lost about 30% of your retirement nest eggs in this decade. Incompetent? Clueless? No, Wall Street is a bunch of crooks without consciences.

Since 2000, my columns have covered many warnings of major debt accumulation, market meltdowns, and the psychological failings of Wall Street's greedy, myopic brains. Last June we summarized 20 predictions made between 2000 and 2007 warning of a subprime meltdown coming. Oddly, no one seemed to be listening to all the warnings from leading minds like Buffett, Grantham, Gross, Faber, Shilling, Roubini, Fed governors, and many more. Was that a repeat of 2000 with no one listening?

Suddenly it hit me: It's just the opposite: Everyone is listening and everybody knew a crash was coming -- but we were in a trance, including Washington's bosses. Bernanke, Bush, Paulson, Greenspan all heard it. So did Wall Street, and Main Street.

Unfortunately America's collective brain was addicted to the adrenaline rush of gambling in a risky bull. The euphoria is intoxicating. We were caught up in a game of musical chairs, squeezing out every last dollar of return, blind to the catastrophe ahead until caught by surprise. Unfortunately, Wall Street lacked a moral compass and stole trillions from American taxpayers. Today, the only lesson Wall Street has learned is "greed is good." Now the beginning of the end has become a moral tragedy that is setting the stage for an implosion of Wall Street, capitalism and our economy circa 2012.

Everyone's still listening, still in a trance

Yes, another meltdown is coming; it's inevitable. This time, I've decided to do more periodic updates -- a watch list of alerts, warnings and predictions. Just like the updates done for over a decade, except this time we're more aware that few in power will listen, not Wall Street, not Washington, not Corporate America. But you must.

Recently a bright idea came to me: a new way to present these predictions. My wife was working all day at a hospital in Templeton, Calif., so I parked myself in the Café Vio in nearby Paso Robles, with two huge briefcases of research files on bubbles, debt, derivatives, behavioral economics and lots more. While trying to make sense of the materials, the headlines themselves started telling a fascinating story. Here's an edited montage of their staccato warnings. Read fast and "feel" the message:

Financial Times: "Second Great Depression [is] still possible."

The economy's "spiral is captured in a Titanic metaphor ... unsinkable."

BusinessWeek: "Next bubble could come sooner than you think."

From Reinhart and Rogoff: "This time is different." But it never is.

Bloomberg: "Citi's 'near death' hoard signals lower profits."

Citi hoarding $244 billion in cash "as if another crisis were on way."

Wall Street Journal: "Three decades of subsidized risk."

Gasparino's "The Sellout:" Greed, mismanagement killed financial system.

SeekingAlpha: "Crisis lessons forgotten in new speculation."

We prop up trash stocks Fannie Mae, Freddie Mac, AIG; learned nothing.

USA Today: "Wall Street bailouts ... business as usual"

Warning: "Too big to fail" protections guarantee another crash down the road.

Boston.com: "Why capitalism fails ... why it will happen again."

Economist says American capitalism "contains seeds of own destruction."

MarketWatch: "Einhorn bets on major currency 'death spiral.'"

Hedger bet against Lehman. Now against dollar. Says "break up too-big-to-fail" banks.

Forbes: "Be prepared for worst ... repeating Great Depression."

Expect "GD2" says Congressman Ron Paul, author, "The Revolution," "End the Fed."

New Republic: "Next financial crisis coming; we made it worse."

Former IMF economist: "Bernanke soft landing, sowing seeds of next crisis."

Wall Street Journal: "The economy is still at the brink."

Moral hazard: No CEOs of failed banks indicted ... even paid millions.

BusinessWeek: "What happens if the dollar crashes?"

Trade wars break out, banks collapse. Cheap dollars are killing us.

Pimco Investment Outlook: "On the course to a new normal."

Gross's "new normal:" spending, stocks down, savings up, banks riskier.

Economix, New York Times: "Finance gone wild."

Simon Johnson: Wall Street's "pathological" power over Washington.

Vanity Fair: "Wall Street lays another egg."

Ferguson: "Math models ignored history, human nature," failed, repeating.

Clusterstock: "10 bubbles in the making."

Fed's toxic debt, gold, emerging markets, ETFs, China, securitization, more!

Rolling Stone: "The great American bubble machine."

Taibbi: Goldman's a giant vampire stealing trillions with "gangster economics."

Temasek Hedge: Roubini predicts bubble, hates equities.

Economist sees "bigger bubble than before" as Fed wastes taxpayer trillions.

CNN/HuffPost: "Wall Street made mess, big bucks on clean-up."

Michael Lewis says "they're too powerful ... we're in for day of reckoning."

Vanity Fair: "Wall Street's toxic message: capitalism failed."

Stiglitz: Wall Street writes self-serving rules, puts global economy at risk.

MarketWatch: "Wasting our chance to fix the banking system."

America's got a "banking system that's just a ticking time bomb."

Mother Jones: "Could cap'n'trade cause new meltdown?"

Yes, and Goldman sees huge profits if this $1 trillion market is created.

Fortune: "We owe what? The next crisis, America's debt."

Yes, "chronic deficits are putting America on the path to fiscal collapse."

Time: "America and its deficits: Are we broke yet?"

Justin Fox, author, "Myth of the Rational Market:" "We'll soon find out."

HuffPost.com: "Main Street jobs? First kill Wall Street jobs."

"Looting of America" author: Wall Street got rich destroying Main Street.

The Nation: "Creative destruction on Wall Street."

Greiner: They treats problem as "psychological," solved by "happy talk."

Kiplinger: New black swan triggers next financial crisis.

Money manager Bob Rodriquez: "Next bubble already growing."

The Atlantic: "Why Wall Street always blows it."

Blodget learned a lesson, but Street chief executives still clueless, no lessons learned.

Questions for today: Do you believe a new crash is coming in 2012, give or take a year? Will it trigger the "Second Great Depression?" And how big a factor is Wall Street's greed and lack of morals?Well, that one is good. This one is Great!

20 reasons new megabubble pops in 2011

Greed blinded us to subprime meltdown, it'll blind us next time too

ARROYO GRANDE, Calif. (MarketWatch) -- You think I'm drinking that famous Beltway Kool-Aid, maybe because I'm predicting another meltdown coming in 2011? Well, you're being served from the same punch bowl, my friends.

Wall Street, Washington and the Fed are all praying the credit crisis is under control. Unfortunately, all their happy-talking is just a lot of hype, to hide their next bubble.

World markets are headed into another meltdown by the end of the first term of the next president ... and you won't even hear it coming under all the happy-talk.

Cycles happen. Bubbles blow, pop, meltdowns happen. Significantly, they're getting bigger and more frequent. Think 1987, 2000, 2007 -- the next in 2011. All the happy-talk from Washington and Wall Street gurus can't start the bull before it's time. Nor will a lot of non-happy-talker warnings make a bubble burst early.

For example, two years ago I analyzed the 2000-2002 bear phase of "The Cycle." We reported on 16 reasons why all the happy-talk failed to restart the bull market during that 30-month recession, while investors slowly lost $8 trillion.

Now you'll see how all the warnings of a housing bubble and a coming meltdown also had no effect on the 2004-2007 bull phase of "The Cycle."

Why? Because bull/bear, bubble/bust, expansion/recession cycles have a natural pattern that ebbs and flows on their own time, making fools of all gurus predictions. And all the happy-talk and not-so-happy-talk in the world has no effect: Happy-talk won't restart a bull. Nor can not-so-happy-talk warnings puncture a bubble. Cycles have lives of their own, they mature and die unpredictable, age and pop when they feel like it.

Another will happen, soon. A busted bubble and a new meltdown coming by the end of the next presidential term. Why then? Because the last few occurred with increasing frequency, separated by thirteen years then seven, and the next will come within four years. These trends are obvious from studying the works of masters like former Commerce Department chief economist Ed Dewey's classics, including his Cycles, the Mysterious Forces that Trigger Events.

Here's my list of warnings from 20 not-so-happy-talkers. Notice how they were as unable to pop the 2004-2007 bubble before its time, as the happy-talkers were unable to restart a bull during the 2000-2002 recession:

-

2000: Fed governor warns Greenspan. Former Federal Reserve governor Ed Gramlich served 1997-2005. He was warning Alan Greenspan as early as 2000 about the coming subprime crisis. See his book "Subprime Mortgages: America's Latest Boom & Bust."

-

2004: Nixon's secretary of commerce. In "Running on Empty," Peter Peterson says: "This administration and the Republican Congress have presided over the biggest, most reckless deterioration of America's finances in history" creating a "bankrupt nation."

-

June 2005: The Economist. Cover story two years before collapse: "The worldwide rise in house prices is the biggest bubble in history. ... Rising property prices helped to prop up the world economy after the stock market bubble burst in 2000." Values increased 75% worldwide in five short years. "Never before have real house prices risen so fast, for so long, in so many countries ... This is the biggest bubble in history."

-

January 2006: Fortune. Interview with Richard Rainwater. "This is the first scenario I've seen where I question the survivability of mankind." He's 112th on the Forbes 400, worth $2.3 billion: "Most people invest and then sit around worrying what the next blowup will be. I do the opposite. I wait for the blowup, then invest." He waited with a half-billion-dollar war chest.

-

February 2006: Faber's Market Newsletter. "Correction Time is Here!" was Faber's headline: "If we combine the overbought condition of the stock market, investors' sentiment high optimism, equity mutual funds' low cash positions, and also heavy foreign buying, we have all the ingredients for a stock market correction in the US getting underway very shortly."

-

March 2006: Forbes. Economist Gary Shilling wrote: "The current housing weakness will develop into a full-scale rout ... It's clearly a bubble and is nationwide ... The house-price collapse will induce a painful recession that will send U.S. stocks into a tailspin ... China will suffer a hard landing ... and weakness in the U.S. and China will spread worldwide."

-

March 2006: "Sell Now." Former Goldman Sachs investment banker John Talbott's book: "Sell Now! The End of the Housing Bubble." His statistics covered America's top 130 metropolitan areas. The top 40 were facing an average 47.2% decline.

-

March 2006: Pimco Investment Outlook. In the quarterly newsletter, "The Gang That Couldn't Shoot Straight," Pimco's boss Bill Gross took a big swipe at a presidential economic report: "It's not so much that the report was a compilation of untruths or even half-truths. It's just that it failed to tell the truth," and hid the fact that Washington's "borrowed from the future to pay for today's party."

-

March 2006: Buffett in Fortune. Remember Warren Buffett's famous farmer story: "Our country has been behaving like an extraordinarily rich family that possesses an immense farm. In order to consume 4% more than they produce -- that's the trade deficit -- we have, day by day, been both selling pieces of the farm and increasing the mortgage on what we still own."

-

May 2006: Harper's magazine. Michael Hudson wrote an article, "Guide to the Coming Real Estate Collapse," analyzing 20 trends: "Taken together, these factors will further shrink the 'real' economy, drive down those already declining real wages, and push our debt-ridden economy into Japan-style stagflation or worse."

-

August 2006: Wall Street Journal. Countrywide's CEO Angelo Mozilo: "I've never seen a 'soft-landing' in 53 years, so we have a ways to go before this levels out. I have to prepare the company for the worst that can happen." He did little. A year later, he was in full denial mode.

-

November 2006: Fortune. Cover story asks: "Can the Economy Survive the Housing Bust?" They said "the correlation between current builder confidence and future stock market returns over the past 10 years is downright unnerving." The NAHB confidence index is a leading indicator because the stock market inevitably follows in lockstep a year later. The index had "plummeted 54%."

-

November 2006: The Economist. In a cover story: "The Dark Side of Debt," Timothy Geithner, president of the Federal Reserve Bank of New York, said in a Hong Kong speech: "The same factors that have reduced the probability of future systemic events, however, may amplify the damage caused by, and complicate the management of, very severe financial shocks. The changes that have reduced the vulnerability of the system to smaller shocks may increase the severity of the larger ones." Geithner later negotiated the Bear Sterns collapse.

-

January 2007: Los Angeles Times. Schwab "averaged 242,300 trades a day the first nine months of 2006. That was up 29% from the same period a year earlier, and a click above its 242,000 peak in 2000"and the last collapse.

-

April 2007. GMO Quarterly Newsletter. GMO manages $145 billion. CEO Jeremy Grantham wrote: "The First Truly Global Bubble: From Indian antiquities to modern Chinese art; from land in Panama to Mayfair; from forestry, infrastructure, and the junkiest bonds to mundane blue chips; it's bubble time. ... Everyone, everywhere is reinforcing one another. ... The bursting of the bubble will be across all countries and all assets ... no similar global event has occurred before."

-

June 2007: Shilling's Insight Newsletter. "Just as the U.S. housing bubble is bursting, speculation elsewhere will come to a violent end if history is any guide. ... Richard Bookstaber, who designed various derivative-laden strategies over the years, now fears that financial derivatives and hedge funds, focal points of today's huge leverage, will trigger a financial meltdown."

-

June 2007: Pop! Then it happened! And Dan Gross had a well-timed book: "Pop! Why Bubbles are Great for the Economy." He says bubbles work miracles, so just let them pop, Pop, POP!

-

July 2007: Fortune. As the contagion spread, Treasury Secretary and former Goldman Sachs CEO Henry Paulson tells Fortune "this is far and away the strongest global economy I've seen in my business lifetime." He's repeated the same remark often since. Earlier, he and Fed Chairman Ben Bernanke said the subprime crisis was "contained." Clueless, Bernanke assembled hedge fund managers, asking them to explain the global derivatives market.

-

August 2007. Wall Street Journal. Former SEC Chairman Arthur Levitt wrote on the Journal's Op-Ed page: "In terms of market meltdowns and the degree of pain inflicted on the financial system, the subprime mortgage crisis has the potential to rival just about anything in recent financial history, from the savings and loan crisis of the late 1980s to the post-Enron turndown in the beginning of this decade."

-

August 2007: 60 Minutes. While Paulson and Bernanke were claiming the subprime crisis was "contained," the chief architect of the subprime-housing meltdown, Alan Greenspan, was on tour, making millions, hustling his new book, "The Age of Turbulence." On 60 Minutes he made a totally incredulous denial that he "really didn't get it until very late." He "didn't get it?" Yes, and to this day Greenspan rigidly maintains his blind faith in the free-market myth. His latest argument: Bubbles are a function of innovation, like the dot-coms and subprime derivatives. Regulators should trust the free markets, never micromanage innovation.

But what blinded Greenspan? His ideology? A brain quirk? Genetics? The president's reelection? It doesn't matter why: Whatever it was, it's bad news for America. Why? Because if the leader of America's monetary system for 18 years "doesn't get" that he was also the chief architect of the biggest economic blunder in American history since the 1929 Crash, can we ever trust any future leaders?

Scary, isn't it! How can we have faith in the next guy? Are our leaders the problem? Or is the system broken? Is capitalism itself at risk when the best and brightest are "blinded," unable to see disasters until it's too late?

But that is our "system," and in this system our leaders inevitably morph into bulls, ideologically blinded by their power. And like real bulls, all they see is red. So eventually ... they must run onto a sword, and self-destruct!Really read some of this stuff. It's worse than we're just going to be a Little Poorer.

We're going to be a lot poorer. But worse, we've lost something.

50 years ago, people actually had some values that weren't financially based abominations. Today, no one cares about that. All they care about is money. If you have it, You're Good. If you don't, You Are Dogshit. That's it. That's AmeriKKKa.

And I'll save the best Farrell for last...

Death of 'Soul of Capitalism': Bogle, Faber, Moore

20 reasons America has lost its soul and collapse is inevitable

ARROYO GRANDE, Calif. (MarketWatch) -- Jack Bogle published "The Battle for the Soul of Capitalism" four years ago. The battle's over. The sequel should be titled: "Capitalism Died a Lost Soul." Worse, we've lost "America's Soul." And, worldwide, the consequences will be catastrophic.

That's why a man like Hong Kong contrarian economist Marc Faber warns in his Doom, Boom & Gloom Report: "The future will be a total disaster, with a collapse of our capitalistic system as we know it today."

No, not just another meltdown, another bear-market recession like the one recently triggered by Wall Street's too-greedy-to-fail banks. Faber is warning that the entire system of capitalism will collapse. Get it? The engine driving the great "American Economic Empire" for 233 years will collapse, a total disaster, a destiny we created.

OK, deny it. But I'll bet you have a nagging feeling that maybe he's right, that the end may be near. I have for a long time: I wrote a column back in 1997: "Battling for the Soul of Wall Street." My interest in "The Soul" -- what Jung called the "collective unconscious" -- dates back to my Ph.D. dissertation, "Modern Man in Search of His Soul," a title borrowed from Jung's 1933 book, "Modern Man in Search of a Soul." This battle has been on my mind since my days at Morgan Stanley 30 years ago, witnessing the decline.

Has capitalism lost its soul? Guys like Bogle and Faber sense it. Read more about the soul in physicist Gary Zukav's "The Seat of the Soul," Thomas Moore's "Care of the Soul" and sacred texts.

But for Wall Street and American capitalism, use your gut. You know something's very wrong: A year ago, too-greedy-to-fail banks were insolvent, in a near-death experience. Now, magically, they're back to business as usual, arrogant, pocketing outrageous bonuses while Main Street sacrifices, and unemployment and foreclosures continue rising as tight credit, inflation and skyrocketing federal debt are killing taxpayers.

Yes, Wall Street has lost its moral compass. It created the mess, but now, like vultures, Wall Streeters are capitalizing on the carcass. They have lost all sense of fiduciary duty, ethical responsibility and public obligation.

Here are the Top 20 reasons American capitalism has lost its soul:

1. Collapse is now inevitable

Capitalism has been the engine driving America and the global economies for over two centuries. Faber predicts its collapse will trigger global "wars, massive government-debt defaults, and the impoverishment of large segments of Western society." Faber knows that capitalism is not working, capitalism has peaked, and the collapse of capitalism is "inevitable."

When? He hesitates: "But what I don't know is whether this final collapse, which is inevitable, will occur tomorrow, or in five or 10 years, and whether it will occur with the Dow at 100,000 and gold at $50,000 per ounce or even confiscated, or with the Dow at 3,000 and gold at $1,000." But the end is inevitable, a historical imperative.

2. Nobody's planning for a 'Black Swan'

While the timing may be uncertain, the trigger is certain. Societies collapse because they fail to plan ahead, cannot act fast enough when a catastrophic crisis hits. Think "Black Swan" and read evolutionary biologist Jared Diamond's "Collapse: How Societies Choose to Fail or Succeed."

A crisis hits. We act surprised. Shouldn't. But it's too late: "Civilizations share a sharp curve of decline. Indeed, a society's demise may begin only a decade or two after it reaches its peak population, wealth and power."

Warnings are everywhere. Why not prepare? Why sabotage our power, our future? Why set up an entire nation to fail? Diamond says: Unfortunately "one of the choices has depended on the courage to practice long-term thinking, and to make bold, courageous, anticipatory decisions at a time when problems have become perceptible but before they reach crisis proportions."

Sound familiar? "This type of decision-making is the opposite of the short-term reactive decision-making that too often characterizes our elected politicians," thus setting up the "inevitable" collapse. Remember, Greenspan, Bernanke, Bush, Paulson all missed the 2007-8 meltdown: It will happen again, in a bigger crisis.

3. Wall Street sacked Washington

Bogle warned of a growing three-part threat -- a "happy conspiracy" -- in "The Battle for the Soul of Capitalism:" "The business and ethical standards of corporate America, of investment America, and of mutual fund America have been gravely compromised."

But since his book, "Wall Street America" went over to the dark side, got mega-greedy and took control of "Washington America." Their spoils of war included bailouts, bankruptcies, stimulus, nationalizations and $23.7 trillion new debt off-loaded to the Treasury, Fed and American people.

Who's in power? Irrelevant. The "happy conspiracy" controls both parties, writes the laws to suit its needs, with absolute control of America's fiscal and monetary policies. Sorry Jack, but the "Battle for the Soul of Capitalism" really was lost.

4. When greed was legalized

Go see Michael Moore's documentary, "Capitalism: A Love Story." "Disaster Capitalism" author Naomi Klein recently interviewed Moore in The Nation magazine: "Capitalism is the legalization of this greed. Greed has been with human beings forever. We have a number of things in our species that you would call the dark side, and greed is one of them. If you don't put certain structures in place or restrictions on those parts of our being that come from that dark place, then it gets out of control."

Greed's OK, within limits, like the 10 Commandments. Yes, the soul can thrive around greed, if there are structures and restrictions to keep it from going out of control. But Moore warns: "Capitalism does the opposite of that. It not only doesn't really put any structure or restrictions on it. It encourages it, it rewards" greed, creating bigger, more frequent bubble/bust cycles.

It happens because capitalism is now in "the hands of people whose only concern is their fiduciary responsibility to their shareholders or to their own pockets." Yes, greed was legalized in America, with Wall Street running Washington.

5. Triggering the end of our 'life cycle'

Like Diamond, Faber also sees the historical imperative: "Every successful society" grows "out of some kind of challenge." Today, the "life cycle" of capitalism is on the decline.