I guess I finally got the answer to my question, "How is the stock market going to discount a disastrous economic event that'll take years to play out?"

Answer? Slowly at first, then all at once.

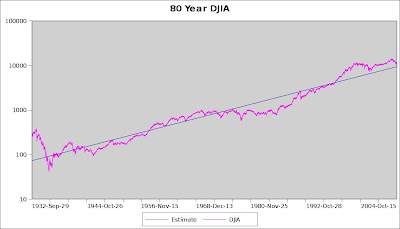

Or for a longer term view of The Pain:

So this weeks little meltdown has put us on a negative 10 year return on the DJIA.

And I don't want to say much this week, cuz I figure events are speaking for themselves, but on the hyper-long term basis, this week, is the first time in a long, long time that the DJIA has fallen to PARITY with its L/T trend.

Here's a 80 YEAR chart of the DJIA, with a best-fit logarithmic estimate. Those 2 big humps on the right are of course, the 2 great bubbles of our lifetimes, The NASDAQ & RE Bubbles.

You'll also notice that when NASDAQ cracked, it never really returned to trend.

And it has been above trend every single day since Mar 24, 1995. Until Wednesday.

The regression estimate for Wednesday is 9,390, and we closed at 9,258.

This may be easier to see in a log chart:

That far right convergence of actual vs estimate doesn't appear to quite meet, but believe me, it does.

Note that this time period includes all sorts of crazy things, from nuking the Japs, to putting man on the moon, WWII, WWI, and essentially the entire modern transportation & electronics era.

It is tough to put some sort of parallel on today's events given the past. But it does look like we are experiencing a Super Wave correction similar to The Great Depression or The Great Malaise of the 1970's.

Strating with the less wrenching meltdown of the 1970's, we see that after a Super Wave up that essentially began in the decades after The Great Depression

I guess we can say The Official Start of The Great Malaise began on July 10, 1969. The DJIA crossed below the L/T least squares estimate of 856.18, and closed at 847.79.

This put to an end an unbroken string of above-trend closes which began on Sept 13, 1954 at DJIA 351.10.

So when did the prior below-trend string start? On May 10, 1940 at DJIA 144.77.

I guess the point here is that what we've seen the past 30 years actually HAS happened, in some measure, before. Calamity following euphoria following calamity... The beat rolls on.

The other point is that this is NOT a short term phenomenon. These long waves take an adult lifetime.

The post Great Depression low of 41.22 was hit on Jul 8, 1932.

A monster rally ended on Mar 10, 1937 at 194.40, or +372%.

New lows were set on Apr 28, 1942 at 92.92, or down 52.2%.

The coming mega-wave carried through to Jan 18, 1966, when the Dow settled at 994.20, or stunning +970%.

But we then paid for it with a pounding that carried us to 577.60 on the Dow, on Dec 6, 1974.

Here begins our modern comparison of the Super Wave Modern Age DJIA Bull Market.

And if you look close and IGNORE the huge, but relatively short live burst from 1932 to 1937, and use the Great Depression low of 41.22 as a starting point, and the near 1,000 top in 1966 as a top, you see this mega wave had a bottom-to-top gain of exactly +2,300%.

A Super Wave up that took 34 years.

Then we had possibly the worst bear market in modern history that took us down 42%, ending 8 years after it started. This is the Dec 6, 1974 low.

Here is the interesting part: We had a super wave higher from Depression lows of +2,300% which took 34 years, right? Extrapolate the 1974 lows forward +2,300% and 34 years and you get...

Yes. Highs in the 13,862 area in 2008. Not perfect. But eery as hell.

Our long wave recent (post 2000) "Opportunity Cost" top was hit July 19, 2007 at 14,000 even.

We have subsequently fallen 40% from this Super Wave Mega-Top.

So where do we go from here? Well, the mathematical nature of a least-squares regression is that the L/T machinations of the market, both positive & negative, will net to zero. And the subsequent negatives will cancel out the prior positives.

On this count, we are in dire straights. Look at the 90th percentile confidence limits:

In point of fact, we have NEVER been as overvalued as we were on Jan 14, 2000 at DJIA 11,722.98 on an opportunity cost basis (excepting the brief Euphoria of pre Great Depression). THAT was the maximum CASH OUT selling point. The only time we've been close to that overvalued was when the DJIA was crashing towards Great Depression lows.

DO NOT believe the banter that we can't go incredibly lower from here. We can, we will. Here is a view of only the difference between actual DJIA closes & least squares estimates:

A short explanation: This is the log of the DJIA close minus the log of the least squares expected value. So at 0, the market is at "fair value" based on long term regression. "+.5" is actually e^.5 - 1, or 64%, above fair value. "-.5" is similarly 39% below fair value. It's no coincidence that (1 + .64) * (1 -.39) = 1.0. Both are equidistant from fair value logarithmically.

You can see that the 2000 top was a selling opportunity of a lifetime comparable to the 1982 bottom was a buying opportunity. Unfortunately these Long Wave moves are just that: Long. They have staying power. This won't end soon.

The Good News? We will probably hit nominal lows soon. That lower band stands at DJIA 5,190 today. I will state right now, that I would go all in at that point. That would mark an almost incomparable nominal low buying point in our lifetimes.

The Bad News? Although nominal lows were hit in late 1974, REAL LOWS were not left behind until late 1982, about 8 years later. There were severe rallies in the meantime, and subsequent falls. Note: REAL LOWS rarely coincide with NOMINAL LOWS. Same for HIGHS. Our recent REAL HIGH was in 2000, the nominal high was late last year. The REAL LOW of The 1970's Malaise was set in 1982, while the NOMINAL low was set in late 1974.

That said, if you do get the chance to buy stocks in the 5,000's, I would DO IT. But I would also consider the next decade a trading range market, and you should sell after significant rallies. That's doubles off the bottom.

If you buy at mid 5,000's, I would consider a run to 11,000 a good sale.

These gut-wrenching falls bring us closer to The End. Buy stocks in the 5,000's. These will be some of the best values of our lifetimes. They ARE coming. We are closer to a bottom than the top. It is too late to sell. Just hold, and buy on severe downdrafts. Scale in on The Horror.

We are simply at fair value now. We might tread water here, we might implode, who knows. But buying stocks at mid 5,000's is a Dead Lock for the trade of a lifetime. Just make sure you sell near +80-100%. Because REAL LOWS will not occur until 2016. Probably in the 6,000's.

THAT will be the Buy-And-Hold point of a lifetime.

352 comments:

«Oldest ‹Older 1 – 200 of 352 Newer› Newest»-

LavaBear

said...

-

-

October 12, 2008 at 11:29 AM

-

Anonymous

said...

-

-

October 12, 2008 at 11:48 AM

-

IHateToBurstYourBubble

said...

-

-

October 12, 2008 at 11:49 AM

-

Anonymous

said...

-

-

October 12, 2008 at 11:50 AM

-

Anonymous

said...

-

-

October 12, 2008 at 11:52 AM

-

Anonymous

said...

-

-

October 12, 2008 at 11:56 AM

-

Anonymous

said...

-

-

October 12, 2008 at 12:03 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:05 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:07 PM

-

IHateToBurstYourBubble

said...

-

-

October 12, 2008 at 12:09 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:13 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:17 PM

-

tim

said...

-

-

October 12, 2008 at 12:19 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:19 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:23 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:26 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:37 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:40 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:42 PM

-

Anonymous

said...

-

-

October 12, 2008 at 12:46 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:22 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:23 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:23 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:26 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:28 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:31 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:31 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:35 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:37 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:38 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:41 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:41 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:42 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:44 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:45 PM

-

Anonymous

said...

-

-

October 12, 2008 at 1:46 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:50 PM

-

Bewert

said...

-

-

October 12, 2008 at 1:51 PM

-

Bewert

said...

-

-

October 12, 2008 at 3:10 PM

-

Bewert

said...

-

-

October 12, 2008 at 3:15 PM

-

Anonymous

said...

-

-

October 12, 2008 at 4:38 PM

-

Anonymous

said...

-

-

October 12, 2008 at 4:40 PM

-

Anonymous

said...

-

-

October 12, 2008 at 4:41 PM

-

Anonymous

said...

-

-

October 12, 2008 at 4:42 PM

-

Anonymous

said...

-

-

October 12, 2008 at 4:55 PM

-

IHateToBurstYourBubble

said...

-

-

October 12, 2008 at 5:33 PM

-

tim

said...

-

-

October 12, 2008 at 5:41 PM

-

Anonymous

said...

-

-

October 12, 2008 at 6:13 PM

-

Anonymous

said...

-

-

October 12, 2008 at 6:17 PM

-

Anonymous

said...

-

-

October 12, 2008 at 6:20 PM

-

Anonymous

said...

-

-

October 12, 2008 at 6:43 PM

-

Anonymous

said...

-

-

October 12, 2008 at 6:53 PM

-

Anonymous

said...

-

-

October 12, 2008 at 8:00 PM

-

IHateToBurstYourBubble

said...

-

-

October 12, 2008 at 8:14 PM

-

Anonymous

said...

-

-

October 12, 2008 at 9:28 PM

-

Anonymous

said...

-

-

October 12, 2008 at 9:34 PM

-

Anonymous

said...

-

-

October 12, 2008 at 9:38 PM

-

Anonymous

said...

-

-

October 13, 2008 at 7:55 AM

-

Anonymous

said...

-

-

October 13, 2008 at 7:55 AM

-

Anonymous

said...

-

-

October 13, 2008 at 7:58 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:00 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:02 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:03 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:07 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:14 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:19 AM

-

foz

said...

-

-

October 13, 2008 at 8:20 AM

-

tim

said...

-

-

October 13, 2008 at 8:21 AM

-

foz

said...

-

-

October 13, 2008 at 8:32 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:46 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:49 AM

-

Anonymous

said...

-

-

October 13, 2008 at 8:51 AM

-

Anonymous

said...

-

-

October 13, 2008 at 9:07 AM

-

Anonymous

said...

-

-

October 13, 2008 at 9:10 AM

-

Anonymous

said...

-

-

October 13, 2008 at 9:17 AM

-

Anonymous

said...

-

-

October 13, 2008 at 12:31 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:14 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:17 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:20 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:21 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:26 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:27 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:30 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:31 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:35 PM

-

Anonymous

said...

-

-

October 13, 2008 at 1:40 PM

-

foz

said...

-

-

October 13, 2008 at 2:05 PM

-

Anonymous

said...

-

-

October 13, 2008 at 2:33 PM

-

Bewert

said...

-

-

October 13, 2008 at 2:36 PM

-

Anonymous

said...

-

-

October 13, 2008 at 3:26 PM

-

foz

said...

-

-

October 13, 2008 at 3:52 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:06 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:11 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:15 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:17 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:19 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:25 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:34 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:51 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:54 PM

-

Anonymous

said...

-

-

October 13, 2008 at 4:57 PM

-

Anonymous

said...

-

-

October 13, 2008 at 6:52 PM

-

Anonymous

said...

-

-

October 13, 2008 at 7:51 PM

-

Anonymous

said...

-

-

October 13, 2008 at 7:55 PM

-

Anonymous

said...

-

-

October 13, 2008 at 8:00 PM

-

Anonymous

said...

-

-

October 13, 2008 at 8:09 PM

-

Anonymous

said...

-

-

October 13, 2008 at 8:11 PM

-

Anonymous

said...

-

-

October 13, 2008 at 8:13 PM

-

Anonymous

said...

-

-

October 13, 2008 at 9:32 PM

-

Anonymous

said...

-

-

October 13, 2008 at 10:11 PM

-

Anonymous

said...

-

-

October 13, 2008 at 10:15 PM

-

Anonymous

said...

-

-

October 13, 2008 at 10:19 PM

-

Anonymous

said...

-

-

October 14, 2008 at 8:18 AM

-

Anonymous

said...

-

-

October 14, 2008 at 8:24 AM

-

Anonymous

said...

-

-

October 14, 2008 at 8:46 AM

-

Anonymous

said...

-

-

October 14, 2008 at 8:56 AM

-

Anonymous

said...

-

-

October 14, 2008 at 8:58 AM

-

tim

said...

-

-

October 14, 2008 at 9:30 AM

-

Bewert

said...

-

-

October 14, 2008 at 9:33 AM

-

Anonymous

said...

-

-

October 14, 2008 at 9:42 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:16 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:17 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:19 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:21 AM

-

Bewert

said...

-

-

October 14, 2008 at 11:35 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:37 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:41 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:44 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:52 AM

-

Bewert

said...

-

-

October 14, 2008 at 11:54 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:56 AM

-

Anonymous

said...

-

-

October 14, 2008 at 11:58 AM

-

Anonymous

said...

-

-

October 14, 2008 at 12:02 PM

-

Anonymous

said...

-

-

October 14, 2008 at 12:03 PM

-

Bewert

said...

-

-

October 14, 2008 at 12:09 PM

-

foz

said...

-

-

October 14, 2008 at 12:22 PM

-

Bewert

said...

-

-

October 14, 2008 at 12:28 PM

-

Bewert

said...

-

-

October 14, 2008 at 12:54 PM

-

Anonymous

said...

-

-

October 14, 2008 at 1:57 PM

-

Anonymous

said...

-

-

October 14, 2008 at 2:26 PM

-

Anonymous

said...

-

-

October 14, 2008 at 2:32 PM

-

Anonymous

said...

-

-

October 14, 2008 at 2:35 PM

-

Anonymous

said...

-

-

October 14, 2008 at 2:38 PM

-

Anonymous

said...

-

-

October 14, 2008 at 2:57 PM

-

Anonymous

said...

-

-

October 14, 2008 at 3:02 PM

-

Anonymous

said...

-

-

October 14, 2008 at 3:25 PM

-

Anonymous

said...

-

-

October 14, 2008 at 4:09 PM

-

Bewert

said...

-

-

October 14, 2008 at 4:21 PM

-

Bewert

said...

-

-

October 14, 2008 at 4:25 PM

-

Bewert

said...

-

-

October 14, 2008 at 4:28 PM

-

Anonymous

said...

-

-

October 14, 2008 at 4:29 PM

-

Bewert

said...

-

-

October 14, 2008 at 4:40 PM

-

Bewert

said...

-

-

October 14, 2008 at 4:49 PM

-

Bewert

said...

-

-

October 14, 2008 at 5:21 PM

-

Anonymous

said...

-

-

October 14, 2008 at 5:41 PM

-

Anonymous

said...

-

-

October 14, 2008 at 5:44 PM

-

Bewert

said...

-

-

October 14, 2008 at 5:51 PM

-

Bewert

said...

-

-

October 14, 2008 at 5:58 PM

-

Bewert

said...

-

-

October 14, 2008 at 6:00 PM

-

Anonymous

said...

-

-

October 14, 2008 at 6:12 PM

-

Anonymous

said...

-

-

October 14, 2008 at 6:15 PM

-

Anonymous

said...

-

-

October 14, 2008 at 8:57 PM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 5:47 AM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 5:52 AM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 5:55 AM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 6:00 AM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 6:07 AM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 6:08 AM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 6:16 AM

-

IHateToBurstYourBubble

said...

-

-

October 15, 2008 at 6:24 AM

-

tim

said...

-

-

October 15, 2008 at 7:11 AM

-

Anonymous

said...

-

-

October 15, 2008 at 7:17 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:13 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:15 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:16 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:19 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:23 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:29 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:36 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:38 AM

-

LavaBear

said...

-

-

October 15, 2008 at 8:48 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:54 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:54 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:57 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:57 AM

-

Anonymous

said...

-

-

October 15, 2008 at 8:59 AM

-

Anonymous

said...

-

-

October 15, 2008 at 9:23 AM

-

Bewert

said...

-

-

October 15, 2008 at 9:27 AM

-

Anonymous

said...

-

-

October 15, 2008 at 9:46 AM

-

Anonymous

said...

-

-

October 15, 2008 at 9:55 AM

-

Bewert

said...

-

-

October 15, 2008 at 9:55 AM

-

Bewert

said...

-

-

October 15, 2008 at 9:57 AM

-

Anonymous

said...

-

-

October 15, 2008 at 9:58 AM

-

Anonymous

said...

-

-

October 15, 2008 at 9:59 AM

-

Anonymous

said...

-

-

October 15, 2008 at 10:08 AM

-

Anonymous

said...

-

-

October 15, 2008 at 10:12 AM

-

Anonymous

said...

-

-

October 15, 2008 at 10:29 AM

-

Bewert

said...

-

-

October 15, 2008 at 10:51 AM

-

Bewert

said...

-

-

October 15, 2008 at 11:05 AM

-

Anonymous

said...

-

-

October 15, 2008 at 2:23 PM

«Oldest ‹Older 1 – 200 of 352 Newer› Newest»Taleb making scary talk.

Tim,

YOU THINK BUFFET is just a lucky guy, and TWATS like you support him cuz you have some BRK-B, and you think your on with his ride. Every fucking thing wrong with risk-based insurance today that is causing the problems, was pulled out of Buffet's ASS. Sure he has the grand-father sweet old persistent, out of bed methodology, lives in a small house. But the fact is HE is the guy that runs ALL from behind the CURTAIN, yes he cultivates POLITICIAN's, most recently REZKO owned OR-BOMB-EO, today BUFFET owns OR-BOMB-EO.

BUFFET is the richest man in the world, and he didn't get their by getting out of bed every AM, and doing the same fucking thing.

Buster,

Buffett just plays the game. And he's damn good at it. I don't see that he's doing anything wrong. He's playing the cards he gets dealt, and that includes constantly increasing his home-court advantage by influencing politicians.

He is what he is, and he's damn good at it. What he has over other people with his brainpower is his incredibly persistent drive at doing stuff the rest of us think of as boring. This guy jumps out of bed every day because he CAN'T WAIT to do the same fucking thing he's done every working day of his life.

Most people would have gone on to something else after making 1/100th of his wealth or less (the Paul Allen/Steve Wozniak model of living wealthy).

He's an anomaly, not particularly good or evil. But funny, smart, determined that his wealth should be run my smart people like Gates and not by the gov't. Is that so bad? There's plenty of worse people.

But yeah, why would anyone treat his public pronouncements as some kind of useful information I'll never know. You want to ask a rich person about tax policy and how it affects them, ask some "normally" rich people.

He's just naturally going to give advice to politicians that helps himself. Not because he's bad, just because it's in line with how he sees the world. His world is how BRKA does.

I guess this recent market action validates one of my theories: One of the most sure things in buying stocks is KNOWING there WILL BE A COLLAPSE after a bubble.

Sounds stupid as hell... but how many people did you talk to 2-3 years ago who thought we were in a new era that would last forever? Almost everyone.

Conversely, when NO ONE ever wants to touch stocks again in their lives, we will see the bottom of our adult lives.

I was too young for the last MEGA BOTTOM (1982). The Good News is that COLLAPSE ALWAYS FOLLOWS BUBBLE, we've seen the top, and are in the mind-numbing process of setting a NOMINAL BOTTOM in the next few years... followed by The Real Bottom 7-8 years after that.

THAT will be my ALL-IN BUY OF A LIFETIME ON LEVERAGE point, probably in the 6,000's in 2016. I think we'll have good trading buys for (relatively) quick doubles between then & now. But DJIA 6,000's about 8 years from now will be when you buy & put that stuff in your will, cuz you should NEVER sell that stock in your life.

Taleb,

Is talking about the same bullshit risk based models with toy math that homer is using today.

Whether its risk-based insurance pools, where BUFFET writes the premiums, or stock-market wave theory, which is highly discredited, its all fucking smoke and mirrors.

Yes, the bitch is going down.

BUFFET is the titanic, and soon he'll hit the fucking iceberg.

IS BUFFET a criminal?? - TIM

Well TIM, buffet has the BEST lawyers and CPA's that money can buy, in spite of the fact that he says he doesn't have an accountant.

Most of his buddy's at the insurance companys that he owns have gone to jail, and to date because of his political power he hasn't been indicted.

Just wait until you TWATS start losing your BRK.n money, and then he'll lose his political support, and he'll go to jail also.

There's a BIG difference on the depression-one recovery and today.

In the 1920's the USA had the world's known oil reserves, and was a young country. Post WWII we secured the industrial machinery, all else having been wasted.

Homer's ENTIRE premise that the USA will bounce back on this one is completely irrelevant, this is MORE like the collapse of RUSSIA.

Trouble is today what will they privatize? Today everything is worthless paper.

We have the largest coal deposit in the world, but who wants coal? Our coal is also the dirtiest coal in the world. Our OIL is gone. NOBODY is going to invest in our manufacturing base.

The USA will once again become the worlds largest agrarian prison colony, mark my fucking words.

Sounds stupid as hell... but how many people did you talk to 2-3 years ago who thought we were in a new era that would last forever? Almost everyone.

*

HOMER are you talking about REAL-ESTATE?? The problem here is that your a stock broker, so its in your bones that the stock-market ALWAYS does a dead-cat bounce, trouble is so many people have been fucked so bad 'investing' in wall-street, that like housing it will take a generation for folks to tip back in.

401k's gone, ... baby-boom retirees pension gone, what the fuck do you think about todays gm,ford,chrysler all going down is all about?? Pensions gone, ...

It took 20+ fucking years after 1929 for folks to tip back in, sure the day-traders of the day tipped back in 1937 and got sheared.

WRT to your argument given that 97% of any given society are always 100% wrong 100% of the time, and 97% of most people never acquire real wealth, stupidity has always been the common denominator.

We all knew BEND bubble housing would recede. I don't give a fuck about the stock-market, I have always known it was a racket. Your obviously a CPA/investment-advisor, and your life-style depends on the stock-market biz returning, ... TOO MANY PEOPLE HAVE BEEN FUCKED.

NO AMOUNT OF PAULSON/BUSH 'CONFIDENCE' SCHEMES is going to fix this one.

Also the notion of international investors now, as USA doesn't save. That foreigners are sick of our shit. You had none of this shit in the 1930's.

We're NOT in kansas anymore HOMER, we're the most despised country on the face of the earth.

I hope everyone here watched the TALEB interview right??

YES, were just at the fucking beginning.

For instance just the insurance loss from LEHMAN is almost $500B, that must be paid soon, ... in the coming weeks people will simply default on all these Credit-Swap's they sold, as there is nothing left to sell to raise cash. When that happens there will be NOTHING on the books, because these insurance policy's sold by BUFFET will be worthless.

The USA will once again become the worlds largest agrarian prison colony, mark my fucking words.

*

Prison stocks homer, anything that has to do with the 'prison industrial complex' that will be YOUR NEXT BUBBLE.

I don't give a fuck about the stock-market, I have always known it was a racket.

Hmmm... when all others think similarly, I will be able to buy.

Spread the word.

Conversely, when NO ONE ever wants to touch stocks again in their lives, we will see the bottom of our adult lives.

*

The old saying from the depression.

At least with homes, people need a place to live, ditto for food.

What the FUCK are you going to do with stock-cert's that only have value based on derivative based paper???

I'm NOT sure how long it will take folks to figure out they have been fucked, the people in this forum ( in spite of the pussy ) know what is going on, but the average AmeriKKKan, has no fucking idea that this country has lost 99.99% of its GOOD-WILL, and the assets were cleared out years ago.

Housing will be safe as I have said from day one here 4X of income, but what will income be? In inflated dollars? Or will we see people in Bend working for $2/hr??

Baby-Boomers are going to be telling their grand-children how they lost their pension. They'll be living with the 'kids', the kids will not trust wall-street.

Homer YOUR SO DEEP into wall-street you can't see the trees, your the type that bought into the stock market in 1937.

Like GRAHAM said in his day ( 1940's ), we're going back to value, and once again value will work. Your investing in the DJIA will not mean shit.

Some say this is political, NO this is about BEND, the blog here is about debating the survival in BEND.

But DJIA 6,000's about 8 years from now will be when you buy & put that stuff in your will, cuz you should NEVER sell that stock in your life.

*

There will always be shit that goes up, and other shit that goes down. Companys will get back to business.

Trouble today is they were ALL doing the same thing as BUFFET, e.g. running holding-company's, where GE no longer made product, but sold credit.

Just watch good companys like Proctor, and 3M, ... there are ton's of good companys, that can be bought on a bargain.

The real issue is the next bubble? There will be an ENERGY-BUBBLE, its being engineered right now. Tax incentives is all it needs.

DOW will go to 4,000, and osciallate there for a long time. If they want the DOW to go to 8,000 they'll have to remove the financial stocks, and replace them all with 'neo-energy' stocks.

>>YOU THINK BUFFET is just a lucky guy

I did not say he was lucky. I said he uses his influence with politians to tilt the board in his favor.

Hmmm... when all others think similarly, I will be able to buy.

Spread the word.

*

There's a big difference between those than can buy, but don't want to buy, and those who want to buy, but cannot buy.

Too bad HBM isn't here, did you read his monkey story yesterday about the stock market???

That was right-on, virtually every village in the world has now been hood-winked by wall-st, its going to take a long time before CON-MEN like BUFFET can come into town and buy/sell monkeys.

I did not say he was lucky. I said he uses his influence with politians to tilt the board in his favor.

*

The richest man in the WORLD, has endorsed a new face in US politics, an OREO, at a perfect time.

Place your bets, and vote for OR-BOMB-EO, and everyone will get rich.

Yes, TT but today the board has been tilted to a 89% degree angle towards BUFFET.

Perhaps at the eve of his life, BUFFET having all the money in the world, will try to do some good for the USA?? Like invest in our manufacturing? For real? To date he seems to prefer the insurance racket, e.g. collect premiums, deny-claims, and invest the premiums in the stock-market.

He's going down and HARD no matter, how much BRK-A/B that the OREO buys with US taxpayer dollars.

"I don't GIVE A fuck About the stock market"

This is for quim, and TT, ... and other 'entrepreneurs'.

Your best investment is always yourself, forever the stock-market has been a rigged game, the house lets a few suckers win some of the time, but most of the time, the house collects all the chips.

In the 1940's there was a book called "where are the customers yachts"?? There weren't any.

You want to get rich? Invest in yourself, start a real business, minimize debt, and make money; and I'm not talking about fucking comic books.

Most people would have gone on to something else after making 1/100th of his wealth or less (the Paul Allen/Steve Wozniak model of living wealthy).

*

Bad FUCKING example TT,

The WOZ was pushed out by KUNT steve-jobs, the woz loved apple, but hated jobs.

Allen was senior to gates by many years, and it was Gates company, Allen moved on, Allen was always a senior assistant to the young Gates, and wanted to make a name for himself.

Most great tycoons, stuck around with their empire until their end. Its the brood that leaves young.

I agree, that IF you were ONLY doing this shit FOR MONEY, then yes, 'most' would have left, but 'most' of what??? First of all you don't even get into the game unless your part of the 3% of humanity.

Gates WANTED to rule an industry since he was 12, he never wanted to sell software. BUFFET too wanted to rule an industry, he just happened to BUY an insurance company, and the rest is history.

97% of all civilization are NOT entrepreneurs, the 3% that are, rarely do it for money, they would fail.

It's like HOMER and his stock-market, these are the 97% that give their money to someone else. 99% of the time, they lose their money.

With entrepreneurs, they watch their money like a hawk.

Tycoons like BUFFET don't do this shit for money.

I think the reason GATES is out, is because software is finished, nobody buys it anymore, and they (MS) have a commodity to license now, its not fun anymore. Software was really HOT from 1975 to 2000, that's 25 years, if you were there, it was a great time to make money.

You folks saw from the end of the last week post sequence that open market today sunday the arab world went down, even abu-dubai, home of cheney.

The fact that the Arab's are dumping their stock to raise cash to cover their margins, ....

But yeah, why would anyone treat his public pronouncements as some kind of useful information I'll never know. You want to ask a rich person about tax policy and how it affects them, ask some "normally" rich people.

He's just naturally going to give advice to politicians that helps himself. Not because he's bad, just because it's in line with how he sees the world. His world is how BRKA does.

*

I would agree 100%, I think the only person here that doesn't see this is BP. Who seems to take BUFFET for his word.

Any fucking NEWS about BEND-CALIF today??

I read the BULL and this AM, and not a word about the economy.

Sorry about so much BUFFET, but the reason is that he is tail wagging the USA dog these days.

OK, another dead-horse education of credit-default-swaps, for months now I have on this, and now the reckoning, and this is JUST ONE FUCKING company, due and that is LEHMAN.

The NY-TIME's has an excellent story, about what is to come, and its fucking ugly, mainly cuz AIG has been promising to pay most of the insurance pay-outs, and is now 'nationalized' with NO MONEY, which means uncle same MUST make good on the insurance of ten's of trillions of dollars of loss.

Insurance on Lehman Debt

By MARY WILLIAMS WALSH

Published: October 10, 2008

NY TIMES

First the house of Lehman fell. Now the insurance bill is coming due.

Gov. David A. Paterson of New York, left, and Eric R. Dinallo, the insurance regulator, want credit-default swaps regulated.

Related

Times Topics: Credit Crisis — The Essentials

Nearly three weeks after the Wall Street bank sank into bankruptcy, financial companies and investment funds that wrote what are effectively insurance policies on Lehman Brothers’ debts are being called on to pay hundreds of billions of dollars in claims.

Whether those claims can or will be paid, and the financial repercussions that could follow if they are not, will signify the biggest test yet for the vast, unregulated market in credit-default swaps.

The danger is that the claims on the Lehman default are so large — they are estimated at $400 billion to $600 billion — that settling them could leave some companies with large, perhaps even crippling, losses and heighten the turmoil in the financial markets.

The magnitude of the exposure came into focus on Friday, when the price of Lehman’s bonds was set via a closely watched auction on Wall Street. The debt was priced at a little above 8 cents on the dollar, leaving companies and funds that insured these debts against default on the hook for the remainder.

The price determined the amount that sellers of bond-default protection would have to pay those who bought their protection, called counterparties. The lower the bonds’ price fell, the higher the payouts were going to be.

But even now, the total amount coming due is unknown because the market for credit-default swaps is not regulated or tracked through any clearinghouse of data. “The huge value of credit-default swaps on Lehman Brothers, and the low price obtained in this auction, mean there are billions of dollars in obligations,” said Eric R. Dinallo, the New York State insurance superintendent. “No one knows who owes this money, how much each counterparty owes, or whether any of these counterparties will now be in trouble themselves, with further potential problems for the financial markets.”

Some of those on the hook will quietly settle their trades as they come due, mostly within the next two weeks, and keep doing business as usual. To the extent there are problems, the world may find out about it only when another financial services company discloses its exposure or perhaps even collapses.

Mr. Dinallo and Gov. David A. Paterson have said that New York State should regulate credit-default swaps to some extent, because they are similar to insurance, which is regulated at the state level. The regulators pay attention to how much coverage insurers write and how much they charge, to make sure they do not get in over their heads and collapse.

Swaps, on the other hand, are private contracts between two counterparties, so no regulator keeps track of who is promising coverage to whom, or whether the swap seller can really afford the coverage being promised.

Complicating things further, it is possible to buy and sell credit-default swaps without owning the underlying bonds. One trader can both buy and sell protection on the same bonds, too. These complexities make it hard to know exactly how much risk lies in the Lehman Brothers default.

Separately on Friday, the Federal Reserve Bank of New York met with representatives of the derivatives industry to review proposals for the creation of a credit-default swaps clearinghouse. The Fed asked for more information about how competing proposals would work, and had not made any decisions as of Friday.

Officials say they believe that if the swaps were traded through a central body, the volume of trading could be tracked and prices would become clear. Investors would stand a better chance of noticing when a company was taking on too much risk, and could dump its stock before disaster struck. That kind of market discipline might force traders to manage their risks more carefully.

But the clearinghouse will only help the swaps market in the future. In the meantime, the financial markets do not know where the next disaster might be.

Market participants were expressing particular concern about the amount of money that the American International Group, the insurance giant that was effectively nationalized, would have to pay as it settled its swap positions on Lehman Brothers’ debt. A.I.G.’s financial products unit was a major issuer of credit-default swaps.

A spokesman for A.I.G., Nicholas J. Ashooh, said on Friday that the big insurer was not able to provide a figure. It was billion-dollar obligations falling due under the terms of A.I.G.’s swaps contracts on other issuers’ debt that led to the company’s collapse in mid-September.

Julie A. Grandstaff, a managing director of StanCorp Investment Advisers, said the outcome of Friday’s auction was “really extraordinary, in that it’s a large bankruptcy and a small recovery value.”

She was concerned that some counterparties might have to make payments big enough to deplete their capital, which could lead to possible ratings downgrades. Capital depletion is a serious problem at the moment because the capital markets are largely frozen and companies cannot easily raise new money if they need it.

“If you exhaust it all in one event, that will cause the ratings agencies to think about whether to downgrade you,” Ms. Grandstaff said.

Re:

Perhaps at the eve of his life, BUFFET having all the money in the world, will try to do some good for the USA?? Like invest in our manufacturing? For real? To date he seems to prefer the insurance racket, e.g. collect premiums, deny-claims, and invest the premiums in the stock-market.

Dumbfuck, here is a link to BH's holdings: http://www.berkshirehathaway.com/subs/sublinks.html

From Acme Brick to Dairy Queen to RC Willey Home Furnishings.

Re:

Allen was senior to gates by many years, and it was Gates company, Allen moved on,

Dumbfuck, Allen got Hodgkins. Allen was born Jan '53, Gates Oct '55, a mere 2 1/2 years apart. They met in the same high school, where their first project together was a traffic measuring program. With over 200 million shares of Microsoft, Allen could do whatever the fuck he wanted after being cured.

All Dumbfuck, all the time around here right now. The Palin Method.

But I do agree about the entrepreneur stuff. Even if I still think you are a Dumbfuck.

Re: I read the BULL and this AM, and not a word about the economy.

Dumbfuck--you're right. The BULL is about the worst waste of paper I have ever seen.

This need to sell stock, to raise cash to pay for all these bad insurance bets, which the same thing that happened on black-friday in 1987.

Perhaps we'll even see a DOW of 2000, where 4,000 will look fucking astronomical.

Like TT mentioned early today, on the prior blog, all OUR modern funds were 'AAA' cuz of these policy's, $80TRillion estimated. All at once, when it becomes clear that people will not cover their bet on selling these policy's, it means that everyones rating goes to the floor.

To quote our beloved HOMER, its going to be much worse than anything you thought possible. Or as TALEB said on todays first post by lava, you ain't seen NOTHING YET!

Dumbfuck, Allen got Hodgkins. Allen was born Jan '53, Gates Oct '55, a mere 2 1/2 years apart.

*

Gates started at Harvard at 14, BP, he's was hanging out with 16 yr-old ALLEN when he was 12.

Since when does a 16yr old hangout with a 12 yr old?? Strange?

That Mary Walsh article at the Times is great. It's about what both Dumbfuck and myself have been railing about. The CDS's are so fucking huge they are going to take down virtually everyone.

It's a brave new world.

Like invest in our manufacturing? For real? To date he seems to prefer the insurance racket, e.g. collect premiums, deny-claims, and invest the premiums in the stock-market.

Dumbfuck, here is a link to BH's holdings: http://www.berkshirehathaway.com/subs/sublinks.html

From Acme Brick to Dairy Queen to RC Willey Home Furnishings

*

BP BUFFET is a fucking HOLDING-COMPANY, I said INVEST from scratch in US manufacturing, take all that CASH, and build the best high-tech energy company in the world.

BUFFET doesn't create anew, or entrepreneur, he just buys shit in deals that normal mortals could never get a piece of.

What I said was that BUFFET needs to take his fucking money, and INVEST in US MANUFACTURING, something that NOBODY has done in the USA since the 1970's or earlier, if you ignore chip-plants, where are all done outside of USA now.

The fact that BUFFET owns dairy-queen doesn't impress me pussy, but I know it impresses you, thinking he might give you an ice cream before bed.

Re: Gates started at Harvard at 14, BP, he's was hanging out with 16 yr-old ALLEN when he was 12.

You are truly a Dumbfuck. From Wiki: "William Henry "Bill" Gates III, KBE (born October 28, 1955)...Gates graduated from Lakeside School in 1973. He scored 1590 out of 1600 on the Scholastic Aptitude Test[17] and subsequently enrolled at Harvard College in the fall of 1973."

Try to at least look things up before spouting such total bullshit, Dumbfuck.

I've been in the software biz since 1979, I actually know a little about Gates.

Re: The fact that BUFFET owns dairy-queen doesn't impress me pussy, but I know it impresses you, thinking he might give you an ice cream before bed.

Dumbfuck, I agree with you on Buffett's needing to pony up.

But I prefer a BJ before bed. Ice cream makes me fat.

The CDS's are so fucking huge they are going to take down virtually everyone.

*

Yes, and just LEHMAN is over $600B, just one fucking BK is bigger than the bailout, there will be 100's of BK's like LEHMAN, this is why the known CDS paper floating around is estimated to be $80 trillion.

If you look at the auction on friday for LEHMAN they got 8 cents on the dollar, which was a 92% loss, apply that to the $80 TRillion in outstand CDS paper, and you get about $70 TRillion, gives you some idea of how much folks will owe.

The LUV-GUV will probably just NULL&VOID these 'illegal insurance' policy's, trouble is the ENTIRE 'AAA' ratings system that HOLDS up all paper assets in the world is riding on these ratings, if this falls, then the 'derivative' paper which is over $300 TRiLLion goes south.

The losses exceed the worlds GDP by what 10X??

FUCKING MIND BOGGLING INCOMPETENCE.

Ice cream makes me fat.

*

I thought ice cream made you bald?

ALway's about bruce ewert 24/7, welcome to bend-bubbble-2.

Re: I thought ice cream made you bald?

Someone who has actually seen me ;)

BP, Gates did start at Harvard when he was 14 I'll look it up some day, right now I'm not interested.

FYI I started college when I was 14, its not that big of a fucking deal.

My point was that Allen was MUCH older than gates, but ALLEN brought senority to this group of children.

Hell when they were in Albuquerque ALLEN was the only one who could legally buy beer.

I was involved with these people in 1975 bp, but lets stay with CDS, & BUFFET, and your oreo.

Someone who has actually seen me ;)

*

I go to all the city-council meetings bp,

Re:

If you look at the auction on friday for LEHMAN they got 8 cents on the dollar, which was a 92% loss, apply that to the $80 TRillion in outstand CDS paper, and you get about $70 TRillion, gives you some idea of how much folks will owe.

The LUV-GUV will probably just NULL&VOID these 'illegal insurance' policy's, trouble is the ENTIRE 'AAA' ratings system that HOLDS up all paper assets in the world is riding on these ratings, if this falls, then the 'derivative' paper which is over $300 TRiLLion goes south.

The losses exceed the worlds GDP by what 10X??

FUCKING MIND BOGGLING INCOMPETENCE.

That is truth. The numbers are fucking mind boggling, and far, far bigger than the actual production of goods by the world.

Yep, it's a Brave New World out there today. It's hard to even imagine what is coming. Marge's answer is sounding better and better. It's time to seriously think about going to ground in a place you know your neighbors and can grow tomatos and kill deer.

The part that really worries me is that it's still getting scarier around the world's financial markets. And the other shoe isn't even close to dropping yet.

RE: I go to all the city-council meetings bp,

Mike?

In this country, justice can be won against the greatest of odds; hope can find its way back to the darkest of corners; and when we are told that we cannot bring about the change that we seek, we answer with one voice - yes, we can.

- Barack Obama, Raleigh, North Carolina, May 6, 2008

It's way better than hate bewert

So Mike, you think the council pays any attention to me? Or is my quest more like Don Quixote's?

Snuggle's is that you?

What about your wife? What about my wife? What about my children?

You promised you would never 'out' me :<

Crisis may set back poorest: World Bank panel - sez chairman BUSH of da world

*

Who would have guessed?

Homer,

The goal here is NOT to fuck with you, you are the man.

You spent way too much time today on the post. It was elegant, it was mathematical, it was insightful.

What does it mean to those of us who are renter's in Bend? What are we to do now master??

What does it mean to those of us who are renter's in Bend? What are we to do now master??

*

"LEAVE"

( I have been hearing this all over town lately )

Homer,

Today's post is brilliant. Much thanks from all of us at Bend City Hall.

You just saved the city from Bankruptcy, tomorrow we'll be cashing out of all our stock market holdings and going to cash.

Sincerely,

Johnson, Clinton, Abernethy, Telfer,

What does it mean to those of us who are renter's in Bend? What are we to do now master??

"LEAVE"

( I have been hearing this all over town lately )

Ditto, I am also starting to hear this. I honestly think talking about Bend v3.0 is fairly futile for 75-80% of this blog's audience. I honestly don't think I will be here at the bottom. This place will have so thoroughly gone the hell in a handbasket, that people will start leaving in droves pretty soon.

The one thing that'll bring 'em back? Rock bottom home prices ($120K medians), and a city NOT on the verge of BK, so we can have cops & firefighters, and patched roads & such. We are about to see the WISDOM of squandering our lotto winnings on bullshit (ie Hollern STD welfare).

We had a Once In A Lifetime thing happen here, and we wasted it. Look how fast we went from Top-O-The-World, to 100% Dead Ass Broke. And have no illusions, this town is technically insolvent.

Stocks bottom in 2016, real economy 1-2 yrs after, and Bend, as usual, about 3-4 years after that, and we will drag ass-bottom for a few years. You'll be able to make good RE money in Bend again, circa 2020.

If you actually need a job to exist though, The Way Is Clear: Get The Fuck Out Of This Town. The rest of the country is about 1/2 way through the wringer, which means we are 1/4th. You ain't seen nut'n yet.

One reason you're hearing so much talk about leaving is that people are stuck and can't leave.

Normally people who want to go just do it and you don't hear so much whining about it.

What a fucking Nightmare "Stranded in Bend, Calif" without any drinking money.

So Mike, you think the council pays any attention to me? Or is my quest more like Don Quixote's?

I don't know about Don Quixote, but I know that Bruce Abernethy is in love with you, and wants to jump on you. Linda doesn't like men. You don't have enough cash for Tefler's taste. It's just me & you bruce, like always. Forever, yours.

In this country, justice can be won against the greatest of odds;

- Barack Obama,

It's way better than hate bewert

*

The odd's for Obama bringing 'Justus' to the USA is about 1M to 1, let's stick with bewert.

Tim how can anybody be stuck in bend california?This is bend remember? We are different aren't we?Oh just wait I forgot this is Oregon I grew up here, so did dad and grandad and greatgrandad. People you outastaters brucepussy included we did not ask you here and the fact that you cum here and bitch nonstop mabe you should just packup and get the fuck out.

Meh don't try to pull rank. I'm not impressed by that. I live where I want to live.

My wife is Oregon Trail on both sides. Beat that.

I haven't tried to leave yet because I ain't broke yet. :-)

Tom mcall and Mark hatfield were true statesmen who looked out for the best interests of the (people). Toms statement it's ok to visit but don't stay says it best. Spend your money here and get the fuck out.Don't ruin oregon with corruption but here we are with so much. Depressions are painful but cleansing.

Yoinks Shaggy!

The outlined time periods DO NOT include WWI! AHHHHH! NOOOOO!

If mike & bruce can wuv each other, that means the everyone here is just a click away from bestiality.

Can't we all just get along??

It's way better than hate bewert

*

Nobody hates bewert, pleeeeeeze people can't we all just for a week say nice things about BP???

Sheeeeeet IMHO 'BP' is in itself the nicest compliment, its way better to be a pussy, than a KUNT.

'Hate', this ain't a pug/dem convention bp, nobody hates anybody,

The rhetorical question was shall we ...

1.) Embrace the OREO for what he says ( which is general feel good non-specific crap )

2.) Hate bewert

Not much of a a choice, me suspects the premise here is that all who don't let OR-BOMB-EO fuck their daughters are bewert haters, but not so it is possible to love bewert, and know that OR-BOMB-EO is a bought and paid for political WHORE.

I call that option 3.

3.) Love bewert, & know that OR-BOMB-EO is just a low-life politician.

Yoinks Shaggy...

#

Gold Rush: Yoinks

Seriously, the Shaggy defense? The child pornography trial of Grammy-winning Trapped in a Courtroom Raunch & Blues singer R. Kelly opened today, ...

reporter.blogs.com/goldrush/2008/05/seriously-the-s.html - 25k - Cached - Similar pages

#

What is the real name of Shaggy on 'Scooby Doo'?

What is the real name of Shaggy on 'Scooby Doo'? - trivia question answer. ... Shaggy's real name is Norville Rogers. http://www.yoinks.com/shaggy.asp ...

www.funtrivia.com/askft/Question25734.html - 21k - Cached - Similar pages

#

Scooby Doo and Shaggy

Embrace the OREO for what he says ( which is general feel good non-specific crap )

Actually Obama has been far more specific about his plans than McClown has. What's McClown's plan for the economy? Cut taxes for billionaires. (Same plan the Republicans have been pushing for 100 years.)

BTW in case you haven't heard, Paul Krugman of the NYT has won the Nobel in economics.

How the world’s largest default was unravelled

Natasha de Terán

13 Oct 2008

Roger Liddell, LCH.Clearnet

Not being able to nail the data down was frustrating, especially with the markets moving so wildly

Chris Jones, LCH.Clearnet

We were very happy with the way the swaps side worked and with the commitment we had from member firms

Roger Liddell, chief executive of LCH.Clearnet, looked remarkably perky for a man who had just managed the biggest and most complex default in clearing house history. Just two years ago he stepped away from a banking career at Goldman Sachs to join LCH.Clearnet – giving up the glamour of the former investment bank to take up his position as head of the dusty utility, then presumed by some in the industry to be something of a poisoned chalice.

But at 09:15 London time on Monday, September 15, he found a multi-trillion dollar trading book in his in-tray containing huge futures and options, swap, repo, equity and bond positions. Clearing houses are in the business of avoiding risk – from that point onward, Liddell’s team would be managing it.

The collapse during the previous night of Lehman Brothers had thrown the financial world into a storm the likes of which it had never seen and which, four weeks later, has yet to abate. Lehman touched every part of LCH.Clearnet’s business – it was in the eye of the hurricane.

Since then, neither Liddell nor many LCH.Clearnet staff have seen the light of day, several of them putting in 17-hour shifts and subsisting on takeaway pizzas.

That Monday morning, outside the company’s headquarters the pavement was being dug up. Inside, construction work was taking place, causing a flood and two power outages. On the computer screens, the markets were gyrating wildly and the negative newsflow on the strength of some of LCH.Clearnet’s large clearing members was unrelenting.

Amid this chaos, order emerged. In conjunction with members, exchanges, dealers and clearing firms, LCH.Clearnet has since successfully hedged out, wound down, transferred or auctioned off the risk pool. As of the end of last week there was virtually nothing left of Lehman’s legacy. If evidence were needed of the value of clearing, LCH.Clearnet has provided it in successfully managing the largest clean-up in clearing house history. But the process was a fraught one.

It had started the weekend before the unfolding of Monday’s events. Because of Lehman-related worries, extra staff were called in to work on the Saturday and Sunday prior to Lehman’s collapse, but as it happened a good many of the clearer’s staff were scheduled to work, since the transfer of positions to the European arm of the IntercontinentalExchange had been scheduled to complete that weekend.

Contingency plans for this process had been put in place well before Lehman’s problems began to escalate. It had been agreed that up until 18:00 on Sunday, systems would be restored to where they were on the Friday night – but from that point the positions would remain with LCH.Clearnet, while ICE’s engines would run the clearing process.

Calls had been scheduled throughout the weekend to manage the transfer process and, each time, Lehman became an agenda item. But it was not until 18.30 on the Sunday, that the Financial Services Authority, ICE and LCH.Clearnet jointly agreed to “roll back”.

Liddell said: “This decision was not based on anything specific. The transfer had worked well that far, it just seemed appropriate to remove any unnecessary strains from the system, even though we didn’t know Lehman’s eventual position at that point.”

Staff, including Liddell, left LCH.Clearnet’s offices about midnight, to return early the next morning. Chris Jones, head of LCH.Clearnet’s 34-strong risk group, was back at his desk by 05:30 on the Monday. He spent the first few hours monitoring the newswires and taking in developments in Asia, as well as talking to officials from the Finanacial Services Authority, in preparation for what might lie ahead.

Jones and his group had spent a good portion of the weekend examining Lehman’s positions and working out how they would macro-hedge the portfolio, were the worst to occur. The previous week they had also double-checked contact numbers, ensuring they had details for everyone from Lehman’s futures head, traders and back office staff, to the officials at the Payment Protection System bank used by the US investment house.

“This is the sort of stuff that kills you – if you don’t have that information you can’t start any of the other processes,” said Jones, who has been at the clearing house since 1993, and who has worked through two other defaults, Barings and Griffin Trading, as well as three near-misses, Enron Metals, Yamaichi International and Refco.

At 07:30 the London Stock Exchange suspended Lehman Brothers from trading, and it was clear action would need to be taken. But there were confusing messages. Lehman had met margin calls at Clearnet SA, LCH.Clearnet’s Paris arm, at 07:00 central European Time. Would it be able to do so in London? It rapidly became clear that Lehman would be unlikely to meet its obligations and LCH.Clearnet acted accordingly.

At 09:15 LCH.Clearnet declared Lehman Brothers International Europe and Lehman Brothers Special Financing Inc in default. Access to trading for Lehman and its customers was immediately cut off and its payment systems shut down. The six SwapClear traders who were on duty were called into LCH.Clearnet’s back-up facilities and by 09:40 had begun hedging the $9 trillion (€6.6 trillion) swap portfolio.

In declaring Lehman in default, the clearing house had assumed all the bank’s risk – including its client positions. It therefore needed to find a means of managing the risk swiftly. Part of Jones’ team guided the swaps traders who started on their hedging programme, while others tried to get in touch with the appointed administrators, PwC, as well as with Lehman’s traders.

Daniel Gisler, managing director, risk and operations, took a team to Lehman’s Canary Wharf offices to collect client records, while the sales and relationship staff remained at LCH.Clearnet offices answering calls from members.

At this point, trouble escalated. Normally the risk managers would expect to look at the portfolios of futures positions market by market, isolating the client positions ready for transfer to a new clearing member, and hedging the house positions before preparing to liquidate them. There was, however, a problem.

Jones said: “We had noticed from some information relating to positions on the London Metal Exchange that at least some client positions were mingled with Lehman’s house risk. This meant we could only hedge out the directional risk and had to take a step back to access the books and records to see what was what.”

Unable to contact the Lehman traders who were not answering calls, and unable to gain access to Lehman’s offices, LCH.Clearnet had no way of establishing which positions were which. Liddell pressed for, and eventually secured, a meeting with PwC early on the Monday afternoon and was able to explain to the auditors what he needed to do and what assistance was required.

Things seemed to be looking up, but what LCH.Clearnet actually gained access to on Monday night was reams of coded print-outs when what it really needed was digital records that it could use, as well as the information necessary to decode the data. Instead, the computer ports in Lehman offices had been blocked.

Liddell said: “We knew what we needed and we knew where it was, but we couldn’t actually get our hands on it. Not being able to nail the data down and move on was hugely frustrating, especially with the markets moving so wildly.”

LCH.Clearnet staff worked late into Monday night in the hope that the required information would be forthcoming and they could start transferring client positions.

By Tuesday afternoon, Mark Huglin, LCH.Clearnet’s head of listed derivatives, managed to get a view on the data from New York, thanks to a call he had put through to the Lehman broker dealer still operating under Chapter 11.

Together with the bank’s back office staff in London, Jones’ team was able to start identifying the customer positions, confirming earlier suspicions of the extent to which these had been mingled with Lehman’s own.

Jones said: “We had lost about 36 hours, but on the Wednesday we started to make real inroads, transferring customer positions across to new clearing members. By this stage, the swaps team had also reduced the VaR significantly – and we were just beginning to breathe.”

The reallocation of customer positions is more complex than it might seem at first glance. All positions for transfer requests have to be approved by the risk group, since the collateral cover held by the clearing house is calculated on a net basis.

The group therefore had to assess the impact of each portfolio’s movement on the residual risk portfolio and in some cases had to schedule multiple movements to ensure that the net position remained covered.

Throughout the process LCH.Clearnet’s diversified spread of business was a help to the clearing house. The margin headroom could be actively managed across the various asset classes, giving comfort from a risk management perspective, and enabling LCH.Clearnet to hold on to the portfolios and take the time required to transfer out client positions.

Liddell said: “Without this degree of diversification it is doubtful whether we would have had the time to identify and transfer the client positions. Instead we would have had no option but to close out all the positions in the house account, leaving many clients unhedged.”

While this work continued, others in the risk group began to package Lehman’s house positions into portfolios prior to sending them out to clearing members ahead of an auction process scheduled for Thursday.

The clearing firms, most of which are banks, were required to sign non-disclosure agreements before they could be sent the portfolio details. They then had just a few hours to assess the portfolios before deciding which suited their book and which they wished to bid on. When the auction process was completed, the winning dealers would be notified and would assume the positions with immediate effect.

Liddell said: “We decided to go straight into that process as soon as we could rather than put on more complicated hedges. The alternative was to go into the markets and start liquidating the positions ourselves, or to pay a dealer to wind down the book on an agency basis for us. These were valid alternatives, but we believed the auction process would be the lowest-impact solution – not least because we knew there was quite a lot of interest from firms.”

LCH.Clearnet ran the Liffe equity product auction first, followed by ICE’s energy book and finally the LME book. Jones said: “As the auction process began, we had more headroom and were able to reallocate the notional collateral cover to other markets. We had collateral cover throughout, but things eased considerably once the auctions had begun and by the end of the week we had very little risk.”

At the same time open cash equity positions were settled through a buy-in process and Jones’ risk group closed out the repo positions held in RepoClear. The hedged swap portfolios were then auctioned – a process that was completed by the swaps traders, on schedule 14 days later.

The entire Lehman clean-up process will become required study material for all clearing houses worldwide, but the swaps clean-up will attract the most attention. The $133 trillion portfolio of interest-rate swap risk in SwapClear has built rapidly since it was established in 2005 as a form of joint-venture between the OTCDerivNet consortium of dealers and LCH.Clearnet.

Qualifying dealers can novate bilaterally negotiated swaps trades to the clearing house, considerably reducing their counterparty credit risk exposure, gaining balance sheet efficiencies and substantial capital charge reductions.

On joining the group, dealers have to commit to participate in any default management process, to allocate staff to the hedging and auctioning process, and to take on defaulting members’ risk. Although routinely rehearsed, the default management process had never been tested.

Jones said: “We were very happy with the way the swaps side worked – and what was comforting was the commitment we had from member firms, not only from the traders that came into work with us, but also from desk heads who would eventually get their calls seeking to put on the hedges and run the auction process.”

Frits Vogels, head of interest rates at interdealer-broker Icap added: “The entire marketplace is pleased with the way this has worked – it is a great success story in a time of unprecedented turmoil. The swaps market has had the least amount of headaches and has continued to function extremely well throughout.”

Although several individuals have been privately critical of the administrators, as well as of the FSA, for not having taken a more authoritative stance toward them, there has been an almost total absence of criticism for LCH.Clearnet. Not only did it not have to tap the default fund, it never even came close to using up the initial margin that had been collected on the Friday morning prior to Lehman’s demise.

Plaudits for the clearinghouse have come in from all over. Nick Carew Hunt, market secretary of Liffe, said: “We have absolutely no criticisms – the battles they had in getting the information were substantial and while they could just have closed everything out on the spot, they took full consideration of the whole picture and did the best thing for the market.

"What is more, they managed the process over what had to be a protracted period of time, but remained within the margin cover.”

The highest praise came from Anthony Belchambers, head of the Futures and Options Association. Cognisant of the need to draw lessons from the events, he has put together a list of to-dos for the industry. LCHClearnet, notably, is not an item on this agenda.

He said: “As you might expect, unravelling the largest default in financial history has thrown up a few issues, but the feeling from member firms is that LCH.Clearnet did a very good job in difficult conditions and under a lot of pressure. LCH.Clearnet has been subject to a lot of criticism in the past, but they have come back in spades.”

Actually Obama has been far more specific about his plans than McClown has.

*

Mc$ain & OREO are in DEAD heat for saying ZERO. I saw all the debates, and neither answered a direct question, and agreed on most orwellian proposals.

Both are OWNED by Fascist USA.

This argument that OREO is good be because CAIN is the lesser of two evils is BULLSHIT. Evil is EVIL, and they're both OWNED by wall-street.

Embrace the OREO for what he says ( which is general feel good non-specific crap )

*

Change

Hope

...

feel good, non-specific crap

DEM&PUG are the same, both party's owned by the same people

WTF "G7 to offer unlimited USD to BUY US stocks" WTF?

The Wall Street Journal

Oct. 13, 2008

The Bank of England, the European Central Bank and the Swiss National Bank said they will offer unlimited U.S. dollar funds to banks in the latest coordinated central bank action to counter the financial crisis. In a joint statement, the central banks said the terms of their respective currency swap arrangements with the U.S. Federal Reserve had been altered to

"accommodate whatever quantity of U.S. dollar funding is demanded." In the statement, the Bank of Japan said it is considering the introduction of similar measures.

Russia & China and all the other non-G7 powerhouses must be laughing their ass off, while G-7 nations toss all their taxpayer treasure in Buffet's toilet.

PAULSON DEMANDS G-7 BANKERS to SUCK his dick at 3pm EST today, let's see if they jump? Will they bail-out Goldman-Sachs?? Can he force G-7, and mainly US bankers to BUY US BUFFET holding companys??

***

The Wall Street Journal

Oct. 13, 2008

Treasury Secretary Henry Paulson has called the top U.S. banking heads to a meeting today in Washington, people familiar with the matter said. The 3 p.m. meeting is being called while most of the banking chiefs are in Washington D.C. for meetings of the World Bank and the International Monetary Fund.

Invited to attend were banking executives including Ken Lewis, CEO of Bank of America, Jamie Dimon, CEO of J.P. Morgan Chase, Lloyd Blankfein, CEO of Goldman Sachs Group; John Mack, CEO of Morgan Stanley; and Vikram Pandit, CEO of Citigroup.

Not much of a a choice, me suspects the premise here is that all who don't let OR-BOMB-EO fuck their daughters are bewert haters, but not so it is possible to love bewert, and know that OR-BOMB-EO is a bought and paid for political WHORE.

I call that option 3.

3.) Love bewert, & know that OR-BOMB-EO is just a low-life politician.

FUCK the 3pm paulson meeting today, the REAL meeting is going to be at CHENEY's office in DUBAI today, and CHENEY is now going to RULE the world.

***

Buyout bosses gather in Dubai as crisis continues

Sun Oct 12, 2008 11:02pm EDT

DUBAI (Reuters) - Private equity executives from the United States and across the Middle East descend on Dubai this week to seek out investment partners and deals during one of the most tumultuous periods in the industry's history.

The three-day annual Super Return Middle East conference coincides with extreme volatility in the financial markets and a credit freeze that has only exacerbated the inability of the firms to access financing for leveraged buyouts.

Attendees will be watching addresses from Wall Street moguls such as KKR's Henry Kravis, Carlyle's David Rubenstein and Blackstone Group's LP (BX.N: Quote, Profile, Research, Stock Buzz) Steve Schwarzman for signs of how U.S. private equity will ride out the storm and the investment opportunities they see emerging.

From the Middle East, the focus will be on private equity and sovereign wealth funds, with speakers including some from Dubai government investment agency Istithmar World Capital, which owns fashion retailer Barneys New York; and Saudi-based private equity firm Swicorp, which recently bought a stake in leasing company Jordan Aviation.

Behind closed doors, a flurry of meetings are expected as U.S. private equity executives test for any appetite for further ventures, fund raising and deals from a region that has been burned by investing in the United States.

Some sovereign wealth fund investors have taken stakes in companies whose shares have dived dramatically, as well as faced a hostile reception from critics questioning their political motives. That has caused concern among U.S. buyout bosses about continued investment in the country.

TOUGH INVESTMENTS

"Imagine a private meeting in a room far from the US; a decision is quietly made and billions of dollars that were invested here find a new and more hospitable home," wrote Schwarzman in a recent column in the Financial Times. "Or billions of dollars that could have been invested here are reallocated to other more benign markets."

coming to bend for a couple weeks to help another Westside friend move out of Oregon...should I bring my gun to fend off the roving mobs of tweakers? :-)

GM and F have large bounces today. Paulson going to use some taxpayer money to buy their stocks, too?

I think it is the consensus that GM and F will finally get access to the funds that have already been approved.

I just bought some CAL this morning. Third trip on it. Probably won't get that big of a move on it this time though.

Recall for Cunt's CHENEY moved all op's for HALLIBURTON to DUBAI, and from now on all serious deals will be done there.

Through intimidation of the US war machine, CHENEY has made himself KING-of-DUBAI, which makes him king of the war.

Right now I would watch closely the war between BUFFET & CHENEY for world dominion.

yes auto was promised $25B a while ago, but is it enough for what?

Also if you start adding up all these promises, they already exceed the budget and authority to pay.