Johnson said the banks of the canal aren’t stable enough to withstand construction like that, and that the only long-term solution would be to pipe the canal through that entire area.

Driving slowly on the road atop one bank of the canal Tuesday, Johnson pointed out all the nearby development: dozens of homes; a strip mall with ice cream and video stores; an auto parts store with its parking lot 10 feet below the canal; and the Sun Ranch Mobile Home Park on the canal’s south bank, which will be razed for the condominiums.

If the canal were to breach near the planned development, water would flow across Reed Market and back toward Third Street, he said. And even if the water was cut off immediately at the top of the canal, the torrents out of a rupture would last for several hours.

Johnson’s piping solution is more complex and costly than it may seem at first blush.

“You can’t just do this, plop a 50-foot piece of pipe in the middle of the canal, because you can’t necessarily get all the water in the pipe,” Johnson said.

Such a pipe would have to start where the canal’s current is faster — in that case where it passes under Third Street.

And with the city’s possible future plans to create a new intersection at Reed Market and American Lane, Johnson would like to extend that pipe past the Burlington Northern Santa Fe railroad tracks to the east.

Cost for such a project: $5.5 million, Johnson said. In a perfect world, he’d like to do it in the next five years, too.

“It’s fair to ask the developers for a share,” Johnson said. “I think it’s likely the city and COID will have to pay something (also).”

"Fair"? What the hell does he mean it's FAIR! It's not just "fair", it should be implicit & mandatory. But of course it's not. You must remember these are developers bringing something we are in dire need of: About 2 billion housing units. You see, we are down to our last couple of decades of housing supply. Prineville only has 10,000+ home units, or 76 years supply at July's torrid sales pace (11 homes sold). Madras is in more perilous condition having breached below the half century mark (in Yarrow alone) by blowing 8 homes out the hatch in July.

This issue has been (over?)addressed by BendBust, SDC charges are Way Too Low in Bend, and this article brings this out in high relief. This move will cost millions, and is being brought on largely by construction activity itself, which threatens to burst these canals. But as usual, City Councilors walk on eggshells around developers who basically run the show in this 2-horse shithole. Perhaps a short graphical novelette is in order? Yes, yes it is. We'll call it:

Steve Johnson, district manager of the Central Oregon Irrigation District, has got a haircut you can set your watch to. I like this guy. He is tired of fuckin' around, and that haircut clearly telegraphs that this guy ain't gonna take any bullshit.

Yeah, here's your typical sleazy-ass Bend Condo Developer. It's not bad enough these bitches make millions, they gotta nickel & dime taxpayers to death on SDC charges. I hate these bitches.

Yeah, here's your typical sleazy-ass Bend Condo Developer. It's not bad enough these bitches make millions, they gotta nickel & dime taxpayers to death on SDC charges. I hate these bitches. Typical City Council meeting swarming with filthy stinkin' rich developers, trying to sleaze their way out of $5 in SDC charges. City Councilor Linda Johnson chimes in when asked about the consequences to locals if excavation activity breaches the canal.

Typical City Council meeting swarming with filthy stinkin' rich developers, trying to sleaze their way out of $5 in SDC charges. City Councilor Linda Johnson chimes in when asked about the consequences to locals if excavation activity breaches the canal. Here we see a recent proposal by Brooks Resources President, Mike Hollern, to build a underground condo parking garage. Hollern uses PowerPoint technology & a laser pointer which quickly makes the male Councilors remark about his virile constitution, and women City Councilors moist about their mid-sections.

Here we see a recent proposal by Brooks Resources President, Mike Hollern, to build a underground condo parking garage. Hollern uses PowerPoint technology & a laser pointer which quickly makes the male Councilors remark about his virile constitution, and women City Councilors moist about their mid-sections. Of course, Steve Johnson doesn't like this one bit. It's his job to see that the muddy banks of the Bend canals ("River Fudge") are packed hard as a fuckin' carp. Above, Johnson utters a solemn creed within his COID corps and it's loyal band of ruthless fudge packers.

Of course, Steve Johnson doesn't like this one bit. It's his job to see that the muddy banks of the Bend canals ("River Fudge") are packed hard as a fuckin' carp. Above, Johnson utters a solemn creed within his COID corps and it's loyal band of ruthless fudge packers. Of course this proposal, like all others, is quickly approved, and Hollern is in the air in no time.

Of course this proposal, like all others, is quickly approved, and Hollern is in the air in no time.

Here's your typical outcome: Stupid-ass City Councilors, reassured by some glad-handing and a $6 bottle of wine from The Grocery Outlet compliments of condo developers, have overlooked the pesky business of DUE DILIGENCE. And something they were assured would cost $1.59 ends up costing $250 million and kills 6,000,000. Nice.

Condo developers celebrate with the Usual Victorious Fly-By...

Condo developers celebrate with the Usual Victorious Fly-By... ...before returning to headquarters. And Bend taxpayers end up where they always do...

...before returning to headquarters. And Bend taxpayers end up where they always do... Well, I don't want to bore you anymore with tales of Bend City Councilor incompetence, so I'll move on....

Well, I don't want to bore you anymore with tales of Bend City Councilor incompetence, so I'll move on....The Bulletin finally came out with what I can typify as The Tipping Point article in the implosion of Bend real estate, "Prices still sliding, sales still slowing". Now, if you go back and take a quick look at last months article, "Home sales continue decline", you see The End Of An Era: The Last YoY chart of Bend home prices rising for what will be many, many moons.

Yup, sales are imploding, but PRICES as of June 2007 were UP year over year. No more. July 2007 is DOWN, across all Cent OR markets. This was clearly telegraphed by the terrible state of volume implosion. No one is buying homes in Bend Oregon anymore. You'll hear different, but simply respond with, "Then why in hell are volume AND price falling?". OK, this is The End that I talked about wayyyy back last Winter. Here is a reproduction of the data from The Bulletin piece:

These are July data points, and it's smooth sailing until July 2007. And then you see something that hasn't happened in many moons, DROPPING PRICES. Get used to it. Now for a better vantage points, here are area medians normalized at 1.0:

These are July data points, and it's smooth sailing until July 2007. And then you see something that hasn't happened in many moons, DROPPING PRICES. Get used to it. Now for a better vantage points, here are area medians normalized at 1.0: You can see it's a pretty close horserace with Prineville taking the clear lead in 2006. Prices are really being led by volume though, which is disastrous:

You can see it's a pretty close horserace with Prineville taking the clear lead in 2006. Prices are really being led by volume though, which is disastrous:In Bend, 109 single-family homes on less than an acre of land sold in July, down 27.8 percent from June’s sales, according to the Central Oregon Multiple Listing Service. The median price — the price at which half sold for more and half for less — stood at $340,000, 4.5 percent less than the median price of homes sold in July 2006.

Monthly sales figures in Redmond, Crook County and Jefferson County also fell to their lowest levels in five years, according to the MLS, while median sale prices dipped below prices in the same month a year ago.

In Redmond, 40 non-acreage homes sold in July, down 45.2 percent from July 2006. Median prices also slipped to $247,000, down 5.7 percent from the same month last year.

In Crook County, 11 homes sold — half of the July 2006 number — while median sales prices slid to $190,000, off 13.5 percent from homes sold in July 2006.

In Jefferson County, eight homes sold — a third of the July 2006 volume — while median sales prices dipped 4.9 percent from July 2006 to $173,250.

These are just huge declines. It's hard to remember that on an individual basis, people of course care about the value of their own home. But the industry as a whole is about dollar volume. When there's no volume, you can ask all you want for your house, but you got a snowballs chance of getting it. You have to have volume to get "what you think it's worth", otherwise you're just dreaming.And volume has gone to hell here. And the other implication of imploding volume is that The Largest, Most Influential, And Certainly Most Lucrative Industry in Central Oregon IS DYING. The 300 layoffs at Columbia Air will look like chickenfeed compared to the RE industry losses coming in the next few years. There will be THOUSANDS losing their jobs day in and day out for as far as the eye can see around here.

THIS IS IT, THE END. This is what this blog has been about in large measure: When will there come a day when there is INCONTROVERTIBLE PROOF that the RE bubble in Bend has busted? That day is today. It's Over.

For a aside, I noticed the Bulletin has gone far afield looking for fresh young nubian Realtors with which the Bend blogosphere could tear a new ass... if it dared. And they found one Pam Lester of Redmond. Clearly not staying abreast of Whitey McBlogfuckers penchant for tearing nitwits a new corn chute, Lester popped off this Cleveland Steamer:

“I don’t expect prices to go anywhere but up from here,” Lester said, “because they can’t go any lower.”

Pam, cuz you quasi-hot, I'm going to give you some advice. That statement is what we call, in the business, a TAUTOLOGY. Like "Boys will be boys". Wikipedia puts it this way:

In propositional logic, a tautology (from the Greek word ταυτολογία) is a sentence that is true in every valuation (also called interpretation) of its propositional variables, independent of the truth values assigned to these variables.

Sounds smart, but actually it's real, real stupid. Your thesis, "they can't go any lower" is flawed in that it is idiotic. Prices can go lower, and will. I'm going to go easy on you, cuz it's your first time, and like I said, you got some moderate hotness. Please refrain from making tremendously stupid statements like that again. Your clients start to wonder where your cheerleading outfit is. And so do I. Where is it, by the way?

On a personal note, the fact that The Bulletin is going farther afield for their Skank-O-The-Month, and skirting pathological liars like Norma "Sold Out" DuBois & Becky Breeze, makes me think that this blog may be achieving one of it's primary goals: Making RE markets FAR more transparent by raising awareness of what are clear misstatements in the public media. It takes me back...

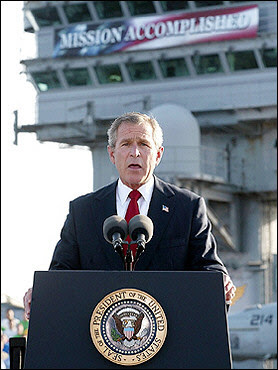

Man, what a proud moment. About 45 minutes after we commenced bombing those filthy stinkin' rich Iraqis, GW arrives via hoverbus on the USS Fuck You, to deliver the Good News:

Man, what a proud moment. About 45 minutes after we commenced bombing those filthy stinkin' rich Iraqis, GW arrives via hoverbus on the USS Fuck You, to deliver the Good News:Damn right. And as we all know, it's been smooth sailing ever since with Iraqi's celebrating, basking in an economic renaissance, and carrying American GI's down Baghdad's glorious palm tree lined boulevards in their Rolls Royces, Lamborghinis and Ferraris. Well, in that spirit, I thought I'd share a personal moment when I realized the battle between Paul-Doh, Blogger Extraordinaire, and Evil Bend Media had well & truly been won:

Finally, for all the World to see, we see Paul-doh sitting on his patented "Coff-Toila-Matt" (combination Mattress, Toilet, and Coffin), soaring light as a feather over his vanquished foes, who he later ate. But Paul-doh doesn't work in a vacuum. No, Paul-doh never give up the fight due to the unwavering support of his Old Lady, who give him comfort when he low, snap occasional PR pics (with titillatingly placed T-shirt/pup tent), and bring Paul-doh 32 gallon drum of lard when it dinnertime.

Finally, for all the World to see, we see Paul-doh sitting on his patented "Coff-Toila-Matt" (combination Mattress, Toilet, and Coffin), soaring light as a feather over his vanquished foes, who he later ate. But Paul-doh doesn't work in a vacuum. No, Paul-doh never give up the fight due to the unwavering support of his Old Lady, who give him comfort when he low, snap occasional PR pics (with titillatingly placed T-shirt/pup tent), and bring Paul-doh 32 gallon drum of lard when it dinnertime.

156 comments:

Oh my God, I think I peed myself!

Holy Shit. That's all I have to say.

Funniest thing EVER! Paul-doh is one sexy bitch.

Dude, you are seriously warped. I Love it! That is some of the funniest blogging ever. Keep it up!

exactly what are the mechanics of mortgage payments and foreclosure actions after a mortgage has been collateralized and sold to a hedge fund, etc?

*

Under the terms of your loan, for a fee the loan is 'serviced' by an appointed fiduciary. If you have a few mtgs in the last 10+ years, you'll know that that the loans frequently get sold, and that you must frequently re-assign insurance and payment to the new holder of the mtg.

WRT foreclosure, default, ... its all subject to state law.

Since you mention 'collateralize & hedge', your talking about an order of magnitude of depth from a simple loan by an originator, this is called unwinding, and has nothing to do with the debtor.

Too many, if not 100's of articles have been posted even in this thread this week on the subject.

For instance your bringing up issues on opposite ends of the continuum "foreclosures' which effect the individual debtor, and 'hedge funds' which effect the individual investor.

Both are going to get FUCKED investors and debtors, the difference is the debtors were deadbeats to begin with, many of the investors were hard working albeit suckers for a high rate of income generation.

I feel that your question is like "What are the mechanics of physical science?", which can be answered, but I feel the first step should be obtaining a PHD in physics, your economic question is basically "what is the mechanics of the post 1980 USA MTG industry."

Please be specific in your question, otherwise your going to get 1000's of textbooks to read.

Again in the past few months and even this week, many good articles were posted on the subject of post 1980 RE-MTG finance 101.

Do you make your payments to the hedge fund? To the originating bank?

{ The originating MTG folk sell your MTG the second it closes, there is NO bank. From minute to minute YOU must know who owns your MTG, and who is servicing your loan. ]

If it is foreclosed, who actually does the foreclosure, filing the papers with the county, taking possession, auctioning it off, etc.

{ You'll get a letter from the owner of the property, this be the first on the title, tell you to get the fuck out, generally it takes 1-2 years before you get dragged into civil court. There the judge will give you 30 days, and if you don't get the fuck out, then your in contempt, jail-time.

}

*

I apologize for the generality, but your question is WIDE-OPEN. I have been horse-trading RE since the 1960's and have gone through many foreclosures NO fault of my own. In 1983 I bought several homes in Oregon just like now for nothing from contractors, on contract, it turned out they weren't paying the FED. So eventually I got a letter from FHA, doing what my lawyer said I just sat on the homes, sure enough it took 1-2 years before the county court dragged my ass before the judge, and he gave 30 days to clear.

The lawyer had told me that the 1-2 years of 'rent-free' I would get my down-payment back, and he was right. It didn't effect me at all.

The system doesn't really care about who is in the house, its just the new owner that cares to get you out so they can sell the house.

Note this question is so wide, for instance what if your the originator of the loan?

Then of course your in default, and you still owe the money, unless you can file bankruptcy, which just got changed, so that is NOT an option.

I hate to change the subject, because I'm assuming from the naivety of the question its a hypothetical. But lets say they forgive your loan and let you walk, then the IRS goes after you for the difference, e.g. you walk from a $500k home, zero down, they sell at auction for $250k, and forgive you. YOU OWE uncle sam full taxes on $250k INCOME.

This is the WORST possible outcome of this game. THIS IS HOW PEOPLE ARE GETTING THE MOST FUCKED TODAY. THIS IS WHY UNCLE LOVES FORECLOSURES. THIS IS why all post-2006 will introduce a new system of debt peonage slavery, and debtors prisons are coming.

There is SIMPLY too much to this game, I wish that folks would ask simple explicit questions of how the system works.

Note on the subject of "who do you send the check to", ... that is all subject to who owns the loan, and YOU the person who took out the loan MUST know your terms, and you'll get mail frequently telling your where to send the check. Remember this is just a clearing house where you send the check, they get $10-20/mo for simply processing your check, and sending a statement, and there are zillion companys doing this service.

IHTBYB,

Thanks for taking out some of your busy time on the subject of SCD and COID.

Yes, the contractors are pissed, they have been paying $12k/home for sdc, which actually costs we the tax-payer, $60k,

Currently the prices is being raised to $16k/home and the contractors have gone insane,

SDC means service development costs

On the subject of COID, central oregon irrigation district,

The issue is that the developers put SHIT right next to the canals, the FUCKHEADS who bought are throwing garbage over the fence, which is blocking the canal at the culverts, which is causing flooding. The solution is to PIPE, rather than MAKING it a felony to dump furniture, garbage, cars, ... in the canal.

The pipe mentioned along the tracks for $5Million is really going to cost 4X, and doesn't solve the fucking problem. The problem is ALL the COID canals either need to be piped, or folks needed to be HIT over the fucking head, not to dump their garbage in the fucking canal.

Now the issue of the PIPE, if the water is piped, then ALL rural wells will go dry, and it will cost over $200 million to deliver potable water to rural property. WHO IN THE HELL IS GOING TO PAY??

My guess is whats really going on here is ALWAYS is big fucking construction creates a fucking problem, and then collects billions to solve the fucking problem. This is how PDX works, like the fucking OHSU-TRAM started out at $5M, I think ended up costing $60M, or light-rail, costs a $1M/mile, was supposed to cost a few million for system.

Bechtel, Halliburton are the largest beneficiary in Oregon. Brooks is SMALL potatoes compared to the folks that will build the new sewage, water, flood control, and freeway system in Eastern Oregon.

All our 'problems' are being manufactured.

On the subject of Brooks the largest developer in Central Oregon.

If you take the $60k/home - $12k/home , which is $48k/home difference, and multiply this by the number of homes built since 2002, then you get over a Billion dollars exactly what needs to be now spent on updating Bends infrastructure.

Ergo a billions dollars profit that Brooks largely made came from CHEAP SDC's, in effect the Bend tax-payer is who enables boss-hogg-brooks.

SDC's are schools, roads, sewage, water, and flood control. Currently we need $300M for sewage, $200M for water, and $500M for flood control. The schools and roads are going to be another 1/2 billion.

Today Brooks has left dodge, and is now up in Priny&Madras shafting those people, its just a few little dumb contractors left in Bend fighting to not have to pay over $12k/home for SDC. Note, that this money must be paid up front, and these developers have NO CASH.

Note that having the city subsidize or DEFER the $48k/home difference is what created the boom, had developers had to pay actual cost in the first place all this shit wouldn't have gotten built.

Today BEND is in a world of pscyho-SHIT, and tomorrow BEND will be wallowing in SHIT if it doesn't figure out how to budget new sewage treatment plants. ASAP.

Many citys in OREGON make Developers pay the actual cost of SDC up front, in Wilsonville Oregon, a city of RICH people, they MUST pay $90k/home, because these are smart rich people who want the best schools for junior, the best roads for their Escalade, and the best pipes for their turds.

Bend is populated with DUMB FUCKING HELOC RICH fuck-heads. Who want something or less than nothing, and what they're going to end up with is worse than poverty with a view.

Bend is going to be a standing in shit with a view, .e.g. if the condo-HO condo isn't blocking your view.

Yeah, to whom you send your money is irrelevant. You just do what you're told.

Your mortgage can be stripped into pieces and so isn't even owned by one investor (thus the difficulty of loan "work outs").

For instance, a vehicle can be made of many mortgages' principle payments only. Another vehicle may be made of interest payments only. These latter are known as "toxic" and investors often have to be paid to take such vehicles.

Mortgage vehicles are not simple. People pay off their loans early when rates come down, which is when the holder would prefer that people don't. And people don't pay them off when rates go up, which is when the holder would prefer they would.

That's why pension funds and hedge funds sometimes blow up holding these things, which they have often borrowed to buy. Knowing how to make money off these things, especially the interest-only crap, means knowing how to price the risks and hedge them. It means you have actuaries and programmers to generate runs of probably movements of interest rates through the future and actuarial models of how people will react to them with regards to their mortgage.

Suffice it to say that Wall Street hires piles of the brainiest people out of Harvard and MIT to figure this out and they still often fail because their assumptions about future correlations can easily go to hell. But there is a profit to be made because the damned things are so undesirable to normal investors.

If you hedge wrong, you go directly to zero when things move around.

Believe it or not investment banks have even created synthetic instruments which ACT like mortgages including having all the undesirable traits of real mortgage loan vehicles. Can you believe that? It's all weirder than you can imagine.

And if you think all that is too much to bear, you haven't heard about all the swaps derivatives out there.

>>But there is a profit to be made because the damned things are so undesirable to normal investors.

Really dumb investors just buy this stuff and don't hedge. The investment banks hedge their risks and dumb investors don't. Naive foreign buyers may have been the biggest suckers in this round of suck. We'll see. It's possible dumb state pension funds may have also bought them without even attempting hedges. The things got popular because everyone knew that hedge funds were making money off them, but maybe they didn't know precisely how.

It reminds me of the poker table. If you look around, and you don't know who the chump is, it's you.

HOW TO SOLVE THE CANAL PROBLEM IN ONE WEEK.

One fucking way to solve the ENTIRE fucking COID water canal problem.

We live in a FUCKING condo sale fucking town like Bend, because some pro-tem city judge doesn't like dogs near the old mill.

Given that city-hall can charge white trash $400/ticket for fido swimming in the Deschutes in the CITY, how about this, ...

Given that the city of bend, can pull any fucking ordinance it wants out of its ass, ... This is legal in Oregon the city-council can do anything.

Make it a $10k fucking fine per instance for dumping ANY KIND or quantity of garbage in the CITY of BEND into a COID canal. Folks along the projects are throwing their garbage bags in the canal, it doesn't take much forensics to determine who they are, also have the FUCKING BEND PIGS ride their bikes along the canal and write $10k tickets, the problem would be solved.

The COID gets saved, rural folks get to have their wells saved, the city gets a new revenue source for awhile. The county doesn't have to put ALL of rural deschutes county on city water, at the cost of over $200Million.

There is one FUCKING sleazy whore, that has the NAME bend written on his ass. This guy fucking hocked fake rolex's in a pawn shop before he was 'discovered' by Steve Jobs, and made into the APPLE evangelists. Bill Graham can't speak to god, but Guy Kawasaki sells shit to god. Everything that ever was sleazy about CALI, this is the epitome. This is the millenium poster boy for Bend, Oregon. Guy Kawasaki.

2007 Bend Venture Conference Featuring Guy Kawasaki, 10/19, Bend, Oregon

June 13, 2007

Bend Venture Conference is proud to announce Guy Kawasaki as the 2007 keynote speaker.

Guy Kawasaki is a managing director of Garage Technology Ventures, an early-stage venture capital firm, and is a columnist for Entrepreneur Magazine.

He is also ranked as one of the top 100 bloggers in the world.

Kawasaki is a nationally recognized author who most recently wrote The Art of the Start.

Overview of BVC

In its fourth year, the Bend Venture Conference is the premier regional event, focused on connecting seed and early stage companies with investment opportunities. The conference attracts entrepreneurs, investors, and service providers from across the Pacific Northwest. BVC is held in the heart of Bend and is committed to fostering economic development in Central Oregon.

It's possible dumb state pension funds may have also bought them without even attempting hedges. - tt

*

Possible? Please do your homework by law they're not allowed to have more than 5%, but GUESS WHAT??

Its a two way street with leverage,

Say you buy the hedge with 5%, but they're running 10to1, and they lose it all, you get a -50% bill on YOUR PRINCIPAL. This is how its playing, this is whats going on, this is WHY USA 401K, is GONE.

The investment banks hedge their risks and dumb investors don't. Naive foreign buyers may have been the biggest suckers in this round of suck.

*

I agree it may be 1/2, and the foreigners are PISSED NOT COMING BACK.

The USA folk will have lost what wasn't lost at DOT-CON, DUMB? Nah?

Since 1980's everybody thought it was their right to 10%/yr, risk free.

The next generation will be just like post-depression, t-bills at 2%, and leave it at that, unless your a fool with his money, ...

That's why pension funds and hedge funds sometimes blow up holding these things, which they have often borrowed to buy.

*

Some hedges have locks of five-years, some have three months,

Right now the short term are fucked, because when the bank-run is ON, they must liquidate for penny's on the dollar.

For long-term lockup hedges, only time will tell.

Let's also remember that at one time a hedge, was an insurance policy. During the last ten years the hedge has become exactly like the 1920's leveraged trade, this is exactly what killed wall street, because when it went down you just didn't lose your money, but your lost your childrens money, e.g. you could lose MORE than your total assets, thus people jumped out of windows.

It's possible dumb state pension funds may have also bought them without even attempting hedges. The things got popular because everyone knew that hedge funds were making money off them, but maybe they didn't know precisely how.

*

Normal fiduciary pension speculative limitation for a trade is 5%, but that can be per fund. I don't blame the fund, it was FUCKING granny demanding her 10%/yr, you all have to remember that it took over 20+ years to bring the most recent 'insane gambling' system about, where every fucking 'house' was creating its OWN TOXIC paper and trading it as cash, with an S&P 'AAA" stamp-of-approval.

Everybody was willing to 'Risk', the problem with risk, but definition it is NOT a positive sum game, in the mathematical sense, sometimes you lose, if you make ONE final BET AND ALL your chips on the table were borrowed, then you can LOSE more than your assets.

Welcome to post 2008 economics.

Everybody played the fucking game, because EVERYBODY was making money, and NOW everybody that played the game will lose their money and MORE, and those that didn't play the game have to watch the 'blame game' unfold.

And if you think all that is too much to bear, you haven't heard about all the swaps derivatives out there.

*

We have to be careful going down that track, otherwise we'll be entering LaRouche-Ville,

Note old LaRouche was predicting a derivative meltdown in the 70's, he must be one happy pecker-wood by now.

ROFLMAO!!! This is some seriously funny shit.

The real estate / developer / builder crowd is always pissing and moaning about "takings," but I believe property owners should be required to compensate government (i.e. the taxpayers) for "givings" -- government actions that make their property more valuable, such as bringing it inside the UGB or increasing the allowable building density. Why doesn't somebody get a ballot initiative going?

>Please do your homework by law they're not allowed to have more than 5%

Time after time, we've seen traders do weird things to keep their jobs or make their bonuses. This shit so so hard to understand that a deliberate clever trader can create an internal pyramid scheme and fool even other smart people around him, let alone a regulator that shows up now and then.

Think of all the blow-ups. Most were discovered when something blew up. In a couple cases, they were discovered when some one was just flat-out doing too well. You look into it and find out he hans't made any money. He's lost $500 million when you unwind the future positions. Maybe some potential blow ups were defused before we ever heard aabout it. But lots of them have happened. Even giant banks with hundred-year histories have died in blow-ups that came from one dork in an ignored satellite office.

But back to Bend. Some in Bend thought (or at least said) that Bend would do OK even if other places slid. They weren't counting on these big events like mortgages getting painfully tight. If you're too provincial, you'll always miss the big picture. They don't have anything to say right now, except the tired old, "This is Central Oregon. This is Bend. People want to live here."

Well, guess what, people want to live in Florida, too. Lots more of them. And how's that working out?

Not just LaRouche. Buffett is expecting it too. They have happened bad enough to take out banks. But yeah, swaps aren't the topic here. Mortgages aare becaause they affect Bend now.

Holy Shit, she is HOT. She could be right, in fact whatever she says I agree, I'm a yes man, where do I sign, see the home? no, coffee? Wine? YES

................................

Pam Lester - Century 21 - Central Oregon's Finest Real Estate Team

Pam Lester's Central Oregon Real Estate, Eastern Oregon ranches and real estate for sale ... *Based on MLS Redmond sales volume statistics from 1/1/04 to 12 ...

www.pamlester.com/ - 15k - Cached - Similar pages - Note this

Pam Lester - Century 21 - Central Oregon's Finest Real Estate Team

Central Oregon Information line Builders line Central Oregon Gallery line Contact Pam Lester line Century 21 - Redmond, OR ...

www.pamlester.com/ourlistings.htm -

The July numbers due out this week are going to show something that hasn't been seen since 1950 -- home prices declining NATIONALLY. Bend is just a microcosm of what's been happening across the country for the last three years: home prices being artificially inflated by buyers flush with too-easy credit. Bush supporters used to boast about the high rate of home ownership as evidence of the supposed health of the economy, but we haven't heard them singing that tune lately.

"Holy Shit, she is HOT."

Semi-hot, yeah. But apparently not too bright.

"Prices have to go up because they can't go down" will go down in history along with "We know where Saddam's weapons of mass destruction are" and "Mission Accomplished."

Not just LaRouche. Buffett is expecting it too.

*

My point is that this was LaRouches #1 topic 30 years ago,

I remember buffet spouting homilies, he's too busy doing the Guy Kawasaki thing, with Berkshire, buffet is just another fucking evangelist,

LaRouche on the other hand is a perpetual presidential candidate.

I don't remember buffet making derivatives a #1 issue 30 years ago, that was my point.

The reason that I brought up LaRouche, is that for most people who haven't followed this "SHIT" for 30+ years, they may not realize there is NOTHING NEW HERE WHATSOEVER.

"Holy Shit, she is HOT."

Semi-hot, yeah. But apparently not too bright.

*

Excuse me, I'll take my women HOT, and my BRAINS cold.

Well, guess what, people want to live in Florida, too. Lots more of them. And how's that working out?

*

We're simply in a transistion, the last 20+ years has been "Have it your way",

Where do you want to live? Anything is possible.

I have asked now ten times, and I'll keep asking until I get an answer, what are the industry's in Bend that will survive, prosper, and enrich their employees during the full cycle of the bend-buuble?

The future slogan will once more be "Brother can you spare a dime".

Remember not a month ago a letter to the EDITOR in the SORE, was demanding that panhandling be banned in Bend.

Where do you want to live today? This is a non-place-bound people, first major difficulty and they're moving home to mom&dad, where ever they came from.

Some in Bend thought (or at least said) that Bend would do OK even if other places slid.

*

The ONLY people who think Bend is special, are people in PDX who think its special during THEIR rainy season.

PDX we're counting on you, to BUY our condos.

>>I don't remember buffet making derivatives a #1 issue 30 years ago, that was my point.

True. Buffett really started caring only when he had to unwind the General RE futures he acquired.

LaRouche was right and early. And the vehicles are exposures are weirder and bigger now. Much bigger than 30 years ago.

Thanks to all for your insights into the mortgage issue I asked about earlier. I'm not too stupid, have a double major in MIS and Finance, built a Black-Scholes 3D-graphing program with a team I put together in my senior year back in 1982 using the only PC on campus to automatically download data from Compuserve and process it on the mainframe, and and scored in the 97th percentile on my GMATs. I've even been issued three patents on software/hardware combinations over the last 10 years regarding controlling video speed with exercise devices.

But I simply have never owned. I lived in Alta, UT, for many years and then SLC, where I didn't want to buy. I missed the last big RE dive as I was right out of college in the mid-80's, and every time I penciled it out it cost 2-4 times as much to own as rent, which just didn't make sense to me. Same since I moved here a little over two years ago. Right now my rent is about 1/4th of mortgage service on the 30+ houses for sale around my area.

I googled "structure of cdos" and came up with some enlightening articles well worth reading. The whole topic of synthetic CDOs explains a lot, i.e. the mortgage itself is not sold, only the risk in return for cash flow. And often in bits a pieces. What a effing mess that has got to be.

On another note, check out this Sacramento area developer watering the lawns of foreclosed, abandoned houses in his subdivision while he tries to sell the remaining inventory:

http://tinyurl.com/yrhjqs

It seems to be bad all over. I haven't seen anybody using a water truck to make his sub look good around here. Yet.

BTW bendbust, that last post is over the top. Great work :)

BTW, both Guy Kawasaki and Warren Buffet are good guys. Buffet publishes an annual letter to shareholders that is a must read. It's available at http://www.berkshirehathaway.com/letters/letters.html

If that got cut off, go to

http://www.berkshirehathaway.com and click on the "Warren Buffett's Letters To Berkshire Shareholders" link. The last one was posted in March.

Guy, whom I've been in contact with off and on for the last ten years, has had ample opportunity to become a rich badass VC/vulture capitalist but has preferred to stay in the early stage startup stage. It's more fun to him, and he's a smart guy.

I'll never forgive Kawasaki for his book "The Macintosh Way." It was one painful read.

Buffett's writing, however, is always a delight to read.

Yeah, the "Mac Way" was a puff piece. There was some truth there, but a lot more wishful thinking.

Were you a Mac guy back in the day?

In the day I remember Guy Kawasaki as one sleazy dude, in the day I worked on the first generation lisa ( Alpha Prototype ), hell I worked on the apple-II in the 70's.

I remember when Steve Jobs pulled Guy Kawasaki out of his ass and made him the Apple evangelist.

True to fact he worked at a pawn shop hocking fake rolex's when Steve discovered him.

I'm sure on a real level, he's a nice guy, if he's your 'friend'.

He just reminds me of everything that is PHONY about California.

WRT the fact that he didn't make it big with his 'garage' deal, .e.g. he fiddled around with OPM during DOT-CON, same old sleaze.

Now he's hustling at seminars, ... My point is that he is PURE BEND, I hope all those that dump their $75 get what they're looking for.

I have nothing against 'GUY', its just that when I was perusing the EDCO website six months ago and saw that he was coming to the tower and was going to be the speaker-of-year I just laughed my ass off. How appropriate for the a major huckster of steve-jobs to come to Bend the land of wanna-be marketing evangelism.

Now if we could just find a Bend RE evangelist.

How about bend-bust, he would make a good evangelist of Bend RE.

Buffett's writing, however, is always a delight to read.

*

I agree buffett is a pleasure, but that said he still is NO different than bill gates; bill sells windows, and warren sells berkshire,

I would still rather read HL-Mencken,

Sorry I don't know him as well as you do. Just from '96 on. He seems a good guy and I agree with a lot of his thinking. Like his treatise on hiring off craigslist in his blog recently.

Amazing the historical perspective here in Bend, though. I thought I was pretty advanced for using an 840AV to edit full screen 30fps video back in '94. Working on the Apple 2 and alpha Lisa? How did you end up in Bend?

I missed the last big RE dive as I was right out of college in the mid-80's, and every time I penciled it out it cost 2-4 times as much to own as rent, which just didn't make sense to me. - bruce

*

Back in Mar or April I wrote a couple positive things on bendbubble.blogspot.com, one was "how to write lowball offers", the other was "How to become rich in Bend".

Both were sincere, I have been a negative bastard ever since.

I'm referencing the above, because there are times when you should BUY RE, perhaps in 3-5 years.

What RE does do is force you to accumulate wealth, if you read the great masters like Getty, Ford, Carnegie a consistent theme is that making money is EASY, but KEEPING it is HARD.

The article I posted called "How to be rich bend, reference books and explains exactly how its done, and why RE is important.

I wrote this to make it clear on how things really work.

Everybody in this forum is smart, brains are dime a dozen. This is why quite often you don't have to be bright to accumulate wealth.

There will be much opportunity in 3-5 years, thus I think its important to every once and awhile to step back and see the big picture.

My goal here is only to humiliate the status quo, but I do think that some younger people need to think forward about becoming the next generation of financial leaders, once ALL can be had for penny's on the dollar.

http://bendbubble.blogspot.com/2007/04/how-to-be-rich-in-bend_08.html

The "How to be rich in Bend" post is interesting, but I think it blasts 98% of the population as being lazy when the precentage is much less. When a majority of the population is working 2 or 3 jobs just to get by, just to support their kids, is that lazy?

I would postulate the lazy percentage as being nearer 20%. The other 78% is treading water as hard as they can.

When a majority of the population is working 2 or 3 jobs just to get by, just to support their kids, is that lazy?

What percentage of Bend is working 2 or 3 jobs?

I've known Guy Kawasaki for many years. Companies that he is involved with are lucky to have him spending his time on helping them find success.

http://www.guykawasaki.com/about/index.shtml

"What percentage of Bend is working 2 or 3 jobs? "

Familywise, I would guess about 80%. But I know nothing, really. Just from talking to peers.

BendBust,

Pls tell us about eating chipmunks. Can they be bred with people?

Why is dog shit sacred?

Why is there so much goose shit in Drake Park?

*

Anything is possible in Bend.

http://bendbubble.blogspot.com/2007/07/bend-oregon-is-happy-because-they-eat.html

I know Gay Kawasaki in the Biblical sense.

Companies that he is involved with are lucky to have him cum on them find success.

Success in Bend is not who know you know, but who you blow.

The "How to be rich in Bend" post is interesting, but I think it blasts 98% of the population as being lazy when the percentage is much less.

*

Its NOTHING about being fucking lazy, its about being human.

Getting rich is NOT about working hard, or even working 2-3 jobs.

Long hours and hard work will make you old.

Throughout history +98% of all people end up poor, in all races, in all time, in all places, just read fucking "Richest man in Babylon" and shut the fuck up.

The 'average' fucking Bend man bought a house @ nwxc and/or shevlin, yeh he's fucked.

Less than 2% of humans ever get ahead, always been this way. Get with the fucking program and learn, or forever be fucked your family.

Lazy has nothing to do with anything, most of the worlds greatest inventions were designed and fabricated by lazy men, the wheel, the printing press, ... the fucking telephone switching system was invented by a fucking lazy undertaker.

I give up, I only offer assistance once. Read the materials suggested and/or go through fucking life as a fucking wage slave, .e.g. modern day house nigger.

Are there pic's of people in Bend having sex with chipmunks?

What if, and this is a big 'if' What if we could get Gay Kawasaki to come and live in Bend, and become 'OUR' Real Estate Evangelist?

He knows ALL the fudge-packers in cali. This could be our only chance, forget about Duncan.

Gay Kawasaki for Mayor.

FED EXEMPTS BIG BANKS FROM FDIC RULES

WRT the Citigroup bailout by the FED, lets remember that what's happening RIGHT-NOW is a Run-On-The-Banks, e.g. everyone is cashing out of the MTG funds, and they want their money back. The FED has stepped in to prevent a 'Bank-Holiday', by keeping the cash withdrawals going a 'bank-holiday' may be prevented. Almost all these banks are already out of cash, as fundamental banking cash-on hand and FDIC are effectively NIL these days.

--TT

*****

The sheer size of the potential lending capacity at Citigroup and Bank of America - $25 billion each - is a cause for unease.

Indeed, this move to exempt Citigroup casts a whole new light on the discount window borrowing that was revealed earlier this week. At the time, the gloss put on the discount window advances was that they were orderly and almost symbolic in nature. But if that were the case, why the need to use these exemptions to rush the funds to the brokerages?

Home sales hit slowest pace in 5 years

I'll bet since new home sales blipped up just barely in July and The Bulletin quickly drew all sorts of parallels as to why the fabulous news would spread to Bend, that they'll certainly cover the fact that existing sales fell for a 5th MONTH IN A ROW.

What's more, PRICES FELL FOR A RECORD 12th MONTH IN A ROW. I'm sure they'll cover that. Right?

Go Bulletin. Call DuBois. Ask her what that means. Prices down YoY first time since the depression. Is THAT good news? Does that bode well for Bend?

>>I'll bet since new home sales blipped up just barely in July...

Maybe they did. Margin of error on the new home sales is...12%!

From MSN:

More bad news for housing

There's more bad news for the housing market, according to a report released this morning.

The number of unsold "existing" homes on the market rose 2.2% in July to 3.85 million, according to the National Association of Realtors. It was the highest inventory in 16 years.

(New-home sales are tracked separately; a Commerce Department report on Friday said that new-home sales rose 2.8% in July after falling 4% in June.)

Sales of existing homes fell 0.2% to a seasonally adjusted annual rate of 5.75 million, the NAR said this morning. The inventory of unsold existing homes represented a 9.2-month supply.

OK Bulletin: We'll wait for you to cover flood of supply, 12th consecutive month of falling prices, and 5th consecutive month of falling existing homes sales... and how it will all soon spread to Bend.

Right.

The Commerce data release said...

"This is 2.8 percent (±12.0%)* above the revised June rate of 846,000 and is 10.2 percent (±12.3%)* below the July 2006 estimate of 969,000."

That's how the Bulletin reported it, right? It's misleading to report the numbers without the margin of error, and the Bulletin is never misleading.

That's how the Bulletin reported it, right? It's misleading to report the numbers without the margin of error, and the Bulletin is never misleading.

*

YOU want the BULL to report the truth?

The people of Bend cannot handle the truth.

You cannot have anyone telling the truth in a town that is 99% marketing, hype, and bull-shit.

The truth is Bend will become a ghost town, and the BULL will not even notice.

The BULL will simply start laying off the few people they have once the advertisers pull the plug.

Anyone see that Breeze & Co have started advertising The Plaza condos on TV?

I remember just a scant few YEARS ago that Breeze stated that "MOST" of these units were already SOLD.

That building will be her undoing.

I thought the last time I went to The Plaza website, there was a page that showed which condos had already been sold. I can't find that page anymore.

I did not think that a single blog entry could blow my mind. I was wrong. It had it all. I laughed, I cried, I learned, I loved.

Anyone see that Breeze & Co have started advertising The Plaza condos on TV?

She is either a dang fool or someone at KTVZ is giving her free airtime. Or did you see it on the Portland channel (in which case it wouldn't be so dumb)? If it was KTVZ or KFXO, man, not so smart. NO MORE CONDO MONEY IN BEND, BECKY.

Anyway, two years ago Becky's approach was different:

Local real estate agent Becky Breeze and her husband are building a 42-unit condominium project in the Old Mill District. Breeze already has sold most of her units. She said buyers know what they want and they don't balk at prices.

"They want to live in a custom home," Breeze said. "And they don't want to sacrifice quality. They want to be close to walking trails and the mountains. They're really mobile and they have a lot of money," she said.

OK so the quote Paul was talking about ("sold most of her units") was October '05. Then in February '06, she had 8 of 42 "under contract" and hadn't even started marketing the rest.

Breeze and [her husband] expect the building to attract local buyers who travel frequently, or who simply don't want to maintain a large house, along with transplants from Southern California or the San Francisco Bay Area who are used to high-end condominium living and are looking for it in Central Oregon.

Eight units are currently under contract for prices in the range of $700,000 to $800,000. Breeze will begin marketing the rest after the building's framing is completed, around May.

It should be ready for occupancy by December.

Then in February 2007, Becky Breeze had "moved" 4 more units:

A few blocks away above the Old Mill’s retail district, The Plaza, a purely residential condominium project, has moved 12 of its 42 units so far, owner and Realtor Becky Breeze said, at prices ranging from around $600,000 to nearly $2 million, although the building won’t be move-in ready until June.

In May 2007, The Bulletin repoted that "So far, 14 of the building's 42 units are under contract." Under contract? We've heard that one before.

Also, note that in February 2006, the building was supposed to be "ready for occupancy" by December 2006. In February 2007, it was supposed to be done by June 2007. And back in August 2005, it was supposed to be done by fall 2006. So the "soldness" of the condos isn't the only place where the Breeze-supplied info hasn't matched up. Maybe some financing issues?

Would you buy a "luxury" condo from this woman?

I laughed, I cried, I learned, I loved.

Learned? THEN YOU'VE LEARNED NOTHING!

Dang, I never really built up the full timeline-horror of Breeze's load of crap regarding that place. Oy... what a nightmare.

And I believe that I also saw a "SOLD" page for The Plaza that has since gone missing. The plot thickens. The monthly carry on that thing has to be right at $100K/mo (I think someone confirmed this awhile back). A few months w/o any sales, and the profits will go bye-bye. A few more, and Becky's long slog through Bend's craptacular years to get to the bubble years will be wiped out.

Becky's Undoing: She wants you to lower your asking price, by God, by 10-20% after 2 days on the market. But not her own stuff: No way. She'll probably hold the line on The Plaza pricing until they sell that behemoth on the Courthouse steps.

And I think I saw that commercial on KTVZ. It was yesterday, and apparently the front facade was at least done enough that there was a shot of people entering & exiting.

Yeah. It was a real hotbed of activity, that. What was odd was the people were under 98 yrs old. Right away I was thinking "Becky don't get her target market...". Her buyers are going to be old, crotchety types that confuse The Plaza for an Old Folks Home.

Seriously... doesn't everyone sort of think of that place as an old folks home for the quasi-well off? I do. I assumed there would be no buyers under 70 yrs old.

Funny you say that. My wife met someone who was moving in there and she said they were a sweet old couple.

BEM's whole post got me thinking (rare), and I remember seeing an article about condo buyers re-negging on purchase agreements, over the smallest deviations of the property from the contract Miami, I think). Floorplans being off by just 1-2 inches, and stuff.

Kinda like this, but real niggly stuff:

Condo Buyers Take Developers

To Court Over Failed Promises

With once-hot condominium markets across the country in sharp decline and many real-estate professionals predicting a further weakening, some developers are facing more than a glut of unsold inventory. Angry condo buyers from Boca Raton, Fla., to San Diego are taking them to court, alleging everything from breach of contract to fraud.

Some of the lawsuits claim that the amenities featured in glossy marketing brochures and model apartments never made it into the final product. Others involve much-hyped projects that went bust, leaving hundreds of buyers with contracts for condos that will never materialize.

I wonder if Breeze hasn't had a whole bunch of prospective buyers blow up on her. That building is WAY past due, and it seems like almost anyone would have a pretty good case for bailing on their agreement, and probably getting ALL their deposit back.

I guarantee you, that's what I'd do. And especially once it (vacancies) gets rollin', it's a totally dominant strategy... even if you want the condo. Threaten to bail on solid legal grounds, and then when she's trying to save the deal, just point out the fact that the place is empty... but you'll take the pain if she knocks $200K right off. Then if she even looks like she'll take it in a 1,000 years, back off... and go -$300K. Repeat until she's in a fetal position gasping for air.

I'll also bet that there were some DuBois Specials in there: Friends Of Becky that were used as Filler, who were going to do a quick flip once they opened the doors, but saw the market go to hell, and told her No Dice on closing day.

We hardly go a day here without mentioning the CONDO-HO's.

At least Brooks is smart. Take land develop it, and sell it, low investment and risk, build one house as a model, and sell lots, or get buyers to order a home on contract.

Then there is OUR condo-ho condo. YOU HAVE to BUILD the whole place, before one unit is sold.

Now you have to pre-sell 25% just to get first financing. Now nobody on the face of the earth will loan you money to build condo's as the world is awash in inventory.

Given the contacts that Breeze has, and the FACT that as I have said ALL along that she will get bail-out, because she's TOO BIG, and TOO beautiful to fail.

Most likely the local TV, just has cut very sweet deal for this RE advert, and why not? What if all of the realtor's out of desperation start pitching their condo-ho condo's on TV? It can only please the media.

You would have to be on Pollyanna Realtor to believe in the CONDO-HO dream. Who believes this dream now? Where in the hell will the suckers come from? Is there really anyone out their in front of the TV calling?

People say commercial building is still moving forward. I don't understand how that can be.

Commercial is still very HOT.

This has been addressed ad-nauseum on this forum, for NO particular reason other than it being monday, post deschutes happy hour were we all fucked each other in the ass for hours, all the while wearing our Gay Kawasaki Jewelery.

Ok, it goes like this ....

1.) You build a condo, you sell zilch until its done, bad investment,

2.) Single family home are fucked, too many,...

3.) Commercial is just a fucking box, and to date there seems to be NEVER enough boxes of bars,coffee shops, ... ITS JUST A FUCKING BOX, the cheapest thing in the fucking world to build, unlike a mcMansion with granite counters, or a fucking condo.

So you build a fucking EMPTY box, and then you find some sucker to sign a five year triple net lease, ( there are tons of dreamers ), everybody in the world wants to own his very own coffee shop. So you get them to sign the lease, and its quite easy to do a postive cash flow.

It's impossible to positive cash-flow on condos or single-family, or multiple-family, but with commercial, again just an empty fucking box, they cash-flow. The bank loves a positive cash-flow, it means that the person has a remote chance of NOT defaulting.

Ok, end of story, so you have all this fucking REIT money with NO where to go except commercial.

Need I write fucking more? BENDBB stands next to me bend over with his guy-kawasaki mask on, I must go.

--TT

Fine, so people will rent out all the space downtown for their hopeless vanity businesses.

But what about all the office space that's being built? How the hell will you fill that? What about these office condos you buy instead of rent? What about the "live upstairs, work downstairs" condos for sale in NW Crossing.

Sure, it's all the builders can build now. But if they're all doing it, it seems like there's a glut tomorrow.

You build a condo, you sell zilch until its done, bad investment,

Good point. I've never bought a condo & never will (unless I turn senile & mistake it for an old folks home), but it seems you can't take title until the thing is done. And if it's a multi-story beast, like Breeze's, that bad boy has to be largely completed.

The economics of that are entirely different from a phased development. You gotta go balls out on a condo & hope like hell it all works & suckers are still on the line when construction is done. Plus, with all the lawsuits, you are sort of at the mercy of buyers all coming thru, cuz if they start tasting blood in the water, it's all over.

Lesson: Next time Becky... build faster.

What about the "live upstairs, work downstairs" condos for sale in NW Crossing.

My God, talk about your hideous financial albatross. If your little retail venture doesn't work, what do you do? Landlord, that's what. What if they fire up a lard rendering factory downstairs?

Man, with live/work units, you are just screwed if you are not the one "working" it. Bundling your "life" with your work is a HORRIBLE idea... this'll go down with tube-tops & hula-hoops.

Live work units are basically what Chinese do, while it works for them, you don't see many US folk doing that YET!

A live/work condo, is simply a condo that can't find a fucking sucker.

In the real world ground level is commercial, and above ground is residential. End of fucking story.

In a market where nothing is fucking selling, you have to pull a new notion out of your fucking ass.

The other perspective is ZONING. Often in a RES nieghborhood the city will NOT let your build COMM, but guess fucking what, if you call it 'work/live' they'll let you build a FUCKING commercial PIG in RES, my guess is this latter is really whats going on.

All this said, its ALL fucking irrelevant, because a CONDO HO FUCKING CONDO, is A FUCKING CONDO.

What kind of fucking idiot would buy a condo with fucking HOA's that Breeze or Dubois can pull out their ass as soon as they need cash-flow?

Lastly a FUCKING condo is NOT commercial. A fucking condo is a BIG fucking building that must be fully finished with tons of little boxes inside that need to be finished, a COMMERCIAL is a self contained empty box,

Good point. I've never bought a condo & never will (unless I turn senile & mistake it for an old folks home), but it seems you can't take title until the thing is done.

*

MOST folks, and by that I mean +99% have to borrow to buy a condo.

A bank isn't going to loan money on a condo that doesn't have an occupancy permit.

Getting an occupancy permit requires that everyone has signed everything off. Which means everything is done, and I mean fucking everything

As we all know in the real world, getting that last 5% done, in the real world can be 90% of the effort, from what I see of "The Plaza" is a big fucking box with windows, started in 2005, and still not 'DONE', the bank draws MUST be getting hard to finish,

Given that the $2M condo penthouses will require gold-plated counters, and toilets. I ask where in the hell is this MONEY coming from?

The TV ad's MUST be the last remnant of desperation. Note also on that subject that her website lists herself as a TV-MARKETING expert, so she could very well be using inside connections.

Note also Before HOLLERN came to bend to pull Brooks Resources out of Brooks-Shevlin in the 1960's, that Hollern worked as a TV Anchorman in Montana. What I'm saying is a lot of these BEND HUCKSTERS are all old time TV evangelists.

What about these office condos you buy instead of rent? What about the "live upstairs, work downstairs" condos for sale in NW Crossing.

--TT

*

First of all the rhetorical question was "Why is commercial is still doing well", then in response were talking about condo's. This is like changing the subject 180 deg. A condo is a fucking CONDO, its just an APT complex, that you can 'BUY' a unit. End of fucking story.

What we have in BEND, is that Breeze&ASS have over-built their fucking condo's, and they cannot sell them to anyone. Thus they keep repositioning their units to be whatever the fuck they want to call them. This week commercial is still HOT, so BREEZE&ASS call their condos "COMMERCIAL", that don't MAKE IT FUCKING SO.

I think I'll start calling my prick a cunt, will that make it so? I think I'll go downtown and whore myself, given that their are already too many male whores in Bend, I think I'll call myself a woman. I wonder if anyone will notice?

With regards to work/live I think I addressed that earlier, its a legal ZONING defn in Oregon, and NWXC is using it to make avail MORE commercial. Whether it works is another subject, given the lack of live-real-people in NWXC I think its a stupid fucking business decision.

Here's a rhetorical? Hey Duncan are you going to open a Pegagus III in NWXC? Great retail, lots of traffic, good parking, NO street events to date...

I'll say one last thing about work/live, the way sub-divisions are built in pristine Oregon, is that you call them resorts, and in the residential neighborhood the way you shoe-horn a commercial is call it work/live.

Read the below VERY carefully.

Sales Fall Again for Existing Homes

Slump May Worsen In Coming Months

By Dina ElBoghdady and Tomoeh Murakami Tse

Washington Post Staff Writers

Tuesday, August 28, 2007; Page D01

Sales of existing U.S. homes fell in July for the fifth consecutive month, prices continued to erode and the supply of single-family homes rose to a 16-year high by one key measure, according to the National Association of Realtors.

The housing figures, released yesterday, showed that sales of previously owned single-family homes, townhouses, condominiums and cooperatives were down 9 percent from a year ago. Sales fell 0.2 percent from June, to a seasonally adjusted annual rate of 5.75 million.

The sign stands outside an unsold new home in the east Denver suburb of Aurora, Colo., on Sunday, Aug. 19, 2007. The Commerce Department reported Friday that new-home sales rose 2.8 percent in July, after falling 4 percent in June. The increase in July lifted sales to a seasonally adjusted annual rate of 870,000 units. (AP Photo/David Zalubowski)

The sign stands outside an unsold new home in the east Denver suburb of Aurora, Colo., on Sunday, Aug. 19, 2007. The Commerce Department reported Friday that new-home sales rose 2.8 percent in July, after falling 4 percent in June. The increase in July lifted sales to a seasonally adjusted annual rate of 870,000 units.

Stock markets reacted mildly yesterday to the news, dipping slightly even though the home-sales report beat Wall Street expectations.

The Realtors association attributed the sales decline to mortgage disruptions that have kept some potential buyers on the sidelines and left others in the lurch as several mortgage companies shut down, yanked away the loans they approved or altered the terms of those loans.

The July figures do not reflect the deepening credit crunch that rocked global financial markets this month, making it more difficult to borrow money. Data released last week that showed a rise in sales of new homes was skewed for the same reason, said experts who track the industry.

"I don't take solace in any of the July numbers because they were put to bed before the market froze in August," said Mark Zandi, chief economist for Moody's Economy.com. "We have to wait until September or October to fully understand the scope of the fallout."

Sales of new homes, which rose 2.8 percent in July, are viewed as more timely because they reflect signed contracts, even though they are drawn from a small sample of sales and do not take contract cancellations into account.

The report on existing homes is thought to be more comprehensive because existing homes make up 85 percent of the housing market. The report is considered a lagging indicator because it captures closed transactions negotiated mostly in May and June.

"We all have to brace ourselves for tougher news ahead based on what's going on in the mortgage market," said Michael Larson, an analyst at Weiss Research.

Most alarming is the excess supply of homes on the market, Larson said. If no more single-family houses were added to the inventory, it would take 9.2 months to sell off the current stock at the current sales pace, yesterday's report said. Inventory now is at its highest level in relation to sales since 1991. Add previously owned condos, townhomes and co-ops to the mix, and the inventory rises to a 9.6-month supply. The supply of existing condos rose by 20 percent in July.

The glut of homes contributed to a 0.6 percent decline in prices. The median home price in July was $228,900, meaning half the homes sold for more and half for less. Larson expects the prices to fall even more in coming months.

From a home seller's perspective, that might mean more bad news, said Nigel Gault, an economist at the research firm Global Insight. Like many analysts, Gault anticipates more foreclosed properties coming on to the market in the months ahead.

"If you're a seller, you're going to be competing with all these extra homes already on the market and you'll be competing with banks that repossessed homes and might be willing to settle for a lower price," Gault said.

Heading into the Labor Day weekend, traders had little news to mull over except for yesterday's housing numbers, but they reacted mildly to the dip in sales.

The numbers "clearly showed that we're not even close to being out of the woods in terms of weakness in housing," said Les Satlow, portfolio manager at Cabot Money Management.

"I don't take solace in any of the July numbers because they were put to bed before the market froze in August," said Mark Zandi, chief economist for Moody's Economy.com. "We have to wait until September or October to fully understand the scope of the fallout."

*

The above should be pasted by the toilet, just wait until turkey-day, and then even the BULL will be signing a new tone.

Honestly I think the intersting numbers are going to be third quarter, because August is when MTG's were complete shutdown. Post august 2007 80% of BUYERS have been banned. Thus at the very most we'll see 20% of prior sales.

Prices?? like the great depression we're still in paralysis, just need a few years of defaults to to loosen up things.

Just go to auctions, and listen, and watch. Weekly at deschutes country courthouse. See if there are ANY buyers, and compare what is being paid to the country assessment, when they start selling for 1/2 assessment you know that the bottom is near collapse.

"RE prices cannot go any lower"

When super babe up in Redmond said that last week we all just shook our heads.

But the more I think about this statement the more I think it was a signal.

We in Central Oregon, must reach into our own pockets and purchase these inventory's its a civic duty to protect the RE industry.

The prices cannot go lower, because if they do, a lot of beautiful people are going to get fucked.

A lot of beautiful realtors told their customers that Central Oregon RE only goes up, if prices goes down that makes them look like liars or fools.

Thus prices CANNOT go lower. I hope you all understand the scope of the problem.

The supply of existing condos rose by 20 percent in July.

*

It's not a condo anymore, its a bird, its a plane. Too many fucking condos. Solution, don't call your condo a condo.

CondoTel? CondoMondo? LiveWorkyDorky? Affordable-Plantation? Senior-Center? Section-8-housing?

Ahh, ... Prisons ... the fastest growing industry in America.

If Mrs. Breeze&ASS can just turn their condo's into work-release centers, they can house inmates, and get free labor. 'House Nigger' call centers right in Bend, competing with Bangalore. iSky now has competition.

Talking about building sub-divisions in remote areas and calling them resorts. Here's a change of subject, MT Bachelor is going to borrow 3300 acres ( from teh US FOREST SERVICE, aka CITIZENRY ), and build a vast forest of high-density condos @ the mountain.

Read carefully SECRET 'master plan', SECRET 'master developer', sounds like old Kuratek of Juniper-Ridge has FOUND a NEW JOB.

This smells like Brooks, can't make money on Condos? How about getting free US federal land and selling lots to the rich? Just one more reason why Bend will become a ghost town, 3300 acres sub-division on the westside mt bachelor BUTT, why in the hell would anyone come down the hill? OH, and did I mention golf courses? The issue is SUMMER, everyone knows you cannot MAKE money in the winter.

A history in Bend, a future at Bachelor

Ski area's new president is crafting a master plan

By Jeff McDonald / The Bulletin

Published: August 28. 2007 5:00AM PST

The view from Matt Janney’s office at the base of Mt. Bachelor ski area near the expansive parking lot might be quite different in five, 10 or 15 years.

That’s because the resort’s new president and general manager — who spent the past four years as president and general manager for three Lake Tahoe-area resorts owned by Park City, Utah-based Powdr Corp., also Mt. Bachelor’s parent company — will embark soon on a long-term planning process that could change the look and future direction of the mountain.

The changes could include a new lodge to replace the 1960s-era West Village Lodge, increased focus on summer operations, new lifts and other capital improvement projects that have yet to be determined.

Janney, who took over the resort’s top job in July, could not give specifics on the resort’s new master plan, which would be a three- to 15-year vision of how the resort would be developed in the future.

“There are a number of things I’d like to do,” he said.

“But what I’d like to do and what we will be able to do are two different things.”

The master-planning process, funding for which Powdr Corp. has approved, will take about a year and involve heavy input from businesses and the community, Janney said. Ultimately, creating a new master plan for the 3,683-acre resort will require approval from the U.S. Forest Service, which owns the land, he said.

Mt. Bachelor is the most heavily visited ski resort in Oregon, drawing on average more than a half-million skiers and snowboarders per year, according to the Pacific Northwest Ski Areas Association. It’s also Central Oregon’s main winter attraction, boosting sales in the region’s $498 million-a-year tourism economy.

But other resorts, particularly in the Mount Hood area, are tightening the competition for visitors and the need for improved services, Janney said.

His wish list for an improved mountain will be dictated by a lengthy approval process and cost, he said.

Customers will notice other changes almost immediately, most notably higher prices for daily tickets and season passes, which will be announced later this week.

“We’ve got a great product and we’ll price it to what we think our product is worth,” he said. “I’m not sure how much yet, but it’s the cost of doing business.”

Janney cited rising operating expenses for things like wages, fuel and equipment for the planned price hikes.

Janney declined to elaborate on operational issues before his arrival, but he acknowledged that he’s addressing lift breakdowns, problems with lift gates, slope grooming and customer service.

“I’d like to say those problems are behind (us),” he said. “They are things we’re going to work on, but I’ve only been here two months. We’re going to focus on what’s attainable.”

Janney vowed to spend more time on the mountain interacting with staff and customers.

“How we treat our customers and their experiences on the mountain will make a huge difference as changes take place,” he said.

Destined for Bend

Janney, 52, has had a vision for the mountain from an early age.

He grew up in Portland, but he spent summers east of the Cascades collecting rocks with his parents in the Steens Mountain Wilderness area. When he graduated high school, he wanted to live in Bend, he said.

“I told my parents, as soon as I graduated high school that I was moving to Bend,” he said. “I knew that’s where I wanted to be.”

After three years as a smokejumper for the U.S. Forest Service and three years in other fire-related operations, Janney took a job as a lift operator at Mt. Bachelor in 1976.

He became lift operations supervisor the following year and spent time on the ski patrol. He worked his way up through the ranks, gaining further knowledge along the way from the likes of Bill Healy, Mt. Bachelor’s founder, and others.

He pursued life as a cowboy in the Eastern Oregon desert for two summers and took classes at Central Oregon Community College until he began working full time at Mt. Bachelor, he said.

“I never thought that I’d be in this position, but by the early 1980s I knew it was a career worth pursuing,” he said.

By 2001, Janney had become a rising star in the ski world, gaining recognition for his consistency and reliability, said Scott Kaden, president of Pacific Northwest Ski Areas Association, based in Hood River.

Janney received the association’s Tower of Excellence Award, given to a ski area manager from within the association’s five-state area, Kaden said.

By 2003, Janney had become director of operations at Mt. Bachelor.

He took over at three Lake Tahoe resorts — Alpine Meadows, Boreal Mountain Resort and Soda Springs Mountain Resort — also owned by Powdr Corp., in 2003.

During his time there, he implemented a process of measuring the resorts’ carbon footprint, or their ecological impact, he said.

Some steps taken included changing to biodiesel-driven buses and to more eco-friendly products, and dramatically expanding recycling programs, he said.

Similar steps will occur at Mt. Bachelor, Janney said.

Janney’s local ties will help, Kaden said.

“It’s an especially strategic move for (Powdr Corp.) because Matt considers Central Oregon home,” he said. “He’s had a long career there and really knows the mountain. If you pull a person in from Colorado or Utah, they don’t know the mountain. It’s a distinct advantage.”

Hearing Janney’s plans at Mt. Bachelor, Kaden said change is a necessary part of survival in the competitive ski industry.

“In general, the general manager has to keep in touch with his marketplace, stay abreast of trends, and continue to reinvent his ski area,” Kaden said. “He has to be innovative, understand what the marketplace wants and stay ahead of the competitor. Matt has a keen awareness of that. He demonstrated that at Alpine Meadows and I’m sure he’ll do the same at Mt. Bachelor.”

Bend PIGS above and beyond the FUCKING LAW. This is a good one, the COP that got caught running his scooter over 100 MPH over Santiam is a Bend cop name 'Church', and the city of Bend is going to give him a medal of honor for safe driving. A real fucking role model for law and order in Bend. The issue here is Bend cops are a fucking un-bridled force of power, and the police chief needs to be canned. The Mayor needs to quit using the cops as WHORES to sell condos, e.g. make sure no dogs are seen near the old mill. Bend is SO fucked that the cops think they can cruise 100+ MPH, and evade police a fucking FELONY, yet the fucking City of Bend is so fucking in DEBT to the cops for help sell fucking condos, they don't give a fuck about public safety.

Bend officer accused of eluding state trooper

Associated Press - August 28, 2007 12:55 AM ET

BEND, Ore. (AP) - The Oregon State Police says an off-duty Bend police officer was arrested following a high-speed chase that ended near Santiam Pass.

Police say 38-year-old Buckley Church was riding a motorcycle Friday with his 16-year-old daughter on the back.

A state trooper says he attempted to stop Church after clocking him at 81 miles per hour.

The trooper says he activated his lights and siren, but the motorcycle passed vehicles at speeds reaching 100 miles per hour before finally stopping on Highway 20.

Church was charged with felony attempt to elude a police officer, reckless driving, and recklessly endangering another person.

Bend Police Chief Andy Jordan says he has yet to decide whether Church will be placed on paid administrative leave, pending results of an investigation.

5,000 fucking acre CONDO CITY to be built between FUCKING BEND & SISTERS.

Developer wants to donate 28,000 Central Oregon acres and build

withing another 5,000

Posted by The Oregonian August 27, 2007 06:56AM

Categories: Central Oregon

The Sisters Nugget reports on a proposal by Fidelity National Financial to build a planned unity development of 5,000 of 33,000 acres, but with very very low housing density.

Skyline Forest is a massive tract of private land east of Three Creek Road between Sisters and Bend. For decades, even as it was logged for timber, local horsemen have ridden its trails, hikers have explored its woods and residents of Plainview and Bend have looked out on its green vista laid against the Three Sisters.