First, I just want to say that The Most Likely International Incident To Be Ignored As Insignificant And Boomerang On Our Corpulent AmeriKKKan Asses is this crap happening in Mumbai.

I know, we've had to endure these low-grade terrorist boom-boom's since Osama showed the World How It's Really Done.

But this one seems different. Blowing up a Train In Spain where the chards fall Mainly On The Plains is one thing. Spain is the trailer park of Europe.

India, in case you've been lost in a fog of hyper-consumerism for the past decade, is RICH. India is extremely wealthy nowadays, and there is NOTHING up-and-comers like to prove more than I Can Kick Your Poor Ass. We've been doing it for 50 years.

Just keep it in mind: That Mumbai shit could escalate to NUCLEAR in no time at all. Always stay alert on where the next downleg can come from.

Speaking of head-in-hand Pathetic, I still very occasionally head over to Bend Economy Board (via ANONYMOUS PROXY!!!!) to see if things are headed up over there. Well, except for BendBB's still kick-ass data collection, this thing has seemingly turned into a Ra-Ra board for RE. To wit:

Housing Consumer Confidence Returns!

posted by:

No better time to buy

All you have to do is read some of the comments to see few people, IF ANY, are buying this tripe. But there is the occasional Realtor plant:

I will admit, having been actively in the real estate market (looking for a good deal on a house) for some time now, there has been an unmistakable uptick in activity.

And there are the Ever-Ebullient Perma-Bulls, like Jack Elliott, for whom No Piece Of Bad News Is Truly Bad.

And I'm sure a lot of people think that I am of the "100% All About Any Piece Of Bad News Is 100% True, And Any Good News Is Bullshit" mindset. Not true.

I just feel that we are in the post-traumatic throes of a Bubble Deflation that will bring down this country to a financial level we have not experienced in 50-100 years. And there will be nowhere in the US that suffers more than Bend.

And I think what I've been saying here about the Nationwide Vicious Aftermath is pretty clear for all to see. Number 1 News Item for months now. But what about Bend?

I'll tell you right now that Bend is going to be ravaged harder than anywhere in the U.S. There's a bit of a somber mood about town, and you can finally actually speak about The Current Bad Times at a cocktail party without fear of ostracism.

But THIS is NOTHING. This is NOTHING compared to what is coming. Just take a look out the Side View Window:

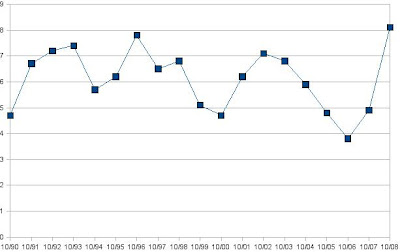

It's pretty plain to see that we spanned almost the Entire Gamut of the previous 19 years of economic activity, in one feel swoop, going from some of the lowest unemployment rates ever, to The Highest October Unemployment Rate On Record In One Year.

This AIN'T a Bump In the Road. Wait for February. We will see The Worst Unemployment Rates In Modern Bend History. There's going to be some Major Epiphanizing going on; People realizing EN MASSE that YES, Bend Is Different. IT'S WORSE THAN ANYWHERE ELSE IN THE U.S.

The Bulletin, of course, ran a piece regarding the Great Deflation Of Bend (Population), but it began with a hashing over of The Glory Hole Years.

"This Here? Why, This Is A Little Bump In The Road! Bigger & Better Than Ever In No Time, And So Forth. Yes, Yes. Outdoor Recreation, Wealthy Widows With Big Ol Double Deez, Monsters Of Cock On 96 Year Old Men! It's A Paradise!"

Yeah. Right.

OK, here's an interesting piece that should get your pot boiling, if you managed to act in a fiscally responsible manner for the past 10 years.

Why lenders might forgive your debt

There was a time when lenders didn't want to work with you if you couldn't pay. Now they want to avoid foreclosure, lawsuits or repossession almost as much as you do.

By Liz Pulliam Weston

People who overdosed on debt in recent years learned the paradox of easy credit: While lenders were willing to let you borrow copious amounts, they weren't particularly interested in helping you work out a solution if you fell behind on repayment.

Lenders often found it easier and cheaper to write off delinquent accounts as bad debt than work with you on a repayment plan. After all, they could get a tax break on the loss and then get on with the profitable business of extending credit to the next guy.

Lately, however, lender perspectives have changed. Soaring default rates, a weakening economy and the credit crunch have rewritten the rules.

* Credit card lenders charged off 5.47% of the total amounts owed on cards as bad debt in the second quarter, according to the Federal Reserve. A year ago, the charge-off rate was 3.85%.

* Consumer bankruptcy filings in October topped 100,000, a 40% increase from a year earlier and the highest level since the federal bankruptcy reform law took effect in October 2005, according to the American Bankruptcy Institute.

* More than 2.2 million homeowners are more than 60 days late on their mortgage payments, according to the Hope Now alliance of lenders and credit counselors, and one in six homeowners owes more on a home than it's worth.

* With home prices plummeting, every foreclosure now represents a loss of 44% of the original loan amount, up from 29% a year ago, according to data from LPS Applied Analytics.

That's why lenders are now looking for ways to keep people paying their bills, even if it means forgiving some of their debt. Now the paradox is that in order to qualify, you must be struggling, but not so much that a change in terms wouldn't help you.

How the new programs work

The most sweeping new program was announced Nov. 11. Freddie Mac and Fannie Mae, the government agencies that guarantee 31 million U.S. mortgages, will begin paying the mortgage service companies that maintain the loans $800 for every loan they modify. Borrowers would get help in several ways: Interest rates would be reduced so that borrowers would not pay more than 38% of their gross income on housing expenses. Another option is for loans to be extended from 30 years to 40 years, and for some of the principal amount to be deferred interest-free.

The same day, Citigroup announced it would halt foreclosures for borrowers who live in their own homes, have decent incomes and stand a good chance of making lowered mortgage payments. Ultimately, it plans to modify the repayment terms on up to $20 billion in loans.

Late last month, JPMorgan Chase expanded its mortgage modification program to an estimated $70 billion in loans, which could aid as many as 400,000 homeowners. The modifications were to include reducing amounts owed or the loans' interest rates, and replacing so-called "pay option" loans that typically resulted in mortgages growing over time.

Bank of America, meanwhile, has said that starting Dec. 1, it will modify an estimated 400,000 loans held by newly acquired Countrywide Financial as part of an $8.4 billion legal settlement reached with 11 states in early October.

Loan forgiveness is a key part of the Hope for Homeowners program. This is the foreclosure prevention program that Congress created as part of the $700 billion Economic and Housing Recovery Act of 2008. Lenders that want to participate typically must agree to reduce borrowers' principal to 90% of their homes' current value.

But wait, there's more

In late October, a coalition of lenders and consumer advocates asked banking regulators to approve a pilot program that would allow struggling borrowers to pay off, over time, less than they owe -- as much as 40% less. Under current rules, any repayment plan has to be for the full amount owed.

Though the Office of the Comptroller of the Currency rejected the first draft over how banks would book the resulting losses, backers of the plan say they're committed to finding a remedy for overtaxed borrowers that's short of bankruptcy -- which would likely mean the banks see no repayment at all.

In the first proposal, a joint project of the Financial Services Roundtable and the Consumer Federation of America, applicants would have been evaluated by certified credit counselors; those who couldn't pay off their debt under a regular debt management program would have been placed in one of four repayment plans that would reduce their principal by 10%, 20%, 30% or 40%. Only consumers closest to bankruptcy could have qualified for the biggest reduction.

Travis Plunkett of the Consumer Federation of America said his group would continue to lobby regulators "to do everything they can, within bounds of the safety and soundness of the financial system, to help consumers," but that ultimately consumer advocates may have to turn to lawmakers for help.

"It may be Congress that has to step in, and I think there's a lot of interest there" in doing so, Plunkett said. "We've got a train wreck coming."

Student loans and car debt

Meanwhile, makers of student and auto loans haven't announced any new plans for forgiveness. In recent years, in fact, both groups made escaping their debt more difficult. But:

* Certain borrowers can still get portions of their federal student loans forgiven through volunteer work, military service and teaching in low-income communities. And Congress passed a law in 2007 that wipes out federal student loan debt for people who work in certain jobs and who make 10 years of on-time payments. Plus:

* Auto lenders are stepping up their education efforts to let troubled borrowers know they have alternatives if they fall behind on their car payments. According to credit bureau Experian, more than 500,000 borrowers are 30 days or more overdue on a car loan.

Yet fewer than half of consumers in a recent poll knew that auto financing companies often worked with troubled borrowers, said Eric Hoffman, spokesman for the Aware, an education group set up by auto dealers and lenders that commissioned the survey.

Auto lenders may be able to modify a loan to stretch payments over a longer period or allow borrowers to make up missing payments, Hoffman said.

"We tell people, 'Don't ignore the situation if you're having trouble,'" Hoffman said. "Get in contact with your lender and see if there's a way to work out a different payment plan."

The same advice holds true for student loans. You may be eligible for income-sensitive or graduated repayment plans or, if you're facing economic hardship, forbearance or deferment that would allow you to skip payments for up to three years.

Here's what to do about other debt:

Credit cards. If you're already behind on your credit card payments, you shouldn't wait to see if you'll qualify for any loan forgiveness programs. Make two calls: one to a legitimate credit counselor and another to an experienced bankruptcy attorney. Between the two, you'll get the information you'll need to decide whether you should continue paying your debt or have it "forgiven" by the U.S. bankruptcy court.

Mortgages. Gather your paperwork -- your mortgage documents, last year's tax return and some recent pay stubs -- and call a HUD-approved housing counselor to evaluate your situation and your options. If you qualify for a loan modification program, the counselor can help you get through to your lender's loss mitigation department, which will evaluate your application.

A lender will want evidence that you're in trouble -- and assurances that any changes will keep the payments coming. Don't expect that it will immediately hack your loan balance to what the house is currently worth; it won't.

Your lender has only a few ways to help you: It can reduce your interest rate, defer payments, extend the length of the loan or forgive some part of your principal.

With your counselor's help, you should decide what solution you want before approaching the lender. If you have a temporary situation such as an illness that will be resolved soon, for example, ask for deferred payments. If your adjustable-rate mortgage is about to reset, use MSN Money's Mortgage Calculator to see if a reduced interest rate could keep you in your home.

You may have trouble getting your lender's attention. That's particularly true if you haven't already fallen behind on your payments, something you should try to avoid, because late payments can kill your credit scores.

In that situation, consider getting an attorney's help, said lawyer and mortgage broker Alan Jablonski, author of "Successfully Navigating the Mortgage Maze" and operator of the AJ Consumer Watch Web site.

Unlike some of those who advertise loan modification help, attorneys have a fiduciary duty to put their clients first (and clients have many remedies, including lawsuits and disciplinary complaints to the bar association, if the attorney fails to fulfill those duties).

That's a far cry from many of the fly-by-night outfits that demand big upfront fees and then fail to act, or disappear with the money.If you decide to hire an attorney, you'll have to find one on your own, Jablonski said; anyone legitimate has a full workload and isn't proactively contacting potential clients.

Your state's bar association may offer referrals. In any case, you'll need to confirm that the attorney is in good standing with the bar, and that he or she has experience with loan modification.

Published Nov. 17, 2008

Just read that over. Sounds good, right? Actually, no. Most of these "workouts" are simple extensions of the loan term, or rolling missed payments into the principal.

You've got to understand these loan workouts are a clusterfuck. They ACTUALLY REWARD PEOPLE FOR DEFAULTING. You are only eligible for The Best Workouts if You Are 3 Months Behind, or are on the verge of going bust. If you are playing by the rules, you get screwed. To wit:

Feel like a sucker? You're not alone

Bailouts are going to reckless Wall Street bankers, to homeowners over their heads and now maybe even to Americans hooked on credit cards. Where's the reward in doing the right thing?

By Liz Pulliam Weston

If you feel like you're being played, you're not alone.

The financial crisis has deepened many people's suspicions that doing the right thing hasn't paid off. Instead, they feel it's made them chumps.

You see it in the "Where's my @#$%ing bailout?" T-shirts, the despair about plummeting retirement accounts and the hostile comments that greet every news story about mortgage restructuring or credit card forgiveness.

One reader put it this way:

"Doesn't keeping your promises mean anything? Most if not all of the people who snagged these (mortgages) were well aware of the risk and the responsibility. It kills me that I'm playing by the rules and bailing out those who were greedy, stupid or both."

Even when they're not directing their anger at anyone in particular, many of my readers feel like they've been led down the garden path.

"I am 62 years old and HAD been planning to retire in 5 years," one wrote. "Although I have lived frugally my entire life and put away 15% of my income every year in a retirement account, my balanced portfolio lost 60% of its value in the last two months."

What he wanted to know: Would he be a bigger fool for pulling his money out of the market now or staying in and possibly suffering more lumps?

If you have similar questions -- if you suspect you're being a chump for making your mortgage payments, paying your credit card bills and continuing to invest in your 401(k) -- read on. You're certainly not alone as you watch others exploit loopholes, mistakes and well-intentioned remedies.

Bailed out but still ruined

The question of why some homeowners are getting bailouts has really been answered by the financial turmoil of the past few months. A huge spike in foreclosures, magnified by derivatives cooked up by Wall Street firms, nearly brought down the global economy. As it stands, we're still likely to suffer one heck of a hangover in the form of a serious recession.

The foreclosure mess is far from over. Many of the riskiest loans -- the ones where homeowners weren't even paying all the interest that was accumulating on their loans each month, let alone touching the principals -- are just now resetting.

Then there's the whole vicious-cycle effect, which I wrote about in April. As foreclosures rise, banks slash the prices of the homes they recover, putting downward pressure on everybody else's property values. With more homes "underwater," more fall into foreclosure when their owners lose a job and can't sell, or simply decide to walk away.

That's why the Powers That Be are finally getting serious about working with struggling homeowners. Given how interconnected everything is in our economy, their success in saving your neighbor from foreclosure might ultimately reduce the chances you'll lose your job.

I agree that a lot of borrowers were complete idiots for agreeing to mortgages that were eight or nine times their incomes (a mortgage that was three times your income used to be considered a stretch in the days before lenders went nuts). Smart borrowers fixed their rates for at least as long as they planned to stay in their homes; dumb ones agreed to adjustable-rate mortgages on their brokers' assurances that they'd be able to refinance before the payments reset.

But borrowers didn't get these loans in a vacuum. Mortgage brokers and loan officers downplayed the risks. So did lenders, who gave the brokers and loan officers fat incentives to push them. The Wall Street machine encouraged looser lending standards and created exotic investment products that wound up multiplying, rather than reducing, the risks. Regulators, meanwhile, stood by and basically did nothing. No one involved is covered in glory.

Neither is anyone getting an entirely free ride. Plenty of people will still lose their homes, and many who get workouts will have to live with trashed credit from the payments they missed before help arrived.

Forgiven but not forgotten

Personally, I wouldn't trade places with any of them, not even the ones who'll wind up keeping the bigger, fancier homes my husband and I decided we couldn't afford. I wouldn't want to live with the anxiety those troubled borrowers have faced ever since they got unaffordable mortgages or the uncertainty they're feeling as they wonder whether a workout will save their homes. Those folks made a hell of a gamble, and even with efforts to help on the rise, most of them are still going to lose.

Give me a home bought with a fat down payment and a 30-year fixed rate any day.

Forgiven but not forgotten

So how about the people who may be about to get big chunks of their credit card debts forgiven?

Major credit card issuers are seeking permission to knock down troubled borrowers' debts by as much as 40%. Debtors would get preferential tax treatment as well; they wouldn't owe income tax on the forgiven debt until they'd paid off the remainder of their balances.

Credit card issuers are recognizing the obvious: that their free-lending ways have come back to bite them. Delinquencies are soaring, and issuers' charge-offs -- balances written off as bad debt -- are up nearly 50% compared with last year.

The issuers figure getting something out of these debtors is better than getting nothing if they stop paying or file for bankruptcy.

The number of people admitted to the issuers' proposed pilot program would be small -- about 50,000 -- although enrollments likely would rise if the plan worked as anticipated.

You might have a beef with this particular bailout if you faced a huge pile of debt and opted to pay it off rather than have it wiped out in bankruptcy.

But once again, I'd rather be financially responsible and conservative than not. I'm not sorry that we've always limited our credit card charges to what we could pay in full every month.

Maybe we haven't bought as many toys as the folks who carried debt and are about to have some of it forgiven. But we also haven't spent a fortune in interest charges, which those people certainly have.

And I seriously doubt I'd have to pay higher interest rates or suffer in any way from this program, even if it became wildly successful. Those of us with good credit still would get the best rates, as I explained in "The real victims of deadbeats? Other deadbeats."

Investing blindly makes you a sucker

How about the last station on the have-I-been-a-sucker line: investing. Surely we were sold a bill of goods when we were told stocks are a good long-term investment. Haven't they gone essentially nowhere for a decade now?

Yes, except that those who continue to invest, in good times and in bad, inevitably come out ahead. MSN Money columnist Jim Jubak explains it best in "When to start investing? Now."

The folks who blow it are the ones who take too much risk in the good times, then panic and bail out in the bad, locking in their losses.

The reader who asked whether he should stay or go is a case in point. So close to retirement, he should have been ratcheting back on his risk. Although he thought his portfolio was balanced, it clearly wasn't -- otherwise, it wouldn't have dropped 30% during the worst of this fall's gyrations, let alone 60%.

This just encapsulates somewhat, the Heinous Agency Problems we are in the midst of creating.

We've already bailed out Huge Banks and Insurers. We are starting to bailout homeowners who have defaulted (ie; SPECULATORS). We're headed towards an Auto bailout, cuz Barack loves Unions, and the largely Muslim sections of Southern Michigan.

Everyone, it seems, is being Bailed Out. Except The Responsible. Those who lived within their means. I'll agree that Hard Times can hit those who deserve it least. But I'll also put forth that ALMOST NONE OF THOSE WHO HAVE BEEN BAILED OUT SO FAR MEET THAT DESCRIPTION.

They've said that They Will Print Money Until This Thing Is Solved.

That will, of course, solve nothing. It simply devalues the proxy by which we exchange goods & services. It also redistributes that proxy. Those of least merit are simply given wealth.

This is where we are on a slippery slope. We're a Bailout Nation 100% Addicted To Government Handouts. This should sound EXTREMELY FAMILAR to our local condition. Bend is NOTHING but a taxpayer boondoggle municipality where wealth is redistributed to those who know that local government is nothing more than a wealth redistribution mechanism. Ask Hooker Creek & Knife River: These are less profit seeking corporations, than Sucker Fish on the ailing Bend Slush Fund City Council.

We're NOT governed as much as we are pilfered of our wealth in Bend. Look no further than the last City Council election. Bought & Paid For By COBA. We deserve whatever we get.

And what we'll get is endless USELESS contracts to build infrastructure & "affordable homes".

I actually saw cripple ramps next to The New COVA building on Harriman & Irving, REMOVED and replaced with regular CURBS. Our City, in it's Infinite Wisdom, has decided to allocate resources AWAY from frivolities like Firemen & Policemen, and TOWARDS bricking up cripple ramps at warp speed. Why? Cuz a cripple ramp built TWICE, and still FAILS TO MEET GOVERNMENT REGULATIONS, is a hell of a profitable racket, and THAT IS ALL BEND IS.

That's us: Schemes & Scams that rob the citizens & reward GRIFTERS. And these poeple essentially RUN our EXECUTIVE & JUSTICE systems, as well. So what should we expect?

Well, from my own experience, I can say NEAR ENDLESS ATTEMPTS TO SHUTDOWN UNSAVORY FREE-SPEECH RE BLOGS. Yeah, it's become an onslaught. And just so you know, if this thing just DISAPPEARS one day, THAT IS THE REASON.

We can also expect cops & judges to be on the dole. This fucking place is going to be The Most Corrupt City On Earth, and we are well on our way. It's just going to be a bunch of suckerfish sucking on a corpse. Sooner or later, the money will go away, and all the Corporate Welfare Sleeze will just up & leave, and we'll be left with a hollow husk. It's already happening. They're gutting city services, while erecting ridiculous roundabout art.

Simply incredible. We're going 100% BROKE, and they're still putting art on roundabouts.

We're going BROKE, and they are WAIVING SDC charges to BUILDERS.

Have no doubt: Bend is The Most Corrupt City In The U.S.A., and we are rapidly coming to the end of our RE lotto winnings. The Good Times are LONG OVER, and you are about to witness the most incredible financial implosion of a municipality EVER.

And All There Is To Do, Is Stand Back And Witness The Horror.

Sunday, November 30, 2008

Subscribe to:

Post Comments (Atom)

598 comments:

«Oldest ‹Older 401 – 598 of 598 Newer› Newest»-

Bewert

said...

-

-

December 8, 2008 at 2:58 PM

-

Bewert

said...

-

-

December 8, 2008 at 3:22 PM

-

Bewert

said...

-

-

December 8, 2008 at 3:58 PM

-

Anonymous

said...

-

-

December 8, 2008 at 7:57 PM

-

Anonymous

said...

-

-

December 8, 2008 at 10:18 PM

-

Anonymous

said...

-

-

December 9, 2008 at 7:48 AM

-

Anonymous

said...

-

-

December 9, 2008 at 8:15 AM

-

Anonymous

said...

-

-

December 9, 2008 at 9:15 AM

-

Anonymous

said...

-

-

December 9, 2008 at 9:21 AM

-

Anonymous

said...

-

-

December 9, 2008 at 9:48 AM

-

Anonymous

said...

-

-

December 9, 2008 at 10:10 AM

-

Anonymous

said...

-

-

December 9, 2008 at 10:13 AM

-

Anonymous

said...

-

-

December 9, 2008 at 10:17 AM

-

Anonymous

said...

-

-

December 9, 2008 at 10:21 AM

-

Anonymous

said...

-

-

December 9, 2008 at 11:39 AM

-

Anonymous

said...

-

-

December 9, 2008 at 11:57 AM

-

Anonymous

said...

-

-

December 9, 2008 at 12:57 PM

-

Anonymous

said...

-

-

December 9, 2008 at 12:59 PM

-

Anonymous

said...

-

-

December 9, 2008 at 1:01 PM

-

Anonymous

said...

-

-

December 9, 2008 at 1:06 PM

-

Bewert

said...

-

-

December 9, 2008 at 1:54 PM

-

Anonymous

said...

-

-

December 9, 2008 at 4:27 PM

-

Anonymous

said...

-

-

December 9, 2008 at 7:25 PM

-

Anonymous

said...

-

-

December 9, 2008 at 7:44 PM

-

Anonymous

said...

-

-

December 9, 2008 at 7:53 PM

-

Anonymous

said...

-

-

December 9, 2008 at 7:55 PM

-

Anonymous

said...

-

-

December 10, 2008 at 7:21 AM

-

Anonymous

said...

-

-

December 10, 2008 at 8:14 AM

-

Anonymous

said...

-

-

December 10, 2008 at 8:24 AM

-

Bewert

said...

-

-

December 10, 2008 at 8:30 AM

-

Bewert

said...

-

-

December 10, 2008 at 8:33 AM

-

Bewert

said...

-

-

December 10, 2008 at 8:48 AM

-

Bewert

said...

-

-

December 10, 2008 at 8:57 AM

-

Bewert

said...

-

-

December 10, 2008 at 9:53 AM

-

Anonymous

said...

-

-

December 10, 2008 at 10:58 AM

-

Anonymous

said...

-

-

December 10, 2008 at 11:36 AM

-

Bewert

said...

-

-

December 10, 2008 at 1:09 PM

-

Anonymous

said...

-

-

December 10, 2008 at 1:35 PM

-

LavaBear

said...

-

-

December 10, 2008 at 1:45 PM

-

Anonymous

said...

-

-

December 10, 2008 at 2:18 PM

-

Bewert

said...

-

-

December 10, 2008 at 2:22 PM

-

Anonymous

said...

-

-

December 10, 2008 at 2:25 PM

-

Anonymous

said...

-

-

December 10, 2008 at 2:29 PM

-

Anonymous

said...

-

-

December 10, 2008 at 2:33 PM

-

Bewert

said...

-

-

December 10, 2008 at 2:42 PM

-

Bewert

said...

-

-

December 10, 2008 at 2:51 PM

-

tim

said...

-

-

December 10, 2008 at 3:26 PM

-

Bewert

said...

-

-

December 10, 2008 at 3:53 PM

-

Anonymous

said...

-

-

December 10, 2008 at 5:08 PM

-

IHateToBurstYourBubble

said...

-

-

December 10, 2008 at 6:38 PM

-

Anonymous

said...

-

-

December 10, 2008 at 9:55 PM

-

Quimby

said...

-

-

December 11, 2008 at 7:13 AM

-

Bewert

said...

-

-

December 11, 2008 at 7:48 AM

-

Anonymous

said...

-

-

December 11, 2008 at 8:18 AM

-

Anonymous

said...

-

-

December 11, 2008 at 8:26 AM

-

Anonymous

said...

-

-

December 11, 2008 at 8:32 AM

-

Anonymous

said...

-

-

December 11, 2008 at 9:17 AM

-

Quimby

said...

-

-

December 11, 2008 at 9:17 AM

-

Anonymous

said...

-

-

December 11, 2008 at 10:02 AM

-

Anonymous

said...

-

-

December 11, 2008 at 10:09 AM

-

Anonymous

said...

-

-

December 11, 2008 at 10:13 AM

-

Anonymous

said...

-

-

December 11, 2008 at 10:19 AM

-

Anonymous

said...

-

-

December 11, 2008 at 11:15 AM

-

Bewert

said...

-

-

December 11, 2008 at 12:37 PM

-

Bewert

said...

-

-

December 11, 2008 at 12:47 PM

-

Bewert

said...

-

-

December 11, 2008 at 1:32 PM

-

Quimby

said...

-

-

December 11, 2008 at 2:09 PM

-

Anonymous

said...

-

-

December 11, 2008 at 3:16 PM

-

Anonymous

said...

-

-

December 11, 2008 at 3:32 PM

-

Anonymous

said...

-

-

December 11, 2008 at 4:57 PM

-

Anonymous

said...

-

-

December 11, 2008 at 4:59 PM

-

Anonymous

said...

-

-

December 11, 2008 at 5:20 PM

-

Anonymous

said...

-

-

December 11, 2008 at 5:22 PM

-

Anonymous

said...

-

-

December 11, 2008 at 5:24 PM

-

Anonymous

said...

-

-

December 11, 2008 at 5:25 PM

-

Anonymous

said...

-

-

December 11, 2008 at 5:28 PM

-

Anonymous

said...

-

-

December 11, 2008 at 5:30 PM

-

Anonymous

said...

-

-

December 11, 2008 at 5:34 PM

-

tim

said...

-

-

December 11, 2008 at 5:53 PM

-

Anonymous

said...

-

-

December 11, 2008 at 6:30 PM

-

Anonymous

said...

-

-

December 11, 2008 at 6:37 PM

-

Anonymous

said...

-

-

December 11, 2008 at 8:43 PM

-

Anonymous

said...

-

-

December 11, 2008 at 8:48 PM

-

Quimby

said...

-

-

December 11, 2008 at 8:49 PM

-

Quimby

said...

-

-

December 11, 2008 at 8:52 PM

-

Quimby

said...

-

-

December 11, 2008 at 8:53 PM

-

Anonymous

said...

-

-

December 11, 2008 at 9:27 PM

-

Anonymous

said...

-

-

December 12, 2008 at 12:01 AM

-

Anonymous

said...

-

-

December 12, 2008 at 12:03 AM

-

Anonymous

said...

-

-

December 12, 2008 at 12:04 AM

-

Anonymous

said...

-

-

December 12, 2008 at 12:09 AM

-

Anonymous

said...

-

-

December 12, 2008 at 6:22 AM

-

Anonymous

said...

-

-

December 12, 2008 at 7:40 AM

-

tim

said...

-

-

December 12, 2008 at 8:13 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:28 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:30 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:33 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:34 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:38 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:43 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:45 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:46 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:48 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:51 AM

-

Anonymous

said...

-

-

December 12, 2008 at 8:59 AM

-

Anonymous

said...

-

-

December 12, 2008 at 9:01 AM

-

Anonymous

said...

-

-

December 12, 2008 at 9:11 AM

-

Anonymous

said...

-

-

December 12, 2008 at 9:20 AM

-

Anonymous

said...

-

-

December 12, 2008 at 11:37 AM

-

Anonymous

said...

-

-

December 12, 2008 at 12:22 PM

-

Anonymous

said...

-

-

December 12, 2008 at 1:28 PM

-

Bewert

said...

-

-

December 12, 2008 at 2:36 PM

-

tim

said...

-

-

December 12, 2008 at 2:40 PM

-

LavaBear

said...

-

-

December 12, 2008 at 2:59 PM

-

Anonymous

said...

-

-

December 12, 2008 at 3:05 PM

-

Anonymous

said...

-

-

December 12, 2008 at 3:09 PM

-

Anonymous

said...

-

-

December 12, 2008 at 8:57 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:09 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:13 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:14 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:17 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:21 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:24 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:29 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:31 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:36 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:44 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:46 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:49 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:51 PM

-

Bewert

said...

-

-

December 12, 2008 at 9:53 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:56 PM

-

Anonymous

said...

-

-

December 12, 2008 at 9:59 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:06 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:12 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:15 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:17 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:20 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:22 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:23 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:26 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:32 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:36 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:38 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:39 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:40 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:41 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:43 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:45 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:46 PM

-

Anonymous

said...

-

-

December 12, 2008 at 10:48 PM

-

Anonymous

said...

-

-

December 12, 2008 at 11:09 PM

-

Anonymous

said...

-

-

December 12, 2008 at 11:15 PM

-

Anonymous

said...

-

-

December 12, 2008 at 11:33 PM

-

Anonymous

said...

-

-

December 13, 2008 at 6:33 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:29 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:30 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:36 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:37 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:40 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:49 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:51 AM

-

Anonymous

said...

-

-

December 13, 2008 at 7:54 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:00 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:01 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:05 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:14 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:16 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:22 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:25 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:33 AM

-

Anonymous

said...

-

-

December 13, 2008 at 8:37 AM

-

tim

said...

-

-

December 13, 2008 at 8:59 AM

-

Bewert

said...

-

-

December 13, 2008 at 10:14 AM

-

Bewert

said...

-

-

December 13, 2008 at 10:20 AM

-

Bewert

said...

-

-

December 13, 2008 at 10:24 AM

-

Anonymous

said...

-

-

December 13, 2008 at 10:52 AM

-

tim

said...

-

-

December 13, 2008 at 11:20 AM

-

Anonymous

said...

-

-

December 13, 2008 at 11:36 AM

-

Anonymous

said...

-

-

December 13, 2008 at 11:50 AM

-

Anonymous

said...

-

-

December 13, 2008 at 2:25 PM

-

Anonymous

said...

-

-

December 13, 2008 at 2:30 PM

-

Anonymous

said...

-

-

December 13, 2008 at 2:36 PM

-

Anonymous

said...

-

-

December 13, 2008 at 3:15 PM

-

Bewert

said...

-

-

December 13, 2008 at 3:22 PM

-

LavaBear

said...

-

-

December 13, 2008 at 5:31 PM

-

Anonymous

said...

-

-

December 13, 2008 at 10:58 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:11 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:17 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:21 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:23 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:25 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:29 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:35 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:47 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:52 PM

-

Anonymous

said...

-

-

December 13, 2008 at 11:57 PM

-

Bewert

said...

-

-

December 14, 2008 at 8:36 AM

«Oldest ‹Older 401 – 598 of 598 Newer› Newest»BTW, the comments in Barney's article are savage. The bottom may be within sight--12-18 months.

Or not.

I'll want in at $80 a foot.

GREED II:

Merrill Lynch & Co. chief John Thain has suggested to directors that he get a 2008 bonus of as much as $10 million, but the battered securities firm's compensation committee is resisting his request, according to people familiar with the situation.

...

Thain has said he deserves a bonus because he helped avert what could have been a much larger crisis at the firm, people familiar with his thinking told the WSJ.

...

Thain will stay with the company following the merger, Bank of America has said. Thain, for his part, has predicted that "thousands" of other Merrill jobs will be lost in the wake of the merger.

'Nuff said.

A political/legal report, on the Blackwater guys who shot up a heavily trafficed square in Iraq last year. They surrendered in Utah, and are represented by the son of Utah Senator Orrin Hatch. Orrin is one of the main reasons I hate some things about Utah:

The prosecution of five Blackwater Worldwide security guards accused in the 2007 shooting of Iraqi civilians will take place in Washington, D.C., a federal magistrate decided today.

A pretrial hearing will take place in Washington at 2 p.m. on Jan. 6.

Magistrate Paul Warner rejected a request to keep proceedings in Salt Lake City, although defense attorneys will continue to argue the case should return to Utah. One of the five men is Donald Ball, 26, of West Valley City.

Warner also denied a defense request for a probable cause hearing, which would have given the men a chance to argue that the case should be dismissed for a lack of evidence.

The five have been indicted on 35 counts of voluntary manslaughter, attempted manslaughter and weapons violations. The charges accuse them of firing on unarmed Iraqi civilians with machine guns and grenades, killing 14 and wounding 20 others in Nisour Square in Baghdad.

A sixth man, Jeremy P. Ridgeway, of California, pleaded guilty Friday to charges of voluntary manslaughter and attempted manslaughter for his role in the shooting. That plea and the indictments, returned Dec. 4, were unsealed today.

Indicted, along with Ball, were: Dustin Heard, 27, a former Marine from Knoxville, Tenn.; Evan Liberty, 26, a former Marine from Rochester, N.H.; Nick Slatten, 25, a former Army sergeant from Sparta, Tenn.; and Paul Slough, 29, an Army veteran from Keller, Texas.

All five men surrendered to federal authorities in Salt Lake City this morning and attended the 1:30 p.m. hearing. Magistrate Warner said the men will not be detained, but ordered them to surrender their passports, stay in their home states except for court proceedings, keep their jobs, and give up their handguns.

Ball, however, was allowed to carry a handgun in his job as a bailiff at the Salt Lake City Justice Court.

He also will be allowed to continued at the Salt Lake Community College police academy, where he is slated to graduate Dec. 18, said David Attridge, supervisor for Peace Officers Standards and Training academy at the college's Miller campus....

More at the local SL Trib article. This is one of the truly flagrant killing incidents in Iraq. Making friends and influencing people, all that.

It reminds me of a conversation I had with a neighbor shortly before I left. He thought that killing everybody in a car approaching a checkpoint was justified, even if there was no observable threat.

The mere possibility of good American/Mormon boys being shot at absolved all.

The mere possibility of a good hard Mormon boy shoot his wad at all, in any direction. Praise be the lord, for it is an act of God himself.

The Lord works in strange ways.

Word at Deschutes tonight is that Volo is done.

RIP. Or don't. No skin off my back.

"I guess I have a little problem with this whole overvalued interpretation," said Cal Gabert, residential manager for Bratton Appraisal Services in Bend. "I've heard we're overvalued before, but we're still somewhat of a resort community. We have a lot to offer that isn't available in other places."

The Bullshittin today has a similar comment from Wendy Adkisson of Gardner: "We have a quality of life that probably other areas of the country don't have and people are willing to pay for that."

Hey Wendy, if that's true, how come nothing is SELLING in the Bend RE market???

This "quality of life" spiel is BULLSHIT and always has been. Bend is NOT unique in its "quality of life." It is NOT the only place in the world where the sun shines. It is NOT the only place in the world that has mountains, rivers, mountain bike trails and golf courses. And what used to be one of the best things about its "quality of life" -- the small-town ambiance and lack of congestion and urban hassle -- has been TRASHED thanks to people like Cal and Wendy and the rest of the realtor/builder/developer axis.

Still, Gabert said, "If you move to Bend, you'd better have employment figured out. A lot of retired people move here,"

And then there are the people who move here and become involuntarily retired.

Wendy Adkisson was quoted last spring that 8 months of inventory was a healthy market. She's a moron.

She bought multiple houses during the bubble with major financing in STDs, up until October 2007 - well after anyone should have known better.

She paid $352k for a 1496 sq foot house in Canal Crossing. The same Canal Crossing where there are 2000 sq foot houses now listed for $179k. Her shit hole is mortgaged for $281k and is probably worth about $150k now, and much much less later.

She is so underwater on her 3 properties that they can't end any other way than foreclosure.

"Local broker expects the Bend market to rebound in 12 months

By Andrew Moore / The Bulletin

March 28, 2008

Wendy Adkisson, principal broker with The Garner Group in Bend, believes home prices in Bend will pick up in the next 12 months, rather than 2010, as Frank Nothaft predicted Thursday in remarks to the National Economists Club.

Adkisson thinks Central Oregon’s recovery will come...."

She is a moron.

According to the report, the median house price for Deschutes County in the third quarter was $277,000. If house prices were 43 percent overvalued, the median price should be roughly $156,000, and that doesn’t make sense, said Adkisson. Citing local data from the Multiple Listing Service, she said the last time prices were at that level was the fourth quarter of 1999.

“I don’t understand where they come up with the number,” said Adkisson. “As long as I remember, they’ve always said we’re overvalued.”

No shit she doesn't understand. 43% overvalued means they think medians should be $194k. If she can't do that SIMPLE math how can she be expected to understand economic principles?

She is moron.

Les Schwab rises from dead and walks at Juniper Ridge.

****

Les Schwab Tire Centers Moves to New Headquarters and Announces Additions to Its Senior Management Team

Last update: 5:53 p.m. EST Dec. 8, 2008

PRINEVILLE, Ore., Dec 08, 2008 (BUSINESS WIRE) -- Les Schwab Tire Centers announced today its new company headquarters office located in Bend, Oregon, opened for business on Monday, November 17,( )2008. Over 100 employees relocated to a 123,000-square-foot office building in the north end of Bend. The remaining 220 corporate employees will move to the building on December 15, 2008.

"The new headquarters office is part of a transition beginning in 2007 to ensure the people, facilities and programs are in place to support our tire centers and their ability to continue providing world-class customer service," said Dick Borgman, CEO of Les Schwab Tire Centers. "With our new headquarters we will continue to attract and retain the talented employees needed to support our retail network of 420 stores and to accommodate future growth."

The architecture and design of the new headquarters building celebrates the company's Central Oregon heritage and reflects its hardworking values. Features include solar panels, state of-the-art mechanical, heating and cooling systems along with water and energy conservation features.

Borgman also announced the recent hiring of three senior management executives with extensive experience in the retail service industry.

John "Jack" Cuniff is the new Chief Financial Officer (CFO) for Les Schwab Tire Centers. Jack was formerly Chief Operating Officer and CFO of Adidas America.

Dale Thompson joined Les Schwab Tire Centers as Chief Marketing Officer. Dale brings more than two decades of experience in marketing and brand management for global brands, including Kellogg's, Mrs. Fields, Campbell Soup and General Mills.

Ken Edwards was hired as Les Schwab's Vice President, Supply Chain Management. Ken joined Les Schwab from Starbucks Coffee Company, where he held a similar position for the company's North American operations.

About Les Schwab Tire Centers

Les Schwab founded Les Schwab Tire Centers in Prineville, Oregon, in 1952. Today the company is one of the leading independent tire dealers in the United States, with more than 7,700 employees in 420 locations throughout Oregon, Washington, Idaho, Montana, California, Nevada, Alaska and Utah.

In 2007-2008 Les Schwab Tire Centers received two awards for its environmental and business practices. The company received an Environmental Excellence award from the Association of Washington Business and it ranked among the top 20 companies in Oregon Business magazine's "Best Places to Work" survey.

SOURCE: Les Schwab Tire Centers

Les Schwab Tire Centers

Jodie Hueske, 541-447-4136

www.Lesschwab.com

Most agree, Bend will be last place on EARTH that recovers from RE bubble.

*********

Housing Solution: Crashing Home Prices or Cheaper Mortgages?

by: SA Editor Judy Weil December 09, 2008

Most will agree that the key to ending this downturn is for the housing market to stabilize. Economists say affordability in the marketplace will bring back buyers. Home prices are down 50% and more in some U.S. markets. This is increasing affordability and bringing in buyers, as demonstrated in California's rise in home sales.

The government is doing its part by forcing lower mortgage rates. The question is whether the market should run its course and regain equilibrium naturally (and at great pain to the American citizen) or will artificially lower mortgage rates make the bottom happen and stick.

James B. Lockhart, federal regulator for Fannie Mae (FNM) and Freddie Mac (FRE) since they were taken over by the government in September, said at a housing conference Monday that

Restoring home affordability was key to a turnaround in the housing market. Despite falling home prices, there are still many potential home buyers "on the fence."

Lockhart was referring to lowering mortgage rates through Fannie and Freddie to help affordability.

Robert Toll, CEO of Toll Brothers (TOL) said affordability is the silver lining on the horizon. Even for a luxury homebuilder like Toll, affordability will bring buyers back. From Toll's FQ408 conference call:

Dan Oppenheim of Credit Suisse just published a report noting that “affordability is significantly improved and better then at any time in the past several decades. The mortgage payment on the median priced home now equates to 16.7% of median household income; an improvement of a 430 basis points since this past summer. That’s down from 25.1% when affordability was at its worst in July, 2006 and well below the long-term average of 23% from 1982 to 2007.”

First signs that foreclosures are subsiding. From MarketWatch:

"Recovery is underway. Affordable is back in the housing market," says Alexis McGee, president of ForeclosureS.com. "In 2009, housing will not only recover, but we'll see buyers leap into this market in droves, depleting our housing oversupply, and actually put higher price pressures on the market."

The latest U.S. Foreclosure Index by ForeclosureS.com shows a slight drop from 84,534 to 84,291 in the number of properties repossessed by lenders following foreclosure last month over October. These are REOs or lender-owned real estate. But that's off nearly 21% from September's 106,415 REO filings. (Year-to-date 12.6 of every 1,000 households nationwide have been lost to foreclosure.)

NAR: The latest U.S. Foreclosure Index numbers show November REO filings in California down to 15,978 in November, down 6.55% from October and off nearly 50% from September. Home prices there have come down, too, as much as 39.4% from Q307 in some areas.

Maybe with home prices where they are, the government effort to artificially reduce mortgage rates will be what pushes the market over to the positive side. Time will tell. From Reuters:

The U.S. housing market is very near a bottom for home sales and prices will hit their low in September, Moody's Economy.com economist Mark Zandi said on Monday… "Foreclosure sales, distress sales, are about 40% of the market. Of course, a bad jobs market means we'll have a couple months more of weak sales."

When prices sink, sales rise. From Newsday:

Multiple Listing Service of Long Island, NY: The median closing price fell to $376,500 for Long Island and Queens last month, down from $421,000 a year ago and $385,000 in October.

The November drop represents a 10.6% decrease from a year ago and a 2.3% decrease from October.

"The good news is things are selling but prices have dropped," said Michael Azzato, associate broker at Century 21 Family Realty in Northport.

USA Today on the Fort Worth, TX area:

The metro area is considered affordable. The median home price is now down a bit, so despite the national financial storm, home buyers are moving ahead.

When prices don't go down enough, sales stagnate. From KTVZ:

It may not seem that way to Realtors or others struggling to make a go of it in Central Oregon's decidedly cooler home-building industry, but… Global Insight, an economic and financial analysis and forecasting firm, found that… the median home price in the Bend, Oregon metro area was $276,900 in Q3. And it said that price was 43% overvalued, despite dropping from $286,300 from Q2 and $315,100 in Q307 - when the report found Bend home prices were 62.3% overvalued.

BEND is 'somewhat' 'kind-of' a 'resort', they must be talking about all our Walmarts, Kmarts, McDonalds, and Costco's.

....

Bend home prices still top U.S. 'overvalued' list

Posted:

Bend residents not looking to buy or sell - just hang onto their homes - also might not be happy to hear area is ranked No. 1 in 'overvalued' homes

Bend residents not looking to buy or sell - just hang onto their homes - also might not be happy to hear area is ranked No. 1 in 'overvalued' homes

But appraisal expert finds it hard to fathom

By Barney Lerten, KTVZ.COM

It may not seem that way to Realtors or others struggling to make a go of it in Central Oregon's decidedly cooler home-building industry, but a national study claims the Bend area still has the most "extremely overvalued" housing market in the country - 43 percent overvalued, as a matter of fact.

Last week's third-quarter report from Global Insight (www.globalinsight.com), an economic and financial analysis and forecasting firm, found that overall, U.S. house prices have fallen 6.5 percent from their 2007 peak.

The analysis found that the median home price in the Bend metro area (defined as all of Deschutes County) was $276,900 in the third quarter. And it said that price was 43 percent overvalued, despite dropping from $286,300 from the second quarter and $315,100 in the third quarter of 2007 - when the report found Bend home prices were 62.3 percent overvalued.

Bend's third-quarter peak was in 2006, when a $318,800 median for Bend home prices was deemed 65.6 percent overvalued, also topping the nation. (Comparatively, Bend's median price of $202,400 in the third quarter of 2004 was considered only 16.5 percent overvalued.)

The study is a joint effort by HIS Global Insight and National City Corp., "to determine what home prices should be, accounting for differences in population density, relative income levels, interest rates, and historically observed market premiums or discounts," a news release stated.

The rest of the top 5 on the overvalued list: Atlantic City, N.J.; St. George, Utah; Honolulu, Hawaii; and Longview, Wash. (Atlantic City and St. George are the only places that join Bend in the "extremely overvalued" category at present.)

But with Honolulu's median price at $650,800 and Longview's at $205,900, a Bend real estate expert says it's hard to see how the Global Insight report relates to what one's seeing in Bend now.

"I guess I have a little problem with this whole overvalued interpretation," said Cal Gabert, residential manager for Bratton Appraisal Services in Bend. "I've heard we're overvalued before, but we're still somewhat of a resort community. We have a lot to offer that isn't available in other places."

"Bend still is right now a good value," Gabert said Friday. "It's statistical analysis. I guess, if you're trying to get to the average of something, I'm not sure it tells you a whole lot on a national basis."

Still, Gabert said, "If you move to Bend, you'd better have employment figured out. A lot of retired people move here," and to Gabert's way of thinking, Bend homes are becoming more of a value all the time.

Gabert's way of thinking, Bend homes are becoming more of a value all the time.

*

Just keep repeating, "Bend only goes up", "Bend never goes down".

Eventually say in 2016, Gardner Group can look back and say "I told you so".

That said, the next eight years, these realtors had better be selling their pussy online in order to eat.

"A rotting corpse becomes MORE valuable"

"A dead fish, becomes MORE valuable"

TO WHOM? FOR WHAT?

If there were a 'shortage' of Bend crap-shacks, this might be true, but we have 10-30 years of inventory in the region.

The entire ploy is to keep bringing in newbies, that simply don't fucking know what the hell is going on.

Recent article was pointing out how many years of inventory Portland had for $1.5million houses, and how outrageously big that number was.

When I saw the number I thought, man, Bend would kill for that few years of inventory.

Funny thread at Bend Economy Board...

http://bendeconomy.informe.com/attention-bratton-appraisal-dt4561.html

Who would have guessed?

Home prices in Deschutes rated as ‘overvalued’

By Andrew Moore / The Bulletin

Published: December 09. 2008 4:00AM PST

Bend, specifically Deschutes County, Atlantic City, N.J., and St. George, Utah, were the three metro areas in the nation with home prices rated “extremely overvalued” in the third quarter of 2008, according to the quarterly House Prices in America report last week from IHS Global Insight and National City Corp.

The report said single-family house prices in Bend and Atlantic City were 43 percent overvalued, while house prices in St. George were 39.7 percent overvalued.

According to the report, the figure does not imply how much house prices should fall. Rather, the figure is a valuation of what house prices should be based on household income. The report recognizes the “disparate conditions that characterize different markets” and attempts to address those variations with statistical models. Extremely overvalued markets are at risk of price declines of 10 percent or more in the future, the report says.

Wendy Adkisson, principal broker for The Garner Group in Bend, disputed the report’s findings.

“We have a quality of life that probably other areas of the country don’t have and people are willing to pay for that,” said Adkisson.

According to the report, the median house price for Deschutes County in the third quarter was $277,000. If house prices were 43 percent overvalued, the median price should be roughly $156,000, and that doesn’t make sense, said Adkisson. Citing local data from the Multiple Listing Service, she said the last time prices were at that level was the fourth quarter of 1999.

“I don’t understand where they come up with the number,” said Adkisson. “As long as I remember, they’ve always said we’re overvalued.”

In the second quarter of 2008, the report said Deschutes County homes were 46.8 percent overvalued. Deschutes County has been among the top three most-overvalued markets listed in the report since the first quarter of 2007.

The most recent Bratton Report, a monthly report on Deschutes County house prices produced locally by the Bratton Appraisal Group of Bend, put the median price for a single-family home in Bend in November at $261,000.

Adkisson said prices have unquestionably dropped — more than 25 percent since September 2006, when Bratton listed Bend’s median price at $380,000 — and as a result, would-be buyers priced out of the market in the last few years are showing interest.

Median sales prices have dropped 34 percent from Bend’s peak median price in May 2007 of $396,000, according to Bratton data.

“We’re now seeing more activity because prices are where people can afford them,” Adkisson said.

Nationally, the report said that across the 330 metropolitan statistical areas in the country, home prices are 3.8 percent undervalued. The report said the Pacific Northwest remains overvalued.

The report considers valuations of 35 percent and greater as “extremely overvalued.” In the second quarter of 2008, four markets were considered “extremely overvalued” and in the third quarter of 2007, 19 markets were considered “extremely overvalued.”

Tim Duy, an adjunct assistant professor at the University of Oregon who follows Central Oregon’s economy and produces the quarterly Central Oregon Business Index, said the Pacific Northwest is the last region in the nation to feel the impact of the nation’s bursting housing bubble.

“The challenge for (Deschutes County) is not that too many houses were built but the wrong kind,” said Duy. “Too many expensive homes (were built) relative to the income profile, and those homes are the ones that are holding up median prices and they aren’t selling, and they’re not selling because they’re overpriced, and the people who purchased them are so underwater they can’t fathom selling at the prices that would clear the market.”

Duy said he believes the report is largely correct and that the proof is a high inventory of homes. According to the Bratton Report, there was a 14-month supply of homes in Bend in November. That means at the current rate of sales, it would take 14 months to sell all the homes on the market. A six-month inventory is generally considered normal.

Larry Wilson, a mortgage broker with True North Mortgage in Bend, said he doesn’t believe the IHS Global Insight report “is necessarily flawed,” but he wonders how it can measure all of the nuances of a real estate market.

“What I believe is it’s so complicated, they can’t take everything into account,” Wilson said. “I think we’ll stay on that list forever because of the amount of people moving here that are earning income from outside the area are also the people buying more expensive houses, and people buying second homes are buying more expensive homes.”

Duy said the amount of telecommuters, in a county with a population of more than 150,000, is likely small.

In addition, Duy said a common complaint he hears about reports such as these are that they don’t take into consideration other resort areas, such as Aspen and Vail in Colorado, and Lake Tahoe in California and Nevada, which are not part of a metropolitan statistical area.

But comparing Deschutes County to those locales is not applicable, Duy said.

“Those are not the right reference points for Deschutes County (because) it’s much larger,” Duy said. “Typical tiny resort communities have very real barriers to expansion that don’t exist in a county that is generally desert, and to compare Bend with some resort communities … ignores the reality of (Deschutes County) not being a traditional resort community.”

Real estate values have appreciated dramatically over the last decade. In Deschutes County, the $277,000 median house prices listed in the IHS Global Insight report is 102 percent more than the median house price of $137,000 reported in the first quarter of 2000.

The report is online at www .nationalcity.com/main/micro-site/economics/pages/commen tary-analysis.asp.

Andrew Moore can be reached at 541-617-7820 or amoore@bendbulletin.com

Deschutes Co challenge: Moving Bend's Tweakers into Broken-TOP Homes

“The challenge for (Deschutes County) is not that too many houses were built but the wrong kind,” said Duy. “Too many expensive homes (were built) relative to the income profile, and those homes are the ones that are holding up median prices and they aren’t selling, and they’re not selling because they’re overpriced, and the people who purchased them are so underwater they can’t fathom selling at the prices that would clear the market.”

SO here we are Dec 9, 2008, .. two years ago Dec 9, 2006 90% of the people even here would have denied the above assertion by Duy, now you got the State of Oregon Economic experts telling the truth, and the BULL printing it.

Strange, very strange.

“Those are not the right reference points for Deschutes County (because) it’s much larger,” Duy said. “Typical tiny resort communities have very real barriers to expansion that don’t exist in a county that is generally desert, and to compare Bend with some resort communities … ignores the reality of (Deschutes County) not being a traditional resort community.”

*

Hell yes, I'll go one step farther, Deschutes Co, isn't a 'resort', its a GARBAGE DUMP, which is why Les Schwab moved its CAMPUSSY here, and is why Suterrra makes its POISON here. This is Deschutes CO, a toxic waste dump.

Hardly a fucking resort, never fucking was a resort, except in the minds of Brooks paid HO's at the BULL 1998->2008, now that the BULL has a new Patron, aka Walmart, Bend will be positioned for what it is, a high desert labor force of tweakers, aka white-trash.

Re: ...which is why Les Schwab moved its CAMPUSSY here, and is why Suterrra makes its POISON here.

Speaking of JR, the Management Board just canceled it's meeting scheduled for tomorrow. They canceled the prior scheduled meeting as well, that for last Monday De. 10th, at the last minute. Something's up.

“The challenge for (Deschutes County) is not that too many houses were built but the wrong kind,” said Duy. “Too many expensive homes (were built) relative to the income profile, and those homes are the ones that are holding up median prices and they aren’t selling, and they’re not selling because they’re overpriced, and the people who purchased them are so underwater they can’t fathom selling at the prices that would clear the market.”

I'd agree with that. Too many 2bd/5bath 3500 square foot houses for 800k plus. Talk about fucking disfunctiontional housing.

I heard that Bill Smith spoke at a meeting this morning and he thinks this town will start to recover in 2011....not 9, not 10...2011 at the earliest.

>>I heard that Bill Smith spoke at a meeting this morning and he thinks this town will start to recover in 2011....not 9, not 10...2011 at the earliest.

That's still playing the "Bend is exceptional" game.

With the national market expected to pick up in 2012 (according to Case-Shiller futures), we should be saying Bend will pick up in 2013, since it had the peak gains in the country along with Naples Florida, and has much further to fall than most places.

Could we all gaze into bill smiths crystal ball? Events unseen or unknown could be at hand don't ya think? Could be 2020 or lets see lets all just throw out a number?How about this idea when the government injects 2 trillion into the economy and the tax payer just can't pay and we can't pay foriegn loans back? then what ? but of course while the whole country is in turmoil Bend will bounce back? This place is totally screwed unless your in health care care giving industry and at that how long will those industries lastwhen the shit totally hits the fan.Then it will be every man for himself.

http://www.cnbc.com/id/26656750/site/14081545/

GM is NOT a bank-holding-company, OMG,... just when I was going to declare Bend as a bank-holding-company.

***

GMAC Hasn’t Met Conditions to Convert to Bank Status

By David Mildenberg and Caroline Salas

Dec. 10 (Bloomberg) -- GMAC LLC, the auto and home lender seeking federal aid, hasn’t obtained enough capital to become a bank holding company and may abandon the effort, casting new doubt on the firm’s ability to survive.

A debt exchange by GMAC and its Residential Capital LLC mortgage unit designed to bolster the company’s finances didn’t attract enough participation, GMAC said today in a statement. That leaves GMAC short of the $30 billion in regulatory capital demanded by the Federal Reserve, and the regulator won’t approve the conversion unless the goal is met, the lender said.

“The challenge for (Deschutes County) is not that too many houses were built but the wrong kind,” said Duy. “Too many expensive homes (were built) relative to the income profile, and those homes are the ones that are holding up median prices and they aren’t selling, and they’re not selling because they’re overpriced, and the people who purchased them are so underwater they can’t fathom selling at the prices that would clear the market.”

Ah, a voice of sweet reason.

For the opposite of sweet reason, check out The Bullshittin's editorial this morning pissing on the latest Global Insight report. Basically their argument is: "It's only a manufactured statistical model, gosh darn it, and it doesn't tell you what homes here are REALLY worth."

They actually used the phrase "manufactured statistical model." What statistical model ISN'T "manufactured"?

Still pushing the Kool-Aid after all these years.

But at least they didn't say Bend is "paradise."

Duy is right -- Deschutes County is NOT a "resort community" and Bend is not a "resort town." Bend is an old timber town where the natural resource that was once the basis of the economy has been exhausted. It's trying to market itself as a recreation and lifestyle "paradise," but the problem is there are too many competitors in that market whose credentials are just as good or better. A population of 75,000 (much less 100,000 or 200,000 or half a million, as some people were predicting back in the good old bubble days) is not sustainable with an economy based on tourism and "lifestyle" marketing.

Re: Kool-aid

###

Being a card-carrying internet gadfly, I find that editorial astounding. Interesting times are coming when the develper-dominated takes office nextg month.

Home prices 101

We cringed when we read the latest report claiming to know what home prices in Bend “should be.”

The price of a home is what someone will pay for it.

If you’re buying a house, you might think the price should be a lot less. And if you’re selling it, maybe it should go for more.

But the price the buyer and the seller agree on is what it’s worth. Shoulda, woulda, coulda isn’t worth beans.

And yet every three months the House Prices of America report tells us all what prices in Bend “should be, statistically speaking.”

The latest report for the third quarter of 2008 says single-family home prices in Bend were 43 percent overvalued.

What is that supposed to mean?

It means that according to a manufactured statistical model, 43 is the percentage that popped out for Bend.

“On the whole,” they explain, “this statistical model works well. It explains 76 percent of the variation in home price-to-income ratios across places and over time.”

Of course, that means that it fails to explain 24 percent of the variation.

The variables used to create the model seem reasonable. They use household population density as a proxy for scarcity of land, the conventional mortgage rate and relative income level. They also throw in a fourth number to account for less measurable influences like pollution, climate, cultural amenities, school systems and whatever else.

Bend’s number for that “whatever else” is 1.86.

That number isn’t assigned. It’s an abstraction spit out by the model that helps explain the difference between housing prices in an area and income levels. It means in Bend, with its positive number of 1.86, those other influences are much more positive than they are for Detroit, with its -2.38.

OK, assuming you’re still with us, let’s assume that this statistical model has been put together with great wisdom and care. Does it mean then that single-family homes in Bend are overvalued by 43 percent?

Nope.

Statistical models and their results, no matter how gosh-darn accurate they are, are merely measures of probability. For this model to be 100 percent certain, homes in Bend would have to be actually overvalued by 43 percent. And the only way to determine the price of homes is to actually sell them.

IHS Global Insight and National City Corp. put out the House Prices of America report for free. So you could snidely argue that’s what it’s worth, nothing.

Presumably, the report is useful to them to get the word out about their forecasting services. And it’s likely useful to a lot of other people as well as a way of assessing the strength of the overall housing market and the relative strength in different regions.

But it doesn’t tell us that home prices in Bend are 43 percent overvalued.

John, perhaps the ratio of sales versus Notices of Default, or the traditional median income vs. median home price ration would tell you something about home prices being overvalued in Bend?

Yes, John, actually selling enough homes might enable us to set a realistic median price.

Unfortunately, that hasn't happened this year, because very few are buying. And many who bought in the last 24 months are finding themselves heading towards a financial abyss, with a mortgage far larger than their home is worth.

But, hey, at least you got the comments to your articles working again.

BTW, http://bendbulletin.com/apps/pbcs.dll/article?AID=/20081210/OPIN01/812100322/1050/OPIN&nav_category=

The comments are working...

File under predicting the bottom:

Foreclosure Expert Sees “Roaring Comeback” in 2009

The nation’s foreclosure hemorrhage has finally slowed — slightly, mind you — from 84,534 REO properties in October to 84,291 in November, according to the 2009 outlook from ForeclosureS.com, released Tuesday. While the decline is largely likely an artifact of a growing push to halt pending foreclosures while lenders and government officials search for solutions to the nation’s housing crisis, Alexis McGee, president at the online foreclosure investing resource says that she sees a significant decline in foreclosures as buyers return in 2009, pushing home prices up and fueling a real estate recovery.

“Recovery is underway. Affordable is back in the housing market,” says McGee. “In 2009, housing will not only recover, but we’ll see buyers leap into this market in droves, depleting our housing oversupply, and actually put higher price pressures on the market.”

That’s a pretty optimistic take, and one that stands in stark contrast to most assessments, given that well-known and respected economists including Mark Zandi at Moody’s Economy.com have suggested that the nation’s housing markets won’t be likely to see a bottom until late next year.