First, I just want to say that The Most Likely International Incident To Be Ignored As Insignificant And Boomerang On Our Corpulent AmeriKKKan Asses is this crap happening in Mumbai.

I know, we've had to endure these low-grade terrorist boom-boom's since Osama showed the World How It's Really Done.

But this one seems different. Blowing up a Train In Spain where the chards fall Mainly On The Plains is one thing. Spain is the trailer park of Europe.

India, in case you've been lost in a fog of hyper-consumerism for the past decade, is RICH. India is extremely wealthy nowadays, and there is NOTHING up-and-comers like to prove more than I Can Kick Your Poor Ass. We've been doing it for 50 years.

Just keep it in mind: That Mumbai shit could escalate to NUCLEAR in no time at all. Always stay alert on where the next downleg can come from.

Speaking of head-in-hand Pathetic, I still very occasionally head over to Bend Economy Board (via ANONYMOUS PROXY!!!!) to see if things are headed up over there. Well, except for BendBB's still kick-ass data collection, this thing has seemingly turned into a Ra-Ra board for RE. To wit:

Housing Consumer Confidence Returns!

posted by:

No better time to buy

All you have to do is read some of the comments to see few people, IF ANY, are buying this tripe. But there is the occasional Realtor plant:

I will admit, having been actively in the real estate market (looking for a good deal on a house) for some time now, there has been an unmistakable uptick in activity.

And there are the Ever-Ebullient Perma-Bulls, like Jack Elliott, for whom No Piece Of Bad News Is Truly Bad.

And I'm sure a lot of people think that I am of the "100% All About Any Piece Of Bad News Is 100% True, And Any Good News Is Bullshit" mindset. Not true.

I just feel that we are in the post-traumatic throes of a Bubble Deflation that will bring down this country to a financial level we have not experienced in 50-100 years. And there will be nowhere in the US that suffers more than Bend.

And I think what I've been saying here about the Nationwide Vicious Aftermath is pretty clear for all to see. Number 1 News Item for months now. But what about Bend?

I'll tell you right now that Bend is going to be ravaged harder than anywhere in the U.S. There's a bit of a somber mood about town, and you can finally actually speak about The Current Bad Times at a cocktail party without fear of ostracism.

But THIS is NOTHING. This is NOTHING compared to what is coming. Just take a look out the Side View Window:

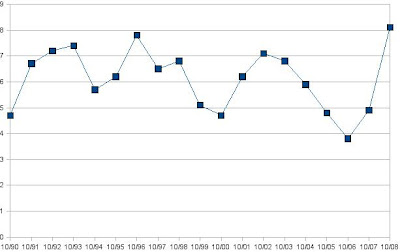

It's pretty plain to see that we spanned almost the Entire Gamut of the previous 19 years of economic activity, in one feel swoop, going from some of the lowest unemployment rates ever, to The Highest October Unemployment Rate On Record In One Year.

This AIN'T a Bump In the Road. Wait for February. We will see The Worst Unemployment Rates In Modern Bend History. There's going to be some Major Epiphanizing going on; People realizing EN MASSE that YES, Bend Is Different. IT'S WORSE THAN ANYWHERE ELSE IN THE U.S.

The Bulletin, of course, ran a piece regarding the Great Deflation Of Bend (Population), but it began with a hashing over of The Glory Hole Years.

"This Here? Why, This Is A Little Bump In The Road! Bigger & Better Than Ever In No Time, And So Forth. Yes, Yes. Outdoor Recreation, Wealthy Widows With Big Ol Double Deez, Monsters Of Cock On 96 Year Old Men! It's A Paradise!"

Yeah. Right.

OK, here's an interesting piece that should get your pot boiling, if you managed to act in a fiscally responsible manner for the past 10 years.

Why lenders might forgive your debt

There was a time when lenders didn't want to work with you if you couldn't pay. Now they want to avoid foreclosure, lawsuits or repossession almost as much as you do.

By Liz Pulliam Weston

People who overdosed on debt in recent years learned the paradox of easy credit: While lenders were willing to let you borrow copious amounts, they weren't particularly interested in helping you work out a solution if you fell behind on repayment.

Lenders often found it easier and cheaper to write off delinquent accounts as bad debt than work with you on a repayment plan. After all, they could get a tax break on the loss and then get on with the profitable business of extending credit to the next guy.

Lately, however, lender perspectives have changed. Soaring default rates, a weakening economy and the credit crunch have rewritten the rules.

* Credit card lenders charged off 5.47% of the total amounts owed on cards as bad debt in the second quarter, according to the Federal Reserve. A year ago, the charge-off rate was 3.85%.

* Consumer bankruptcy filings in October topped 100,000, a 40% increase from a year earlier and the highest level since the federal bankruptcy reform law took effect in October 2005, according to the American Bankruptcy Institute.

* More than 2.2 million homeowners are more than 60 days late on their mortgage payments, according to the Hope Now alliance of lenders and credit counselors, and one in six homeowners owes more on a home than it's worth.

* With home prices plummeting, every foreclosure now represents a loss of 44% of the original loan amount, up from 29% a year ago, according to data from LPS Applied Analytics.

That's why lenders are now looking for ways to keep people paying their bills, even if it means forgiving some of their debt. Now the paradox is that in order to qualify, you must be struggling, but not so much that a change in terms wouldn't help you.

How the new programs work

The most sweeping new program was announced Nov. 11. Freddie Mac and Fannie Mae, the government agencies that guarantee 31 million U.S. mortgages, will begin paying the mortgage service companies that maintain the loans $800 for every loan they modify. Borrowers would get help in several ways: Interest rates would be reduced so that borrowers would not pay more than 38% of their gross income on housing expenses. Another option is for loans to be extended from 30 years to 40 years, and for some of the principal amount to be deferred interest-free.

The same day, Citigroup announced it would halt foreclosures for borrowers who live in their own homes, have decent incomes and stand a good chance of making lowered mortgage payments. Ultimately, it plans to modify the repayment terms on up to $20 billion in loans.

Late last month, JPMorgan Chase expanded its mortgage modification program to an estimated $70 billion in loans, which could aid as many as 400,000 homeowners. The modifications were to include reducing amounts owed or the loans' interest rates, and replacing so-called "pay option" loans that typically resulted in mortgages growing over time.

Bank of America, meanwhile, has said that starting Dec. 1, it will modify an estimated 400,000 loans held by newly acquired Countrywide Financial as part of an $8.4 billion legal settlement reached with 11 states in early October.

Loan forgiveness is a key part of the Hope for Homeowners program. This is the foreclosure prevention program that Congress created as part of the $700 billion Economic and Housing Recovery Act of 2008. Lenders that want to participate typically must agree to reduce borrowers' principal to 90% of their homes' current value.

But wait, there's more

In late October, a coalition of lenders and consumer advocates asked banking regulators to approve a pilot program that would allow struggling borrowers to pay off, over time, less than they owe -- as much as 40% less. Under current rules, any repayment plan has to be for the full amount owed.

Though the Office of the Comptroller of the Currency rejected the first draft over how banks would book the resulting losses, backers of the plan say they're committed to finding a remedy for overtaxed borrowers that's short of bankruptcy -- which would likely mean the banks see no repayment at all.

In the first proposal, a joint project of the Financial Services Roundtable and the Consumer Federation of America, applicants would have been evaluated by certified credit counselors; those who couldn't pay off their debt under a regular debt management program would have been placed in one of four repayment plans that would reduce their principal by 10%, 20%, 30% or 40%. Only consumers closest to bankruptcy could have qualified for the biggest reduction.

Travis Plunkett of the Consumer Federation of America said his group would continue to lobby regulators "to do everything they can, within bounds of the safety and soundness of the financial system, to help consumers," but that ultimately consumer advocates may have to turn to lawmakers for help.

"It may be Congress that has to step in, and I think there's a lot of interest there" in doing so, Plunkett said. "We've got a train wreck coming."

Student loans and car debt

Meanwhile, makers of student and auto loans haven't announced any new plans for forgiveness. In recent years, in fact, both groups made escaping their debt more difficult. But:

* Certain borrowers can still get portions of their federal student loans forgiven through volunteer work, military service and teaching in low-income communities. And Congress passed a law in 2007 that wipes out federal student loan debt for people who work in certain jobs and who make 10 years of on-time payments. Plus:

* Auto lenders are stepping up their education efforts to let troubled borrowers know they have alternatives if they fall behind on their car payments. According to credit bureau Experian, more than 500,000 borrowers are 30 days or more overdue on a car loan.

Yet fewer than half of consumers in a recent poll knew that auto financing companies often worked with troubled borrowers, said Eric Hoffman, spokesman for the Aware, an education group set up by auto dealers and lenders that commissioned the survey.

Auto lenders may be able to modify a loan to stretch payments over a longer period or allow borrowers to make up missing payments, Hoffman said.

"We tell people, 'Don't ignore the situation if you're having trouble,'" Hoffman said. "Get in contact with your lender and see if there's a way to work out a different payment plan."

The same advice holds true for student loans. You may be eligible for income-sensitive or graduated repayment plans or, if you're facing economic hardship, forbearance or deferment that would allow you to skip payments for up to three years.

Here's what to do about other debt:

Credit cards. If you're already behind on your credit card payments, you shouldn't wait to see if you'll qualify for any loan forgiveness programs. Make two calls: one to a legitimate credit counselor and another to an experienced bankruptcy attorney. Between the two, you'll get the information you'll need to decide whether you should continue paying your debt or have it "forgiven" by the U.S. bankruptcy court.

Mortgages. Gather your paperwork -- your mortgage documents, last year's tax return and some recent pay stubs -- and call a HUD-approved housing counselor to evaluate your situation and your options. If you qualify for a loan modification program, the counselor can help you get through to your lender's loss mitigation department, which will evaluate your application.

A lender will want evidence that you're in trouble -- and assurances that any changes will keep the payments coming. Don't expect that it will immediately hack your loan balance to what the house is currently worth; it won't.

Your lender has only a few ways to help you: It can reduce your interest rate, defer payments, extend the length of the loan or forgive some part of your principal.

With your counselor's help, you should decide what solution you want before approaching the lender. If you have a temporary situation such as an illness that will be resolved soon, for example, ask for deferred payments. If your adjustable-rate mortgage is about to reset, use MSN Money's Mortgage Calculator to see if a reduced interest rate could keep you in your home.

You may have trouble getting your lender's attention. That's particularly true if you haven't already fallen behind on your payments, something you should try to avoid, because late payments can kill your credit scores.

In that situation, consider getting an attorney's help, said lawyer and mortgage broker Alan Jablonski, author of "Successfully Navigating the Mortgage Maze" and operator of the AJ Consumer Watch Web site.

Unlike some of those who advertise loan modification help, attorneys have a fiduciary duty to put their clients first (and clients have many remedies, including lawsuits and disciplinary complaints to the bar association, if the attorney fails to fulfill those duties).

That's a far cry from many of the fly-by-night outfits that demand big upfront fees and then fail to act, or disappear with the money.If you decide to hire an attorney, you'll have to find one on your own, Jablonski said; anyone legitimate has a full workload and isn't proactively contacting potential clients.

Your state's bar association may offer referrals. In any case, you'll need to confirm that the attorney is in good standing with the bar, and that he or she has experience with loan modification.

Published Nov. 17, 2008

Just read that over. Sounds good, right? Actually, no. Most of these "workouts" are simple extensions of the loan term, or rolling missed payments into the principal.

You've got to understand these loan workouts are a clusterfuck. They ACTUALLY REWARD PEOPLE FOR DEFAULTING. You are only eligible for The Best Workouts if You Are 3 Months Behind, or are on the verge of going bust. If you are playing by the rules, you get screwed. To wit:

Feel like a sucker? You're not alone

Bailouts are going to reckless Wall Street bankers, to homeowners over their heads and now maybe even to Americans hooked on credit cards. Where's the reward in doing the right thing?

By Liz Pulliam Weston

If you feel like you're being played, you're not alone.

The financial crisis has deepened many people's suspicions that doing the right thing hasn't paid off. Instead, they feel it's made them chumps.

You see it in the "Where's my @#$%ing bailout?" T-shirts, the despair about plummeting retirement accounts and the hostile comments that greet every news story about mortgage restructuring or credit card forgiveness.

One reader put it this way:

"Doesn't keeping your promises mean anything? Most if not all of the people who snagged these (mortgages) were well aware of the risk and the responsibility. It kills me that I'm playing by the rules and bailing out those who were greedy, stupid or both."

Even when they're not directing their anger at anyone in particular, many of my readers feel like they've been led down the garden path.

"I am 62 years old and HAD been planning to retire in 5 years," one wrote. "Although I have lived frugally my entire life and put away 15% of my income every year in a retirement account, my balanced portfolio lost 60% of its value in the last two months."

What he wanted to know: Would he be a bigger fool for pulling his money out of the market now or staying in and possibly suffering more lumps?

If you have similar questions -- if you suspect you're being a chump for making your mortgage payments, paying your credit card bills and continuing to invest in your 401(k) -- read on. You're certainly not alone as you watch others exploit loopholes, mistakes and well-intentioned remedies.

Bailed out but still ruined

The question of why some homeowners are getting bailouts has really been answered by the financial turmoil of the past few months. A huge spike in foreclosures, magnified by derivatives cooked up by Wall Street firms, nearly brought down the global economy. As it stands, we're still likely to suffer one heck of a hangover in the form of a serious recession.

The foreclosure mess is far from over. Many of the riskiest loans -- the ones where homeowners weren't even paying all the interest that was accumulating on their loans each month, let alone touching the principals -- are just now resetting.

Then there's the whole vicious-cycle effect, which I wrote about in April. As foreclosures rise, banks slash the prices of the homes they recover, putting downward pressure on everybody else's property values. With more homes "underwater," more fall into foreclosure when their owners lose a job and can't sell, or simply decide to walk away.

That's why the Powers That Be are finally getting serious about working with struggling homeowners. Given how interconnected everything is in our economy, their success in saving your neighbor from foreclosure might ultimately reduce the chances you'll lose your job.

I agree that a lot of borrowers were complete idiots for agreeing to mortgages that were eight or nine times their incomes (a mortgage that was three times your income used to be considered a stretch in the days before lenders went nuts). Smart borrowers fixed their rates for at least as long as they planned to stay in their homes; dumb ones agreed to adjustable-rate mortgages on their brokers' assurances that they'd be able to refinance before the payments reset.

But borrowers didn't get these loans in a vacuum. Mortgage brokers and loan officers downplayed the risks. So did lenders, who gave the brokers and loan officers fat incentives to push them. The Wall Street machine encouraged looser lending standards and created exotic investment products that wound up multiplying, rather than reducing, the risks. Regulators, meanwhile, stood by and basically did nothing. No one involved is covered in glory.

Neither is anyone getting an entirely free ride. Plenty of people will still lose their homes, and many who get workouts will have to live with trashed credit from the payments they missed before help arrived.

Forgiven but not forgotten

Personally, I wouldn't trade places with any of them, not even the ones who'll wind up keeping the bigger, fancier homes my husband and I decided we couldn't afford. I wouldn't want to live with the anxiety those troubled borrowers have faced ever since they got unaffordable mortgages or the uncertainty they're feeling as they wonder whether a workout will save their homes. Those folks made a hell of a gamble, and even with efforts to help on the rise, most of them are still going to lose.

Give me a home bought with a fat down payment and a 30-year fixed rate any day.

Forgiven but not forgotten

So how about the people who may be about to get big chunks of their credit card debts forgiven?

Major credit card issuers are seeking permission to knock down troubled borrowers' debts by as much as 40%. Debtors would get preferential tax treatment as well; they wouldn't owe income tax on the forgiven debt until they'd paid off the remainder of their balances.

Credit card issuers are recognizing the obvious: that their free-lending ways have come back to bite them. Delinquencies are soaring, and issuers' charge-offs -- balances written off as bad debt -- are up nearly 50% compared with last year.

The issuers figure getting something out of these debtors is better than getting nothing if they stop paying or file for bankruptcy.

The number of people admitted to the issuers' proposed pilot program would be small -- about 50,000 -- although enrollments likely would rise if the plan worked as anticipated.

You might have a beef with this particular bailout if you faced a huge pile of debt and opted to pay it off rather than have it wiped out in bankruptcy.

But once again, I'd rather be financially responsible and conservative than not. I'm not sorry that we've always limited our credit card charges to what we could pay in full every month.

Maybe we haven't bought as many toys as the folks who carried debt and are about to have some of it forgiven. But we also haven't spent a fortune in interest charges, which those people certainly have.

And I seriously doubt I'd have to pay higher interest rates or suffer in any way from this program, even if it became wildly successful. Those of us with good credit still would get the best rates, as I explained in "The real victims of deadbeats? Other deadbeats."

Investing blindly makes you a sucker

How about the last station on the have-I-been-a-sucker line: investing. Surely we were sold a bill of goods when we were told stocks are a good long-term investment. Haven't they gone essentially nowhere for a decade now?

Yes, except that those who continue to invest, in good times and in bad, inevitably come out ahead. MSN Money columnist Jim Jubak explains it best in "When to start investing? Now."

The folks who blow it are the ones who take too much risk in the good times, then panic and bail out in the bad, locking in their losses.

The reader who asked whether he should stay or go is a case in point. So close to retirement, he should have been ratcheting back on his risk. Although he thought his portfolio was balanced, it clearly wasn't -- otherwise, it wouldn't have dropped 30% during the worst of this fall's gyrations, let alone 60%.

This just encapsulates somewhat, the Heinous Agency Problems we are in the midst of creating.

We've already bailed out Huge Banks and Insurers. We are starting to bailout homeowners who have defaulted (ie; SPECULATORS). We're headed towards an Auto bailout, cuz Barack loves Unions, and the largely Muslim sections of Southern Michigan.

Everyone, it seems, is being Bailed Out. Except The Responsible. Those who lived within their means. I'll agree that Hard Times can hit those who deserve it least. But I'll also put forth that ALMOST NONE OF THOSE WHO HAVE BEEN BAILED OUT SO FAR MEET THAT DESCRIPTION.

They've said that They Will Print Money Until This Thing Is Solved.

That will, of course, solve nothing. It simply devalues the proxy by which we exchange goods & services. It also redistributes that proxy. Those of least merit are simply given wealth.

This is where we are on a slippery slope. We're a Bailout Nation 100% Addicted To Government Handouts. This should sound EXTREMELY FAMILAR to our local condition. Bend is NOTHING but a taxpayer boondoggle municipality where wealth is redistributed to those who know that local government is nothing more than a wealth redistribution mechanism. Ask Hooker Creek & Knife River: These are less profit seeking corporations, than Sucker Fish on the ailing Bend Slush Fund City Council.

We're NOT governed as much as we are pilfered of our wealth in Bend. Look no further than the last City Council election. Bought & Paid For By COBA. We deserve whatever we get.

And what we'll get is endless USELESS contracts to build infrastructure & "affordable homes".

I actually saw cripple ramps next to The New COVA building on Harriman & Irving, REMOVED and replaced with regular CURBS. Our City, in it's Infinite Wisdom, has decided to allocate resources AWAY from frivolities like Firemen & Policemen, and TOWARDS bricking up cripple ramps at warp speed. Why? Cuz a cripple ramp built TWICE, and still FAILS TO MEET GOVERNMENT REGULATIONS, is a hell of a profitable racket, and THAT IS ALL BEND IS.

That's us: Schemes & Scams that rob the citizens & reward GRIFTERS. And these poeple essentially RUN our EXECUTIVE & JUSTICE systems, as well. So what should we expect?

Well, from my own experience, I can say NEAR ENDLESS ATTEMPTS TO SHUTDOWN UNSAVORY FREE-SPEECH RE BLOGS. Yeah, it's become an onslaught. And just so you know, if this thing just DISAPPEARS one day, THAT IS THE REASON.

We can also expect cops & judges to be on the dole. This fucking place is going to be The Most Corrupt City On Earth, and we are well on our way. It's just going to be a bunch of suckerfish sucking on a corpse. Sooner or later, the money will go away, and all the Corporate Welfare Sleeze will just up & leave, and we'll be left with a hollow husk. It's already happening. They're gutting city services, while erecting ridiculous roundabout art.

Simply incredible. We're going 100% BROKE, and they're still putting art on roundabouts.

We're going BROKE, and they are WAIVING SDC charges to BUILDERS.

Have no doubt: Bend is The Most Corrupt City In The U.S.A., and we are rapidly coming to the end of our RE lotto winnings. The Good Times are LONG OVER, and you are about to witness the most incredible financial implosion of a municipality EVER.

And All There Is To Do, Is Stand Back And Witness The Horror.

Sunday, November 30, 2008

Subscribe to:

Post Comments (Atom)

598 comments:

«Oldest ‹Older 201 – 400 of 598 Newer› Newest»-

Anonymous

said...

-

-

December 3, 2008 at 10:09 AM

-

tim

said...

-

-

December 3, 2008 at 10:38 AM

-

Anonymous

said...

-

-

December 3, 2008 at 10:41 AM

-

Anonymous

said...

-

-

December 3, 2008 at 11:18 AM

-

Anonymous

said...

-

-

December 3, 2008 at 11:22 AM

-

Anonymous

said...

-

-

December 3, 2008 at 11:24 AM

-

Anonymous

said...

-

-

December 3, 2008 at 11:27 AM

-

tim

said...

-

-

December 3, 2008 at 1:29 PM

-

Bewert

said...

-

-

December 3, 2008 at 2:46 PM

-

Bewert

said...

-

-

December 3, 2008 at 2:54 PM

-

Quimby

said...

-

-

December 3, 2008 at 3:30 PM

-

Anonymous

said...

-

-

December 3, 2008 at 3:55 PM

-

Anonymous

said...

-

-

December 3, 2008 at 4:01 PM

-

Bewert

said...

-

-

December 3, 2008 at 4:14 PM

-

Quimby

said...

-

-

December 3, 2008 at 4:20 PM

-

Quimby

said...

-

-

December 3, 2008 at 4:21 PM

-

Anonymous

said...

-

-

December 3, 2008 at 4:40 PM

-

Anonymous

said...

-

-

December 3, 2008 at 4:42 PM

-

Anonymous

said...

-

-

December 3, 2008 at 4:45 PM

-

Anonymous

said...

-

-

December 3, 2008 at 5:15 PM

-

Anonymous

said...

-

-

December 3, 2008 at 5:23 PM

-

Anonymous

said...

-

-

December 3, 2008 at 5:26 PM

-

Anonymous

said...

-

-

December 3, 2008 at 5:41 PM

-

Anonymous

said...

-

-

December 3, 2008 at 5:52 PM

-

Bewert

said...

-

-

December 3, 2008 at 6:58 PM

-

Bewert

said...

-

-

December 3, 2008 at 7:46 PM

-

Anonymous

said...

-

-

December 3, 2008 at 8:29 PM

-

Anonymous

said...

-

-

December 3, 2008 at 8:29 PM

-

Anonymous

said...

-

-

December 3, 2008 at 8:33 PM

-

Bewert

said...

-

-

December 3, 2008 at 8:36 PM

-

Anonymous

said...

-

-

December 3, 2008 at 8:40 PM

-

Anonymous

said...

-

-

December 3, 2008 at 8:41 PM

-

Quimby

said...

-

-

December 3, 2008 at 9:22 PM

-

Anonymous

said...

-

-

December 3, 2008 at 9:24 PM

-

tim

said...

-

-

December 3, 2008 at 9:55 PM

-

IHateToBurstYourBubble

said...

-

-

December 4, 2008 at 7:39 AM

-

IHateToBurstYourBubble

said...

-

-

December 4, 2008 at 7:41 AM

-

IHateToBurstYourBubble

said...

-

-

December 4, 2008 at 7:43 AM

-

IHateToBurstYourBubble

said...

-

-

December 4, 2008 at 7:54 AM

-

Anonymous

said...

-

-

December 4, 2008 at 8:03 AM

-

Anonymous

said...

-

-

December 4, 2008 at 8:05 AM

-

Anonymous

said...

-

-

December 4, 2008 at 8:07 AM

-

Anonymous

said...

-

-

December 4, 2008 at 8:09 AM

-

Anonymous

said...

-

-

December 4, 2008 at 8:16 AM

-

Anonymous

said...

-

-

December 4, 2008 at 8:22 AM

-

tim

said...

-

-

December 4, 2008 at 9:05 AM

-

LavaBear

said...

-

-

December 4, 2008 at 9:15 AM

-

Quimby

said...

-

-

December 4, 2008 at 9:16 AM

-

Quimby

said...

-

-

December 4, 2008 at 9:25 AM

-

tim

said...

-

-

December 4, 2008 at 9:29 AM

-

Anonymous

said...

-

-

December 4, 2008 at 10:28 AM

-

Anonymous

said...

-

-

December 4, 2008 at 10:32 AM

-

Anonymous

said...

-

-

December 4, 2008 at 10:34 AM

-

Anonymous

said...

-

-

December 4, 2008 at 10:38 AM

-

Anonymous

said...

-

-

December 4, 2008 at 10:39 AM

-

Anonymous

said...

-

-

December 4, 2008 at 5:44 PM

-

IHateToBurstYourBubble

said...

-

-

December 5, 2008 at 4:47 AM

-

IHateToBurstYourBubble

said...

-

-

December 5, 2008 at 7:34 AM

-

IHateToBurstYourBubble

said...

-

-

December 5, 2008 at 7:36 AM

-

IHateToBurstYourBubble

said...

-

-

December 5, 2008 at 7:40 AM

-

IHateToBurstYourBubble

said...

-

-

December 5, 2008 at 7:44 AM

-

Anonymous

said...

-

-

December 5, 2008 at 7:45 AM

-

Anonymous

said...

-

-

December 5, 2008 at 7:48 AM

-

Anonymous

said...

-

-

December 5, 2008 at 7:50 AM

-

Anonymous

said...

-

-

December 5, 2008 at 7:53 AM

-

Anonymous

said...

-

-

December 5, 2008 at 7:54 AM

-

Anonymous

said...

-

-

December 5, 2008 at 7:58 AM

-

Anonymous

said...

-

-

December 5, 2008 at 8:00 AM

-

Quimby

said...

-

-

December 5, 2008 at 8:09 AM

-

Anonymous

said...

-

-

December 5, 2008 at 8:21 AM

-

Bewert

said...

-

-

December 5, 2008 at 8:33 AM

-

Anonymous

said...

-

-

December 5, 2008 at 8:34 AM

-

Anonymous

said...

-

-

December 5, 2008 at 8:35 AM

-

Quimby

said...

-

-

December 5, 2008 at 9:17 AM

-

Anonymous

said...

-

-

December 5, 2008 at 9:49 AM

-

Anonymous

said...

-

-

December 5, 2008 at 9:58 AM

-

Anonymous

said...

-

-

December 5, 2008 at 10:05 AM

-

Quimby

said...

-

-

December 5, 2008 at 10:43 AM

-

Quimby

said...

-

-

December 5, 2008 at 11:08 AM

-

Anonymous

said...

-

-

December 5, 2008 at 11:08 AM

-

Quimby

said...

-

-

December 5, 2008 at 11:12 AM

-

Quimby

said...

-

-

December 5, 2008 at 11:32 AM

-

tim

said...

-

-

December 5, 2008 at 11:33 AM

-

Quimby

said...

-

-

December 5, 2008 at 11:41 AM

-

Quimby

said...

-

-

December 5, 2008 at 1:01 PM

-

Anonymous

said...

-

-

December 5, 2008 at 1:26 PM

-

Anonymous

said...

-

-

December 5, 2008 at 1:35 PM

-

Anonymous

said...

-

-

December 5, 2008 at 1:45 PM

-

Anonymous

said...

-

-

December 5, 2008 at 1:57 PM

-

Anonymous

said...

-

-

December 5, 2008 at 2:55 PM

-

Anonymous

said...

-

-

December 5, 2008 at 3:03 PM

-

LavaBear

said...

-

-

December 5, 2008 at 3:17 PM

-

Anonymous

said...

-

-

December 5, 2008 at 3:44 PM

-

Anonymous

said...

-

-

December 5, 2008 at 3:49 PM

-

Anonymous

said...

-

-

December 5, 2008 at 3:52 PM

-

Anonymous

said...

-

-

December 5, 2008 at 4:03 PM

-

Quimby

said...

-

-

December 5, 2008 at 4:10 PM

-

Quimby

said...

-

-

December 5, 2008 at 4:13 PM

-

Bewert

said...

-

-

December 5, 2008 at 5:19 PM

-

Anonymous

said...

-

-

December 5, 2008 at 5:34 PM

-

Anonymous

said...

-

-

December 5, 2008 at 5:36 PM

-

Anonymous

said...

-

-

December 5, 2008 at 5:36 PM

-

LavaBear

said...

-

-

December 5, 2008 at 5:44 PM

-

LavaBear

said...

-

-

December 5, 2008 at 5:52 PM

-

Anonymous

said...

-

-

December 5, 2008 at 5:52 PM

-

Anonymous

said...

-

-

December 5, 2008 at 5:57 PM

-

Anonymous

said...

-

-

December 5, 2008 at 5:59 PM

-

Anonymous

said...

-

-

December 5, 2008 at 6:05 PM

-

Anonymous

said...

-

-

December 5, 2008 at 6:07 PM

-

Anonymous

said...

-

-

December 5, 2008 at 6:11 PM

-

Anonymous

said...

-

-

December 5, 2008 at 6:17 PM

-

LavaBear

said...

-

-

December 5, 2008 at 6:20 PM

-

Anonymous

said...

-

-

December 5, 2008 at 6:29 PM

-

LavaBear

said...

-

-

December 5, 2008 at 6:36 PM

-

Anonymous

said...

-

-

December 5, 2008 at 6:38 PM

-

Anonymous

said...

-

-

December 5, 2008 at 6:46 PM

-

LavaBear

said...

-

-

December 5, 2008 at 7:36 PM

-

Anonymous

said...

-

-

December 5, 2008 at 7:59 PM

-

Anonymous

said...

-

-

December 5, 2008 at 8:02 PM

-

Anonymous

said...

-

-

December 5, 2008 at 8:07 PM

-

Anonymous

said...

-

-

December 5, 2008 at 8:11 PM

-

Anonymous

said...

-

-

December 5, 2008 at 8:15 PM

-

LavaBear

said...

-

-

December 5, 2008 at 8:22 PM

-

LavaBear

said...

-

-

December 5, 2008 at 8:25 PM

-

LavaBear

said...

-

-

December 5, 2008 at 8:28 PM

-

LavaBear

said...

-

-

December 5, 2008 at 8:29 PM

-

Quimby

said...

-

-

December 5, 2008 at 9:11 PM

-

LavaBear

said...

-

-

December 5, 2008 at 9:46 PM

-

Anonymous

said...

-

-

December 6, 2008 at 6:29 AM

-

Anonymous

said...

-

-

December 6, 2008 at 6:32 AM

-

Anonymous

said...

-

-

December 6, 2008 at 6:36 AM

-

Anonymous

said...

-

-

December 6, 2008 at 6:46 AM

-

Anonymous

said...

-

-

December 6, 2008 at 6:49 AM

-

Anonymous

said...

-

-

December 6, 2008 at 6:53 AM

-

Quimby

said...

-

-

December 6, 2008 at 7:11 AM

-

Anonymous

said...

-

-

December 6, 2008 at 7:27 AM

-

Quimby

said...

-

-

December 6, 2008 at 7:30 AM

-

Anonymous

said...

-

-

December 6, 2008 at 7:31 AM

-

Quimby

said...

-

-

December 6, 2008 at 7:39 AM

-

IHateToBurstYourBubble

said...

-

-

December 6, 2008 at 8:26 AM

-

Anonymous

said...

-

-

December 6, 2008 at 8:34 AM

-

Anonymous

said...

-

-

December 6, 2008 at 8:36 AM

-

Anonymous

said...

-

-

December 6, 2008 at 8:37 AM

-

Anonymous

said...

-

-

December 6, 2008 at 8:44 AM

-

Quimby

said...

-

-

December 6, 2008 at 8:45 AM

-

Anonymous

said...

-

-

December 6, 2008 at 8:48 AM

-

Anonymous

said...

-

-

December 6, 2008 at 8:54 AM

-

Anonymous

said...

-

-

December 6, 2008 at 8:57 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:03 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:11 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:17 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:22 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:30 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:32 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:34 AM

-

Anonymous

said...

-

-

December 6, 2008 at 9:37 AM

-

tim

said...

-

-

December 6, 2008 at 10:23 AM

-

IHateToBurstYourBubble

said...

-

-

December 6, 2008 at 10:39 AM

-

Bewert

said...

-

-

December 6, 2008 at 2:21 PM

-

tim

said...

-

-

December 6, 2008 at 5:39 PM

-

tim

said...

-

-

December 6, 2008 at 5:53 PM

-

Anonymous

said...

-

-

December 6, 2008 at 9:47 PM

-

Quimby

said...

-

-

December 6, 2008 at 9:57 PM

-

Anonymous

said...

-

-

December 7, 2008 at 3:57 AM

-

Anonymous

said...

-

-

December 7, 2008 at 4:00 AM

-

Anonymous

said...

-

-

December 7, 2008 at 4:03 AM

-

Anonymous

said...

-

-

December 7, 2008 at 4:15 AM

-

Anonymous

said...

-

-

December 7, 2008 at 4:23 AM

-

Anonymous

said...

-

-

December 7, 2008 at 4:26 AM

-

LavaBear

said...

-

-

December 7, 2008 at 7:50 AM

-

tim

said...

-

-

December 7, 2008 at 9:16 AM

-

Anonymous

said...

-

-

December 7, 2008 at 10:07 AM

-

Anonymous

said...

-

-

December 7, 2008 at 10:12 AM

-

Anonymous

said...

-

-

December 7, 2008 at 10:15 AM

-

Anonymous

said...

-

-

December 7, 2008 at 10:17 AM

-

Anonymous

said...

-

-

December 7, 2008 at 10:19 AM

-

tim

said...

-

-

December 7, 2008 at 10:29 AM

-

Bewert

said...

-

-

December 7, 2008 at 12:17 PM

-

Bewert

said...

-

-

December 7, 2008 at 12:39 PM

-

Bewert

said...

-

-

December 7, 2008 at 12:43 PM

-

Anonymous

said...

-

-

December 7, 2008 at 1:02 PM

-

Quimby

said...

-

-

December 7, 2008 at 1:18 PM

-

Bewert

said...

-

-

December 7, 2008 at 2:35 PM

-

Bewert

said...

-

-

December 7, 2008 at 3:44 PM

-

Anonymous

said...

-

-

December 7, 2008 at 3:52 PM

-

Anonymous

said...

-

-

December 7, 2008 at 3:54 PM

-

Anonymous

said...

-

-

December 7, 2008 at 3:56 PM

-

Anonymous

said...

-

-

December 7, 2008 at 3:59 PM

-

Bewert

said...

-

-

December 7, 2008 at 4:08 PM

-

Bewert

said...

-

-

December 7, 2008 at 4:17 PM

-

Bewert

said...

-

-

December 7, 2008 at 7:04 PM

-

Anonymous

said...

-

-

December 7, 2008 at 7:24 PM

-

Quimby

said...

-

-

December 8, 2008 at 9:06 AM

-

Quimby

said...

-

-

December 8, 2008 at 9:36 AM

-

Bewert

said...

-

-

December 8, 2008 at 12:51 PM

-

Anonymous

said...

-

-

December 8, 2008 at 1:15 PM

-

Bewert

said...

-

-

December 8, 2008 at 2:32 PM

-

Anonymous

said...

-

-

December 8, 2008 at 2:32 PM

-

Anonymous

said...

-

-

December 8, 2008 at 2:35 PM

-

Bewert

said...

-

-

December 8, 2008 at 2:46 PM

«Oldest ‹Older 201 – 400 of 598 Newer› Newest»I think its a good thing to have information, and thus I'm against allowing the 'nofollow' be the default.

*

That said, you all know that the BEND BULLETIN doesn't run in NO-FOLLOW mode by default, cuz that is GOOD INFO.

Bend and its sister cities (Atlantic City, NJ and St George, UT) featured in this article...

http://www.marketwatch.com/news/story/Home-prices-now-undervalued-economists/story.aspx?guid={E5CF55AB-4E86-4D86-B888-4EAFF46B4B97}

You think BEND has it tough? Here's your feeder market: http://flippersintrouble.blogspot.com/

Bend and its sister cities (Atlantic City, NJ and St George, UT) featured in this article...

*

Yep, there are two story's running all over the world right now.

1.) Bend has the best and most snow in the world, and the nicest people who will go out and play with tourists.

2.) Bend(Sisters) is now the deal of a lifetime.

Now who in the fucking earth would be issuing these press releases???

My guess is that is our old friends at Bends own COVA doing this at taxpayer expense.

The best part is they have learned, now all the press release say "anonymous" for author.

Haven't you heard? Bend is the ASPEN of the west! Real Estate is a steal in Bend! Buy, and buy now before everyone finds out!!!

This one just came out and I saw it this AM picked up by Australia, from prlog.com, all one has to do is back-track to COVA, this one came from our own NWXC, aka Brooks, aka boss-hogg-hollern.

Bend, Oregon’S Northwest Crossing Wins Buildernews’ Spirit Of The West Awards

Bend, Oregon neighborhood’s mixed-use aspects and focus on true community wins annual award

FOR IMMEDIATE RELEASE

PRLog (Press Release) – Dec 03, 2008 – Bend, OR -- NorthWest Crossing was included in BUILDERnews Magazine’s 2008 Spirit of the West awards, an annual program that celebrates innovation by builders, developers and architects. Selected companies reflect the very best in design and vision, and have emerged as leaders in their fields. Winners are featured in the December issue of the publication.

“NorthWest Crossing has always focused on building a true community, not just rows of houses,” said David Ford, general manager for the Bend, Oregon neighborhood. “Our commitment to building a mixed-use, traditional neighborhood based on the principles of new urbanism helped us to earn this recognition from one of the nation’s leading industry magazines.”

A total of six companies were recognized in this year’s program, including three architects and two individual homes. NorthWest Crossing was the only neighborhood recognized in the 2008 program.

BUILDERnews cited that one of the “winning aspects for NorthWest Crossing is the built-in aspect to promote a better community.” Things such as publically owned parks and streets, homes with inviting front porches and wide sidewalks to promote neighborly interaction were mentioned as some of the ways NorthWest Crossing has worked to achieve this goal.

More information about the Spirit of the West award winners may be viewed in the electronic version of the magazine, by visiting BNmag.com.

About NorthWest Crossing

NorthWest Crossing is a mixed-use community on Bend’s west side which has won several national awards for its green building practices, as well as receiving the PCBC’s 2008 Gold Nugget Award of Merit for Master-Planned Community of the Year, Urban Land Institute’s 2007 “Development of Excellence” award and Cottage Living magazine’s 2008 Top Cottage Neighborhoods. West Bend Property Company LLC, a partnership of Brooks Resources Corporation and Tennant Family Limited Partnership, is developing the community. Both companies, based in Bend, have solid histories of commitment to thoughtful, quality real estate developments in Central Oregon. Their goal of creating a livable and sustainable community at NorthWest Crossing is rooted in their understanding and respect for the true essence of Bend and the Central Oregon lifestyle. http://www.northwestcrossing.com

About BUILDERnews magazine

A publication of PNW Publishing Inc. in Vancouver, Wash., BUILDERnews magazine is a national building trade magazine covering both residential and Mixed-Use/Multifamily construction. Its readers are top executives at established construction, design and engineering firms, as well as suppliers who look to BN magazine for national news, facts, and business information that speaks to the core issues affecting their businesses. For more information visit BNmag.com

Contact:

David Ford

NorthWest Crossing

Bend, OR

541-312-6473

dford@northwestcrossing.com

Tim,

This ain't 'good news' for Bend, this is very bad news. Perhaps in the future when you post a link, you might mention if the link is PR crap, or a real fucking story.

... BEND IS STILL MOST OVER-VALUED IN USA ... who would have guessed??

The quarterly report from Global Insight and National City Bank compares observed home prices with fundamental values based on differences in population density, relative income levels, interest rates, and historically observed market premiums or discounts.

According to the Global Insight report, only three metro areas are extremely overvalued: Atlantic City, N.J., Bend, Ore., and St. George, Utah. In 2005, 52 metro areas were deemed to be extremely overvalued.

Home prices fell more than 10% in nine metro areas in central California during the third quarter, Global Insight said. Prices in Merced, Stockton and Modesto are down more than 50% from their peak, while 26 other cities in California, Nevada and Florida are down more than 30%, they said. End of Story

>>This ain't 'good news' for Bend, this is very bad news. Perhaps in the future when you post a link, you might mention if the link is PR crap, or a real fucking story.

And spoil the thrill of opening the story to see what wonderful prize is inside. You know I'm more subtle than that.

I have to have some fun here, or it's not worth coming. :-)

Yep, we're tied for #1 in overvaluation, at 43%. Here is the data. See page 19. Our medians should be $157,800 to be fairly valued, according to Nat City.

Re: Homer's hero

###

Note this sentence: "Frey says a more reasonable, albeit unpopular, solution would be for the government -- that is, taxpayers -- to ante up another $500 billion to buy all of the troubled loans from mortgage-backed securities pools..."

So why is the bailout costing somewhere between $3 and $8 trillion?

Because the mortgages aren't the real problem--the CDS's are.

For the last few years BushCo's regulators (as well as Geitner) have kept saying the banks are big boys and can handle the risk, so no need to regulate.

Now, after the bankers have dealt themselves billions in bonuses based on high returns from CDS's and other derivatives from securitized debt, the palace is crashing and they are being bailed out.

It's the biggest transfer of wealth in history--while the middle class gets poorer the rich bankers get bailed out.

>> "Frey says a more reasonable, albeit unpopular, solution would be for the government -- that is, taxpayers -- to ante up another $500 billion to buy all of the troubled loans from mortgage-backed securities pools..."

Yes Bruce, I do have to admit that he is off his rocker with that statement.

What I do like about his stance is:

YOU MAKE YOUR BED AND LIE IN IT!

What part of a signed contract (agreement) don't you people understand?

Yep, we're tied for #1 in overvaluation, at 43%. Here is the data. See page 19. Our medians should be $157,800 to be fairly valued, according to Nat City.

*

I agree with $160k as a low, but there will be an over-correction, it will go lower.

Lastly, this shit about Bend being most over-valued is another reason you folks that want to buy, better do so, eventually the writing will be on the wall, and nobody will loan for Bend.

WSJ just had a news-release out how fan&fred will be doing 4.5% loans, should be interesting if it happens, and if they'll loan on Bend even close to the current over-valuations.

Another 'teaser' is sent out to make folks feel good. Yes, the US Gov needs a new loan company that is not afraid to loan, but Fred & Fan should have been allowed to BK. Thus they're really NOT part of the solution, more than likely this is PR being used to justify keeping them fed.

Who wouldn't want all their outstanding loans dropped to 4.5% fixed??? Are only deadbeats going to get this deal??

***

The Wall Street Journal

The Treasury Department is considering a plan to halt the slide in home prices that would lower mortgage rates using Fannie Mae and Freddie Mac. The plan could reduce rates for newly issued loans to as low as 4.5%.

Re: YOU MAKE YOUR BED AND LIE IN IT!

What part of a signed contract (agreement) don't you people understand?

###

Quim, are you applying that to the CDS sellers and buyers, as well as the home mortgage holders?

>> Quim, are you applying that to the CDS sellers and buyers, as well as the home mortgage holders?

Man, I don't know. That CDS stuff is beyond me, don't understand it. I'm mainly railing against re-writing contracts for people who made poor house buying decisions. And no, I don't feel sorry for them.

I'm an all around no-bailout guy for anyone, rich or poor.

Everyone is playing FAST & LOOSE these days with their money and there is often a COST to taking on that risk!

A 43% overvaluation does NOT mean that prices should be $157k. You did the math as .57 x 276.9 = 157 which is "it's worth 43% less."

The math you should have done:

276.9 / 1.43 = 193.6 which is "it's priced 43% more than it's worth."

That being said, every other bubble area that started it's crash before us has gone UNDER their fair valuation, so Bend will drop below $193.6k.

Naples FL was more overvalued than us at one point, and 43% overvalued in Q3-2006. It's now 19.4% undervalued, and still going down.

For comparison, if Bend were 19.4% under valued our medians would be $156k. That's coming no problem by next year at this time.

Napa CA was 58% over in Q3-2005, and it's now -8%.

Sacramento was +55% Q3-2006 and is now -16.7%

Salinas CA was +72.4% Q2-2006 and is now -23.4%. It was still up 29.4 last year at this time.

>Lastly, this shit about Bend being most over-valued is another reason you folks that want to buy, better do so, eventually the writing will be on the wall, and nobody will loan for Bend.

Dumb advice. Fucking dumb.

Another one for the RIP board, not that anyone noticed they were gone:

http://www.oikoshomes.com/

And the house the developer lives in on Elgin just got it's NOD today.

Lastly, this shit about Bend being most over-valued is another reason you folks that want to buy, better do so, eventually the writing will be on the wall, and nobody will loan for Bend.

It's bad advice. As prices crash we will see more people underwater which will lead to more foreclosures. The banks are going to own a shitload of inventory. They don't want it. They will either loan or have to sell it goddamn cheap. If they loan it won't be for nearly as much as they currently are which means they will have to sell it to whoever they can that has a decent down payment and good credit.

If they don't loan we'll see medians below $100k. I don't see that happening. If it does that's fine. I'd rather pay cash for the house than take out a loan when it's still overvalued.

So you take Fuckhead's advice and buy now. In two years you lose your job and have to sell. Banks aren't loaning, so even though you put 30% down on the house the prices are down 70%. You hand the keys over to the bank. The next person comes in and buys your house for cash. Cash you would have had if you hadn't have bought now.

Fuckhead is wrong. Fuckhead is usually wrong.

money comes from 'investors' not banks,

if an 'origination' even say's "BEND" on it, it will be the 'kiss of death', thus no money for bend,

banks don't have a fucking thing to do with MTG's,

the way it was played the last ten years is that MTG companys sold the MTG's as an asset to investors.

anybody that uses the words 'banks' in the same sentence as 'inventory' is an idiot.

sure a few lending outfits like CACB are sitting on a ton of non-performing commercial, but those were fool plays, ...

almost all easy money since 1998 was done by the likes of county-wide, and friends, ... everybody got involved in lending for mtg's as you could slice & dice them, and resell the paper on wall st as 'AAA' cash, ... none of this had a fucking thing to do with banks,

Regarding 'math'.

I think the better math is that right now Bend is still 100% over-valued, which means a future 50% hair-cut, given were at $260K median, that means $130k.

National City just pulls #'s out of their ass like the rest of us, my gut tells me about $120k, and I think most of us old timers here have been saying this for a long time, ... Of course I see stability at $160-180K, but I see the low below $150k, stability being 4X income, and that here in town is $40k, and dropping like a rock.

Man, I don't know. That CDS stuff is beyond me, don't understand it.

- quim

*

I'll try to explain it.

The CDS is nothing more than an insurance policy. Let's say I package a dozen Bend $1M homes, that be $12M, and I want to sell insure that in order to call it a 'AAA' rated investment, then for a FEE, somebody would cover the PAPER, and say it was .25%-.5% not uncommon, so for $30k I got a policy, the person who wrote the policy is on the hook for $12M if my HOMES become worthless, the insurance simply comes out of the amount that I get for selling my paper.

WALL ST will NOT buy my $12M paper on these homes, unless its insured, that's how it MY paper gets its 'AAA' rating, which then makes the buyer comfy, and his 'investors' comfy.

Now the assumption was that NOTHING could possible ever go down, cuz as we all KNOW BEND RE only goes UP!!!

How BIG is the CDS play, well in the USA $100 TRILLION in the last ten years were written, I'll repeat one hundred trillion US DOLLARS, in the world the number is $500 TRILLION. Figure the commissions on all this insurance was 10%, so there was middle man that found a buyer for my deal and got $3k.

BERKSHIRE of Hathaway, aka BUFFET has made most of his money the last 10-20 years selling this insurance, basically pocketing CASH, BILLIONS of dollars, all on the assumption that NOTHING EVER GOES DOWN.

Well now we have the black-swan. It's estimated RIGHT NOW by the smart boyz, that 20% of the CDS's written are due for the down-side loss, that here in the USA is $20 TRILLION dollars.

Ok, to date we know uncle-sam has promised $8 TRILLION, that's still 1/3 of the amount due, the problem is if any of these policy's are NOT covered, then the WHOLE $500T world-wide implodes, that is 12X of the world GDP, and thus the end of the world,

Now NOTE that worldwide the WORLD has to come up with $100T, which is almost 2X of the world GDP.

If anyone doesn't understand the above, I'll try to simplify even more.

- fuckhead

What's even more interesting is even today city's all over the USA just like BEND are getting CASH by selling these types of policy's, mostly on interest-rate bets on the future.

It's an easy way to get $5M cash up-front, on the 'bet' that you know what the interest rates will be in 2015.

The call CDS which are a subset of 'derivatives', cuz they are derived from something else, these policy's themselves are then traded as 'AAA' paper later by other party's.

I liken this all selling PUT's on the stock market. A PUT is a bet that a stock will go down, most people WHO BUY PUT's lose their money, as short-sellers are statistically wrong. Thus if you SELL a PUT, you generally get to keep the money, statistically. Smart people SELL 'covered' puts, so that in the event they're wrong, the loss can be mitigated. The world wide market for PUT's is only in the BILLION's and thus one cannot get BUFFET-BERKSHIRE rich playing the covered-put-game.

The CDS was invented to create an environment just like SELLING-PUT's, but now the market is $500Trillion world wide, and people like BUFFET got $500B over the last ten years selling the insurance on the assumption they would never pay-out, that is there would be NO CLAIMS.

However we have had a black-swan, everybody and his dog got into the game, DOG-SHIT got marked up on paper and resold on wall-st as 'AAA'.

On the $500B so made on selling these insurance policy's vast $50B in commission was netted by your favorite brokerage houses, like Goldman-Sachs, AIG, ... Lehman.

The reason that LEHMAN hurt the market so bad, was that they couldn't pay on the CDS bets that they had written policy's for, neither can AIG, and thats where we're at today, using US government to 'COVER' all the bad debts.

The trouble is that given the size of the bad bets exceeds the world GDP, that honestly folks like Jim Rogers see the END of the Economy as we know it.

I noted that tuesday nov 25,2008 WSJ had an article called 'new banks', that not since alex-hamilton created the first US bank, are we in as much as a pickle as now, even Roger's says that the US dollar is finished, and that the US must start over like they did in 1791, 1841, and after the civil-war,

The USA has a long history of making its money worthless, goes back to HAMILTON and his philosophy that those who own the most real-estate get to control the banks.

Re: The reason that LEHMAN hurt the market so bad, was that they couldn't pay on the CDS bets that they had written policy's for, neither can AIG, and thats where we're at today, using US government to 'COVER' all the bad debts.

The trouble is that given the size of the bad bets exceeds the world GDP, that honestly folks like Jim Rogers see the END of the Economy as we know it.

###

Good explanation.

Here is an even better one: http://www.thislife.org/extras/radio/355_transcript.pdf

You can buy the podcast for a buck. Probably the best buck you'll ever spend. Or you can listen to it online. Here is the source: http://www.thislife.org/radio_episode.aspx?episode=355

Of all the explanations I've heard (and I have a finance background and actually understand this stuff) this NPR episode is by far the best for the layman.

If I could put this mess into a 30 second elevator speech, it would go something like this:

"Millions of iffy mortgages, etc. were made to feed a institutional funding scheme that was supposed to provide higher yields. These mortgages were bundled into huge products, consisting of thousands of mortgages, or auto loans, or credit card balances, and they were then rated by agencies that had in intrinsic interest if giving them a high rating. This high rating allowed them to be sold to normally conservative institutions like pension funds, earning high fees to the banks that sold them.

Now this all could have been all right, without too much disruption if the underlying mortgages defaulted at times.

The real issue is that the Masters of the Universe figured out a way to create derivatives, pieces of contractual paper with a value tied to an actual financial instrument, based on the value of these bundled mortgages. And sold each other insurance against the default of said mortgages. This became a market of hundreds of trillions of dollars in less than ten years. A market based entirely on financial legerdemain, not anything actually produced.

These were bets on interest rates and default rates. Without any reserve required.

And all along the Fed, the Treasury, etc. said that the big boys doing these complicated things were smart and could take the risk. They would never require a bailout. That's why they were paying out billions in bonuses.

And now they have their snouts buried deeper into the public trough than anyone who ever preceded them.

Fuck them. They don't actually produce anything. Let them go BK, and we'll figure out how to keep actually producing stuff.

Unfortunately, they are being bailed out with trillions of taxpayer dollars."

OK, maybe a 6o second elevator rant.

The key thing to understand is that the mortgage security market is a half-trillion, while the derivative/paper on said mortgage securities market is multiple trillions.

Trillions based on paper, not actual produced goods.

The key thing to remember is the the USA has written an outstanding insurance for $100 Trillion, and that the US GDP is $13 Trillion.

Yes, MTG is just a percentage of total CDS coverage, but so fucking what, it doesn't mean that all the obligations aren't due.

MTG CDS is just the tip of the FUCKING CDS iceberg that is going to BK the USA.

http://tinyurl.com/5p4tbd

Intelligent life found in Bend, who would have guessed???

Two suicides in the woods off century drive on the way to MT-B in two weeks.

Now it isn't just developer suicides that the cop's and media are keeping secret, young kids coming to Bend to live in their rigs are going up in the mtn's and offing themselves and not a fucking peep.

What is especially funny for those who claim to be fiscally responsible Republicans must the the secret hold put on a bailout Inspector General.

Yep, you're party cares about where federal money goes, all right.

It all must go to connected folks with no oversight.

Good article in todays WSJ about how fucked google is we're talking like down 90% in revenue, and they're pulling the plug on everything across the board.

Expect to see AD's soon on blogspot.com ( about time ? ).

I know myself I used pay almost $10k/mo for ad's on google in say 2002, and now its like $20/mo, people simply are no longer clicking on the ad's, I knew that.

Also they have two tiers click by keyword, and click by context, the context was bullshit, and everyone has disabled that, and today nobody is click on keyword. Keyword is when you put in an explicit keyword, and an ad pop's up based on that keyword, and they click on the ad. Context is if their current content ( say this blog ) matches your website, then your ad comes up, complete fucking bullshit.

Expect to see google down to below $50 very soon.

Sounds like they're pulling the plug on everything, gmail, google-earth, ... everything.

The google party is over.

BP,

Where is your city hall report for tonight?, I saw you there.

>> I know myself I used pay almost $10k/mo for ad's on google in say 2002, and now its like $20/mo, people simply are no longer clicking on the ad's, I knew that.

AdBlockPlus...haven't seen an ad in YEARS.

What's up with some suicides of non-developer types that hasn't hit the news. How did you hear?

I just read the google article in WSJ, and it doesn't sound anything like that. 90% down in revenue No. Pulling the plug on gmail and google earth? No.

OIKOS HOMES

Updated October 2008

Due to market conditions, Oikos Homes is in the process of winding down operations. Our lenders for the neighborhoods at Waverly, Gleneden, Oikos Homes at Lava Ridges, and Parkway Cottages have not renewed or extended their loan financing. The company can be reached at the contact information below.

Our lenders for the neighborhoods at Waverly, Gleneden, Oikos Homes at Lava Ridges, and Parkway Cottages have not renewed or extended their loan financing...

ie: Bends Newest Meth Dealer Den! Welcome Meth Heads!

Sounds like they're pulling the plug on everything, gmail, google-earth, ... everything.

Hmmmm... I don't know. Look at Google's financials, they are one of the most financially conservative companies on Earth. Them and Qualcomm.

For comparison, if Bend were 19.4% under valued our medians would be $156k. That's coming no problem by next year at this time.

Napa CA was 58% over in Q3-2005, and it's now -8%.

Sacramento was +55% Q3-2006 and is now -16.7%

Salinas CA was +72.4% Q2-2006 and is now -23.4%. It was still up 29.4 last year at this time.

Yeah, see this is where we're screwed. This Nat City stuff has a bit of a feedback component to it, and as things went berzerk on the upside, they in turn had to raise their "fair value" bell curve average.

We're going to see Nat City start to LOWER what they define as fair value when it becomes clear that the last 10 years were an anomaly.

$195K "fair value" in Bend will start looking pretty stupid when we're at $120K. This rationale will go for everyone. EVERYTHING will be so far to the left on the bell curve of fair value, that they will simply be forced to lower their Grand Idea of What "Median" means.

$120K WILL be undervalued in bend for awhile.... then they'll start lowering fair value till it hits $120K & we're All Good Again.

Read the fucking WSJ article from yesterday's paper homer.

Yesterday's 'financials' don't matter, the trend line for google revenue is targetted for zero in a few years. They're plummeting.

It's all getting shutdown, and all the graphs were in the WSJ yesterday.

'Conservative', yeh like paying for all medical, 3 meals day, health club, letting people work on anything they want, ... Google is what it was, but no more. The austere years have arrived.

I know your being 'sarcastic' with Qualcomm, they were the love-canal of the DOT-COM, and went into the toilet.

I still bet you we see $50 google in a year, and it will never come back.

The issue is they had, had 100% or more growth in revenue from 1996(?) to 2006, and now its tiny. There growth is OVER. What's worse for ALL their investing 98% of revenue still comes from fucking google-search clicks, which is dying 50%/mo.

Our lenders for the neighborhoods at Waverly, Gleneden, Oikos Homes at Lava Ridges, and Parkway Cottages have not renewed or extended their loan financing.

*

"WHAT YOU SAY BITCH"?? "YOU IN BEND-ORYGUN", and YOU WANT US TO INCREASE OUR LOSS???

Who would have guessed that NOBODY would want to loan to BEND when this town went into the toilet???

Let's remember also, this is what happened to Tetherow, their finance ( lender ) was terminated, they shopped , and plowed through 3 lenders before PAPE bailed them out last year, and then he pulled the plug.

Once you can't get CORP money, then you go after PRIVATE money, today NOT even private money will loan on BEND.

Today from Taiwan News ... You got to Give MT-B PR&MARKETING CREDIT, they're getting the fucking word out about all the fucking snow on MT-B. This is the FIRST-TIME I have seen a 'name' on this press-release. Somebody follow this name.

Skiing at Mount Bachelor, Oregon

By WHITNEY MALKIN

Associated Press

2008-12-04 07:21 AM

Deep powder is standard issue at Mount Bachelor, a West Coast favorite that averages 400 inches (1,000 centimeters) of snow per season, just 20 miles (32 kilometers) from the outdoors haven of Bend, Oregon.

Framed by towering ponderosas and crackling pines, Bend is home to world-class cyclists, triathletes, kayakers and rock climbers.

The local population has quadrupled in the past 20 years, but the town's core of 70,000 are friendly and eager to get outside and play.

Named one of the five best little ski towns in America by Travel + Leisure magazine's December issue, and one of Outside magazine's best towns last year, Bend is surrounded by 2 million acres (809,390 hectares) of national forest, roaring rivers and of course, the Cascade Mountains.

A logging town that hasn't forgotten its roots, the earthy, laid-back community has Craftsman-style architecture, a buzzing downtown and an exceptional culinary scene.

More than half of the people here have a dog, and you're likely to see Subarus with roof racks crowding nearly every parking lot in town.

On the slopes, there are 10 lifts, several terrain parks, more than 31 miles (50 kilometers) of Nordic trails, and a tubing hill.

At a little over 9,000 feet (2,740 meters), this is a mountain known for exceptionally long seasons that stretch into May. It's also a dormant volcano that regularly breathes steam through tiny cracks. The vents are so small, you ski right over them, but the heat melts snow around the crevices, which can be seen if you happen to look.

Lift tickets are $58 ($69 on Saturdays and on holidays) for adults and $14 to $17 for Nordic skiing.

On the mountain's cloudy days, skiers should try the Outback chair, on the northwest shoulder of the mountain, where conditions are often pristine and runs feature the best moguls.

Boarders will likely feel at home in the Superpipe, which has been home to the Chevy Truck US Snowboard Grand Prix and 2006 Olympic Qualifier.

Both boarders and skiers alike should hit up the Summit chair on clear days . Bombing down the longest run on the mountain is a 3,365-foot (1,026-meter) straight shot with breathtaking views that make the chilly ride to the top well worth it.

If you get hungry, try the mid-mountain Pine Marten Lodge's Scapolo's for lunch, and at the end of the day, the Clearing Rock Bar in the West Village Lodge.

Back in town, there are a lot of choices.

With more than six homegrown breweries, nightlife in this town is defined by grabbing a pint and warming up by the fire. Check out Deschutes Brewery, 1044 Bond St., which features more than 18 taps. Be sure to try Jubelale, a seasonal winter ale brewed for just a few months each year during the holiday season.

But if you tire of long lines at Deschutes, head down the street to the Silver Moon Brewing, 24 NW Greenwood Ave., which offers the cheapest craft brews in town at $3.

For dinner, wander downtown to grab a bite at Merenda, 900 NW Wall St., for tapas-style offerings of small plates and an extensive wine bar.

Other surefire bets are Zydeco, 185 SE Third St., where fresh local ingredients, northwest flare and Cajun spice collide, and The Decoy Bar and Grill, 1051 Bond St., a newcomer that's turning heads.

For meals that are easier on the wallet, check out Parilla Grill, 635 NW 14th St., and order the fish tacos, made with fresh snapper, with the "rerecommendations." The homemade corn salsa, cheese, and special sauce make this a meal to remember.

After the sun goes down, there's still plenty to keep you busy.

Head to McMenamin's Old St. Francis, 700 NW Bond St., a Catholic school turned hotel (doubles from $104). In addition to a billiards room, Turkish soaking bath and cigar bar, the downtown hotspot is home to concerts and shows $3 movies in a theater filled with couches. The staff will deliver pizza and beer right to your seat during the show.

http://www.wanderlusttours.com

http://www.seventhmountain.com

http://www.sunriver-resort.com

Save on gas and grab the mountain's Super Shuttle ($7 one way), which leaves almost every hour from the Bend Park-N-Ride on the corner of Simpson and Colorado.

Before you go, don't forget to grab the most important meal of the day. Locals suggest the Victorian Cafe, 1404 NW Galveston Ave., for eggs Benedict and Bloody Marys that draw crowds each weekend.

For a breakfast on the go, try Nancy P's Baking Company, 1054 NW Milwaukie Ave., home of killer marionberry scones and a yogurt parfait that will keep you full until nightfall.

If some of your crew is staying in town, stop by the Old Mill District, the former site of the Brooks-Scanlon Mill, now a vibrant 49-store shopping complex in the heart of Bend's west side.

Farther south you'll find Factory Outlets, 61334 S. Highway 97, where bargain-hunters can grab deals from Oregon-based Columbia Sportswear and Nike.

What's up with some suicides of non-developer types that hasn't hit the news. How did you hear?

*

I go mtn-biking everyday.

Kids living in their trucks have been living in the shelters up off century in the last few weeks.

Basically they setup the shelter like home, and leave their rig nearby and go off in the woods and off themselves.

Too bad really, a lot of these people could have been helped.

I think the 'real' problem is they come to BEND, cuz they believe the PR&MARKETING, and BEND is a fucking COLD town, I'm talking COUGAR-COLD.

It's not real safe being one of Bend's 5,000+ homeless, sleeping by the fire near Walmart with the bro's, so the newbies hear about the shelters full of firewood, and go live in them, but I think the isolation effects them. Youngsters should be out chasing pussy, not living like hermits.

Bend is a cold town, most women here will not give you the time of day, unless you got gold jewelery hanging from your DICK. In Bend you got drive the HUMMER, and act like the rich guy hanging at Martini bar to get pussy. Back in the day kids would come here and mtn-bike, snow-board, climb at smith, the people coming now are looking for mecca, but finding depression.

I don't know what to tell you about ALL the fucking suicides.

What I do know is that its an OFFICE SORE & BULL decision not to report them.

If you be HBM and want to do a story, contact the local USFS office and talk to the admin, and have them give you the lowdown, and I know their is a search going on right now for a new case.

"THE FUCKING NEWS, YES RIGHT, WAIT UNTIL THE FUCKING NEWS REPORTS ANYTHING IN THIS TOWN"

I just read the google article in WSJ, and it doesn't sound anything like that. 90% down in revenue No. Pulling the plug on gmail and google earth? No.

*

Well its all going to change.

They're going to try and spin google-earth off, and your going to see ad's on the blogger.

Perhaps you didn't see the story in the WSJ as negative as I did, but my reading is that 'everything is going to change'.

Did you see the graph on revenue growth? It's a run to zero.

The growth days of google is over, and all new projects are over.

Perhaps your not a fucking TECH GUY TIM, I know you said your journalism.

BUT ITS over, if gmail, google-earth, ... et-al don't make a nickle it means NO MORE FUCKING development, which is the kiss of death for software.

The entire paradigm of FREE ENDLESS SOFTWARE and service is OVER.

This is a BIG story TIM, go back and read it, if you don't see what I see, maybe its because you didn't spend 40+ years working in this shit.

I'm not disagreeing with your Google projections, I just wanted to clarify that what has happened so far is:

1) Growth slowing (a lot). But still growth of 30%. Was almost 100% growth in '05.

2) Chopping pet projects, irritating some of the big talent.

3) Reduction in the benefits. In my opinion, Google was a little short-sited to be over-the-top on their benefits. Programmers HATE having benefits cut. They like to feel pampered.

4) Acknowledgment of the need to make money. Google Finance recently got ads, other places will.

5) Dramatic slowdown in hiring and server farm building.

Yes, this is "gearing" down. And yes, it's a big deal.

>>>Yes, this is "gearing" down. And yes, it's a big deal.

I think it's called "growing up". They've been teenagers blowing mom and dad's cash on stupid shit. Time to begin to try and act like adults.

>> Whitney Malkin

http://www.facebook.com/people/Whitney-Malkin/11500312

Just another local PR Bunny I suspect

http://center.spoke.com/info/pDLLLKj/WhitneyMalkin

Looks like she used to (or still does) work for the Eugene Register Guard.

Appears to be an AP writer now.

>>I think it's called "growing up". They've been teenagers blowing mom and dad's cash on stupid shit. Time to begin to try and act like adults.