Sunday, November 30, 2008

Bailout Nation

I know, we've had to endure these low-grade terrorist boom-boom's since Osama showed the World How It's Really Done.

But this one seems different. Blowing up a Train In Spain where the chards fall Mainly On The Plains is one thing. Spain is the trailer park of Europe.

India, in case you've been lost in a fog of hyper-consumerism for the past decade, is RICH. India is extremely wealthy nowadays, and there is NOTHING up-and-comers like to prove more than I Can Kick Your Poor Ass. We've been doing it for 50 years.

Just keep it in mind: That Mumbai shit could escalate to NUCLEAR in no time at all. Always stay alert on where the next downleg can come from.

Speaking of head-in-hand Pathetic, I still very occasionally head over to Bend Economy Board (via ANONYMOUS PROXY!!!!) to see if things are headed up over there. Well, except for BendBB's still kick-ass data collection, this thing has seemingly turned into a Ra-Ra board for RE. To wit:

Housing Consumer Confidence Returns!

posted by:

No better time to buy

All you have to do is read some of the comments to see few people, IF ANY, are buying this tripe. But there is the occasional Realtor plant:

I will admit, having been actively in the real estate market (looking for a good deal on a house) for some time now, there has been an unmistakable uptick in activity.

And there are the Ever-Ebullient Perma-Bulls, like Jack Elliott, for whom No Piece Of Bad News Is Truly Bad.

And I'm sure a lot of people think that I am of the "100% All About Any Piece Of Bad News Is 100% True, And Any Good News Is Bullshit" mindset. Not true.

I just feel that we are in the post-traumatic throes of a Bubble Deflation that will bring down this country to a financial level we have not experienced in 50-100 years. And there will be nowhere in the US that suffers more than Bend.

And I think what I've been saying here about the Nationwide Vicious Aftermath is pretty clear for all to see. Number 1 News Item for months now. But what about Bend?

I'll tell you right now that Bend is going to be ravaged harder than anywhere in the U.S. There's a bit of a somber mood about town, and you can finally actually speak about The Current Bad Times at a cocktail party without fear of ostracism.

But THIS is NOTHING. This is NOTHING compared to what is coming. Just take a look out the Side View Window:

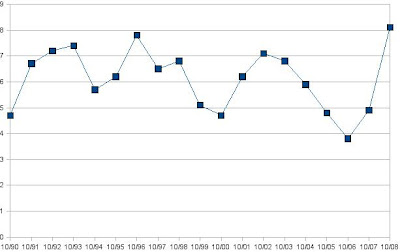

It's pretty plain to see that we spanned almost the Entire Gamut of the previous 19 years of economic activity, in one feel swoop, going from some of the lowest unemployment rates ever, to The Highest October Unemployment Rate On Record In One Year.

This AIN'T a Bump In the Road. Wait for February. We will see The Worst Unemployment Rates In Modern Bend History. There's going to be some Major Epiphanizing going on; People realizing EN MASSE that YES, Bend Is Different. IT'S WORSE THAN ANYWHERE ELSE IN THE U.S.

The Bulletin, of course, ran a piece regarding the Great Deflation Of Bend (Population), but it began with a hashing over of The Glory Hole Years.

"This Here? Why, This Is A Little Bump In The Road! Bigger & Better Than Ever In No Time, And So Forth. Yes, Yes. Outdoor Recreation, Wealthy Widows With Big Ol Double Deez, Monsters Of Cock On 96 Year Old Men! It's A Paradise!"

Yeah. Right.

OK, here's an interesting piece that should get your pot boiling, if you managed to act in a fiscally responsible manner for the past 10 years.

Why lenders might forgive your debt

There was a time when lenders didn't want to work with you if you couldn't pay. Now they want to avoid foreclosure, lawsuits or repossession almost as much as you do.

By Liz Pulliam Weston

People who overdosed on debt in recent years learned the paradox of easy credit: While lenders were willing to let you borrow copious amounts, they weren't particularly interested in helping you work out a solution if you fell behind on repayment.

Lenders often found it easier and cheaper to write off delinquent accounts as bad debt than work with you on a repayment plan. After all, they could get a tax break on the loss and then get on with the profitable business of extending credit to the next guy.

Lately, however, lender perspectives have changed. Soaring default rates, a weakening economy and the credit crunch have rewritten the rules.

* Credit card lenders charged off 5.47% of the total amounts owed on cards as bad debt in the second quarter, according to the Federal Reserve. A year ago, the charge-off rate was 3.85%.

* Consumer bankruptcy filings in October topped 100,000, a 40% increase from a year earlier and the highest level since the federal bankruptcy reform law took effect in October 2005, according to the American Bankruptcy Institute.

* More than 2.2 million homeowners are more than 60 days late on their mortgage payments, according to the Hope Now alliance of lenders and credit counselors, and one in six homeowners owes more on a home than it's worth.

* With home prices plummeting, every foreclosure now represents a loss of 44% of the original loan amount, up from 29% a year ago, according to data from LPS Applied Analytics.

That's why lenders are now looking for ways to keep people paying their bills, even if it means forgiving some of their debt. Now the paradox is that in order to qualify, you must be struggling, but not so much that a change in terms wouldn't help you.

How the new programs work

The most sweeping new program was announced Nov. 11. Freddie Mac and Fannie Mae, the government agencies that guarantee 31 million U.S. mortgages, will begin paying the mortgage service companies that maintain the loans $800 for every loan they modify. Borrowers would get help in several ways: Interest rates would be reduced so that borrowers would not pay more than 38% of their gross income on housing expenses. Another option is for loans to be extended from 30 years to 40 years, and for some of the principal amount to be deferred interest-free.

The same day, Citigroup announced it would halt foreclosures for borrowers who live in their own homes, have decent incomes and stand a good chance of making lowered mortgage payments. Ultimately, it plans to modify the repayment terms on up to $20 billion in loans.

Late last month, JPMorgan Chase expanded its mortgage modification program to an estimated $70 billion in loans, which could aid as many as 400,000 homeowners. The modifications were to include reducing amounts owed or the loans' interest rates, and replacing so-called "pay option" loans that typically resulted in mortgages growing over time.

Bank of America, meanwhile, has said that starting Dec. 1, it will modify an estimated 400,000 loans held by newly acquired Countrywide Financial as part of an $8.4 billion legal settlement reached with 11 states in early October.

Loan forgiveness is a key part of the Hope for Homeowners program. This is the foreclosure prevention program that Congress created as part of the $700 billion Economic and Housing Recovery Act of 2008. Lenders that want to participate typically must agree to reduce borrowers' principal to 90% of their homes' current value.

But wait, there's more

In late October, a coalition of lenders and consumer advocates asked banking regulators to approve a pilot program that would allow struggling borrowers to pay off, over time, less than they owe -- as much as 40% less. Under current rules, any repayment plan has to be for the full amount owed.

Though the Office of the Comptroller of the Currency rejected the first draft over how banks would book the resulting losses, backers of the plan say they're committed to finding a remedy for overtaxed borrowers that's short of bankruptcy -- which would likely mean the banks see no repayment at all.

In the first proposal, a joint project of the Financial Services Roundtable and the Consumer Federation of America, applicants would have been evaluated by certified credit counselors; those who couldn't pay off their debt under a regular debt management program would have been placed in one of four repayment plans that would reduce their principal by 10%, 20%, 30% or 40%. Only consumers closest to bankruptcy could have qualified for the biggest reduction.

Travis Plunkett of the Consumer Federation of America said his group would continue to lobby regulators "to do everything they can, within bounds of the safety and soundness of the financial system, to help consumers," but that ultimately consumer advocates may have to turn to lawmakers for help.

"It may be Congress that has to step in, and I think there's a lot of interest there" in doing so, Plunkett said. "We've got a train wreck coming."

Student loans and car debt

Meanwhile, makers of student and auto loans haven't announced any new plans for forgiveness. In recent years, in fact, both groups made escaping their debt more difficult. But:

* Certain borrowers can still get portions of their federal student loans forgiven through volunteer work, military service and teaching in low-income communities. And Congress passed a law in 2007 that wipes out federal student loan debt for people who work in certain jobs and who make 10 years of on-time payments. Plus:

* Auto lenders are stepping up their education efforts to let troubled borrowers know they have alternatives if they fall behind on their car payments. According to credit bureau Experian, more than 500,000 borrowers are 30 days or more overdue on a car loan.

Yet fewer than half of consumers in a recent poll knew that auto financing companies often worked with troubled borrowers, said Eric Hoffman, spokesman for the Aware, an education group set up by auto dealers and lenders that commissioned the survey.

Auto lenders may be able to modify a loan to stretch payments over a longer period or allow borrowers to make up missing payments, Hoffman said.

"We tell people, 'Don't ignore the situation if you're having trouble,'" Hoffman said. "Get in contact with your lender and see if there's a way to work out a different payment plan."

The same advice holds true for student loans. You may be eligible for income-sensitive or graduated repayment plans or, if you're facing economic hardship, forbearance or deferment that would allow you to skip payments for up to three years.

Here's what to do about other debt:

Credit cards. If you're already behind on your credit card payments, you shouldn't wait to see if you'll qualify for any loan forgiveness programs. Make two calls: one to a legitimate credit counselor and another to an experienced bankruptcy attorney. Between the two, you'll get the information you'll need to decide whether you should continue paying your debt or have it "forgiven" by the U.S. bankruptcy court.

Mortgages. Gather your paperwork -- your mortgage documents, last year's tax return and some recent pay stubs -- and call a HUD-approved housing counselor to evaluate your situation and your options. If you qualify for a loan modification program, the counselor can help you get through to your lender's loss mitigation department, which will evaluate your application.

A lender will want evidence that you're in trouble -- and assurances that any changes will keep the payments coming. Don't expect that it will immediately hack your loan balance to what the house is currently worth; it won't.

Your lender has only a few ways to help you: It can reduce your interest rate, defer payments, extend the length of the loan or forgive some part of your principal.

With your counselor's help, you should decide what solution you want before approaching the lender. If you have a temporary situation such as an illness that will be resolved soon, for example, ask for deferred payments. If your adjustable-rate mortgage is about to reset, use MSN Money's Mortgage Calculator to see if a reduced interest rate could keep you in your home.

You may have trouble getting your lender's attention. That's particularly true if you haven't already fallen behind on your payments, something you should try to avoid, because late payments can kill your credit scores.

In that situation, consider getting an attorney's help, said lawyer and mortgage broker Alan Jablonski, author of "Successfully Navigating the Mortgage Maze" and operator of the AJ Consumer Watch Web site.

Unlike some of those who advertise loan modification help, attorneys have a fiduciary duty to put their clients first (and clients have many remedies, including lawsuits and disciplinary complaints to the bar association, if the attorney fails to fulfill those duties).

That's a far cry from many of the fly-by-night outfits that demand big upfront fees and then fail to act, or disappear with the money.If you decide to hire an attorney, you'll have to find one on your own, Jablonski said; anyone legitimate has a full workload and isn't proactively contacting potential clients.

Your state's bar association may offer referrals. In any case, you'll need to confirm that the attorney is in good standing with the bar, and that he or she has experience with loan modification.

Published Nov. 17, 2008

Just read that over. Sounds good, right? Actually, no. Most of these "workouts" are simple extensions of the loan term, or rolling missed payments into the principal.

You've got to understand these loan workouts are a clusterfuck. They ACTUALLY REWARD PEOPLE FOR DEFAULTING. You are only eligible for The Best Workouts if You Are 3 Months Behind, or are on the verge of going bust. If you are playing by the rules, you get screwed. To wit:

Feel like a sucker? You're not alone

Bailouts are going to reckless Wall Street bankers, to homeowners over their heads and now maybe even to Americans hooked on credit cards. Where's the reward in doing the right thing?

By Liz Pulliam Weston

If you feel like you're being played, you're not alone.

The financial crisis has deepened many people's suspicions that doing the right thing hasn't paid off. Instead, they feel it's made them chumps.

You see it in the "Where's my @#$%ing bailout?" T-shirts, the despair about plummeting retirement accounts and the hostile comments that greet every news story about mortgage restructuring or credit card forgiveness.

One reader put it this way:

"Doesn't keeping your promises mean anything? Most if not all of the people who snagged these (mortgages) were well aware of the risk and the responsibility. It kills me that I'm playing by the rules and bailing out those who were greedy, stupid or both."

Even when they're not directing their anger at anyone in particular, many of my readers feel like they've been led down the garden path.

"I am 62 years old and HAD been planning to retire in 5 years," one wrote. "Although I have lived frugally my entire life and put away 15% of my income every year in a retirement account, my balanced portfolio lost 60% of its value in the last two months."

What he wanted to know: Would he be a bigger fool for pulling his money out of the market now or staying in and possibly suffering more lumps?

If you have similar questions -- if you suspect you're being a chump for making your mortgage payments, paying your credit card bills and continuing to invest in your 401(k) -- read on. You're certainly not alone as you watch others exploit loopholes, mistakes and well-intentioned remedies.

Bailed out but still ruined

The question of why some homeowners are getting bailouts has really been answered by the financial turmoil of the past few months. A huge spike in foreclosures, magnified by derivatives cooked up by Wall Street firms, nearly brought down the global economy. As it stands, we're still likely to suffer one heck of a hangover in the form of a serious recession.

The foreclosure mess is far from over. Many of the riskiest loans -- the ones where homeowners weren't even paying all the interest that was accumulating on their loans each month, let alone touching the principals -- are just now resetting.

Then there's the whole vicious-cycle effect, which I wrote about in April. As foreclosures rise, banks slash the prices of the homes they recover, putting downward pressure on everybody else's property values. With more homes "underwater," more fall into foreclosure when their owners lose a job and can't sell, or simply decide to walk away.

That's why the Powers That Be are finally getting serious about working with struggling homeowners. Given how interconnected everything is in our economy, their success in saving your neighbor from foreclosure might ultimately reduce the chances you'll lose your job.

I agree that a lot of borrowers were complete idiots for agreeing to mortgages that were eight or nine times their incomes (a mortgage that was three times your income used to be considered a stretch in the days before lenders went nuts). Smart borrowers fixed their rates for at least as long as they planned to stay in their homes; dumb ones agreed to adjustable-rate mortgages on their brokers' assurances that they'd be able to refinance before the payments reset.

But borrowers didn't get these loans in a vacuum. Mortgage brokers and loan officers downplayed the risks. So did lenders, who gave the brokers and loan officers fat incentives to push them. The Wall Street machine encouraged looser lending standards and created exotic investment products that wound up multiplying, rather than reducing, the risks. Regulators, meanwhile, stood by and basically did nothing. No one involved is covered in glory.

Neither is anyone getting an entirely free ride. Plenty of people will still lose their homes, and many who get workouts will have to live with trashed credit from the payments they missed before help arrived.

Forgiven but not forgotten

Personally, I wouldn't trade places with any of them, not even the ones who'll wind up keeping the bigger, fancier homes my husband and I decided we couldn't afford. I wouldn't want to live with the anxiety those troubled borrowers have faced ever since they got unaffordable mortgages or the uncertainty they're feeling as they wonder whether a workout will save their homes. Those folks made a hell of a gamble, and even with efforts to help on the rise, most of them are still going to lose.

Give me a home bought with a fat down payment and a 30-year fixed rate any day.

Forgiven but not forgotten

So how about the people who may be about to get big chunks of their credit card debts forgiven?

Major credit card issuers are seeking permission to knock down troubled borrowers' debts by as much as 40%. Debtors would get preferential tax treatment as well; they wouldn't owe income tax on the forgiven debt until they'd paid off the remainder of their balances.

Credit card issuers are recognizing the obvious: that their free-lending ways have come back to bite them. Delinquencies are soaring, and issuers' charge-offs -- balances written off as bad debt -- are up nearly 50% compared with last year.

The issuers figure getting something out of these debtors is better than getting nothing if they stop paying or file for bankruptcy.

The number of people admitted to the issuers' proposed pilot program would be small -- about 50,000 -- although enrollments likely would rise if the plan worked as anticipated.

You might have a beef with this particular bailout if you faced a huge pile of debt and opted to pay it off rather than have it wiped out in bankruptcy.

But once again, I'd rather be financially responsible and conservative than not. I'm not sorry that we've always limited our credit card charges to what we could pay in full every month.

Maybe we haven't bought as many toys as the folks who carried debt and are about to have some of it forgiven. But we also haven't spent a fortune in interest charges, which those people certainly have.

And I seriously doubt I'd have to pay higher interest rates or suffer in any way from this program, even if it became wildly successful. Those of us with good credit still would get the best rates, as I explained in "The real victims of deadbeats? Other deadbeats."

Investing blindly makes you a sucker

How about the last station on the have-I-been-a-sucker line: investing. Surely we were sold a bill of goods when we were told stocks are a good long-term investment. Haven't they gone essentially nowhere for a decade now?

Yes, except that those who continue to invest, in good times and in bad, inevitably come out ahead. MSN Money columnist Jim Jubak explains it best in "When to start investing? Now."

The folks who blow it are the ones who take too much risk in the good times, then panic and bail out in the bad, locking in their losses.

The reader who asked whether he should stay or go is a case in point. So close to retirement, he should have been ratcheting back on his risk. Although he thought his portfolio was balanced, it clearly wasn't -- otherwise, it wouldn't have dropped 30% during the worst of this fall's gyrations, let alone 60%.

This just encapsulates somewhat, the Heinous Agency Problems we are in the midst of creating.

We've already bailed out Huge Banks and Insurers. We are starting to bailout homeowners who have defaulted (ie; SPECULATORS). We're headed towards an Auto bailout, cuz Barack loves Unions, and the largely Muslim sections of Southern Michigan.

Everyone, it seems, is being Bailed Out. Except The Responsible. Those who lived within their means. I'll agree that Hard Times can hit those who deserve it least. But I'll also put forth that ALMOST NONE OF THOSE WHO HAVE BEEN BAILED OUT SO FAR MEET THAT DESCRIPTION.

They've said that They Will Print Money Until This Thing Is Solved.

That will, of course, solve nothing. It simply devalues the proxy by which we exchange goods & services. It also redistributes that proxy. Those of least merit are simply given wealth.

This is where we are on a slippery slope. We're a Bailout Nation 100% Addicted To Government Handouts. This should sound EXTREMELY FAMILAR to our local condition. Bend is NOTHING but a taxpayer boondoggle municipality where wealth is redistributed to those who know that local government is nothing more than a wealth redistribution mechanism. Ask Hooker Creek & Knife River: These are less profit seeking corporations, than Sucker Fish on the ailing Bend Slush Fund City Council.

We're NOT governed as much as we are pilfered of our wealth in Bend. Look no further than the last City Council election. Bought & Paid For By COBA. We deserve whatever we get.

And what we'll get is endless USELESS contracts to build infrastructure & "affordable homes".

I actually saw cripple ramps next to The New COVA building on Harriman & Irving, REMOVED and replaced with regular CURBS. Our City, in it's Infinite Wisdom, has decided to allocate resources AWAY from frivolities like Firemen & Policemen, and TOWARDS bricking up cripple ramps at warp speed. Why? Cuz a cripple ramp built TWICE, and still FAILS TO MEET GOVERNMENT REGULATIONS, is a hell of a profitable racket, and THAT IS ALL BEND IS.

That's us: Schemes & Scams that rob the citizens & reward GRIFTERS. And these poeple essentially RUN our EXECUTIVE & JUSTICE systems, as well. So what should we expect?

Well, from my own experience, I can say NEAR ENDLESS ATTEMPTS TO SHUTDOWN UNSAVORY FREE-SPEECH RE BLOGS. Yeah, it's become an onslaught. And just so you know, if this thing just DISAPPEARS one day, THAT IS THE REASON.

We can also expect cops & judges to be on the dole. This fucking place is going to be The Most Corrupt City On Earth, and we are well on our way. It's just going to be a bunch of suckerfish sucking on a corpse. Sooner or later, the money will go away, and all the Corporate Welfare Sleeze will just up & leave, and we'll be left with a hollow husk. It's already happening. They're gutting city services, while erecting ridiculous roundabout art.

Simply incredible. We're going 100% BROKE, and they're still putting art on roundabouts.

We're going BROKE, and they are WAIVING SDC charges to BUILDERS.

Have no doubt: Bend is The Most Corrupt City In The U.S.A., and we are rapidly coming to the end of our RE lotto winnings. The Good Times are LONG OVER, and you are about to witness the most incredible financial implosion of a municipality EVER.

And All There Is To Do, Is Stand Back And Witness The Horror.

Sunday, November 23, 2008

The Rich Getting... Poorer, For Once!

Monday, November 17, 2008

Bend -- A City in Tatters

Economic troubles push Bend plans back

By Erin Golden / The Bulletin

Published: November 17. 2008 4:00AM PST

From new roundabouts to sewer treatment upgrades and accessibility improvements, the ongoing economic slowdown is forcing the city of Bend to revise or hold off on plans for many large infrastructure projects.

Over the past year, as revenues from development-related permits plummeted, the city went through three rounds of budget cuts, laying off 44 workers and leaving another 55 positions unfilled. Officials have slashed costs across the board by reducing employee overtime and using more energy-efficient computer systems and vehicles, among other changes. The city has even dipped heavily into reserve funds to keep services running.

But for some projects, especially those with multimillion-dollar price tags, the cuts haven’t been enough.

The city is required by law to keep up with some work, including accessibility improvements and sewer system expansions, but it says other plans for wider roads, updated intersections and even a new City Hall are simply going to have to wait.

“As a result of revenue from the state going down, and on top of that, what our general fund is going through, we’re having to go through some reprioritization exercises,” said City Manager Eric King.

Water and sewer

After years of rapid growth across the city, many systems, from sewer to water to roads, are in need of upgrades and expansions. In some cases, the work is required so the city can stay in compliance with a variety of state and federal regulations.

Public Works Director Paul Rheault said his department recently completed work on one major mandated improvement — an $8 million headworks facility, where sewage is filtered before it reaches the city’s wastewater treatment plant. The city is required to increase the system’s capacity as the population grows.

Construction of the headworks project was supported in part by increased sewer rates, which went up by 14.5 percent in July.

Though Rheault said the new facility will help reduce the stress on the wastewater system, it’s not the only upgrade the city will need over the next few decades. Officials are currently working on a sewer master plan that calls for about $100 million in major pipeline projects that would allow more areas of the city to connect to the existing system. Rheault said the city will probably have to spend another $52 million to update and expand the treatment plant between now and 2030.

Though officials never planned to complete the work in the next few years, they say the budget cuts have pushed the time line even further. Now, City Engineer Michael Magee said the city will probably have to do the work in small sections. He said a project in southeast Bend to build an interceptor, or trunk line, will focus on the most problematic areas, one at a time.

“Typically, if you had the money, you would start at one end of the project to the other and work in phases, start at one end and work your way south to hook people up with the sewer interceptor as you go,” Magee said. “But with limited resources, we have to go at it differently, and look at the bottlenecks.”

The city is also working on a water master plan that would include about $100 million in upgrades to piping and treatment systems. Magee said plans for that work haven’t been narrowed down yet, but like the sewer projects, officials are looking at how to complete the upgrades in phases, rather than all at once.

Rheault said some smaller stormwater system upgrades are still on track, including a plan that would reroute water from flood-prone underpasses to a state-owned drainage area near the Colorado Avenue interchange with U.S. Highway 97. That project is still in the planning phase, and officials have estimated that it could cost around $500,000, money that will come from stormwater fees charged to residents.

Street upgrades and repairs

The building slowdown has created a dramatic drop in revenues generated by transportation system development charges — money that is used to fund a variety of large street projects. Transportation Engineering Manager Nick Arnis said the city expected to bring in between $4 million and $5 million in transportation SDCs this year, but has only received about $550,000 since the fiscal year started in July.

As a result, it might be awhile before a handful of major SDC-funded street improvements can get under way. Among the projects: a $20 million expansion and upgrade of Reed Market Road, which would include a roundabout at Reed Market and Southeast 15th Street, and $14 million in work along Empire Avenue, including a roundabout at Empire and Northeast 18th Street.

Arnis said the city is looking to start with small parts of the projects, some with the help of developers who agreed to chip in as part of their development agreements with the city. He said some of those partnerships have already been formalized for the Reed Market work, which was supposed to have been finished last year but was delayed because of the tight budget.

“I think taking the projects (and) phasing them is going to be really important; finding the partnerships with the state or private developers is going to be really important,” he said.

Arnis said engineers are currently working to get the plans for the Reed Market and Empire projects and others, including a fix for the congested intersection of Cooley Road and U.S. Highway 97 in north Bend, ready so they won’t have to wait to start building when the money becomes available. Arnis said the city is working hard to look for additional grants and private funding options, but it isn’t yet clear how long it will take to find enough funds to complete the majority of the work.

The tight budget situation also means smaller street projects will be tougher to finance.

Street Division Manager Hardy Hanson said his office lost about $50,000 for paving operations in the last round of budget cuts. After three cycles of budget adjustments over the last year, he said the city has about $1 million in its fund for patching and paving roads, down from about $1.5 million before the local economy started to slow down.

The division is funded with money from the city’s general fund, along with state grants and gas taxes. With fewer dollars coming in from all three sources, officials have dipped into the street operations reserve fund, which has dropped from about $1.6 million at the end of the 2006-07 fiscal year to a projected $613,000 at the end of the current fiscal year.

Hanson said those numbers mean the city will only be able to repave most streets once every 36 years. He said the industry standard is to do the work every seven to 10 years — a level the city was working toward before the economic downturn hit and created a hole in the Street Division’s budget. Now, Hanson said the city is spending its limited resources sealing individual cracks and holes in the roads, rather than repaving them altogether for a more lasting fix.

“A lot of what we’re doing is Band-Aids, where before maybe we could do surgical improvements,” Hanson said.

Other projects

Over the next few years, the city must also complete a variety of accessibility improvements.

As a requirement of a settlement with the U.S. Department of Justice, Bend needs to make all sidewalks, curb ramps, parking spaces and government buildings compliant with the Americans with Disabilities Act by 2014. In addition, the city must bring all of its Bend Area Transit bus stops into compliance with federal regulations by 2012 because of a separate settlement with Disability Rights Oregon, formerly called the Oregon Advocacy Center.

The city has made progress on some of the improvements, installing new handicapped parking spaces downtown and updating some bus stops. But there’s still more work to be done; officials have said there could be more than 1,000 ramps around the city that need to be fixed.

The city set aside $1 million for the work, but King said it won’t be enough. He said officials haven’t narrowed down exactly how they’ll pay for the upgrades but said debt financing is one of the options on the table.

“We’re under those settlement requirements, so we have to do our best to comply with those — we can’t not do them,” King said. “That’s something we’re going to have to figure out how to finance.”

Officials said a variety of other large projects up for consideration over the past couple of years — a new City Hall, a permit center, the Heritage Square downtown concept — probably won’t see the light of day for a while. But King said he wants to keep the plans for those projects up to date for a time when finances aren’t so tight.

“We definitely just aren’t able to move forward as quickly as we’d like. ... But that doesn’t mean that we’re completely abandoning those things,” he said. “We’re still trying to put ourselves in a good position so we’re ready when funding becomes available.”

What's amazing is that these people look at a 80-90% drop in SDC's to $550K.... but, by God, they still got their eyes on a $20 MILLION roundabout on Reed Market. And luckily they had the FORESIGHT to "defer" (ie cancel) all builder SDC charges to fight this housing glut.

Then there are the $250+ MILLION infrastructure required fixes. That's around $3,500 for ever person in Bend. And that's just to get sewer & water upgrades & improvements that we MUST HAVE right now!

And of course NO ONE at City Hall will even acknowledge that we're in the Worst Slowdown in a Generation. No, it'll all be alright. We'll return to the Hyper-Growth Bend of the Past 25 Years, cuz that's all I can remember.

Think again dumbshits. Businesses closing (Cessna, etc) and people LEAVING is going to be the DOMINANT THEME for the next decade, and almost certainly longer. These required fixes will probably go to $5,000 per capita at a time when incomes & profits are imploding.

Again, not to rub salt in the wound, but THIS IS WHAT YOU GET FOR BLOWING THE LARGEST SURPLUS WE WILL EVER RECEIVE AS A TOWN, AND DOUBLING DOWN ON REd OVER AND OVER AND OVER AND OVER...!

It should NOT SURPRISE ANYONE that this has happened. This city's infrastructure is IN TATTERS because we spent every fucking cent we got on PR & MARKETING and RE WELFARE, and NOTHING on infrastructure.

"How could anyone have predicted...?"

Right. That's like asking a slot-jockey if they think they'll lose everything. There's a difference between PREDICTION & MYOPIC OPINION OF THE DELUDED. Of course a gambler THINKS they'll win, that's why they're there. And of course, overall, they NEVER DO. THIS is why no one at City Hall could have predicted this slowdown: THEY'RE STUCK IN A GAMBLER MENTALITY. Always THE NEXT HAND is going to BRING ME BACK. The End Game of this mentality is ALWAYS THE SAME: 100% CRACKER ASS CRACKER BROKE.

This is why almost everyone in City Hall is 100% unqualified to hold their position. "Cut SDC Charges" = DOUBLE DOWN on 12. Whn you're flat ass broke sitting at the blackjack tables, PR & MARKETING ain't going to do SHIT.

But that is what we will do. See, they aren't betting THEIR MONEY. They are betting OUR MONEY. They are betting OUR TOWN. They have NOTHING TO LOSE. They'll just lose their jobs. WE WILL LOSE OUR TOWN.

We're going broke. And it's because NO ONE CARES. COAR & COBA bought City Hall.

Don't think they'll push us RIGHT INTO THE ABYSS?

Where's marge? Why is she GONE? Yeah. Free Speech is the sworn ENEMY of the characters who have BOUGHT & PAID FOR our City Councilor WHORES. RE has tapped into a multi-hundred-million dollar kitty... for LESS THAN PENNIES ON THE DOLLAR. They bought their City Councilor WHORES for next to nothing.

They have zero incentive to save this place, and 100% incentive to enrich themselves as much as possible, before BK-ing this place. And when it goes BK, YOU & I will pay. For DECADES. They are lining their pockets, getting dollars for less than a penny, and you & I are supplying the dollars & taking the pennies.

So I apologize to Buster & BEM regarding their optimism that Bend "can be saved". I don't think it can be saved. We've elected THIEVES to office, and their puppeteers DO NOT CARE about anything but lining their pockets. No COCC expansion. No road improvements. No statutorily required sewage improvements.

We're already in hock for 10-20 years. And with our recent elections and the economic implosion, it's going to get worse. We're down to our last $100 (started with $100 million) at the blackjack tables, and we're going to go into PR & MARKETING OVERDRIVE (asking the dealer for money), and we're claiming that "we couldn't have possibly known THIS was going to happen".

Really? Didn't think you were going to lose? Didn't think the dealer would tell you to FUCK OFF? You're surprised?

Yes, this is exactly what we are being told. And most people are swallowing it whole. No questions asked. Kool-Aid mania still running strong.

Sunday, November 9, 2008

"Gotcha!", -- media

What do new faces mean for Bend City Council?

(City Councilor Jim) Clinton said he expects much of the council’s business to carry on as usual but worries the three incoming councilors might have a shared support for particular industries.

In total, Eckman, Eager and Green received more than $38,500 in campaign contributions from Central Oregonians for Affordable Housing, the political action committee run by the Central Oregon Builders Association. The three candidates received a total of $14,050 from the Central Oregon Association of Realtors, the group for which Greene serves as president.

“I think there’s a danger signal that three of the new people were massively, disproportionately supported by the development industry — that’s something to watch for,” Clinton said. “We hope they’ll have a broader perspective beyond that.”

It goes on to have the usual denials from each of these Bought & Paid For Whores. Big Surprise.So, we can pretty much expect More Of The Same. Such as pandering to builders with such great ideas as Attacking Bend's Mega-Glut Of Homes By Eliminating SDC Charges, and other such mindlessness. I guess I shouldn't forget the $4.3MM revenue shortfall at City Hall. And the layoffs.

We don't need policemen, firemen, or roads! We need New Houses! Right?

Yes, yes. Selling out our city to RE interests is just proving to be all kinds of smart. And here we've done it again.

So what else happened during the recent election? Oh right! We elected a black dude!

Like I said in the comments, this thing could go in quite a few directions. The worst is what I call The Jesse Jackson Reverse Lynch Mob route, where black men on meth, driving 120mph through a school zone with their kids in the bed of the pickup, who decide, "Hey, this is because I'm BLACK! I ain't doin' nothing wrong!", and so they start shooting.

Or White Dudes in Cadillacs are pulled over and thrown to the ground & is given a Rodney King, ie "A White Rodney".

This is the lowest, basest, most vile thing on Earth, and it's exhibited by all Black Leaders, and 99.999% of all Liberals: REVERSE RACISM. Like putting the word "Reverse" in there somehow gets rid of the RACISM. No. It doesn't. Just makes it a vicious cycle.

OK, this is where it could go, and if JJ Jackson has his way, this is where we're headed.

OK, read again KNEE JERK, SELF-HATING LIBERALS: I HOPE NOT. OK?

This is where I HOPE & PRAY it goes: I hope Obama serves as a model for blacks. I hope he SAVES them from decades of VICTIM-MENTALITY BULLSHIT that has been spewed by HATERS like Jackson for decades. I hope Obama KILLS the WHITE OPPRESSOR MYTH that bigots like Jesse Pedophile Jackson has spread his WHOLE LIFE for his own personal profit, and nothing else.

THAT is what I hope.

But this guy is up against entrenched forces that have a RACE-FUELED HATE AGENDA, and they see this guy as their "In" to getting WHATEVER they want. And they are going to PUSH, CAJOLE, THREATEN or whatever else they have to do to take over his position & turn him into a puppet. I pray to God Obama doesn't get Lewinskied by these fuckers.

I am pulling for the guy. I want to believe that POSITIVE CHANGE is coming. I AM thrilled there is a black dude replacing the insular, inbred bullshit we've had to put up with for 8 years. OK... 240 years. I just hope this guy can fulfill the promise by taking The High Road, when there is overwhelming pressure to take the Low.

OK, moving on....

I've noticed a trend that's been around quite a while, and I've commented on it several times, but recently I've noticed it's in Almost Every Single Negative Economic Piece in Cent OR media. I have in fact seen it already this morning. Here is the snippet, and see if you can spot the "odd" passage:

GM, Ford woes impact Bend car dealerships

The sputtering economy is clogging the engine that runs this industry. Auto sales are at a 25-year low and still falling.

Dealerships in Bend say sales are down significantly, following the national trend.

"Following the national trend".

"We're just like everywhere else, right? We're not immune. How could we have escaped such an overwhelming force?"

The other fairly obvious statement is along the lines of, "How could we have possibly known this was going to happen?"

The Bulletin runs stories ad nauseum FILLED with these 2 statements by City leaders. You WILL NOT see these sorts of statements in any other self-respecting news organization, anywhere. Why?

Because NO WHERE is local government, local media, and a dominating local industry so incestuously intertwined. RE interests BOUGHT & PAID FOR our local city council, as City Councilor Jim Clinton stated. RE interests donated a multi-million dollar property to the local newspaper. NO WHERE will you find such RIDICULOUSLY biased news reporting as you will find in Bend, Oregon. NO WHERE.

THAT is why you find virtually ALL news pieces FILLED, sometimes very subtley, with odd statements about the BLAMELESSNESS of local government for the current financial debacle. And if you've been out, that debacle is the rapid bankrupting of this town that is 100% INEVITABLE.

We are being conditioned for it. That's what these statements are: They are bracing us for the train wreck they KNOW is coming. We're in Layoff Round #3 at City Hall. They are NOW telling us they KNEW it was coming in September! But after the first 2 rounds, King proclaimed, "This is it, we're done." Of course, a 100% LIE.

Just keep your eye out for this sort of thing:

"We're suffering just like everyone else."

Translation: We have to TELL YOU that we are suffering just like everyone else, because for 10 years we have told you that we WILL NOT SUFFER, EVER, because we Bendites are Gods Chosen People. Plus this statement cushions the inevitable blow of Bankruptcy that WE ALONE have pushed us into.

"How could we have known this was going to happen?"

Translation: We are headed towards bankruptcy, and we MUST find a way to HOLD OURSELVES BLAMELESS for the cataclysmic implosion of city finances that WE ALONE are responsible for.

If you want to see ONE EXAMPLE of the ENLESS BOONDOGGLES we as taxpayers have funded, just go to Bend2030. Here's an excerpt of just what Bend2030 is STRAIGHT from the homepage:

Bend 2030 is a private non-profit 501 (c) 3 organization, independant from the City of Bend.

Ummmm, yes. Yes, Timmy. "independant". They are INDEPENDANT from the city of Bend, as well as a decent spell checker.

Click on the Bend2030 "Action Plan & Progress Report". Their original action plan was published in Dec 2006, and they recently put out a Bend2030 Progress Report. Some excerpts of EXACTLY what has been accomplished with our taxpayer funds over the past 2 years:

With respect to the Modal Connectivity Plan (yes, BIG WORDS & MYSTIFYING TITLES fill this thing):

"...a Recreation Assets Committee... is identifying opportunities for recreation and connection in Central Oregon."

Holy Shit! They've fired up the old RAC and are vigorously IDENTIFYING CONNECTION OPPORTUNITIES! Pardon me Sir! I stand corrected! Bend2030 is on the EVER-INCREASING "CONNECTION" problem we've got going! Whew! What a relief.

Regarding the Mirror Pond Vision (these fuckers do a lot of VISIONING):

"Bend2030 is in discussion with stakeholders about facilitating community forums concerning Mirror Pond."

Ummmm. What? So the sum total of your PROGRESS with respect to the MIRROR POND VISION is that you have... talked.... to..... people.... about.... it. Ah ha.

With respect to The Green Print Plan (no, I do NOT know what The Green Print Plan is, as it is not defined ANYWHERE. But it has the word GREEN in it, so it must be wonderful):

"The need for a Green Print Plan was initially identified in the Bend 2030 Vision. Trust for Public Lands requested support from several partners including Bend2030 to make the plan a reality. TPL is close to raising the funds needed to support the plan."

Seriously, that's all there is. Green Print Plan is 100% undefined. But the fuckers did decide we needed it. And the PROGRESS made by Bend2030 is that SOMEONE ELSE has started asking THEM for money, and the other party has not yet achieved their fund raising goal.

OK, when someone asks me for a progress report of MY LIFE, I don't blow out a story about how the local Girl Scouts have STARTED SELLING ME FUCKING COOKIES, BUT THEY HAVE NOT YET ACHIEVED THEIR GOAL. OK, that is NOT an accomplishment.

OK, but enough soft-hearted BULLSHIT. The Bend2030 is Dead Fucking Serious, and has some MAJOR INVOLVEMENT in Real Community Issues, such as BAT & The Redmond Airport, Gat Damn It!

Regarding BAT Expansion:

"Bend2030 has approved a resolution in support of the November ballot measure."

Holy Shitballs! They've APPROVED A RESOLUTION! I think all readers should know the IMPORTANCE of this SEMINAL EVENT. I also approved a similar RESOLUTION when I was taking crap this morning. Believe me, that shit does not happen every morning. Sometimes I will go a week and only approve 3-4 resolutions when taking a dump.

Regarding Redmond Airport Expansion:

"Bend2030 continues to support construction on the Redmond Airport terminal expansion which is underway, and expected to be completed by 2010."

Whoa! They SUPPORT construction of the Redmond terminal! FUCK ME! So... the construction of the terminal is UNDERWAY. And Bend2030 CONTINUES to support this construction. Which is underway. It's already going.

Ummmm... I'm just curious what sort of "resources" Bend2030 has CONTRIBUTED to this vast effort of SUPPORTING THIS CONSTRUCTION? How many vast LEGIONS of people are TASKED with SUPPORTING this terminal expansion?

Funny, but this DOES NOT sound like PROGRESS to me. It sounds like a bunch of fuckwads patting themselves on the back for doing NOTHING. Here's how they describe themselves:

"Bend 2030 is made up of 18 very passionate and deeply committed volunteer board members who are dedicated community leaders representing a wide-spectrum of backgrounds and neighborhoods from the community."

"Passionate and committed"? Huh. "Wide spectrum of backgrounds and neighborhoods"? Really? OK. Let's name some board members:

Linda Johnson - Bend City Councilor

Peter Gramlich - Bend City Councilor

Erik King - Bend City Manager

Brian Shetterly - City of Bend Planning

Yeah. It's real fucking diverse. Like most of Bend organizations, Bend2030 is a taxpayer funded boondoggle-circle-jerk that does NOTHING except increase the INFLUENCE PEDDLING POWER of BOUGHT & PAID FOR WHORES of the local RE industry. That's all.

Yeah. It's DIVERSE. How many black motherfuckers are on Bend2030's Board? How many EAST SIIIIIEEEEEDERS? How many CITIZENS NOT in City or LOCAL GOVERNMENT? By my count? ONE.

"Diverse" to these fuckers means that they got BOUGHT by COAR AND COBA! Holy SHIT!

"WE LIKE BOTH KINDS OF MUSIC, COUNTRY AND WESTERN!"

And we have spent close to $1,000,000 on this. And what have we got?

Real kick ass FAQ's on VISIONING:

Q: What is community "visioning"?

A: Visioning is a planning process that can help a community create a shared vision for its future.

Q: What is a vision?

A: Think of a vision as a community's preferred "destination" - where it would like to be in the long-term future.

Fuck me. "What is a vision?". We've paid these fuckers a million dollars for answering THAT? We're dead. Here's my FUCKING QUESTION:

"Can you define, or go 2 fucking seconds, WITHOUT USING THE WORD "VISION", "VISIONING", or some derivation of THAT FUCKING WORD?"

So what did our recent election accomplish?

Well, we did manage to Throw The Bums Out. But they were replaced by Newer, More Fucked Up Bums. And these BUMS have, and will continue to work SOLELY for the local RE interests. Think WAIVED SDC CHARGES to "solve" the local "RE PROBLEM". These fuckers are SO MYOPIC, they can't even fathom a solution that does not DIRECTLY BENEFIT their PIMPS (ie HOLLERN).

Go to the Bend2030.com website. And just prepare to be amazed at the WASTE of it all. BIG WORDS. COMPLICATED "VISIONS". Lots' of PROGRESS.

Until you really start reading. And realize they have done NOTHING. Not a single fucking thing. So where is the MILLION DOLLARS? WHERE?

Right. Boondoggle. A bunch of back-slapper, old boy network, bought & paid for WHORES sucking the cock of local Real Estate. All paid for BY US.